There are several different types of accounts that would be included as part of the ledger:

- Asset accounts: prepaid expenses, cash, accounts receivable, assets, and cash

- Liability accounts: lines of credit, accounts payable, debt, and notes payable

- Revenue accounts

- Expense accounts

- Equity accounts

- Profit and loss accounts

- General ledger.

- Sales ledger.

- Purchase ledger.

How to make a ledger account [examples]?

To begin, allocate the capital account to be credited with the capital contributed by their partners, their share of the profit, their share of the partners’ compensation, or any additional receipt that is provided to them directly by their partner. In step two you’ll debit your capital account.

How do we prepare a ledger account?

Posting method

- firstly you can post the debit entry from journal to the ledger

- to record the transaction date of the journal in the ledger account

- The opposite account of debit is recorded in ledger account.

- the reference number of the journal records into the ledger account

- to record the debit amount is ledger accounts

Which accounts belong in a general ledger?

- Operating revenues

- Operating expenses

- Non-operating revenues and gains

- Non-operating expenses and losses

What is the difference between an account and a ledger?

journal

- Format. The format for recording financial information in a journal differs from the format of a ledger. ...

- Recordings. Another difference between a ledger and a journal in accounting is the way they display recordings. ...

- Importance. One manner in which a ledger is different from a journal in accounting is its importance. ...

- Requirements. ...

- Necessity. ...

What are the different types of ledger accounts?

The three types of ledgers are the general, debtors, and creditors.

What are the 5 types of general ledger accounts?

The different types of general ledger accountAccounts receivable: money owed to your business—an asset account.Accounts payable: money your business owes—an expense account.Cash: liquid assets your company owns, including owners' equity—an equity account.More items...•

What is ledger and types of ledgers?

A ledger is a book where all ledger accounts are maintained in a summarized way. All accounts combined together make a ledger book. Predominantly there are 3 different types of ledgers; Sales, Purchase and General ledger.

What are the four general ledger accounts?

The categories are:Assets. Assets are any resources that are owned by the business and produce value. ... Liabilities. Liabilities are current or future financial debts the business has to pay. ... Equity. ... Revenue. ... Expenses. ... Assets = Liabilities + Equity.

What are the 7 basic accounting categories?

Key TakeawaysAssets. Items of financial value that the business controls (“owns”) for the purpose of producing income for the owners.Liabilities. Monies that the business owes to non-owners.Owners Equity. ... Revenue. ... Expenses.

What is ledger account with example?

Examples of ledger accounts are cash, accounts receivable, inventory, fixed assets, accounts payable accrued expenses, debt, stockholders' equity, revenue, cost of goods sold, salaries and wages, offices expenses, depreciation, and income tax expense.

What are the two types of ledgers?

General Ledger – General Ledger is divided into two types – Nominal Ledger and Private Ledger. Nominal ledger gives information on expenses, income, depreciation, insurance, etc. And Private ledger gives private information like salaries, wages, capitals, etc.

How many accounts are there in a ledger?

General ledger accounts are found in the general ledger of a business. The accounts are the place where all the financial transactions of a business are contained. A business can have as few as 5 accounts ledgers and a large business can end up with 100's of accounts ledgers.

What are the different types of accounts?

Different Types of Bank AccountsCurrent account. A current account is a deposit account for traders, business owners, and entrepreneurs, who need to make and receive payments more often than others. ... Savings account. ... Salary account. ... Fixed deposit account. ... Recurring deposit account. ... NRI accounts.

What is GL balance?

A general ledger represents the record-keeping system for a company's financial data, with debit and credit account records validated by a trial balance.

Is the list of all ledger balances?

Trial Balance is the list of all ledger balances. Explanation: A Trial Balance is the list of all ledger balances, as it is prepared to ensure whether the total of the debit column of the Trial Balance is equal to its credit column.

What is journal entry and ledger?

Journal is a subsidiary book of account that records transactions. Ledger is a principal book of account that classifies transactions recorded in a journal. Order. The journal transactions get recorded in chronological order on the day of their occurrence.

