What is not negotiable account payee only? When you cross a cheque or add the words ‘not negotiable’ between the crossing you may be able to protect yourself, but not always, against theft or fraud. When you add the words account payee only between these lines you are saying that only the named person can collect the proceeds of the cheque.

What does'not negotiable payee only'mean?

You also can have "not negotiable account payee only" which meant it needs to go into that persons account. MatthewQ writes... Perhaps NN means it must not only be put into an account, but that the name must match (and cannot be endorsed to someone else)? I'm sure some smart cookie will confirm or refute this.

What does account payee only mean?

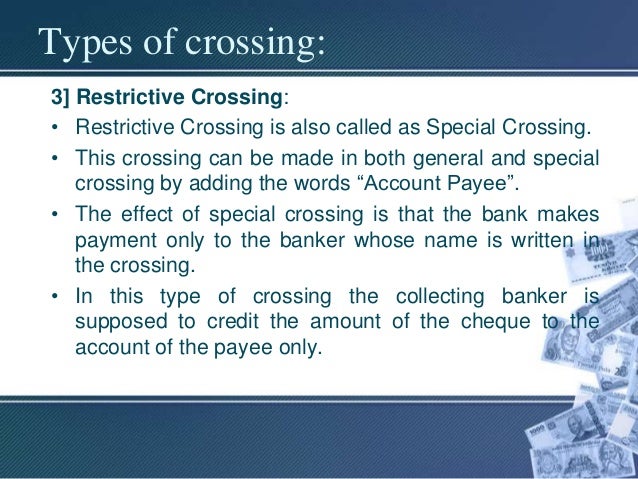

account payee only. Words added to the crossing on a check to ensure that check is paid only into the account of the entity to whom the check is made out. This step makes a check a non-negotiable instrument, and provides protection against its fraudulent conversion. The words 'not negotiable' have the same effect.

What does non-negotiable mean on a bank statement?

In that case, "non-negotiable" means that you couldn't actually take it to the bank and deposit or cash it; it's merely documenting a transaction that has already taken place.

Is it mandatory to pay payee through bank account?

Account payee, ‘& Co’ and not negotiable crossings make payment through bank account mandatory. In case of account payee cheque the cheque can be credited to payee’s or beneficiary account and further negotiation is not allowed.

What does it mean not negotiable account payee only?

Meaning of 'not negotiable' You may write the words 'not negotiable' between the two parallel lines on your cheque. This means that if the cheque is transferred to another person, the person who obtains the cheque has no greater rights to it than the person who gave it.

What is not negotiable and account payee crossing?

Crossing of cheque means drawing two parallel lines on the left corner of the cheque with or without additional words like “Account Payee Only” or “Not Negotiable”. Crossed cheque cannot be encashed at the bank counter. It is used to directly credit the bank account of the payee, making it a must safer instrument.Mar 16, 2019

What is the meaning of account payee not negotiable in cheque?

Crossing a cheque, not negotiable or account payee only Crossing a cheque means drawing 2 lines clearly across the face of the cheque as shown above. When you cross a cheque or add the words 'not negotiable' between the crossing you may be able to protect yourself, but not always, against theft or fraud.

Why did I get a non-negotiable check?

A non-negotiable check is a check that cannot be deposited, transferred, or exchanged for cash. An example of a non-negotiable check would be when an employer pays an employee via direct deposit but issues a non-negotiable check outlining the details of the payment.

What is account payee only?

Meaning of account payee (only) in English The words show that the cheque must be paid only into the account of the person to whom it is written.4 days ago

What does non negotiable number mean?

What Is Non-Negotiable? Non-negotiable means not open for debate or modification. It can refer to the price of a good or security that is firmly established and cannot be adjusted, or a part of a contract or deal that is considered a requirement by one or both involved parties.

How do I make a cheque payee only?

Ideally, you should also write “account payee" or “A/C payee" between the two parallel lines. If you want the bearer or payee to encash the cheque over the counter in any branch of your bank, do not draw the lines or write the words “account payee" or “A/C payee" on the cheque.Sep 29, 2011

What is negotiable cheque?

Cheques are also called negotiable instruments. In banking terms, a negotiable instrument is a document that promises its bearer a payment of the specified amount either on furnishing the document to the banker or by a given date.

Which is the safest form of crossing in cheque?

