Some of the examplesof Liabilitiesare Accountspayable, Expenses payable, Salaries payable, Interest payable. These accountsare like the money to be paid to the customer on the demand of the customer instantly or over a particular period of time. These accountsfor an individual are referred to as the Assets.

What are the types of liability accounts?

Definition of Types of Liabilities on Balance Sheet

- Explanation. Liabilities are obligations of the company that arise as a result of past transactions. ...

- Types of Current Liabilities. Accounts Payable: These are also known as Trade Creditors. ...

- Conclusion – Types of Liabilities on Balance Sheet. ...

- Recommended Articles. ...

What are some examples of liabilities in accounting?

What Are Liabilities in Accounting?

- COMMON LIABILITIES IN SMALL BUSINESS. If you borrow instead of paying outright, you have liabilities. ...

- IMPORTANCE OF LIABILITIES TO SMALL BUSINESS. Liabilities (money owing) isn’t necessarily bad. ...

- LIABILITIES VS. EXPENSES. A liability is money owed to buy an asset, like a loan used to purchase new office equipment. ...

What are the different types of liability?

Types of Liabilities

- Lawsuit proceedings

- Product warranty claims

- Guarantee for loans

What are the different types of liabilities?

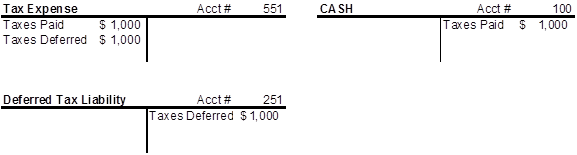

- Deferred tax liabilities

- Mortgage payable

- Bonds payable

- Capital leases

- Long-term notes payable

What are some examples of liabilities?

Examples of liabilities. Liabilities are legal obligations payable to a third party. A promise to make a payment on a future date is a liability. A liability is recorded in the general ledger, in a liability-type account that has a natural credit balance.

What is current liability account?

Current Liability Accounts (due in less than one year): Accounts payable. Invoiced liabilities payable to suppliers. Accrued liabilities. Liabilities that have not yet been invoiced by a supplier, but which are owed as of the balance sheet date. Accrued wages.

What is interest payable?

Interest payable. Interest accrued on debt that has not yet been invoiced by the lender.

What is a bond payable?

Bonds payable. The remaining principal balance on bonds outstanding that is due for payment in more than one year.

What is a current portion of debt payable?

Current portion of debt payable. Any portion of long-term debt that is due for payment within one year.

What is accrued wages?

Accrued wages. Compensation earned but not yet paid to employees as of the balance sheet date. Customer deposits. Payments made by customers in advance of the seller completing services or shipping goods to them. If the goods or services are not provided, the company has an obligation to return the funds.

What is compensation owed to employees?

Compensation owed to employees, typically to be paid out in the next payroll cycle. Sales taxes payable. Sales taxes charged to customers, which the company must remit to the applicable taxing authority. Use taxes payable.

What is a liability in business?

A simpler way of thinking about liabilities is that they are a source of third-party funding that business uses to buy assets and fund operations. It should be noted that the other party might have the right to confiscate the assets from the business or make it sell assets to repay the debt a business is not paying otherwise.

What is a current liability?

A current liability is a type of liability that is expected to be paid within a maximum one year. These liabilities are better known as short-term liabilities.

What is the term for probable future sacrifices of economic benefits arising from present obligations of a particular entity?

Liabilities are probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events.

What is the current portion of long term debt?

Current Portion of Long-Term Debt – a portion of debt with an overall maturity of more than a year; portion due within 12 months.

Why is it important to understand what liabilities are?

It is important to understand what liabilities are because they are crucial part of normal business. The word liabilities always makes them seem like a bad thing and something we want to avoid, but that is not the case. Liabilities are just a normal part of business and they are not anything to be afraid of.

What is accrued expense?

Accrued Expenses – when a business or organization accounts for expenses that it will pay off at future dates; Customer Prepayments – money paid by customers to who the business owe services or products in return; Interest Payable – any interest on loans that have accrued since the last payment;

What is account payable?

Accounts Payable – when a business buys inputs or products on account, which they need to pay back; Taxes Payable – for collection of sales taxes and employee deductions; Salaries Payable – any salaries the company owes to its workers and has not paid yet;