Salaries expense is how much an employee earned in salary. Salaries payable refers only to the amount of salary pay that employers have not yet distributed to employees. While salaries payable changes based on financial transactions between a company and its employees, salaries expense is the same regardless of the company's payments to employees.

Is wages payable is an example of an expense?

Wages expense is an expense account, whereas wages payable is a current liability account. A current liability is one that the company must pay within one year. The company presents its expense accounts on the income statement and its liability accounts on the balance sheet.

Is salaries payable a current liability?

Salary payable is classified as a current liability account under the head of current liabilities on the balance sheet. All the general rules of accounting are also applicable to this account. When the salaries expenses are recognized, but the company has not paid yet to its staff, the following journal entries should be recorded:

Is salaries payable current liabilities?

Salary payable is a current liability account containing all the balance or unpaid wages at the end of the accounting period. The amount of salary payable is reported in the balance sheet at the end of the month or year, and it is not reported in the income statement.

What is the difference between wages payable and wage expense?

What is a Wage Expense?

- Wage Expense vs. Salary Expense. ...

- Types of Wage Expenses. Time wages are based on the amount of time worked – for example, an hourly wage of $10. ...

- Practical Example. Background Information: A company currently employs five individuals. ...

- Wage Expense on the Income Statement. ...

- Accrual Method of Accounting for Wage Expense. ...

What is the difference between salary expense and salary payable?

What is salary payable?

What is accrued salary?

How much is paid on 30th January?

Is salary payable a current liability?

Is salary payable reported on income statement?

Is salary payable recorded on the debit side?

See more

How do you account for salary payable?

0:005:03How to Record Salary Payable - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe accounting for salaries paid to employees is a little bit complicated. If you've taken financialMoreThe accounting for salaries paid to employees is a little bit complicated. If you've taken financial accounting you've probably seen the sets of journal entries that i have here when employees perform

Is salary a liability or expense?

liabilityWage expenses that are not yet paid are recorded as wages payable on the balance sheet, which is a liability account. Salary expenses differ from wage expenses as they are not hourly but rather quoted annually. Wage expenses can incur overtime whereas salaried jobs do not include overtime pay.

Is salary payable a personal account?

Salary is an expense and obviously, it is a nominal account. It is already debited to the P&L, but not paid. So, it becomes a current liability payable to some one, ie., employee(s). Any money payable to someone (who is definitely a person or entity) or receivable from someone is a personal account.Sep 9, 2013

Is salary payable a real account?

Salary payable is a current liability account containing all the balance or unpaid wages at the end of the accounting period. The amount of salary payable is reported in the balance sheet at the end of the month or year, and it is not reported in the income statement.

JOURNAL ENTRY FOR SALARY (including allowance and deductions)

ESI: - Employee state Insurance scheme is a self-financing social security and health scheme for workers.It is applicable for all employees whose salary is Rs.15000/- per month. The employer contributes 4.75 percent and employee contributes 1.75 percent, total of 6.5 percent.

Accrued Salaries Journal Entry | Exmple | - Accountinguide

The company makes this journal entry of salaries paid to eliminate the liabilities that it has recorded in the period-end adjusting entry. Likewise, there is no effect on the income statement in this journal entry as the company has already recorded the expense that has incurred together with the accrued salary in the previous period adjusting entry.

Are salaries and wages part of expenses on the income statement?

Definition of Salaries and Wages Salaries and wages are forms of compensation paid to employees of a company. Salaries and Wages as Expenses on Income Statement Salaries and wages of a company's employees working in nonmanufacturing functions (e.g. selling, general administration, etc.) are part ...

What is salaries payable?

Salaries payable is a type of entry in business accounting journals that describes how much a company owes their employees. Accounting professionals or managers record salaries payable when they owe salary pay to their employees, but haven't distributed the money yet.

Why do businesses need to know about salaries payable?

Company leaders and accounting professionals need to be aware of their salaries payable amount so they can pay their employees on time and operate within their budget. There are multiple reasons a business may not have paid the full amount of an employee's salary by the end of an accounting period, resulting in a salaries payable balance.

