The quality of income ratio is defined as the proportion of cash flow from operations to net income. The formula for the quality of income ratio is: A ratio of greater than 1.0 usually indicates high-quality income, while a ratio of less than 1.0 indicates low-quality. Click to see full answer.

How to calculate quality of income?

What is Gross Annual Income?

- Hourly, Daily, Weekly, Monthly Income Conversion. You can easily convert your hourly, daily, weekly, or monthly income to an annual figure by using some simple formulas shown below.

- Example of Annual Income Calculator. ...

- Download the Free Template. ...

- Salary vs Wage. ...

- Total Annual Income. ...

- Income, Revenue, and Earnings. ...

- Additional Resources. ...

How to calculate quality of earnings?

- Maintain consistent accounting policies from quarter to quarter

- Compare your accounting policies to industry norms

- Disclose any changes in estimation methods

- Maximize the objective measures used in estimates and decrease subjective measures

- Keep track of the data needed to better inform your estimates

How is the quality of earnings ratio computed?

Use of Financial Ratios to Measure the Quality of Earnings

- Nell S Gullett, College of Business and Global Affairs, University of Tennessee at Martin

- Ronald W Kilgore, College of Business and Global Affairs, University of Tennessee at Martin

- Mary F Geddie, College of Business and Global Affairs, University of Tennessee at Martin

What is the quality of earnings ratio?

The quality of earnings ratio is an indicator of the degree to which the net income of a business satisfies quality criteria. Quality is a subjective matter but generally earnings are considered to be of high quality if they have some of the following characteristics. Consistent, predictable and sustainable.

How do you find the quality of income ratio?

The formula for quality of ratio is dividing the net cash from operating activities by the net income. This formula gives the quality of the earnings ratio rather than the absolute figure.

What is the quality ratio?

The Quality Ratio (not to be confused with Earnings Quality) is a quantitative factor that determines how efficiently companies use their assets to generate high gross margin sales. Recently, modern finance has been looking to the Quality Ratio as a 5th key "Factor" that explains long-term equity investment returns.*

What is good quality of earnings?

The quality of earnings refers to the proportion of income attributable to the core operating activities of a business. Thus, if a business reports an increase in profits due to improved sales or cost reductions, the quality of earnings is considered to be high.

What decreases quality income ratio?

The quality of income ratio decreases because the ratio denominator (net income) increases.

Why is quality of earnings important?

For sellers, a well-done quality of earnings report allows a third-party to peek under the hood of their business as if they were a potential buyer to point out inconsistencies with financial data, areas of concern, items to highlight, and processes to improve to better position the seller to maximize value on a sale ...

Which of the following transactions increases the quality of income ratio?

A decrease in receivables is the correct answer.

What does a low quality of income mean?

Companies that manipulate their earnings are said to have poor or low earnings quality. Companies that do not manipulate their earnings have a high quality of earnings. This is because as a company's quality of earnings improves, its need to manipulate earnings to portray a certain financial state decreases.

What is the quality of earnings ratio?

The quality of earnings ratio is an indicator of the degree to which the net income of a business satisfies quality criteria. Quality is a subjective matter but generally earnings are considered to be of high quality if they have some of the following characteristics.

What does it mean when a business has a quality of earnings greater than 1?

A quality of earnings significantly greater than 1 indicates that the net income is less than the operating cash flow of the business and suggests that the business is conservative in its approach to income recognition.

What is the ratio used to measure quality of earnings?

One of the common techniques used in evaluating the quality of earnings is the ratio analysis . One of the ratios commonly used to measure the quality of earning is as follows: A quality of income ratio higher than 1 usually indicates high quality earnings, while the ratio lower than 1 is considered to indicate low quality earnings.

Do accrual earnings reflect cash flows?

In accounting, accrual earnings (i.e., net income reported on the income statement) do not necessary reflect cash flows. As the result, the logic behind the quality of income ratio is as follows: high quality earnings should reflect the cash flows (from operations) of the organization.

What is quality of earnings?

Quality of earnings is the percentage of income that is due to higher sales or lower costs. An increase in net income without a corresponding increase in cash flow from operations is a red flag. Tracking activity from the income statement through to the balance sheet and cash flow statement is a good way to gauge quality of earnings.

How can quality of earnings be eroded?

Quality of earnings can be eroded by accounting practices that hide poor sales or increased business risk . Fortunately, there are generally accepted accounting principles (GAAP). The more closely a company sticks to those standards, the higher its quality of earnings is likely to be.

Why do companies not manipulate their earnings?

Companies that do not manipulate their earnings have a high quality of earnings.This is because as a company's quality of earnings improves, its need to manipulate earnings to portray a certain financial state decreases. However, many companies with high earnings quality will still adjust their financial information to minimize their tax burden. ...

What is a company with a high net income but negative cash flows?

A company that has a high net income but negative cash flows from operations is achieving those apparent earnings somewhere other than sales. One-time adjustments to net income, also known as nonrecurring income or expenses, are another red flag.

What is the number that analysts like to track?

