Budget Deficit. when federal expenditures exceed federal revenues for a one year period. Deficit Spending. the federal government's practice of spending more money than it takes in as revenues. Click to see full answer. Then, what is a deficit AP Gov? Deficit is the excess of federal expenditures over federal revenues.

What does deficit spending require a government to do?

What does deficit spending require a government to do? – a government’s budget deficit causes debt to increase. – debt requires a government to pay back more than it has borrowed. – the deficit is the amount a government spends above what it brings in.

What is a deficit government?

With the state governments' fiscal deficit projected at a relatively modest 3.3 per cent of GDP in FY2022, the general government fiscal deficit is estimated at around 10.4 per cent of the GDP, the agency said in a report. In the base case for FY2023, it sees the government's fiscal deficit moderating to Rs 15.2 lakh crore or 5.8 per cent of GDP.

What is a divided Government AP Gov?

RICHMOND, Va. (AP) — A newly empowered Republican majority assumed control of the Virginia House of Delegates on Wednesday as the General Assembly opened its 2022 session under divided party Newly divided Virginia General Assembly kicks off session | Ap | richmond.com Skip to main contentSkip to main content

What does federal budget deficit mean?

The federal budget deficit is an estimate of how much money the federal government expects to make (revenue) and how much it expects to spend (expenditures or outlay) each fiscal year. US Deficit: Understanding the US Federal Deficit

What is a budget deficit quizlet?

Budget deficit. The amount by which expenditures of the federal government exceeded its revenues in any year. Contractionary fiscal policy. A decrease in government spending, and increasing taxes, or some combination of the two for the purpose of decreasing aggregate demand and halting inflation.

What is deficit AP Gov?

deficit. the result of when the government in one year spends more money than it takes in from taxes.

What is budget surplus AP Gov?

Budget surplus. government budget receipts that exceed its budgets outlays for the given budget/year.

What is the difference between debt and deficit AP Gov?

Deficit is the excess of federal expenditures over federal revenues. When the government has a high deficit, it has to borrow money to pay its dues. The borrowed money then turns into the Federal Debt. The deficit is yearly as opposed to the debt really doesn't end...

What is a government deficit quizlet?

The deficit is. the amount by which government purchases, transfers, and net interest exceed tax revenues.

Why are budget deficits bad?

Fiscal Deficit Impact on the Economy Others argue that budget deficits crowd out private borrowing, manipulate capital structures and interest rates, decrease net exports, and lead to either higher taxes, higher inflation or both.

What is a deficit budget?

A budget deficit occurs when expenses exceed revenue, and it can indicate the financial health of a country. The government generally uses the term budget deficit when referring to spending rather than businesses or individuals. Accrued deficits form national debt.

What is an example of budget deficit?

A budget deficit occurs when a government spends more in a given year than it collects in revenues, such as taxes. As a simple example, if a government takes in $10 billion in revenue in a particular year, and its expenditures for the same year are $12 billion, it is running a deficit of $2 billion.

What is surplus budget and deficit budget?

A budget surplus is when extra money is left over in a budget after expenses are paid. A budget deficit occurs when the federal government spends more money that it collects in revenue.

What is the difference between a budget deficit and the national debt quizlet?

What is the difference between the federal budget deficit and the national debt? The budget deficit is the amount by which expenditures exceed revenues in a particular year, while the national debt is the cumulative effect of all past budget deficits and surpluses.

When the government runs a budget deficit quizlet?

A government budget deficit exists if the government spends more than it receives in taxes during a given period of time. A situation in which the government's spending is exactly equal to the total taxes and other revenues it collects during a given period of time.

How do budget deficits contribute to the national debt?

When a government's expenditures on goods, services, or transfer payments exceed their tax revenue, the government has run a budget deficit. Governments borrow money to pay for budget deficits, and whenever a government borrows money, this adds to its national debt.

Budget Deficit: Definition, Causes, Effects - The Balance

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their money—and themselves—in crypto, blockchain, and the future of finance and digital assets.

Budget Deficit: Definition, Types, Formula, Impact - BYJUS

Budget deficit is the situation that arises when the extent of spending surpasses the extent of income in an economy. Read more here

What is a Budget Deficit? | Definition and Meaning | Capital.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83.45% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

What is a budget deficit?

Image by Tim Liedtke © The Balance 2019. A budget deficit is when spending exceeds income. The term applies to governments, although individuals, companies, and other organizations can run deficits. A deficit must be paid. If it isn't, then it creates debt. Each year's deficit adds to the debt.

What is the opposite of a budget deficit?

That further increases each year's deficit. 1. The opposite of a budget deficit is a surplus. It occurs when spending is lower than income. A budget surplus allows for savings.

Why is the federal budget deficit not an accident?

That's because government spending drives economic growth. It's a result of expansionary fiscal policy. Job creation gives more people money to spend, which further boosts growth.

What is the difference between a deficit and a surplus?

If a deficit is financed by debt, then it has the opposite effect. It is money borrowed from the future to pay for the present standard of living.

