The sum of MPC and the MPS must equal 1 because all additional income must be spent or saved. A downshift of the consumption schedule typically involves an equal upshift of the saving schedule except when there is an increase in personal taxes; then they both shift downward.

How does the MPC differ from the MPs?

Consequently, how does the MPC differ from the MPS? MPS is defined as the marginal propensity to save, which means the ratio of a change in saving to the change in income. MPC and MPS are different because MPC measures the effect of income on consumption, whereas MPS measures the effect of income on saving.

What is the MPC percentage and why is it important?

The MPC percentage can also be used by economists to determine how much of each $1 in tax rebates will be spent. In doing so, they can adjust the total size of the rebate program to achieve the desired spending per household. The MPC is also vital to the study of Keynesian economics, which is the result of economist John Maynard Keynes.

How do you find the value of MPC and MPs?

Clearly if one is given, we can find out the other because the sum of MPC and MPS is equal to unity, i.e., Incremental (additional) income. What is the value of MPC when MPS is zero? The value of MPC is equal to unity (i.e., 1) when MPS is zero since whole of disposable income is spent on consumption.

What is MPC and MPs in economics Quizlet?

What is MPC and MPS in economics? The marginal propensity to save (MPS) is the portion of each extra dollar of a household's income that's saved. MPC is the portion of each extra dollar of a household's income that is consumed or spent. Click to see full answer. Hereof, what is MPC in economics?

Why the value of the MPC Cannot be greater than 1?

Marginal Propensity to consume refers to the ratio between the percentage change in consumption for every one rupee of change in the income. Therefore, it cannot be more than one as it is percentage change in consumption when there is some change in the level of income which cannot be more than the change in income.

What is the relationship between the MPC and the MPS?

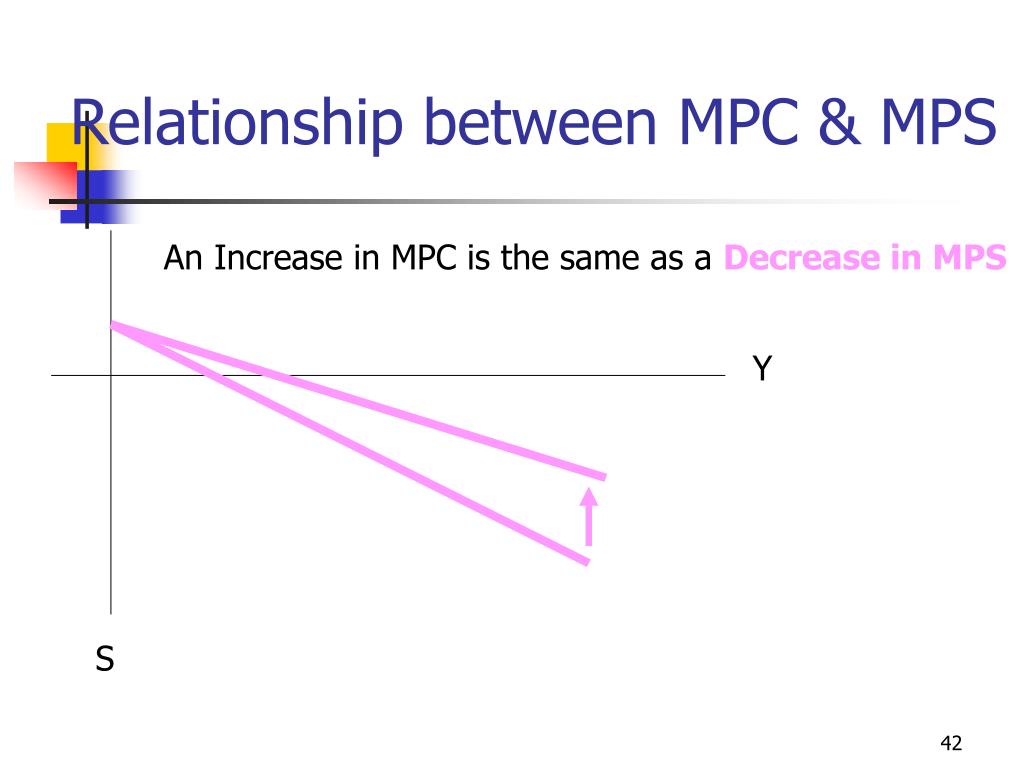

The marginal propensity to consume (MPC) is the flip side of MPS. Economic theory tends to support that as income increases, so too does spending and consumption. Therefore, the MPC and MPS have a inversely proportional relationship with each other.

