Is an oligopoly a price maker or a price taker?

Is an oligopoly a price searcher? Oligopolies are price setters rather than price takers. Oligopolistic firms are price searchers. They can raise the price of their good and still sell some, or all, of their product. If only a few firms account for a large percentage of sales, then the market is considered oligopolistic.

Why is the monopoly firm a price maker?

A monopoly firm is a price-maker simply because the absence of competition from other firms frees the monopoly firm from having to adjust the prices it charges downward in response to the competition. The whole point of a competitive marketplace is that consumers can choose among multiple companies for the...

How does a monopoly firm a price maker?

In pure monopolies the firm is a price maker as they are able to take the markets demand curve as their own. The monopoly firm is able to set the price anywhere on this demand curve. The ability of the monopoly firm to set price is dependent on price elasticity of the product – if demand is elastic it will limit the firms price setting power.

Are firms in the oligopoly a price taker?

The economic and legal concern is that an oligopoly can block new entrants, slow innovation, and increase prices, all of which harm consumers. Firms in an oligopoly set prices, whether collectively—in a cartel —or under the leadership of one firm, rather than taking prices from the market.

Why is oligopoly a price maker?

Firms in an oligopoly set prices, whether collectively—in a cartel—or under the leadership of one firm, rather than taking prices from the market. Profit margins are thus higher than they would be in a more competitive market.

Can a oligopoly be price taker?

The paper studies an oligopoly game, where firms can choose between price-taking and price-making strategies. On a mixed market price takers are always better off than price makers, though the profits of both types decline in the number of price takers.

Are monopolies price makers?

A monopolist is considered to be a price maker, and can set the price of the product that it sells. However, the monopolist is constrained by consumer willingness and ability to purchase the good, also called demand.

Who is the price maker?

A price maker is an entity that has the power to influence the price it charges as the good it produces does not have perfect substitutes. Price makers are usually monopolies or producers of goods or services that differ in some way from their competition.

Who is price maker in perfect competition?

In perfect competition the seller is a price maker.

What markets are price takers?

Price takers are found in perfectly competitive markets. Price makers are able to influence the market price and enjoy pricing power. Price makers are found in imperfectly competitive markets such as a monopoly or oligopoly market.

What means oligopoly?

An oligopoly is a market characterized by a small number of firms who realize they are interdependent in their pricing and output policies. The number of firms is small enough to give each firm some market power.

Is oligopoly monopolistic competition?

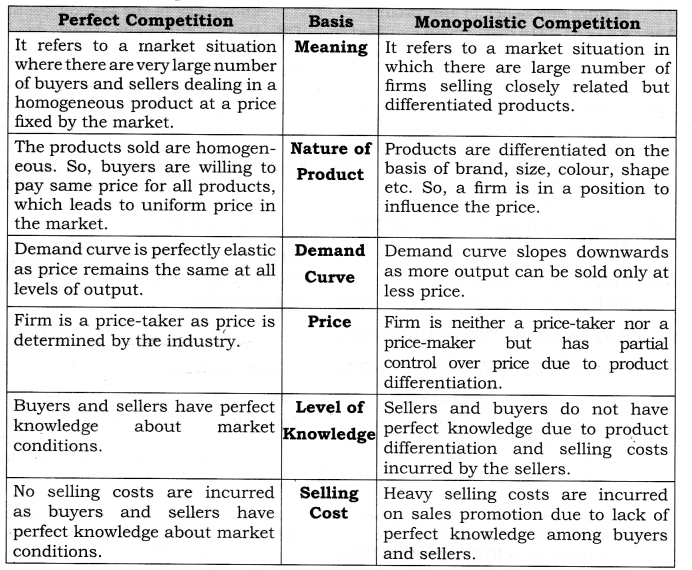

Perfect and monopolistic competition have a large number of small firms, whereas, oligopoly consists of fewer firms that are relatively large in size. For the purpose of detailed understanding, oligopoly and monopolistic competitions have been explained in greater depth along with their major differences.

What is an oligopoly competition?

a competitive situation in which there are only a few sellers (of products that can be differentiated but not to any great extent); each seller has a high percentage of the market and cannot afford to ignore the actions of the others.

Which firm is price maker firm?

A price maker firm refers to that firm which has complete control over price of the product in the market.

Why industry is a known as price maker?

Once the price is determined by the industry, every firm in the industry has to accept the price as given and firm can sell as many units of the commodity as it wants. It is because of this position why industry is called price-maker and the firm price-taker.

What happens when price decreases?

A price decrease would lead to a significant increase in quantity demanded at competitors’ expense. However, if also competitors lower their prices, demand curve 2 comes into effect necessitating only a modest increase in quantity demanded. When it comes to an increase in price, it is desirable that competitors follow.

How to explain kinked demand curve?