Salaries payable vs. salaries expense

Salaries payable and salaries expense are similar concepts, but they have distinct roles in accounting. Salaries expense is how much an employee earned in salary. Salaries payable refers only to the amount of salary pay that employers have not yet distributed to employees.

Salaries payable in accrual accounting

Accounting professionals only need to record salaries payable if their department or client manages their accounts through the accrual accounting method. Accrual accounting means that a business records all revenue and expenses as they happen, even if employees won't receive the money until a later date.

How to record salaries payable

Here are the steps for documenting salaries payable in your accounting books:

Example journal entries

Here are a few examples of accounting journal entries for salaries payable.

Nature and Classification of Salaries and Wages

Salaries and Wages are expenses, which are declared in the Income Statement. Under the Matching Principle of Accounting, all expenses for a current year should be matched with revenues in a current year.

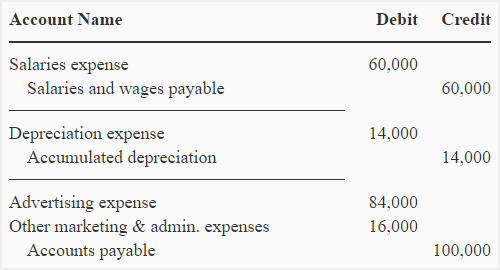

Journal Entries to record Salaries and Wages

The journal entries that are required to record salaries and wages (that are paid) are as follows:

What is Meant by Salaries and Wages Payable?

Salaries and Wages Payable imply that the organization owes money to its employees. In other words, it means that the organization needs to pay its salaries and wages to its employees, and they have already rendered services (or work) against this amount.

Nature and Classification of Salaries and Wages Payable

Salaries and Wages Payable are considered as a Current Liability on the Balance Sheet of the Company. This is because this is a short-term accrual, which needs to be settled on an earlier basis, in order to avoid any confusion that might otherwise occur.

Journal Entries to record Salaries and Wages Payable

When an organization incurs a liability in the form of salaries and wages payable, the following journal entries are recorded:

Example of Salaries and Wages Payable

The concept of Salaries and Wages Payable is illustrated in the following example:

Salaries and Wages Payable – Debit or Credit?

The question that arises pertaining to salaries and wages being a debit transaction or a credit transaction clouds the judgment of several different accountants.

What is salary and wages?

Definition of Salaries and Wages. Salaries and wages are forms of compensation paid to employees of a company.

When are the costs assigned to those products included in the cost of goods sold?

When the products are sold, the costs assigned to those products (including the manufacturing salaries and wages) are included in the cost of goods sold, which is reported on the income statement. (The costs of the products that are not sold are reported as inventory on the balance sheet.

What is a wages payable account?

Wages payable is a liability account that shows the amount that the company owes to employees for hours they have already worked, but for which the company has not yet issued a paycheck. This account directly corresponds to the wages expense account.

What is wages expense?

Wages Expense. Wages expense is the account that the bookkeeper or accountant uses to record the labor costs of the company. You may also refer to it as salary expense or payroll expense, depending on the organization's preference.

What is accrual method in accounting?

Companies that use the accrual method of accounting record wages expense as the cost is incurred, which is not necessarily when the company pays the employee. A debit to this account, under the accrual basis, requires a credit to the wages payable account for any amounts not paid.

Why do companies use accrual basis?

Many companies, and all publicly traded corporations, use the accrual basis of accounting to keep track of and record revenue and expenses. Unlike cash basis accounting, which records expenses when the company pays for them, the accrual method records them when the company earns the revenue or incurs the expense.

What is a debit account?

When you have a debit, there must be a corresponding credit, or credits, to make the accounting equation balance .

Is wages payable a liability?

Wages expense is an expense account, whereas wages payable is a current liability account. A current liability is one that the company must pay within one year. The company presents its expense accounts on the income statement and its liability accounts on the balance sheet.

What is payable in finance?

A payable means an existing obligation or loan to be settled on the terms and conditions negotiated by all parties. Examples include electrical costs, cable bills, and phone bills, which already require users to use the service and are granted later payment of a fee.

What is payable in a credit transaction?

The payable shall include all costs arising out of credit transactions by suppliers /sellers of products or services. Present obligations are payable and are due within 12 months of the transaction date. In balances, the most commonly incurred non-financial costs include benefits, wages, interest, and royalties.

