What is the relationship between present values and interest rates? The higher the interest rate, the lower the PV and the higher the FV. The same relationships apply for the number of periods.

How do interest rates affect net present value?

Interest rates are periodically set by central banks, and they fluctuate in the marketplace on a daily basis. Changing interest rates affect the cost of capital for companies and, as a result, impact the net present value of their corporate projects.

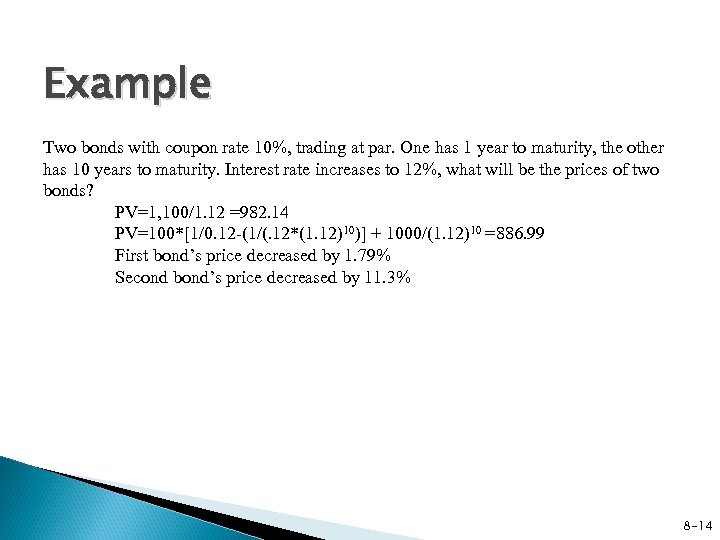

What is the relationship between interest rates and bond prices?

He has also spent 10+ years as a journalist. Bonds have an inverse relationship to interest rates. When the cost of borrowing money rises (when interest rates rise), bond prices usually fall, and vice-versa.

What is the present value of money?

Conversely, a present value equals the future value minus the interest that comes from ownership of the money; it is today's value of a future amount to be received at some specified time in the future.

What is the interest rate?

Interest rate is the rate of one period, for example if the annual rate is 6% and the interest is paid semiannually then interest rate = 3% for one period.

How is present value affected by interest rates?

The discount rate or interest rate can affect the present value of future cash flows. If the discount rate is lower (representing a lower risk and a lower required return), the present value is higher, and vice versa.

What happens to a present value if you increase the interest rate?

The future value gets larger as you increase the interest rate. 5. What happens to a present value as you increase the discount rate? The present value gets smaller as you increase the discount rate.

What is the relationship between present value and future value interest factors?

What is the relationship between present value and future value interest factors? The present value and future value factors are equal to each other. The present value factor is the exponent of the future value factor. The future value factor is the exponent of the present value factor.

What is the relationship between present value future value and the interest rate in the case of a perpetuity?

Perpetuity is a perpetual annuity, it is a series of equal infinite cash flows that occur at the end of each period and there is equal interval of time between the cash flows. Present value of a perpetuity equals the periodic cash flow divided by the interest rate.

Why do higher interest rates lower present value?

What Effect Does a Higher Discount Rate Have on the Time Value of Money? Future cash flows are reduced by the discount rate, so the higher the discount rate the lower the present value of the future cash flows. A lower discount rate leads to a higher present value.

What is the impact of a decrease in interest rates on present value?

If the appropriate interest rate is only 4 percent, then the present value of $100 spent or earned one year from now is $100 divided by 1.04, or about $96. This illustrates the fact that the lower the interest rate, the higher the present value.

How does interest rate affect time value of money?

Interest rates are a key quantitative representation of the time value of money. When investing in bonds, for example, the interest increases the value of deposited cash over time if left reinvested.

What is the relationship between the future value of one and the present value of one?

What is the relationship between the future value of one and the present value of one? The present value of one equals one divided by the future value of one.

Which is better present value or future value?

While the present value decides the current value of the future cash flows, future value decides the gains on future investments after a certain time period. Present value is crucial because it is a more reliable value, and an analyst can be almost certain about that value.

What happens to the present value and future value of an annuity as the interest rate increases?

What happens to the present value of an annuity if you increase the rate r? Assuming positive cash flows and interest rates, the present value will fall. Assuming a positive interest rate, the present value of an annuity due will always be larger than the present value of an ordinary annuity.

What is the relationship between the value of an annuity and the level of interest rates?

The relationship between the value of an annuity and the level of interest rates is that they are inversely proportional i.e. the higher the interest...

What happens to the present value of an annuity when the interest rate rises?

As the interest rate rises the present value of an annuity decreases. This is because the higher the interest rate the lower the present value will need to be. The natural compounding factor of higher interest would necessitate a lower present value.

What is net present value?

The net present value (NPV) of a corporate project is an estimate of its value based on the projected cash flows and the weighted average cost of capital. With a higher WACC, the projected cash flows will be discounted at a greater rate, reducing the net present value, and vice versa. As interest rates rise, discount rates will rise, thereby reducing the NPV of corporate projects. Notably, a proposed corporate project can either have a positive or negative NPV based on its expected cash flows and the relative cost of capital.

What is the IRR in finance?

Internal rate of return (IRR) is the amount expected to be earned on a capital invested in a proposed corporate project. However, corporate capital comes at a cost, which is known as the weighted average cost of capital (WACC).

What is the national interest rate?

This is the rate of interest charged on the inter-bank transfer of funds held by the Federal Reserve (Fed) and is widely used as a benchmark for interest rates on all kinds of investments and debt securities. 1

What happens to bond interest rate if interest rates rise?

Most bonds pay a fixed interest rate that becomes more attractive if interest rates fall, driving up demand and the price of the bond. Conversely, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in a decline in its price. Zero-coupon bonds provide a clear example ...

Why do bond prices move in the opposite direction?

An easy way to grasp why bond prices move in the opposite direction of interest rates is to consider zero-coupon bonds, which don't pay regular interest and instead derive all of their value from the difference between the purchase price and the par value paid at maturity. Zero-coupon bonds are issued at a discount to par value, ...

Why are zero-coupon bonds volatile?

Zero-coupon bonds tend to be more volatile , as they do not pay any periodic interest during the life of the bond. Upon maturity, a zero-coupon bondholder receives the face value of the bond. Thus, the value of these debt securities increases the closer they get to expiring.

How many times did the Fed raise interest rates?

The Fed raised interest rates four times in 2018. After the last raise of the year announced on Dec. 20, 2018, the yield on 10-year T-notes fell from 2.79% to 2.69%.1 3. 1 4 .

Do bonds have a negative correlation?

Bonds have an inverse relationship to interest rates. When the cost of borrowing money rises (when interest rates rise), bond prices usually fall, and vice-versa. At first glance, the negative correlation between interest rates and bond prices seems somewhat illogical. However, upon closer examination, it actually begins to make good sense.