The kinked demand curve model studies these dynamics. The model is based on an assumption according to which competitors in an oligopolistic situation will follow a price decrease but will not react to a price increase: 1 A company considering a price decrease thinks that it faces demand curve 1, which is true if competitors do not react. A price decrease would lead to a significant increase in quantity demanded at competitors’ expense. However, if also competitors lower their prices, demand curve 2 comes into effect necessitating only a modest increase in quantity demanded. 2 When it comes to an increase in price, it is desirable that competitors follow. Once again, demand curve 2 comes into force: there is only a modest decrease in quantity demanded as the result of the price increase. Conversely, if competitors do not follow, a sharp decrease in quantity will result.

Does lowering price increase market share?

In practice, besides differentiation, lowering price can increase a company’s market share. This is, however, prone to competitors’ similar actions, which leads to lower profits without an impact on the market share. A price increase, in contrast, can decrease sales if competitors will not follow the stroke.

What is an oligopoly market?

Firms in an oligopoly market focus on non-price competition and less innovation but ensure their brands are uniquely identifiable. They believe in making customers stick to their brands for core competencies rather than lower prices to gain profits and market share. Despite having the same market share, a smaller number of firms causes oligopolists to get influenced by each other’s decisions, such as price cuts and increases.

What is an oligopoly in economics?

An oligopoly in economics refers to a market structure comprising multiple big companies that dominate a particular sector through restrictive trade practices, such as collusion and market sharing. Oligopolists seek to maximize market profits while minimizing market competition through non-price competition and product differentiation.

How do oligopolists work?

Oligopolists offer comparable products or services, so they control prices rather than the market. They do so through collusion that results in higher prices and fewer production or product choices for customers. It encourages existing brands to improve product quality and originality by instilling a sense of rivalry.

Why do oligopolists collaborate?

Businesses in such a market collaborate to dominate the rest of the players and maximize joint revenue. Oligopolists do not compete with each other. Instead, they collaborate on various fronts, such as economies of scale, market demand, and product differentiation.

Why do oligopolists not raise their prices?

Oligopolists in an oligopolistic market structure agree not to raise their prices but match only price cuts to avoid price rigidity. However, too much price decrease can lead to a price war. As a result, each firm obligates to adhere to pre-determined price and quantity/output levels to maximize revenue.

How does oligopoly help brands?

It encourages existing brands to improve product quality and originality by instilling a sense of rivalry. Key Takeaways. An oligopoly is a market structure where a few large firms collude and dominate a particular market segment.

What are the factors that determine a market structure?

The factors that determine a market structure include the number of businesses, control over prices, and barriers to market entry. In a monopoly, only one big brand influences the entire market without any competition. When two major players dominate a sector, the market becomes a duopoly.

What does it mean when a company is an oligopoly?

It means that oligopoly firms set prices to maximize their own profit. Ultimately, it leads to partnerships and collaborations that foster success for themselves and other firms, specifically smaller companies operating within the same market or industry.

What is the primary idea behind an oligopolistic market?

The primary idea behind an oligopolistic market (an oligopoly) is that a few companies rule over many in a particular market or industry, offering similar goods and services. Because of a limited number of players in an oligopolistic market, competition is limited, allowing every firm to operate successfully.

Why is it so difficult to enter oligopolistic markets?

It is primarily due to two significant factors: strong competition from well-established and successful large firms that dominate the space and their competitive and wide-ranging product and service offerings, including premium and mass market.

What is the purpose of oligopolies?

built by oligopolies generally ensure that they have a production cost advantage. Oligopolies form when several dominant companies rule over a particular market or industry, making collaboration and partnerships possible between the firms that exist within them.

What is market positioning?

Market Positioning Market Positioning refers to the ability to influence consumer perception regarding a brand or product relative to competitors. The objective of market. Natural Monopoly. Natural Monopoly A natural monopoly is a market where a single seller can provide the output because of its size.

What is a price leader?

Price Leader A price leader is a company that exercises control in determining the price of goods and services in a market. The price leader’s actions. , seeking out and forming partnerships and deals that establish prices that are higher than the ruling companies’ marginal costs.

Do oligopoly companies enter price wars?

Oligopoly companies generally do not enter such price wars and, instead, tend to funnel more money into research to improve their goods and services and into advertising that highlights the superiority of what they offer over other companies with similar products.

What is the meaning of oligopoly?

Meaning of Oligopoly: Oligopoly refers to a market situation or a type of market organisational in which a few firms control the supply of a commodity. The competing firms are few in number but each one is large enough so as to be able to control the total industry output and a moderate. However, increase of its output or sales will reduce ...

What is an oligopolistic model?

Generally, oligopolistic models are of two types: one presumes conjectural behaviour on the part of the oligopolist, another presumes non-conjectural behaviour.

What is the kinked demand curve model?