Why are accrued expenses reported on the balance sheet?

This is because these expenditures must always be measured and updated to account for the full sum after receipt of bills.

What is an expense in accounting?

Expense. Meaning. The money to be paid by the corporation to the creditors shall be the short-term sum. Expenses are used to report expenses on the books before it is billed. Expenses are used in accounting. Occurrence. Payable only occurs when credit is purchased. Expenses are used in both organizations. Example.

What is an expense?

Expenses are the payment of money for goods and services to another individual. When you pay for the rent or buy food, drugs, automobiles, or clothing, you are charged. In business and accounting, a charge refers to the cost of generating income charged to another person or business company in cash or value.

What are non-financial costs?

In balances, the most commonly incurred non-financial costs include benefits, wages, interest, and royalties. Both costs incurred by purchasing credit of products or services from suppliers shall be included in accounts payable. Present obligations that are to be accrued in the near term are accounts payable.

What are accumulated costs?

There are mostly costs such as rent, bank loans, and salaries where every month payments are made. Accumulated costs, or accumulated liabilities, are accumulated over the course of time. The portion of outstanding bills increases as a company collects costs.

What is accounts payable?

Strictly defined, the business term " accounts payable " refers to a liability, where a company owes money to one or more creditors. Some people mistakenly believe accounts payable refers to the routine expenses of a company’s core operations, however that is an incorrect interpretation of the term. The balance of a company’s accounts payable is ...

How to distinguish between liabilities and expenses?

The best way to distinguish between liabilities and expenses is by analyzing past versus future actions. Liabilities are obligations that have yet to be paid, expenses are obligations that have already been paid in an effort to generate revenue.

Why is accounts payable important?

Therefore, accounts payable is a critical metric to analyze when a company is up for consideration for possible merger or acquisition activity. A company’s expenses are also included in a company’s financial statements.

How long does it take to pay debt to creditors?

Debt owed to creditors typically must be paid within a short time frame, around 30 days or less.

Where are liabilities recorded?

Liabilities are traditionally recorded in the “accounts payable” sub-ledger at the time an invoice is vouched for payment.

Is mortgage debt a note payable?

For this reason, mortgage obligations fall under “notes payable,” which is classified as a separate expenditure category. “Expenses” are displayed on a company’s income statement, which itemizes revenues and expenses, to convey net income for a given period.

Do mortgage payments have a promissory note?

Most importantly, these payments do not involve a promissory note. For example, mortgage obligations would not be grouped in with accounts payable because they do in fact come with a promissory note attached.

What is the difference between salary expense and salary payable?

In short, the difference between salary expense and salary payable is that the salary expense is the total expense for the period while the salary payable is only the amount of remuneration that is due.

What is salary payable?

Salary payable is a liability account keeping the balance of all the outstanding wages. Every company doesn’t need to maintain salaries payable account because some companies pay their employees at the end of every month, so in that situation, there is no liability present at the end of the month. In short, the difference between salary expense ...

What is accrued salary?

Accrued salary expenses are different from the salaries payable. In the salaries payable, the company knows the exact amount of payment to be paid and actually incurred. However, the accrued salary expenses are the expenses that the company is expected to be incurred based on their best estimate. However, the company does not know yet ...

How much is paid on 30th January?

Out of which, $10,000 is paid on 30th January, while the remaining balance is still unpaid. During the month, $5,000 is paid against the previous month’s salary. Wages of 30 th January are still unpaid due to a shortage of cash at the office amounting to $2,000.

Is salary payable a current liability?

Salary payable is classified as a current liability account that appears under the head of current liabilities on the balance sheet. All the general rules of accounting are also applicable to this account.

Is salary payable reported on income statement?

The amount of salary payable is reported in the balance sheet at the end of the month or year and it is not reported in the income statement. This account is treated as a current liabilit y because usually, its balance is due within one year. The balance of this account increases with credit and decreases with debit entries.

Is salary payable recorded on the debit side?

The same as other liabilities accounts, salary payable increase is recording on the credit side and when it is decreasing is recording on the debit side. The recording is different from the recording of assets or expenses and it is the same effect as revenues and equity.