Why do governments prefer to finance their deficits?

Most governments prefer to finance their deficits instead of balancing the budget. Government bonds finance the deficit. Most creditors think that the government is highly likely to repay its creditors. That makes government bonds more attractive than riskier corporate bonds.

What happens if you run a persistent deficit?

There are immediate penalties for most organizations that run persistent deficits. If an individual or family does so, their creditors come calling. As the bills go unpaid, their credit score plummets. That makes new credit more expensive. Eventually, they may declare bankruptcy.

What happens if the government cuts spending too much?

6 . Cutting spending also has pitfalls. Government spending is a component of GDP. If the government cuts spending too much, economic growth will slow.

Why is the government budget deficit so bad?

That’s because the government’s main source of revenue is taxation, so having low tax income means that the government’s total income is low.

What causes a national budget deficit?

National budget deficits can be caused by a number of factors: Tax cuts that decrease revenue, such as those intended to boost large companies’ ability to hire employees. Low GDP (gross domestic product — the money being made in the country) resulting in low overall revenue, and so low tax revenue.

Why is my home budget running at a deficit?

For instance, your home budget might be running at a deficit if your total monthly expenses are more than your monthly household income. Budget deficits happen in companies when the costs of operation are greater than revenue.

What is the national deficit in 2020?

They can occur at the individual, company, or governmental level. The national deficit is often politically important. As of late 2020, it stood at $3.3 trillion.

How does the government budget affect the economy?

The impact of the government budget on the economy can be severe if they cut programs like these that millions of people rely on. On the other hand, many investors and large corporations worry about the deficit because they fear it will urge the government to raise taxes on them.

How much is the federal deficit in 2020?

Right now, the federal government of the US is running a deficit — it’s spending more than it is taking in. As of late 2020, the federal deficit was $3.3 trillion. This is caused by a few factors.

How to lower fiscal deficit?

It’s important to keep tabs on the amount of money you’re bringing in each month. This is especially important if you work multiple jobs, work inconsistent hourly shifts, perform contract or freelance labor, or receive grants.

What is a budget deficit?

Budget Deficit. A budgetary deficit is referred to as the situation in which the spending is more than the income. Although it is mostly used for governments, this can also be broadly applied to individuals and businesses. In other words, a budgetary deficit is said to have taken place when the individual, government, ...

What is the primary deficit?

Primary deficit is said to be the fiscal deficit of the current year subtracted by the interest payments that are pending on previous borrowings. In other words, the primary deficit is the requirement of borrowing without the interest payment.

How to calculate the fiscal deficit?

The formula for calculating fiscal deficit is as follows: Fiscal deficit = Total expenditures – Total receipts excluding borrowings.

What are the effects of fiscal deficit?

Unnecessary expenditure: A high fiscal deficit leads to unnecessary expenditure done by the government that leads to potential inflationary pressure on the economy.

How does revenue deficit affect the economy?

Revenue deficit has the following impacts on the economy. Reduction in assets: For meeting the shortfall in the form of revenue deficit, the government has to sell some assets. It leads to the conditions of inflation in the economy. A large amount of borrowing leads to a greater debt burden on the economy.

What is revenue expenditure?

Revenue expenditure is defined as the excess of total revenue expenditure over the total revenue receipts. In other words, the shortfall of revenue receipts as compared to that of the revenue expenditure is known as revenue deficit.

Why do governments run deficits?

A government may run a budget deficit to finance infrastructure investment. This could include building new roads, railways, more housing and improved telecommunications. This public sector investment can help increase long-run productive capacity and enable a higher rate of economic growth. If growth does improve, then ...

What are the economic effects of a deficit?

Economic effects of a budget deficit. A budget deficit is the annual shortfall between government spending and tax revenue. The deficit is the annual amount the government need to borrow. The deficit is primarily funded by selling government bonds (gilts) to the private sector.

How does government borrowing affect the private sector?

Increased government borrowing may cause a decrease in the size of the private sector. The government borrow by selling bonds to the private sector. Therefore, if the private sector (banks/private individuals) buy government bonds, they have less money to invest in private sector projects.

What is public sector debt?

In the UK, the Debt Management Office (DMO) sells bonds and gilts to the private sector. The public sector debt is the total amount of debt owed by the government.

What happens if the government increases borrowing in a recession?

1. Depends on the situation of the economy. If the government increases borrowing in a recession, then there is unlikely to be crowding out. In a recession, we get a fall in private sector spending and investment – and a rise in private sector saving.

Why does the government borrow money to finance infrastructure?

If the government borrow to finance infrastructure investment, it can help boost the supply side of the economy and enable higher economic growth. If growth improves, then there will be higher tax revenues to pay back the debt.

Why did the UK bond market fall in 2009?

From 2009 to 2015, UK bond yields fell – despite high levels of borrowing. This was because there was high demand for buying government bonds.

What Is A Budget Deficit?

- A budget deficit occurs when expenses exceed revenue, and it can indicate the financial health of a country. The government generally uses the term budget deficit when referring to spending rather than businesses or individuals. Accrued deficits form national debt.

