Many people bought stocks on the margin in the late 1920s because they thought stock prices would keep going up forever. Because people were buying on the margin and because they were overconfident about the prospects for the stocks, they were willing to pay inflated prices for the stocks. This made stock prices go up more than they should have.

What does it mean to buy investments on margin?

When it comes to investing, buying on margin involves borrowing money from your broker to buy securities, such as stocks or bonds. Margin is the difference between the total value of the investment and the amount you borrow from a broker.

What is buying on margin history?

Buying on Margin In the 1920s, the buyer only had to put down 10 to 20 percent of his own money and thus borrowed 80 to 90 percent of the cost of the stock. In the 1920s, many speculators (people who hoped to make a lot of money on the stock market) bought stocks on margin.

What is buying on margin US history definition?

- Interesting Facts about Long Bull Market for kids and schools

- Summary of the Long Bull Market in US history

- The Long Bull Market, selling and buying stocks

- Herbert Hoover from March 4, 1929 to March 4, 1933

- Fast, fun facts about the Long Bull Market and Margin Call

- Foreign & Domestic policies of President Herbert Hoover

What is buying stocks on margin?

UBS analyst Adam Beatty initiated a Buy on TPG due to the company's potential for greater scale and margin expansion in ... wrote in a note to clients. The stock market's recent volatility could ...

What was buying on margin and why was it popular in the 1920s quizlet?

During the 1920s, Many Americans had seen how some had gotten rich by investing in the stock market. They wanted to invest, too. Stock brokers made it easier to buy stock on credit by paying as little as 10% and owing the rest. This was known as buying on margin.

What is buying on margin 1920s quizlet?

buying on margin. the purchasing of stocks by paying only a small percentage of the price and borrowing the rest. Roaring 20s. cabinet.

What was buying on margin?

Buying on margin involves getting a loan from your brokerage and using the money from the loan to invest in more securities than you can buy with your available cash. Through margin buying, investors can amplify their returns — but only if their investments outperform the cost of the loan itself.Sep 28, 2021

What is buying on margin and why is it significant?

Buying on margin means you are investing with borrowed money. Buying on margin amplifies both gains and losses. If your account falls below the maintenance margin, your broker can sell some or all of your portfolio to get your account back in balance.

What is margin buying in the 1920s?

Buying on Margin In the 1920s, the buyer only had to put down 10–20% of his own money and thus borrowed 80–90% of the cost of the stock. Buying on margin could be very risky.Mar 6, 2020

How was buying on margin good for the economy?

A margin account increases purchasing power and allows investors to use someone else's money to increase financial leverage. Margin trading offers greater profit potential than traditional trading but also greater risks. Purchasing stocks on margin amplifies the effects of losses.

How did buying on margin caused the Great Depression?

This meant that many investors who had traded on margin were forced to sell off their stocks to pay back their loans – when millions of people were trying to sell stocks at the same time with very few buyers, it caused the prices to fall even more, leading to a bigger stock market crash.

How did buying on margin impact the stock market in 1929?

People Bought Stocks With Easy Credit People encouraged by the market's stability were unafraid of debt. The concept of “buying on margin” allowed ordinary people with little financial acumen to borrow money from their stockbroker and put down as little as 10 percent of the share value.Apr 27, 2021

How does using margin work?

Trading on margin means borrowing money from a brokerage firm in order to carry out trades. When trading on margin, investors first deposit cash that then serves as collateral for the loan and then pay ongoing interest payments on the money they borrow.

What did it mean to purchase stocks on margin quizlet?

To buy "on margin" meant that a person would purchase stocks uncredited with a loan from their broker. Later they would sell the stocks at a higher price, pay back the loan, and keep the profit. Buying on margin was very tempting because it offered the prospect of large profits for a small cash investment.

Why Buying on margin is less riskier compared to short selling?

In this sense, short selling is even riskier than margin trading because you can be on the hook for an unlimited amount of money. With margin trading, you're only at risk of losing what you've invested and borrowed.Dec 29, 2021

What is true about using margin to buy stock quizlet?

Trading on margin involves buying securities partly with borrowed funds. Investors use margin to lower the amount of their own money involved in investments. This allows the investor to buy more securities than he otherwise could have. Using borrowed money creates leverage which magnifies both gains and losses.

What did the American people buy in the 1920s?

The American people bought stocks in unprecedented fashion. Stocks on the installment plan, stocks via investment clubs, stocks bought with capital rather than income, stocks on margin. It was a big new fad. Nothing like the participation in the market that the nation experienced in the 1920s can be found in previous eras of history.