In a ledger if the debit side is greater than the credit side then what does it represents?

If Debit side is greateer than the credit side then it represents Cash at the bank.

What is Ledger Posting?

Whenever a transaction takes place it is denoted and recorded in the journal in the form of the journal entry. Furthermore, this entry is posted ag...

What are the different categories of Ledger Accounts?

Assets, Liabilities, Stocks, Operating Revenue and Expense are some categories of Ledger Account

What are the different types of ledgers?

There are 3 types of Ledgers –. Sales Ledger. Purchase Ledger. General Ledger. 1. Sales Ledger – Sales Ledger is a ledger in which the company maintains the transaction of selling the products, services or cost of goods sold to customers. This ledger gives the idea of sales revenue and income statement. 2.

What is a general ledger account?

Ledger Account is a journal in which a company maintains the data of all the transactions and financial statement. Company’s general ledger account is organized under the general ledger with the balance sheet classified in multiple accounts like assets, Accounts receivable, account payable, stockholders, liabilities, equities, revenues, taxes, ...

What is the book of accounts?

Ledger is a book that contains the accounts. Any financial statement related to the financial position of the company emerges only from the accounts. Thus, this ledger is known as the principal book. So, the result of all this is that it is necessary to relate all the information for any account available is from the ledger. This book of accounts is the most important book for any business and that is why it is known as the king of all books. Also, the ledger book is also known as the book of the final entry. The Ledger account is thought of the book that has all the accounting information of the company.

What are general ledger accounts?

Ledger Accounts or General Ledgers are the summaries or the records of the primary books. General Ledgers contain the detailed transactions of each item in Financial Statements. For example, in Statement of Financial Position, the sub-component of total assets would be: 1 Property Plant and Equipment (PPE) 2 Inventories 3 Cash and Cash equivalent

Why do companies need a general ledger?

The company needs General Ledger to records its financial information and to produce financial statements. The financial information will records in the different ledger, date consequently, and based on its nature.

What is journal entry?

The journal entry. All of the financial transactions that occurred in the company is initially records in the journal entry. Manual, journal entry is the first place to records all of the transactions; however, in the accounting system, the journal entry will immediately affect the ledgers accounts that they should effect.

What is the standard form of ledger account?

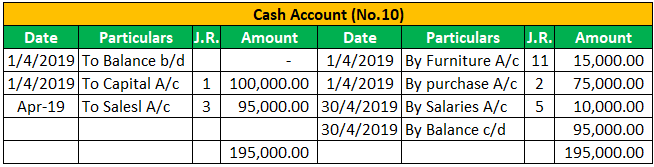

In standard form of ledger account, the page of the ledger is divided into two equal halves. The left-hand side is known as the debit side and the right-hand side as the credit side. As it takes the shape of capital letter “T”, it is also known as T Shape of the ledger account. The debit side is used for recording debit entries and credit side is used for recording credit entries. The title of the account is written in the center at the top of the page. The account number is written in the extreme right-hand corner.#N#The standard form of ledger account does not show the balance after each entry. The balance is found out after certain period or when needed so this form of account is also called periodical balance form of ledger account.

What is the ledger in accounting?

The ledger is the principal book of accounts where transactions of similar nature relating to a particular person or thing are recorded in classified form.#N#Ledger (or general ledger) is a book in which all accounts relating to a business enterprise are kept. In other words, it is a collection or group of all accounts of a business enterprise. The accounts kept in the ledger are sometimes termed as ledger accounts. One account usually occupies one page in the ledger but if the account is big one, it may extend to two or more pages. All entries recorded in the general journal must be transferred to ledger accounts.#N#The ledger may be in a bounded form or loose-leaf form. It is the master reference book of the accounting system. It provides a permanent and classified record of every element in the business operation. Because of these features, ledger is sometimes called the king of all the books of accounts.

What side is a debited journal entry posted on?

If an account is debited in the general journal, it will be posted on the debit side in the ledger account and if it is credited in the general journal, it will be posted on the credit side. In description column, the title (name) of the account included in other part of the journal entry is written.