Understanding Budget Deficits

- In cases where a budget deficit is identified, current expenses exceed the amount of income received through standard operations. A nation wishing to correct its budget deficit may need to cut back on certain expenditures, increase revenue-generating activities, or employ a combination of the two. The opposite of a budget deficit is a budget surplus.When a surplus occurs, revenue …

The Danger of Budget Deficits

- One of the primary dangers of a budget deficit is inflation, which is the continuous increase of price levels. In the United States, a budget deficit can cause the Federal Reserve to release more money into the economy, which feeds inflation.2Continued budget deficits can lead to inflationary monetary policies, year after year.

Strategies to Reduce Budget Deficits

- Countries can counter budget deficits by promoting economic growth through fiscal policies, such as reducing government spending and increasing taxes. For example, one strategy to increase Treasury inflows is to reduce regulations and lower corporate income taxes to improve business confidence and promote economic growth, generating higher taxable profits and more income t…

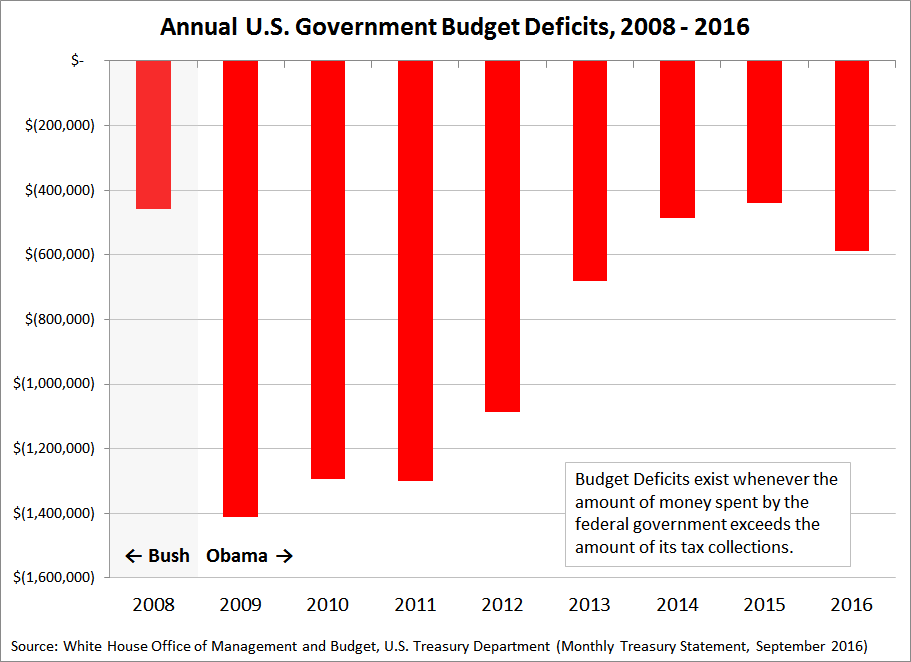

Real-World Example

- Budget deficits may occur as a way to respond to certain unanticipated events and policies, such as the increase in defense spending after the September 11 terror attacks.3 While the initial war in Afghanistan cost an estimated $22.8 billion, spending in Iraq cost $51 billion in the fiscal year 2003.4 At the end of George W. Bush's presidential term in 2009, the total amount spent rea…

The Bottom Line

- Budget deficits happen when expenses exceed revenue. When incurred by nations, they can lead to problems such as inflation. For example, the U.S. incurred a deficit through wars in Afghanistan and Iraq under the Bush and Obama administrations. Using policy to promote economic growth can decrease a deficit. These deficits may also lessen during times of economic prosperity.

Causes

Effects

- There are immediate penalties for most organizations that run persistent deficits. If an individual or family does so, their creditors come calling. As the bills go unpaid, their credit score plummets. That makes new credit more expensive. Eventually, they may declare bankruptcy. The same applies to companies who have ongoing budget deficits. Their bond ratings fall. When that happ…

How to Reduce A Budget Deficit

- There are only two ways to reduce a budget deficit. You must either increase revenue or decrease spending. On a personal level, you can increase revenue by getting a raise, finding a better job, or working two jobs. You can also start a business on the side, draw down investment income, or rent out real estate. Decreasing spending is easier in the short-term. Many experts recommend c…

Financing Deficits

- Most governments prefer to finance their deficits instead of balancing the budget. Government bonds finance the deficit. Most creditors think that the government is highly likely to repay its creditors. That makes government bonds more attractive than riskier corporate bonds. As a result, government interest rates remain relatively low. That allows...

Budget Deficit History

- For most of its history, the U.S. budget deficit remained below 3% of GDP. It exceeded that ratio to finance wars and during recessions. Once the wars and recessions ended, the deficit-to-GDP ratio returned to typical levels.14 An examination of the deficit by year reveals the deficit-to-GDP ratio tripled during the financial crisis. Part of the reason was slower economic growth. But part …