Hello, pals! Let’s look at credit card management apps made for people in the United States. It can be difficult to keep track of your expenditures and online payments, but do not worry!

These apps are here to help, whether you’re a beginner or an expert. Let’s take a look at the best applications for stress free online payments.

Top 5 Credit Card Management Apps for Online Payment

- Mint

- Credit Karma

- YNAB (You Need A Budget)

- PocketGuard

- WalletHub

Application Overview 2024:

| App | Overview |

|---|---|

| Mint | Your personal finance guru, tracking spending and helping stick to budget. |

| Credit Karma | Comprehensive financial tool for managing credit cards and improving financial health. |

| YNAB (You Need A Budget) | Assigns every dollar a job, helps stay on top of finances and save more money. |

| PocketGuard | Personal finance assistant to track spending, optimize budget, and find ways to save. |

| WalletHub | One-stop-shop for financial needs, from credit cards to loans to insurance. |

Let us know all these information in detail.

1. Mint

Mint is similar to a personal finance expert in that it constantly monitors your expenditure and assists you in staying on track. It’s free to use and consolidates all of your accounts into one location, providing you a clear picture of where your money goes.

Features:

- Track spending and set budgets

- Receive bill reminders

- Monitor credit score

- Get personalized money saving tips

2. Credit Karma:

Credit Karma is more than just a credit score checker; it’s a comprehensive financial tool that can help you manage your credit cards and improve your overall financial health.

Features:

- Check credit scores from TransUnion and Equifax

- Receive personalized recommendations for credit cards and loans

- Monitor credit report for suspicious activity

- Track spending habits

3. YNAB (You Need A Budget):

YNAB is all about putting every dollar to work and keeping you in control of your budget. It’s ideal for people who wish to gain control over their spending and save more money.

Features:

- Assign every dollar to a specific category

- Set financial goals and track progress

- Sync transactions automatically

- Access to educational resources for better money management

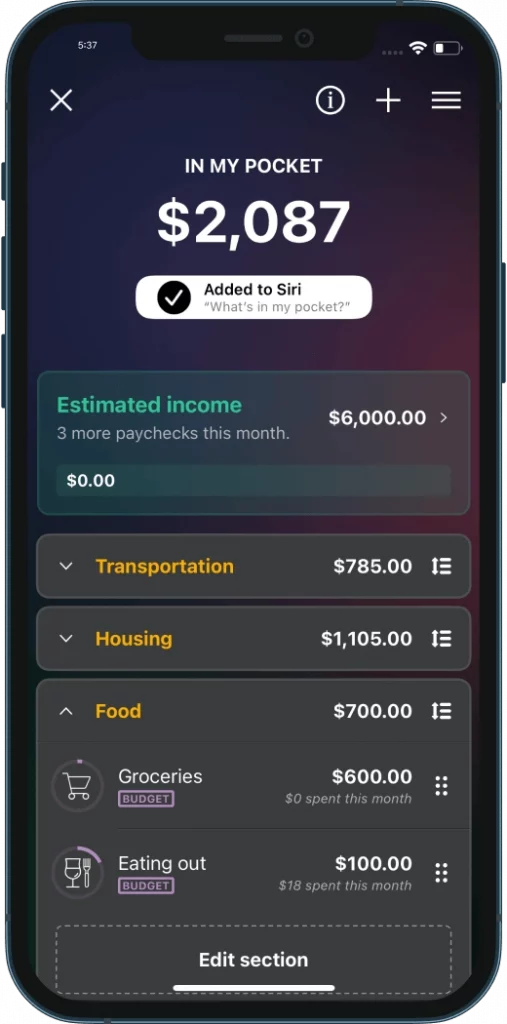

4. PocketGuard

PocketGuard is like to having a personal finance advisor in your pocket; it allows you to watch your spending, optimize your budget, and even uncover methods to save money on bills.

Features:

- Track spending and categorize transactions

- Analyze spending patterns and identify areas for saving

- Set financial goals and track progress

- Receive alerts for upcoming bills and low balances

5. WalletHub

WalletHub is a one stop shop for everything financial, including credit cards, loans, and insurance. With its simple layout and strong functionality, managing your credit cards has never been easier.

Features:

- Check credit scores and reports

- Compare credit card offers and find the best deals

- Receive personalized recommendations for improving credit

- Track spending and set budget goals

Conclusion

Here you are, folks 5 amazing applications for managing your credit cards and excelling at online payments in the United States. These apps can help you track spending, improve your credit score, and stick to a budget. Say goodbye to financial troubles and welcome a happier, more secure future!

FAQs

Q1. What are credit card management apps?

Ans: Credit card management apps are tools designed to help you track and manage your credit card transactions, budgets, and spending habits.

Q2. Are these apps safe to use for managing credit cards?

Ans: Yes, these apps use encryption and other security measures to safeguard your financial information, ensuring a secure experience.

Q3. Do I need to pay to use these credit card management apps?

Ans: Most of these apps offer free versions with basic features, while some may have premium options with additional functionalities for a fee.

Q4. Can these apps help improve my credit score?

Ans: Absolutely! Many of these apps provide insights and tips to help you manage your finances better, which can ultimately lead to an improved credit score over time.