What is Tenant track on credit report? A tenant credit check is run by landlords on potential renters to screen tenants who have financial or personal problems. A rental credit check shows the potential tenant's credit score as well as details about his or her recent credit history, including instances of non-payment or delinquencies.

Full Answer

What is a tenant credit report?

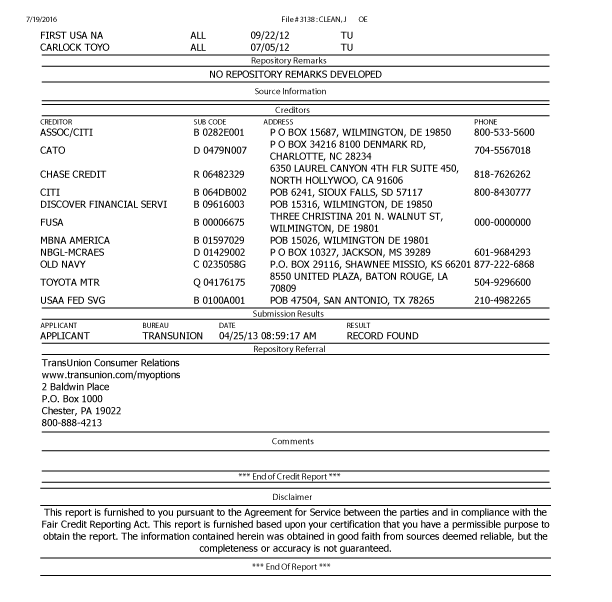

A credit report is a detailed snapshot of a person’s borrowing history that typically includes information from banks and other financial institutions, creditors and public records. Reports from different bureaus and services look slightly different, but all tenant credit reports should contain:

What do landlords look for on a credit report?

Many landlords find it essential to check a prospective tenant's credit history with at least one credit reporting agency to see how responsibly the applicant manages money. A credit report contains a gold mine of information for a prospective landlord.

What is included in a tenant screening report?

A tenant screening report may consist of any or all of the following: 1 Credit reports 2 Rental history information including any eviction actions and lawsuits 3 Employment verification 4 Criminal history 5 Sex offender registries 6 National terrorist watchlist 7 A risk score or recommendation based on criteria selected by the landlord

Why do landlords run credit checks on tenants?

Why should landlords run credit checks on tenants? A rental credit check helps demonstrate a tenant’s history of responsible borrowing, meaning they pay their debts on time (and are more likely to pay their rent on time). It also helps show whether they can afford to live in your rental property. What information is needed for a credit check?

Does renters history show up on credit report?

Contact your landlord or property manager. Your lease will appear in the "accounts" section of your Experian credit report, showing the date the lease started, your monthly payment amount and your payment history for the past 25 months.

How long does rental inquiry stay on credit report?

2 yearsAs we've seen above, soft credit pulls might show up in your rental credit check history, but they don't affect your credit score in any way. They also disappear within 30 days. On the other hand, hard inquiry credit checks stay on your credit report for 2 years.

Does a rental inquiry hurt your credit?

Since most credit checks for renting are considered soft checks, they won't negatively impact your credit score. The FICO® credit-scoring model, one of the most popular credit scores, ignores inquiries made within 30 days of scoring.

Do rent payments affect credit score?

Rent payment history, in general, affects around 35% of your overall credit score. So, even a single late rent payment or missed rent payment can significantly impact your credit score — especially if it's already on the higher side.

Why should landlords run credit checks on tenants?

A rental credit check helps demonstrate a tenant's history of responsible borrowing, meaning they pay their debts on time (and are more likely to p...

What information is needed for a credit check?

Before you can run a credit check on rental applicants, each applicant over the age of 18 must submit a completed rental application and give the l...

What landlord credit check services are available?

There are several providers that offer self-serve credit report services to landlords, but the most common way is to go through one of the three ma...

How much is a credit check for a tenant?

The three main credit bureaus - Equifax, Experian and TransUnion - will charge a fee, typically around $25 to $75 per applicant, depending on the i...

How long does a tenant credit check take?

With most services, it can take 2-10 days to get approval to run a credit check on prospective tenants. After you're approved, the results of the c...

What to look for in a tenant credit report?

A credit report is a detailed snapshot of a person's borrowing history that typically includes information from banks and other financial instituti...

What factors affect a tenant's credit score?

Many factors negatively impact a tenant's credit score. While the credit score is important, look at it as part of the larger credit story. A great...

How to read a tenant's credit report?

If an applicant has an outstanding medical bill or is recovering after a period of unemployment, they might have negative items on their credit rep...

How do landlords verify income and rental history?

One person out of five has an error on their credit report - so it's a good idea to verify your landlord credit check and make sure your informatio...

What is a tenant credit report?

A credit report is a detailed snapshot of a person’s borrowing history that typically includes information from banks and other financial institutions, creditors and public records. Reports from different bureaus and services look slightly different, but all tenant credit reports should contain: 1.

What is a rental credit check?

A rental credit check helps demonstrate a tenant’s history of responsible borrowing, meaning they pay their debts on time (and are more likely to pay their rent on time). It also helps show whether they can afford to live in your rental property.

What to do if tenant credit check comes up empty?

If the tenant credit check comes up empty, you can use employment verification and criminal background checks to verify the information they provided in their application.

What happens if a tenant has a good credit score?

