What Is Unlevered Equity?

- Unlevered. Unlevered describes the cost projections of project analysis and other business plans. ...

- Unlevered Equity. Unlevered equity is simply the cost of equity for a project, untouched by debt factors. ...

- Purposes of Calculation. Unlevered equity is not necessarily an accurate calculation. ...

- Discount Rates. ...

How to calculate unlevered cost of capital?

What is the unlevered cost of capital?

- Calculating Unlevered Cost of Capital. Unlevered Beta / Asset Beta Unlevered Beta (Asset Beta) is the volatility of returns for a business, without considering its financial leverage.

- Formula. ...

- Unlevered cost of capital when there is debt. ...

- Download the Free Template. ...

- Additional resources. ...

How do you calculate cost of equity?

To calculate a company's unlevered cost of capital the following information is required:

- Risk-free Rate of Return.

- Unlevered beta. It only takes into account its assets.

- Market Risk Premium.

How to calculate return on assets for an unlevered company?

- Begin with EBIT EBIT Guide EBIT stands for Earnings Before Interest and Taxes and is one of the last subtotals in the income statement before net income. ...

- Calculate the theoretical taxes the company would have to pay if they didn’t have a tax shield (i.e., without deducting interest expense)

- Subtract the new tax figure from EBIT

How to calculate cost of equity?

You can calculate the amount of equity you have in your home by taking its market value ... matching contributions -- which is free money for you to invest. All in, the cost of not participating in a 401(k) could stretch into six figures.

How do you calculate cost of unlevered equity?

Calculating the unlevered cost of equity requires a specific formula, which is B/[1 + (1 - T)(D/E)], where B represents beta, T represents the tax rate as a decimal, D represents total liabilities, and E represents the market capitalization.

What is unlevered equity?

Unlevered equity is a term used when describing costs for a business, referring to equity that is not adjusted for any long-term debt accounting. It is used especially in cost analysis for business projects and long-term strategic planning.

How do you calculate cost of equity?

There are two primary ways to calculate the cost of equity. The dividend capitalization model takes dividends per share (DPS) for the next year divided by the current market value (CMV) of the stock, and adds this number to the growth rate of dividends (GRD), where Cost of Equity = DPS ÷ CMV + GRD.

Is unlevered cost of capital the same as WACC?

The weighted average cost of capital (WACC) assumes the company's current capital structure is used for the analysis, while the unlevered cost of capital assumes the company is 100% equity financed.

What is levered vs unlevered equity?

The difference between levered and unlevered free cash flow is expenses. Levered cash flow is the amount of cash a business has after it has met its financial obligations. Unlevered free cash flow is the money the business has before paying its financial obligations.

What does unlevered mean?

Unlevered means to remove consideration to leverage, or debt. Since firms must pay financing and interest expenses on outstanding debt, un-levering removes that consideration from analysis. Therefore, you do not deduct the interest expense in computing UFCF.

What are 3 methods used to calculate the cost of equity capital?

