How do you calculate depreciation of equipment?

The straight line calculation steps are:

- Determine the cost of the asset.

- Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

- Determine the useful life of the asset.

How to calculate depreciation expenses of computer equipment?

To depreciate the equipment, you must know the following:

- Cost Value: Original price or purchase price of the asset.

- Salvage Value: Salvage value Salvage Value Salvage value or scrap value is the estimated value of an asset after its useful life is over. ...

- Book Value: Cost value minus resale value is book value.

What is the depreciation rate of equipment?

depreciation rate = 1 / useful life If an asset with a useful life of five years and a salvage value of $1,000 costs you $10,000, the total depreciation in the first year is $1,800. Next year’s item value will be $1,800 cheaper, meaning that depreciation will amount to $1,440. The figure will go down annually, allowing you to pay less each year.

How do you calculate the rate of depreciation?

To calculate using this method:

- Double the amount you would take under the straight-line method.

- Multiply that number by the book value of the asset at the beginning of the year.

- Subtract that number from the original value of the asset for depreciation value in year one.

- Repeat the first two steps.

- Subtract the new number from year one's value to find year two's value.

Would depreciation be a product cost?

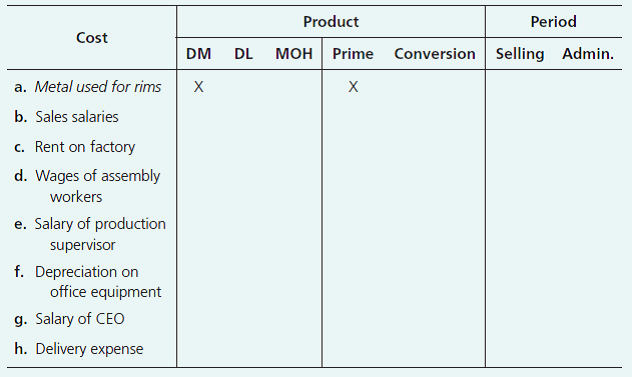

Examples of product costs are direct materials, direct labor, and allocated factory overhead. Examples of period costs are general and administrative expenses, such as rent, office depreciation, office supplies, and utilities.

Is depreciation of equipment a product or period cost?

period costsSelling expenses such as sales salaries, sales commissions, and delivery expense, and general and administrative expenses such as office salaries, and depreciation on office equipment, are all considered period costs. In a manufacturing company, these costs are often referred to as nonmanufacturing costs.

What type of cost is depreciation on equipment?

Depreciation is a fixed cost, because it recurs in the same amount per period throughout the useful life of an asset. Depreciation cannot be considered a variable cost, since it does not vary with activity volume.

Is depreciation an expense or cost?

Depreciation expense is recorded on the income statement as an expense and represents how much of an asset's value has been used up for that year. As a result, it is neither an asset nor a liability.

Is depreciation always a period cost?

As shown in the income statement above, salaries and benefits, rent and overhead, depreciation and amortization, and interest are all period costs that are expensed in the period incurred.

What is included in product cost?

The costs involved in creating a product are called Product Costs. These costs include materials, labor, production supplies and factory overhead. The cost of the labor required to deliver a service to a customer is also considered a product cost.

How do you record depreciation on equipment?

How Do I Record Depreciation? Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation. Contra accounts are used to track reductions in the valuation of an account without changing the balance in the original account.

Why is depreciation of an equipment an indirect cost?

The depreciation of the equipment is also an indirect cost of the products using the equipment. It is an indirect cost because the company has to allocate the depreciation to the three versions of the product line that are processed in the Finishing Department.

Is depreciation part of fixed costs?

Depreciation is one common fixed cost that is recorded as an indirect expense.

Should depreciation be included in inventory cost?

The depreciation of assets used in the manufacturing process are considered to be a product cost and will be allocated or assigned to the goods produced. The allocated depreciation will be included in the inventory cost of the goods manufactured until the goods are sold.

Is depreciation an overhead cost?

Other typical examples of overhead in cost accounting include indirect labor, indirect materials, utilities, and depreciation.

What type of expense is depreciation expense?

operating expenseDepreciation represents the periodic, scheduled conversion of a fixed asset into an expense as the asset is used during normal business operations. Since the asset is part of normal business operations, depreciation is considered an operating expense.

Why is depreciation used in accounting?

Depreciation is used mainly for tax purposes and accounting purposes to know the real value of the asset, the method each entity chooses varies as per their needs and purpose. If a company doesn’t depreciate, then financial reports.

What is equipment in accounting?

Equipment in accounting refers to assets that are used in day-to-day business operations. Every equipment which is bought is used over certain years, which leads to a decrease in its value. Any office Equipment like devices, other tools bought at a cost cannot be sold at the same price as it has been used. Hence every year, the same or different percentage of amount is deducted from the value of an asset. This amount, which is deducted, is called as the depreciation of equipment.

What is the book value of an asset?

This method calculates depreciation on the cost after deducting the depreciation on each year of an asset; such value is known as Book value. This method can also be referred to as the diminishing balance method or reducing balance method.

Is depreciation based on the number of units produced in a year?

It is considered as the best method as it is depreciated based on the number of units machinery produced in the year than how many years machinery is used, as the production increases depreciation will also be more and vice versa.

What is depreciation in business?