What was the precondition of the mass participation in stocks in the 1920s?

Prior to the 1920s, saving money in traditional and homely instruments, including in cash and coin, enabled one, years later, to buy all the things one had been able to when the money had first been saved. Furthermore, this saved money captured the real economic growth ...

What was the reality of the 1920s?

These realities gave no spur to stock-market participation. The permanent denuding of the dollar, the reality of which first became clear in the 1920s, forced savers to find some instrument that would pay them back in the old way, in money that held its value.

What was the government doing in the 1930s?

Government then, in the early 1930s, stepped in with its tariffs, taxes, confiscations (of both gold at the federal level and property at the state and local level— the foreclosure crisis), and spending increases, and thereby chased away the real economy. The void left over was the Great Depression.

What was the big switch in the 1920s?

The big switch, in the 1920s, from the perspective of the average person’s financial position, is what occurred with respect to the long-term value of savings. Never before in American history had there been multi-decade evidence that the dollar was not holding its value.

What was the American economy during the Industrial Revolution?

It was the paragon of global growth during the central years of the industrial revolution. The American economy became the largest in the world, and then some, beginning in the 1880s, having been quite literally a backwater not many decades before. Before the 1920s, in other words, people, as they acquired resources by dint ...

What is the meaning of the stock market mania?

The stock market “mania,” to use Charles Kindleberger’s phrase, was a choice born of new circumstances.

Why was the 1920s called the Roaring 20s?

The 1920s have been called the Roaring '20s and for good reason. Not only was American culture 'roaring' in terms of style and social trends, but the economy was 'roaring' as well. The decade was a time of tremendous prosperity. Following the end of World War I, the industrial might of the United States was unleashed for domestic, peaceful purposes.

What is margin buying?

Buying on margin was a risky practice in which the buyer would typically borrow money from their broker in order to pay for the stock. For example, a buyer might put down 20% of the cost of stock, but borrow the other 80% from a broker.

What was the thing to do in the 1920s?

With money to invest, many Americans began buying stock. This was the thing to do in the 1920s. It was seen as modern: a venture for those who were smart, sophisticated, and urbane. And while it carried risks, it was generally seen as a sound investment. As the economy continued to grow throughout the decade, some people came to see investing in stock as a foolproof way to get rich quick.

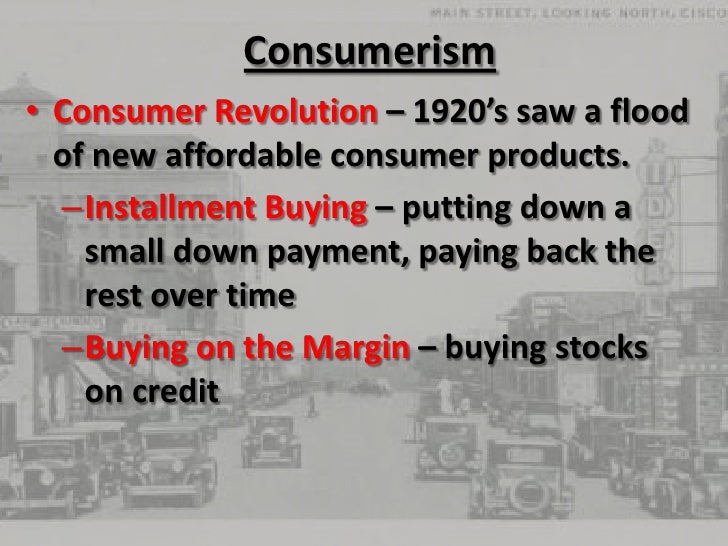

What was consumerism in the 1920s?

Consumerism came into its own throughout the 1920s as a result of mass production, new products on the market, and improved advertising techniques.

What happened in the 1920s?

The Stock Market Crash. The prosperity of the 1920s came to crashing halt in the last year of the decade. In September of that year, the stock market began to show signs of stagnation. Then, in October, the bottom fell out as people panicked and began selling out their stock.

What were the new technologies that led to the growth of the economy?

New technologies like the automobile, household appliances, and other mass-produced products led to a vibrant consumer culture, stimulating economic growth. Furthermore, under the administration of three consecutive Republican presidents, the government adopted fiscally conservative policies that fueled private business.

When was the Sears catalog invented?

Sears, Roebuck & Co., a company founded in 1893, regularly issued a mail-order catalog. By the 1920s, the catalog, nicknamed the consumer's bible, had become enormously popular. It completely revolutionized how people purchased items.