A cross cheque is safer as compared to a bearer cheque as it is crossed i.e, has two parallel lines either on the whole cheque or top left which tells the banker that it cannot be encashed over the counter. It has to be directly deposited in the bank account of the person who's name is written on the cheque.

What does non-negotiable meaning in bank?

non-negotiable in Banking topic 2 a cheque, bond etc that is non-negotiable can only be exchanged for money by the person whose name is on itExamples from the Corpusnon-negotiable• The price is non-negotiable.

How do I cash a non-negotiable Cheque?

(a) You can simply present the certificate to a teller at a local branch of your bank, and CASH it. Or, (b) you can have the dollar amount (stated on the certificate) deposited directly in your bank account.

What is another word for non-negotiable?

Non-negotiable synonyms In this page you can discover 8 synonyms, antonyms, idiomatic expressions, and related words for non-negotiable, like: sine qua non, , unchangeable, inviolable, inclusive of, in conflict with, self-evident and sacrosanct.

What does "non negotiable" mean?

It means that the value and title derived from t. Continue Reading. “Non negotiable” is one method of crossing the cheque. Normally all cheques are negotiable instruments and in the case of negotiable instruments, the transferee/holder gets better title from the transferor.

What does "not negotiable crossing" mean?

The ‘Not Negotiable” crossing is a warning to the transferee of a cheque, in that he will not get a better title than the transferor had. So the transferee, before accepting such a cheque, should examine the title of the transferor and accept only if the title of the transferor is good. Dr. M.J. SUBRAMANYAM.

Can a payee transfer a cheque to another person?

The payee has better title; however, he is prohibited to transfer the cheque to another person. In the abovementioned case, we have to take into account one legal point.

Can a cheque be transferred to a number of people?

Please note that such a cheque can be transferred to any number of persons as transferability of the cheque is not affected. But such a cheque, even if transferred, then the transferee cannot get better title of ownership of the cheque than the transferor or the previous holder of the cheque had.

Can a cheque be credited to another account?

In case of account payee cheque the cheque can be credited to payee’s or beneficiary account and further negotiation is not allowed. In case of ‘& Co’ crossing negotiations are allowed and cheque can be credited in another account through valid endorsement. Not negotiable crossing restricts negotiation.

Can a cheque be transferred?

In other words, the cheque can be transferred, but the transferee cannot get a better title than that of the transferor. Continue Reading.

Can a cheque be paid to the payee?

Instead, it must be deposited in the account of the payee. In general, a cheque may only be paid to the payee, unless it is payable to bearer (a.k.a. “cash”) or has an “open en. Continue Reading. I’m going to assume this question pertains to a cheque written on an account that’s outside of the United States.

What does "non negotiable" mean?

In the United States, “non-negotiable” means that the check has already been deposited - such as when the check is a dummy or copy check for which the actual amount has been direct deposited to a bank account. 2.5K views. ·.

What does it mean when someone says a check is non-negotiable?

When someone says a check is non-negotiable, it means, in a nutshell, it can’t be used as money. It can’t be deposited or cashed, etc. From time to time a teller may hand a seemingly good check back to you if you try to cash it and tell you that it too is non-negotiable.

What is section 130 of the Negotiable Instruments Act?

lays down that – “A person taking a cheque crossed generally or specially, bearing in either case the words “not negotiable”, shall not have and shall not be capable of giving, a better title to the cheque than that which the person from whom he took it had”.

What does "not negotiable crossing" mean?

The ‘Not Negotiable” crossing is a warning to the transferee of a cheque, in that he will not get a better title than the transferor had. So the transferee, before accepting such a cheque, should examine the title of the transferor and accept only if the title of the transferor is good. Dr. M.J. SUBRAMANYAM.

Can a cheque be transferred?

In other words, the cheque can be transferred, but the transferee cannot get a better title than that of the transferor. Continue Reading.

Can a cheque be transferred to a number of people?

Please note that such a cheque can be transferred to any number of persons as transferability of the cheque is not affected. But such a cheque, even if transferred, then the transferee cannot get better title of ownership of the cheque than the transferor or the previous holder of the cheque had.

Can a non-negotiable check be deposited to a bank account?

In Britain and most former British colonies, “non-negotiable” means that the payee cannot sign the check (or “cheque”) over to a third party and therefore can only deposit it to a bank account.