What is the next step in recording transactions?

Once, the opening balances, i.e. the amount at the beginning of an accounting period, have been recorded in the ledger account, the next step is to record transactions at they take place. Transactions result in increasing and decreasing the value of various individual Balance Sheet items. The following rules are applied to recording these increases and decreases in individual ledger account.

What is double entry accounting?

The ledger system of double-entry bookkeeping involves the use of a number of account-ruled books (known as a set of books) for the purpose of recording accurate information, in money values, of the day-to-day trading operations of a business. From these permanent records, periodical statements are prepared to show the trading profit or loss made by the business and its assets and liabilities, at any given date.#N#In the past, these records would quite literally have been kept in bound ledger books. However, even before the widespread introduction of computers, mechanized systems based upon mechanical accounting machines were used by many larger companies. In smaller organizations, looseleaf systems with multipart forms and carbon paper reduced the number of times that bookkeepers had to write out the same data.#N#Now any business with a full-time bookkeeper is likely to have computerized its accounting. However, computerization can only speed up the arithmetic of accounting, it cannot replace an understanding of the concepts. Underlying all modern computer accounting programs is the same double-entry system.

Where are assets recorded?

Assets are recorded on the debit side of an account . Any increase to an asset are recorded on the debit side . Any decreases in an asset are recorded on the credit side of its account.

Where is capital recorded in a ledger?

Capital is recorded on the credit side of a ledger account. Any increase in capital is also recorded on the credit side. Any decrease in the capital is recorded on the debit side of the respective Capital Account.

What are some examples of ledger accounts?

Some common examples of ledger accounts are: Cash. Inventory. Fixed Assets. Accounts Receivable. Accounts Receivable Accounts receivables refer to the amount due on the customers for the credit sales of the products or services made by the company to them.

What is ledger account?

The ledger accounts are the separate records of the business transactions carried by an entity that is prepared using the reference of the daily journal entries and are related to a specific account, which can be an asset or a liability, capital or equity, expense item, or revenue item. You are free to use this image on your website, templates etc, ...

What is the most important information that a ledger account provides?

The most important information that a ledger account provides is the periodical (usually annual) closing balances about a specific item or account. The ledger accounts are essential in the formation of trial balances and also the financial statements of the company.

What is accrued expense?

Accrued Expenses An accrued expense is the expenses which is incurred by the company over one accounting period but not paid in the same accounting period. In the books of accounts it is recorded in a way that the expense account is debited and the accrued expense account is credited. read more. Sales or Revenue.

What is accounts payable?

Accounts Payable Accounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services. It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period. read more. Accrued Expenses.

What is dividend in business?

Dividend. Dividend Dividend is that portion of profit which is distributed to the shareholders of the company as the reward for their investment in the company and its distribution amount is decided by the board of the company and thereafter approved by the shareholders of the company . read more. Interest Income.

What is an asset account?

An asset account covers accounts receivable, cash, prepaid expenses, and fixed assets. Asset accounts are also referred to as real accounts or permanent accounts because they don't close at the conclusion of the accounting year. Each asset's account balance is carried forward to serve as the starting balance for the next accounting period. Such assets add to the value of your business.

What is revenue loss account?

A revenue and loss account covers things like investment, interest, and disposal of an asset. Asset disposal may occur if you sell an asset because it's no longer useful or needed. For example, if you invested in three new computers for your team but then downsized and now only have one employee, you might sell the remaining two computers (which are technically assets).

What is a liability account?

A liability account covers customer deposits and prepayments, business financial obligations, debt, and some types of deferred income taxes related to past transactions. The types of liability accounts may include accounts payable, deferred income taxes, and accrued liabilities (amounts owed but not yet recorded in accounts payable). These are all types of credit balances, meaning they detract from the value of your business.

Why is it important to keep a record of financial transactions?

Maintaining an accurate record of your business's financial transactions will ensure a streamlined accounting system, making it easier to create accurate ledgers and financial statements. If you aren't comfortable creating financial statements yourself, you can simply record the relevant information and hire a professional accountant for the analytical part.