What does it mean if MPC equals 1?

An MPC equal to one means that a change in income (∆Y) led to the same proportionate change in consumption (∆C). That is, a person spent 100% of the additional income on goods and services and saved none of it.

Why is MPC not equal to 1?

The value of MPC is equal to unity (i.e., 1) when MPS is zero since whole of disposable income is spent on consumption. Again, value of MPC cannot he greater than 1 because change in consumption (i.e., additional consumption) cannot be more than change in income (i.e., additional income).

What is the relationship between the simple multiplier and marginal propensity to consume?

Since the simple spending multiplier is based on the marginal propensity to consume, any increase in the MPC will increase the value of the multiplier. Likewise, any decrease in the MPS will increase the value of the multiplier.

What is the relationship between marginal propensity to save and value of simple multiplier?

Therefore, there is an inverse relationship between investment multiplier and marginal propensity to save which means if marginal propensity to save increases, investment multiplier decreases and vice-versa.

Can marginal propensity consume 1?

When we observe an MPC that is equal to one, it means that changes in income levels lead to proportionate changes in the consumption of a particular good.

When the marginal propensity to consume is less than 1 THE?

MPC less than 1: When MPC will be less than 1, there will be a proportionately smaller increase in the consumption with respect to the change in income levels.

What will happen to multiplier if MPC 1?

Therefore, the value of the multiplier is infinity.

Why is MPC always positive and lies between 0 and 1?

The reason MPC lies between 0 and 1 is that the additional income can be either consumed or entirely saved. If entire additional income is consumed, the change in consumption will be equal to change in income making MPC = 1. Or otherwise, if the entire income is saved, change in consumption is 0 making MPC = 0.

What is the relation between MPC and MPS Class 12?

Answer: (i) The ratio of change in consumption (C) to change in income (Y) is known as marginal propensity to consume. It indicates the proportion of additional income that is being spent on consumption. MPC + MPS = 1 because total increment in income is either used for consumption or for saving.

Answer

Marginal propensity to consume and marginal Propensity to save always equals to each other.you consume only from what you have saved

New questions in Business

According to the video, what are some qualities Manicurists and Pedicurists need? Check all that apply. people skills leadership research skills creat …

How does MPC differ from MPS?

Keeping this in consideration, how does the MPC differ from the MPS? MPS is defined as the marginal propensity to save, which means the ratio of a change in saving to the change in income. MPC and MPS are different because MPC measures the effect of income on consumption, whereas MPS measures the effect of income on saving.

Why is MPC important?

MPC is important because it varies at different income levels and is the lowest for higher-income households.

What is marginal propensity to consume?

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending (consumption) occurs with an increase in disposable income (income after taxes and transfers). Also Know, how do you calculate MPC?

Why do we use MPC?

MPC can be used to assess the likelihood of which household's, based on their income, would have the greatest likelihood or propensity to spend the tax cut, rather than save it.

Why is MPC important?

MPC is important because it varies at different income levels and is the lowest for higher-income households. The marginal propensity to consume is calculated by dividing the change in spending by the change in income.

What is MPS in economics?

The marginal propensity to save (MPS) is the portion of each extra dollar of a household’s income that's saved. The MPS indicates what the overall household sector does with extra income—specifically, the percent of extra income that is saved.

What is marginal propensity to consume?

The marginal propensity to consume (MPC) is the flip side of MPS. MPC helps to quantify the relationship between income and consumption. MPC is the portion of each extra dollar of a household’s income that is consumed or spent. For example, if the marginal propensity to consume is 45%, out of each additional dollar earned, 45 cents is spent.