What does "not negotiable" mean on a cheque?

This means that if the cheque is transferred to another person, the person who obtains the cheque has no greater rights to it than the person who gave it.

What is the effect of a not negotiable crossing?

The effect of a “not negotiable” crossing is that when such a cheque is transferred by negotiation to another person, the person taking the cheque does not receive and is not capable of giving better title to the cheque than the title the transferor had.

What does it mean when a cheque has the person's name?

You will notice on a cheque where it has the persons name it also says "or bearer". This means that absolutely anyone can take the cheque and put it in their bank account. The bank won't stop it. There is no need to "endorse" the cheque.

What does "two vertical lines with not negotiable" mean?

My understanding was that the two vertical lines with not negotiable meant it had to be paid into a bank account. It seemed to be accepted that two vertical lines meant the same thing.

What does a double verticle crossing tell the teller?

you do a double verticle crossing to tell the teller you don't want it to be cashed, only paid into an account. The person could, theoretically, write 'not negotiable' between those lines and it would become cashable

Can you cash a cheque if it says "negotiable"?

Usually they come with it already printed on. therefore you can't cash it, which might be a disadvantage should I be paying someone. Anyone can still cash a cheque even if it says not negotiable if it says "or bearer".

Can a bank stop a cheque from going into someone's account?

So the bank won't stop it going into someone's account, but the writer of the cheque can sue saying it wasn't meant for that person. That's a good explanation. Anyone can still cash a cheque even if it says not negotiable if it says "or bearer".

What is account payee cheque?

An Account Payee Cheque is a highly secured type of cheque as the amount can only be deposited in the account of the payee. The payee cannot endorse this cheque to anyone else. To understand the concept better, one must understand the difference between a drawer, drawee and payee. A drawer is a party that writes and signs the cheque- usually, ...

What is a payee on a cheque?

A payee is a party to whom the final payment is made and his/her/its name is written on the cheque. So, in case of an account payee cheque, the payment will be made only by depositing it to the payee’s account. Get Your Free Credit Report with Monthly Updates Check Now.

How long is a payee cheque valid?

Another important point to note about account payee cheques is that it is valid only for three months.

Why is an account payee cheque important?

Since the amount will only be paid by depositing it into the account of the payee, there is the least chance of misuse. Moreover, the payee cannot endorse ...

Is a cheque a payment in India?

Cheques are a preferred mode of payment in India as they are safe and easy. A number of times, people are confused about different types of cheques such as crossed cheque, bearer cheque and account payee cheque. The detailed information about the account payee cheques, their uses and how these cheques are different from other types ...

Can a payee cheque be endorsed?

An account payee cheque is a type of cheque which can be deposited in the account of the payee (the party to whom the final payment is supposed to be made and whose name is mentioned on the cheque). It cannot be endorsed to anyone else. Q.

Is an account payee cheque the same as a crossed cheque?

Hence, an account payee cheque is different from crossed cheque and order check in terms of endorsement and it is completely opposite of a bearer check. While bearer check is the most vulnerable to misuse, an account payee cheque is a highly secured instrument.

What does "not negotiable" mean?

It means, a person takes a stolen cheque marked with ‘Not Negotiable’ from another person, and encashes it then he is liable to refund encashed money to the true owner. For example; Mr.Panjwani issues a crossed cheque in favour of Mr.Khubchandani which does not bear the words ‘not negotiable’ therein. One Mr.Nowani steals it from the office of ...

What happens if a cheque bears the word "not negotiable"?

Gulabani accepts a stolen cheque marked with ‘Not Negotiable’ and encashes it, then he is liable to refund encashed money to the true owner of the cheque.

What is the effect of the "not negotiable" mark on a cheque?

What is the effect of “not negotiable” mark on a cheque? Section 130 of Negotiable acts 1881 provides that ‘a person taking a cheque cross ed generally or specially bearing in either case the words ‘not negotiable’ shall not have and shall not be capable of giving a better title to the cheque than that which the person from whom he took it had’. ...

Can a cheque be crossed and not negotiable?

According to above section, the cheque marked ‘ not negotiable’ to a crossed cheque does not bar it from transferred in the name of another person. However, a person who takes a cheque marked ‘ not negotiable’ does not acquire better title than the person from whom he acquired the cheque.