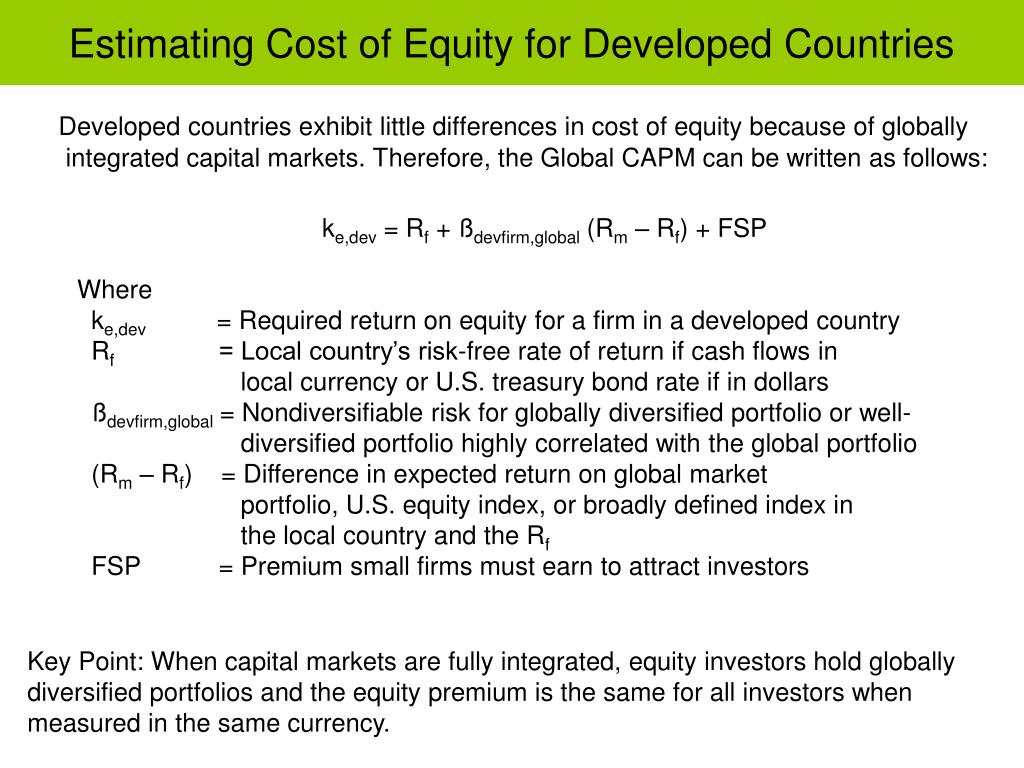

There are three methods commonly used to calculate cost of equity: the capital asset pricing model ( CAPM ), the dividend discount mode ( DDM ) and bond yield plus risk premium approach.

Is CAPM cost of equity?

CAPM is a formula used to calculate the cost of equity—the rate of return a company pays to equity investors. For companies that pay dividends, the dividend capitalization model can be used to calculate the cost of equity.

What is the EPS formula?

Earnings per share is calculated by dividing the company's total earnings by the total number of shares outstanding. The formula is simple: EPS = Total Earnings / Outstanding Shares. Total earnings is the same as net income on the income statement. It is also referred to as profit.

How do you calculate unlevered cost of capital from WACC?

The Formula for calculating unlevered cost of capital is: Unlevered Cost of Capital = Risk-Free Rate + Unlevered Beta (Market Risk Premium). Unlevered Beta means the volatility of an investment when compared to the market or other companies.

Is CAPM beta levered or unlevered?

In a Capital Asset Pricing Model (CAPM), the risk of holding a stock, calculated as a function of its financial debt vs. equity, is called Levered Beta or Equity Beta. The amount of debt a firm owes in relation to its equity holdings makes up the key factor in measuring its Levered Beta for investors buying its stocks.

Is equity beta levered or unlevered?

Levered beta (commonly referred to as just beta or equity beta) is a measure of market risk. Debt and equity are factored in when assessing a company's risk profile.

What is unlevered cost of capital?

The unlevered cost of capital is generally higher than the levered cost ...

What are the factors that determine the unlevered cost of capital?

Several factors are necessary to calculate the unlevered cost of capital, which includes unlevered beta, market risk premium, and the risk-free rate of return . This calculation can be used as a standard for measuring the soundness of the investment.

What is unlevered beta?

The unlevered beta represents an investment's volatility as compared to the market. The unlevered beta, also known as asset beta, is determined by comparing the company to similar companies with known levered betas, often by using an average of multiple betas to derive an estimate.

Why do investors reject investment?

If a company fails to meet the anticipated unlevered returns, investors may reject the investment. In general, if an investor believes a stock is high-risk, it will typically be because it has a higher unlevered cost of capital, other aspects being constant.

What is WACC in investing?

The weighted average cost of capital (WA CC) is another formula that investors and companies use to determine whether an investment is worth the cost. WACC takes into consideration the entire capital structure of a firm, which includes common stock, preferred stock, bonds, and any other long-term debt.

Is borrowing money cheaper than selling equity?

Borrowing money is cheaper than selling equity in the company. This is true given the tax benefit related to the interest expense paid on the debt. There are costs associated with levered projects including underwriting costs, brokerage fees, and coupon payments, however. Nevertheless, over the life of the capital project or ...

Is 10% unlevered capital a wise investment?

If the result of the calculation produces an unlevered cost of capital of 10%, and the company's return falls below that amount, then it may not be a wise investment. Comparison of the result to the current cost of company-held debt can determine the actual returns.

What is unlevered equity?

Unlevered equity is a term used when describing costs for a business, referring to equity that is not adjusted for any long-term debt accounting. It is used especially in cost analysis for business projects and long-term strategic planning. In scenarios like these, a business typically knows what type of funds it will be using for the project, ...

What does "unlevered" mean in business?

Unlevered. Unlevered describes the cost projections of project analysis and other business plans. If a cost is unlevered, this means that there is no additional factors attached to it because of debt. In other words, the cost will not be affected by debt payments, interest or claims on assets.

Is unlevered equity accurate?