First, there is the kinked (kinky) demand curve model of Paul Sweezy. It is not designed to deal with oligopolistic price and output determination. Rather, it seeks to explain why, once a price-quantity combination has been arrived at, it is not changed frequently.

Why is oligopoly important?

An oligopolist cannot set any price for its product independent. It is so because there is interdependence among the oligopolistic firms. The most important aspect of oligopoly market is reaction of rival films.

What is the consequence of oligopolistic interdependence?

Oligopolistic interdependence has another consequence which is more significant for the economic literature than for the operation of the economy. This feature of oligopoly has made the formulation of a systematic analysis of oligopoly virtually impossible.

What is the oligopoly situation?

The oligopoly situation (as also the duopoly situation) has one feature which has drawn the attention of economists. This is the interdependence in the decision making of the few dominant firms and this interdependence is recognised by all of them.

What is the main problem in an oligopoly market?

The main problem arises in the construction of a stable and a certain demand curve for the product of an oligopolist. This point may be explained further.

How are oligopolies complex?

Oligopolies are very complex market structures. Consider, for example, an established industry where a homogeneous good is produced by several profit-maximizing firms with identical cost structure and where both demand and cost structure is a common knowledge. There is no one, commonly agreed descriptive model of firms’ behavior even for this idealized environment. Firms might take into account how their production decisions affect prices, as they do in Cournot competition or if they collude. Or, at another extreme, firms may take price as given and behave competitively. Even if price-making behavior brings firms higher profits,1 the recent literature casts doubts on whether this behavior will actually be observed. A celebrated result by Vega-Redondo (1997) states that the Cournot-Nash equilibrium is not evolutionary stable. That is if firms use trial and error and adapt via imitation of the most profitable firm, the dynamic process moves them away from the Cournot outcome and bring the market to the Walrasian point, which corresponds to the equilibrium under price-taking firms. Results in Huang, 2003, Huang, 2007 show that a firm that deviates from collusive behavior unilaterally to be a price taker will earn a higher profit than the non-deviating collusive firms.

What are the two conditions of compositionally stable markets?

On compositionally stable markets the two conditions are satisfied. First, no price-taking firm has an incentive to become a price maker (assuming that all other firms do not change their types). Second, no price-making firm has an incentive to become a price taker (assuming that all other firms keep their types unchanged). 21

What is an oligopoly?

Oligopoly Definition. In an oligopoly market structure, there are just a few interdependent firms that collectively dominate the market. While individually powerful, each of these firms also cannot prevent other competing firms from holding sway over the market. Depending on the industry, each of the firms might also sell products ...

What are some examples of oligopoly?

Mass media is a very significant example of oligopoly—a staggering 90 percent of media outlets in the United States are owned by just six massive corporations: NBC Universal, Viacom (VIAB), New Corporation (NWSA), Time Warner (TWX), and Walt Disney (DIS). Auto manufacturing in the United States is likewise dominated by Chrysler, Ford, and GMC.

How is a duopoly different from a monopoly?

The existence of a monopoly means there is just one firm in a given industry, while a duopoly refers to a market structure with exactly two firms. Meanwhile, an oligopoly involves two firms or more. Technically, there is not a maximum number of firms that can exist in an oligopoly, but as a rule there have to be so few powerful firms in an industry ...

Why is OPEC a cartel?

The OPEC is a legal cartel because it is an agreement signed between countries and not individual firms. In an informal agreement, the firms behave as a monopoly and choose the price that maximizes output. The diagram would be like the monopoly profit maximizer.

What is the most significant threat to the existing balance of an oligopoly?

The most significant threat to the existing balance of an oligopoly is the fact that each business in such a structure is incentivized to sabotage the other businesses for their own financial benefit.

Why are prices higher for consumers?

Prices for consumers are higher than they would otherwise be, because competition and the usual laws of supply and demand are not operating as normal. The result of these higher prices for consumers is higher profit margins for the firms involved in the oligopoly.

Which cell phone companies dominate the market?

In the wireless cell phone service industry, the providers that tend to dominate the industry are Verizon (VZ), Sprint (S), AT&T (T), and T-Mobile (TMUS). For smartphone operating systems, Android, iOS, and Windows are the most prevalent options. Mass media is a very significant example of oligopoly—a staggering 90 percent ...

Breaking Down Oligopolistic Markets and Firms

Entering Oligopolistic Markets

- Because of the structure of oligopolies, new firms typically find it difficult – if not impossible – to penetrate into oligopolistic markets. It is primarily due to two significant factors: strong competition from well-established and successful large firms that dominate the space and their competitive and wide-ranging product and service offerings, including premium and mass mark…

Additional Resources

- We hope you enjoyed reading CFI’s explanation of oligopolistic markets, industries, and companies. The following CFI resources will be helpful in furthering your financial education: 1. Free Economics for Capital Markets Course 2. Barriers to Entry 3. Market Positioning 4. Natural Monopoly 5. Syndicate