What Are The Primary Objectives Of Financial Management?

- Profit Maximization. The basic objective of financial management is to achieve optimal profit, both in the short and long run.

- Proper Mobilization. Effective mobilization is one of the most important objectives of financial function. ...

- Improved Efficiency. ...

- Business Survival. ...

- Balanced Structure. ...

What are the goals of a financial manager?

16/08/2021 · The primary goal of financial management is to manage an organization’s finances so that businesses are compliant with necessary regulations and are successful in their field. The process involves high-level planning and proper execution. When done right, businesses succeed and improve profitability.

What are the scope and objectives of financial management?

30/01/2022 · The primary goal of the financial management is to maximize the wealth of owners. All businesses aim to maximize their profits, minimize their expenses and maximize their market share. The primary goal of financial management is to maximize the: Current value of each share of outstanding stock. A proxy fight is: A method used by […]

What is business financial management and why is it important?

It is the primary objective of financial management. Every business organization should reach its peak position only with the help of well-structured financial management. So it is essential to make sure that all the availability of funds and also plan for the equalization of funds from variable resources. ... These are the various goals and objectives of financial management. As …

What are the components of financial management?

08/02/2022 · Goals of Financial Management. The goals of financial management can be grouped in many ways. However, most of those goals are overlapping and ultimately boils down to the following three goals. ... When the main goal of financial management is towards improving market share in an inconsistent manner that may lead to a monopoly where single …

What is the primary goal of financial management quizlet?

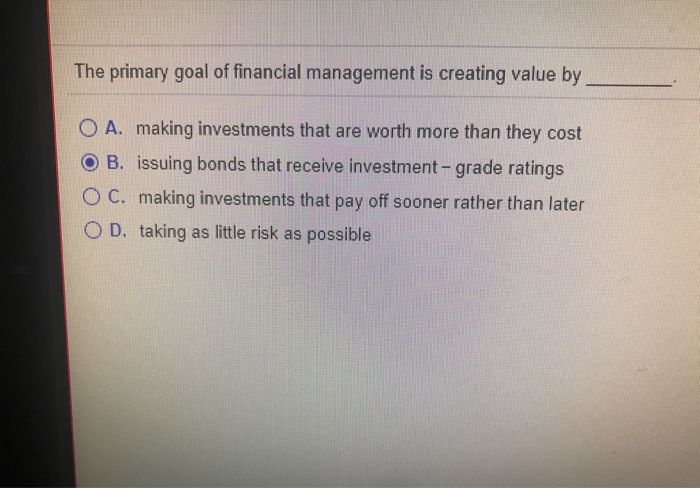

The primary goal of financial management is to maximize the current value of the existing stock.

What are the two primary objective of financial management?

This article throws light upon the top two objectives of financial management. The objectives are: 1. Profit Maximisation 2. Wealth Maximisation.

1. What are the Basic Elements of Financial Management?

Financial management is defined by various scholars. In easy terms, it is defined as a process of organizing, planning, maintaining all the financi...

2. Explain the Procedure of Financial Planning?

As financial planning is the first and foremost element of financial management, it involves a set of steps in its procedure. That is,First, we nee...

3. What is the Significance of Financial Management?

Financial management plays a significant role in every organization irrespective of its nature. It acts as the backbone of an organization. It has...

What are the functions of financial management?

Functions of Financial Management 1 Controlling all the financial decisions. 2 Acquisition of funds from the available resources. 3 Managing liquid cash and cash related activities. 4 Maintaining proper records for all transactions. 5 Designing security measures to protect financial resources.

Why is financial management important?

The financial management also helps to maintain proper records of every transaction of an organization related to monetary terms. It is one of the provisions to maintain security for the available funds and optimum utilization of funds.

What is financial decision?

Financial Decisions: These are the decisions related to equalization of funds, utilization of those funds, forecasting the returns based on the investment, etc. 2. Investment Decisions: The name itself specifies that the decisions related to the investment. Whether it is fixed assets, working capital, investment, etc.

What is the structure of capital optimally?

Structure of the Capital Optimally: It is also the main objective of financial management. It is to utilize all the capital in a structured way to its maximum extent. It means a single penny should not be wasted and also should not be misused or left.

Why is profit criticized?

Although profit is considered as a basic criterion for financial decision-making, this goal has been criticized because on the following basis: Ambiguity. Ignores the time value of the benefits. Ignores the Quality of benefits. Unsuitable in a modern business environment.

What is financial management?

Financial Management is one of the areas of finance which deals with the management of all the financial resources of the organization for the smooth functioning of the organization’s goals. Generally, a firm or corporation is the purpose for which the finance functions are carried out. They provide criteria for financial decision-making ...

Why is value maximization considered a superior goal to profit maximization?

Value maximization goal as a financial management decision criterion is considered a superior goal to profit maximization goal because: It is a clear goal. It considers the timing of cash flows. It considers the quality of benefits. It reduces the conflict of interest among the stakeholders of a firm. Similar Searches,

What is the goal of a financial manager?

They provide criteria for financial decision-making and are essential for the right financial decision, Financial manager takes goals of a firm as guidelines for financial decisions. Hence, the goals of firms are also called a goal of financial management or financial goal.

What is the test of economic efficiency?

Those people or financial managers who follow profit maximization goal believe that. Test of economic efficiency is determined by profit. Profit leads to the effective utilization of scarce economic resources in every business firm.

What is value maximization?

The value of a firm is the total of the market value of equity and the market value of debt. Debt holders have fixed claims to the firm. So if the value of the firm is maximized, the market value of equity will increase. Thus, maximizing the firm’s value is consistent with maximizing stock price or maximizing shareholder wealth.

What is the difference between shareholder wealth and net present value?

The difference between Shareholder wealth is maximized when a decision generates a net present value. The net present value is the difference between the present value of the benefits of a project and the present value of its costs. Therefore, only those projects which have positive net present value should be accepted.