If the tenant credit check form comes back with a high score, they are more likely to pay their bills on time and have a favorable income-to-debt ratio. Make sure to run a background check before making your final decision and moving forward with a lease agreement.

How old do you have to be to get a credit check for a rental?

Before you can run a credit check on rental applicants, each applicant over the age of 18 must submit a completed rental application and give the landlord permission to check their credit. As the landlord, you must follow all Fair Credit Reporting Act guidelines and be able to verify that you’re the actual landlord.

What is a soft inquiry?

Soft inquiries: These occur as part of a background check (or when someone requests a copy of their own credit report) and don’t affect the credit score. A tenant credit check is an example of a soft inquiry. 7. Collections.

How much does a credit bureau charge?

The three main credit bureaus — Equifax, Experian and TransUnion — will charge a fee, typically around $25 to $75 per applica nt, depending on the information requested (such as a criminal background check in addition to the credit report).

Why do landlords do credit checks?

Which is why credit checks are a popular way for landlords to determine if an applicant will be a reliable tenant. Although it is called a credit check, most landlords look for more than just the credit score, if at all. Landlords understand that rent payment history seldom gets reported in the credit bureau.

What is tenant score?

It tells you who the report is about, their Tenant score- a recommendation on whether they would be a good tenant, based off of their financial and background check, an overall summary of whether they passed/failed any check and a risk assessment.

Does a landlord report rent payments?

Landlords understand that rent payment history seldom gets reported in the credit bureau. Instead they look for a tenant screening service that provides landlords an insight into an applicant’s financial health, bankruptcies or delinquent accounts, and criminal history.

Can I skip the application if my credit report is bad?

Of course, if the report is extremely good, you may proceed with the reference checks and further onboarding processes, and for a bad report with low score, a number of missing payments and with other red flags, you may do well to skip the application.

What is a credit report?

A credit report is a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts. Learn more about credit reports.

Why do landlords use tenant screening?

Landlords use tenant screening reports to help make decisions on possible tenants. These reports may contain information from many sources including your rental history and credit reports. When you apply to rent a home, many landlords use a tenant screening report to help decide whether to rent to you and how much to charge for your security ...

How long does it take to get a free credit report from a landlord?

Your right to a free copy of that report if you make the request within 60 days of when the landlord denies you housing. Learn more about your rights if you’re denied housing due to your credit report. Tenant screening reports are different than credit reports.

Which credit bureaus have tenant screening services?

Three credit bureaus have cornered the market on credit reports: Experian (Experian has its own tenant screening services ). As linked above, each of these credit bureaus offers tenant screening services that include credit checks. You can order the reports online and receive them immediately.

What is a credit report?

A credit report contains a gold mine of information for a prospective landlord. You can find out, for example, if a particular person has ever filed for bankruptcy or has been: late or delinquent in paying rent or bills, including student loans or car loans. convicted of a crime, or, in many states, even arrested.

What to do if you don't rent to someone?

If you do not rent to someone because of negative information in a credit report, or you charge someone a higher rent because of such information, you must give the prospective tenant the name and address of the agency that reported the negative information. This is a requirement of the federal Fair Credit Reporting Act. (15 U.S.C. §§ 1681 and following.) You must also tell the person that he has a right to obtain a copy of the file from the agency that reported the negative information, by requesting it within 60 days of being told that your rejection was based on the individual's credit report. The Federal Trade Commission's website offers helpful tips on how landlords can use consumer reports.

How much does a tenant screening cost?

You can order the reports online and receive them immediately. Fees for the services vary, but usually are no more than $40.

How long does a credit report cover?

Information in credit reports covers the past seven to ten years. Depending on the type of report you order (the offerings vary according to the agency you deal with), you may also get an applicant's credit score. The most commonly used credit score is the FICO score.

What is the most common credit score?

The most commonly used credit score is the FICO score. It ranges from 300 to 850 , and purports to indicate the risk that an individual will default on payments. High scores indicate less risk. Generally, any score above 650 is considered a medium risk or less. Another type of credit score is VantageScore.

How long does it take to get a copy of a credit report?

You must also tell the person that he has a right to obtain a copy of the file from the agency that reported the negative information, by requesting it within 60 days of being told that your rejection was based on the individual's credit report.

ECOA Inquiry and Account Designators

A = Authorized user of the shared account. Does not have responsibility for the account.

Date Reported Codes

A = Information reported automatically on accounts receivable tapes by credit grantor.

Permissible Purpose

Credit-monitoring services, such as CreditKarma, LifeLock, or IdentityGuard are consumer reporting agencies that serve a specific permissible purpose, which is credit monitoring.

Credit Scores Can Vary by Permissible Purpose

Permissible purpose could be insurance underwriting, debt-collections, employment screening, credit granting, government benefit or licensing eligibility, or tenant screening. An individual’s credit score can even vary depending on which permissible purpose the credit report was processed for.

Generic Credit Score

The credit-monitoring service offers more of a generic credit score, which serves as an educational tool for the consumer and to help the consumer uncover potentially fraudulent activity in their credit file.

Tenant Credit Check Done by You

While this doesn’t happen frequently, credit reports can be doctored by your potential tenant. Image editing tools are prevalent and simple to use, and it is possible to go to work in one of these photo editing tools to repair the credit report more to an applicant’s liking.