Depreciation sounds like a complicated business term , but once you understand how important it is for your company, it will get a lot more interesting. Whenever you purchase a piece of equipment, your company spends money. As you use the item, the amount of money you would be able to get for it if you sold it to someone else diminishes.

Why is depreciation important?

On top of that, depreciation helps you with taxes as you can write it off as a company expense, which saves you money.

What is depreciation for non-physical assets?

However, the depreciation for non-physical assets is called amortization. You should focus on physical equipment when working out depreciation. Before calculating it, you need to know how much you paid for the equipment itself, which is where receipts and proofs of purchase come in handy. Supposing an asset’s purchase price is $5,000, ...

What is unit of production?

Units of Production Depreciation. The units of production method lets you depreciate an asset, based on how much work it does for you, hen ce the “units” part of its name. Units don’t necessarily have to be finished products—they can refer to the number of hours the asset has spent working.

What is residual value?

Salvage or residual value is the estimated amount you could get for your asset if you were to sell it at the end of its useful life, i.e., once you can’t use it for its original purpose anymore. In accounting, it’s the amount the company can receive after the useful life period.

What is equipment life?

Equipment Lifetime. Equipment lifetime is an estimate of how long you can use an asset for its original purpose before it depreciates fully. It doesn’t stand for the number of years the equipment will exist, but for the years during which you can use it to produce income.

Why is equipment of higher value?

The equipment in question is of higher value because it includes constant tracking throughout the year. While this method is helpful for internal bookkeeping, you can’t use it for tax purposes. The recommended formula for calculating depreciation using the units of production method is.

What is indirect cost?

An indirect cost is one that is not directly associated with an activity or product. Thus, the determination of depreciation as a direct or indirect cost depends upon what it is associated with. For example, a cost center such as the power generation facility of a university contains an electric turbine. The turbine is the entire responsibility of ...

Is turbine depreciation a direct cost?

The turbine is the entire responsibility of the power generation cost center. Since the depreciation expense associated with the turbine is charged entirely to the cost center, depreciation can be considered a direct cost of the power generation cost center. Conversely, the depreciation charge for the turbine may then be added to a cost pool ...

What is depreciation expense?

Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. Tangible Assets. Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment.

What is depreciated cost?

The depreciated cost of an asset is the purchase price less the total depreciation taken to date. The depreciated cost equals the net book value if the asset is not written off for impairment. The depreciated cost of an asset is determined by the depreciation method applied.

How is depreciation determined?

The depreciated cost of an asset can be determined by a depreciation schedule that a company applies to the asset. There are several allowable methods of depreciation, which will lead to different rates of depreciation, as well as different depreciation expenses for each period.

What is depreciation in accounting?

In accounting, depreciation is an accounting process of reducing the cost of a physical asset over the asset’s useful life to mirror its wear and tear. It can be applied to tangible assets, of which the values decrease as they are used up.

What is units of production?

The units-of-production method depreciates equipment based on its usage versus the equipment’s expected capacity. The more units produced by the equipment, the greater amount the equipment is depreciated, and the lower the depreciated cost is.

Does the sum of the year method accelerate depreciation?

Similar to the declining-balance method, the sum-of-the-year’s method also accelerates the depreciation of an asset. The asset will lose more of its book value during the early periods of its lifespan.

Does depreciation decrease faster?

Thus, the depreciated cost decreases faster at first and slows down later. The double declining-balance depreciation is a commonly used type of declining-balance method. 3.

What are some examples of period costs?

Examples of period costs are general and administrative expenses, such as rent, office depreciation, office supplies, and utilities. Product costs are sometimes broken out into the variable and fixed subcategories.

Is building rent an administrative expense?

Building rent, insurance, subscriptions, utilities, and office supplies may be classified as either a general expense or an administrative expense. Depending on the asset being depreciated, depreciation expense may be classified as a general, administrative, or selling expense.

Is depreciation on production equipment a manufacturing cost?

Depreciation on production equipment is a manufacturing cost, but depreciation on the warehouse in which products are stored after being manufactured is a period cost.

Is depreciation a variable cost?

Depreciation is a fixed cost, because it recurs in the same amount per period throughout the useful life of an asset. Depreciation cannot be considered a variable cost, since it does not vary with activity volume. However, there is an exception.

Is sales commission a period cost?

Selling expenses such as sales salaries, sales commissions, and delivery expense, and general and administrative expenses such as office salaries, and depreciation on office equipment, are all considered period costs. In a manufacturing company, these costs are often referred to as nonmanufacturing costs. Click to see full answer.

When a manufacturer's products are sold, will depreciation be included in the cost of goods sold?

When a manufacturer's products are sold, some of the depreciation will be included in the cost of goods sold. When some of the manufactured products are held in inventory, some of the depreciation associated with the manufacturing process will be included in the cost of the inventory. As you can see, depreciation is often part ...

Is depreciation an administrative expense?

Where depreciation is reported depends on the assets being depreciated. For example, the depreciation on the building and furnishings of a company's central administrative staff is considered an administrative ...

Is depreciation on the building and furnishings of a company's central administrative staff considered an administrative expense

For example, the depreciation on the building and furnishings of a company's central administrative staff is considered an administrative expense. The depreciation on the sales staff's automobiles is considered part of the company's selling expenses.

Is depreciation part of a company?

As you can see, depreciation is often part of many functions within a company. The company's depreciation should be assigned to each of the areas where the assets are utilized.