Unlevered equity is not necessarily an accurate calculation. Many times the project itself will use financing at some point during operations, even if the only money used to fund it is from equity. But debt factors can make forecasts very complicated. An unlevered scenario is much easier to calculate, tweak and examine than one filled with additional debt expenses. Also, when it comes to investor claims and similar legal matters the amounts are often based on the unlevered equity, giving another reason to make the calculation.

What is unleveraged equity?

Unlevered (unleveraged) equity refers the stock of a company that is financing operations with all equity and no debt. In this case, the cost of capital is only the cost of equity, as there is no debt to account for.

How to calculate cost of equity with no debt?

The formula for the cost of equity with no debt is: rf + bu (rm - rf), where rf is the risk-free rate, bu is the delevered beta, and rm is the expected market return. Beta is a measure of risk used by the investor community.

What does it mean when a stock has a beta of 1?

A beta over 1 is riskier than the market, a beta of 1 is market-neutral, and a beta less than 1 means the stock is less risky than the average market. Advertisement.

Is beta 1 a neutral metric?

Alternatively, you can ask your broker or look up the metric on an investment research website. A beta of 1 is neutral. A beta over 1 poses more risk, and a beta less than 1 poses less risk. Advertisement.

Is debt more expensive than equity?

Since debt is more costly for companies to issue than equity, the difference between the cost of capital for a company with unlevered equity and a company with levered equity can be significant. This creates economic advantages for companies that raise capital without tapping into the debt markets. Advertisement.

What is unlevered equity?

Defining Unlevered Equity. Equity in a company that has no debt is called unlevered equity. Put another way, when a company uses 100 percent equity financing, it has unlevered equity. When a company has unlevered equity, it has no financial risk.

What is equity in a business?

Equity represents the ownership stake one or more individuals or entities have in a business. For publicly traded corporations, equity is referred to as shareholder's equity. For sole proprietorships or small businesses that operate as an extension of their owners, equity is referred to as owner's equity. On the balance sheet, equity includes the ...

What happens when a company uses no debt financing?

When a company uses no debt financing, it has unlevered equity, or equity that has not be properly adjusted to compensate for longer-term debt accounting.

What is leverage in finance?

Leverage refers to the amount of debt a company has. For example, a company may buy a property for $3 million. It obtains a mortgage for 70 percent of its purchase price or $2.4 million. It uses its own cash to pay the remaining $600,000. The company therefore leveraged its $600,000 in equity with $2.4 million in debt.

What is equity on a balance sheet?

On the balance sheet, equity includes the investment from the founders, venture capitalists and initial public offerings plus the profits the business retains or minus any losses. Equity also reflects any owner withdrawals or dividend distributions.

Does leverage increase the risk of equity?

Leverage increases the financial risks of equity. However, leverage has an upside. It increases the returns that go to equity holders. The expected returns on levered equity are higher than that for unlevered equity. 00:00.

Why are companies with a higher unlevered cost of equity considered riskier than other firms?

In general, companies with a higher unlevered cost of equity are considered riskier than other firms because investors want more potential reward for more risk.

Does unlevered cost of equity require cash?

Unlike advertising or other costs, a company’s unlevered cost of equity doesn’t require any actual cash payments. This cost represents the annual percentage return investors would require to own the company’s stock if the company had no debt, or leverage.

What is unlevered cost of capital?

Unlevered cost of capital is a theoretical figure used in business. The value of unlevered cost of capital represents the cost of a company financing a capital project without debt. Typically, companies that have higher values for unlevered costs of capital are riskier, while companies that have lower values are considered less risky.

Why is unlevered cost of capital important?

Unlevered cost of capital is important because calculating its value can help you determine the cost of your company financing a capital project on its own, without having to incur any debt. You can also use the value of a company's unlevered cost of capital to evaluate it overall.

Unlevered cost of capital formula

You can use a formula to calculate unlevered cost of capital. You can solve the formula simply by using basic multiplication and addition. The unlevered cost of capital formula is:

Unlevered cost of capital calculation example

A financial analyst at Kaysville Investments wants to calculate the company's unlevered cost of capital. The financial analyst knows they need to use the unlevered cost of capital calculation formula, which is:

Tips for using unlevered cost of capital

Here are some tips to help you use the unlevered cost of capital formula effectively:

Why do firms use cost of equity?

A firm uses cost of equity to assess the relative attractiveness of investments, including both internal projects and external acquisition opportunities. Companies typically use a combination of equity and debt financing, with equity capital being more expensive.

How to find the share price of a company?

The share price of a company can be found by searching the ticker or company name on the exchange that the stock is being traded on, or by simply using a credible search engine.

Does dividend capitalization model account for investment risk?

The model does not account for investment risk to the extent that CAPM does (since CAPM requires beta).