One number that analysts like to track is net income. It provides a point of reference for how well the company is doing from an earnings perspective. If net income is higher than it was the previous quarter or year, and if it beats analyst estimates, it's a win for the company.

What happens when earnings per share goes up?

When earnings-per-share goes up, the price-to-earnings ratio goes down. That should signal that the stock is undervalued. It doesn't, though, if the company changed the number by simply repurchasing shares. It is particularly worrisome when a company takes on additional debt to finance stock repurchases.

Do companies with high earnings quality still adjust their financial information to minimize their tax burden?

However, many companies with high earnings quality will still adjust their financial information to minimize their tax burden. As noted above, companies with a high quality of earnings stick with the GAAP standards. The fundamental qualities of those standards are reliability and relevance. That is:

How to gauge quality of earnings?

One can gauge the quality of earnings by tracking activities from the income statement to the balance sheet and cash flow statement. The one item, however, that analysts focus more on is the net income. It is the point of reference that tells analysts how well the company is performing. If the income is higher than the last year ...

Why do high quality earnings matter?

For investors, high-quality earnings matter more as a company is more likely to repeat such a performance in the future. This, in turn, would mean more cash flows for investors and high stock prices for the company. 1–3

What is QoE report?

Basically, the QoE report measures how a company accumulates its revenues, including recurring or nonrecurring and cash or non-cash. We can say that this measure is primarily concerned with the income from the core operating activities of a business.

What is QoE in accounting?

Quality of Earnings (QoE) represents a true picture of the company without any accounting trick, one-time item, or anomalies. Or, we can say, it refers to the income that the company generates from the core operations. Often it is seen that net income does not represent the true financial picture of a company. It may happen that a company reports a massive net income, but its operating cash flows are negative. In such a case, one can’t say that the company is financially sound. Thus, to get the true position in these cases, we calculate the quality of earnings.

What can an analyst look for in a company's cash flow statement?

If a company has high net income but its cash flows are negative. Then, an analyst can look for variations between the operating cash flow and net income.

Is net income a financial picture?

Often it is seen that net income does not represent the true financial picture of a company. It may happen that a company reports a massive net income, but its operating cash flows are negative. In such a case, one can’t say that the company is financially sound. Thus, to get the true position in these cases, we calculate the quality of earnings.

Can a company report high quality earnings?

A company can report high-quality earnings quarter after quarter. Low-quality earnings, however, are not repeatable due to one-time events or items. In the quality earnings report, a company must provide details of all sources of earnings. Also, it should mention the changes, if any, it expects in these sources.

What is quality of earnings?

Quality of earnings refers to the income generated from the core operations (recurring) of the business and does not include the one-off revenues (nonrecurring) generated from other sources. Evaluating the quality will help the financial statement user make judgments about the “certainty” of current income and the prospects for the future.

Why is a company's earnings low quality?

If a company’s earnings are linked to outside sources such as increasing commodity prices, then the company would be seen as having a low quality of earnings. Also, a company may report a growth in sales, but this may be due to growing credit sales.

How many CFOs think earnings are important?

According to a survey conducted by the Emory University, 94.7% of CFOs think that earnings are either very important or somewhat necessary for investors in valuing the company. It is difficult to define the quality of earnings and, although there are no definitive criteria by which to evaluate it, there are many factors that can be considered in assessing the earnings.

What is valuation based on?

In the case of acquisitions, valuations are typically based on a multiple of EBITDA (earnings before interest, taxes, depreciation, and amortization). It is, therefore, critical for a buyer to understand historical earnings, trends, critical assumptions used in forecasts, and the sustainability of earnings. For an income measure to be considered of ...

How to calculate cost to income ratio?

The following steps can compute the cost to income ratio: 1 Deduct interest income and interest expenses to arrive at net interest income. 2 Add commission and discount income to net interest income (income from financing, income from portfolio, income from investment 3 Add other income to get total income. 4 Deduct operating expenses and financing expense to get net income. 5 Adjust for LLP and foreign exchange gain/ losses. 6 Deduct operating expenses to get net income before taxes 7 Deduct taxes paid and we get net income after taxes. 8 Cost to income ratio is obtained by dividing operating expenses to operating income.

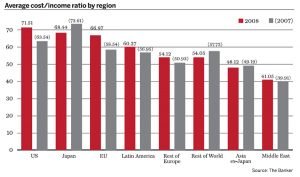

What is cost to income ratio?

The cost to income ratio is one of the efficiency ratios used to gauge an organization’s efficiency. It is used to compare the operating expenses of a bank vis-à-vis its income. The lower the cost to income ratio, the better the company’s performance.

Is discounting charge the same as operating costs?

Discounting charges. The same ratio can be written for banks as Operating costs/ Financial margin. It is useful in analyzing banking stocks. There exists an inverse relationship exists between the Cost Income ratio and bank profitability.

Is a bank an efficient business?

Bank is not managed in an efficient manner. Too much of competition in the banking industry. To reduce this ratio, the company either needs to increase its operating income or decrease its operating expenses. Employee expenses and administration expenses come under the operating expenses.