Salvage Value Vs Residual Value The residual value, also known as salvage value, is the estimated value of a fixed asset at the end of its lease term or useful life. As a general rule, the longer the useful life or lease period of an asset, the lower its residual value.

Is residual value the same thing as salvage value?

To determine how much depreciation to claim each year, you need to estimate how much you will receive when you sell the asset once its useful life is over. This amount is the asset's residual value, also known as its salvage value. Accountants make no distinction between the two terms.

How do you determine salvage value?

Salvage value is the estimated resale value of an asset at the end of its useful life. It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. Thus, salvage value is used as a component of the depreciation calculation. If it is too difficult to determine a salvage value, or if the ...

How to calculate the residual value?

What is the Residual Value?

- Breaking down Residual Value. Suppose you lease out a car for the next five years. ...

- Residual Value Example. Let us consider a Residual value example of printing machinery. ...

- 3 Ways to Calculate Residual Value. There are several ways to understand what an owner will get from an asset s of a future date. ...

- Conclusions. ...

- Recommended Articles. ...

How to calculate salvage value?

Part 1 of 4: Determine Blue Book values

- Find the value of your vehicle in KBB: Find the make, model and year of your vehicle in the Kelley Blue Book either in print or online. ...

- Click on "Trade to Dealer". This will give you the trade-in value for your car. ...

- Go back and select “Sell to Private Party”. ...

- Check NADA for your car value. ...

- Compare the value with Edmunds.com. ...

- Calculate market value. ...

Are residual value and salvage value the same?

The residual value, also known as salvage value, is the estimated value of a fixed asset at the end of its lease term or useful life.

What is the difference between recoverable amount and residual value?

Residual value is the value remaining in the asset at the point in time when the asset has deteriorated to a point that it must either be closed or renewed, and is therefore not usually the same as recoverable value.

What is the difference between salvage value and resale value?

Scrap value is also referred to as an asset's salvage value or residual value. Salvage value is the estimated resale value of an asset at the end of its useful life. Salvage value is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated.

What is salvage value?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset's estimated salvage value is an important component in the calculation of a depreciation schedule.

How do you calculate salvage value?

Salvage Value Formula Calculating the salvage value is a two-step process: The annual depreciation is multiplied by the number of years the asset was depreciated, resulting in total depreciation. The original purchase price is subtracted from the total depreciation expensed across the useful life.

What is residual value in depreciation?

Residual value refers to the estimated worth of an asset after the asset has fully depreciated. Generally, the length of an asset's lease period or useful life is inversely proportional to its residual value.

What is residual value of an asset?

The residual value of an asset is the estimated amount that an asset's owner would earn by disposing of the asset, less any disposal cost. With residual value, it's assumed that the asset has reached the end of its useful life.

What is the difference between market value and residual value?

In order to find an asset's residual value, you must also deduct the estimated costs of disposing the asset. The residual value of an asset is usually estimated as its fair market value, as determined by agreement or appraisal.

Is salvage value positive or negative?

A positive salvage value at the end of the asset's life is treated as a negative cost. Note that capital costs explicitly exclude O&M costs. When we write any equation for cost, a negative cash flow becomes a positive cost.

How do you calculate salvage value for depreciation?

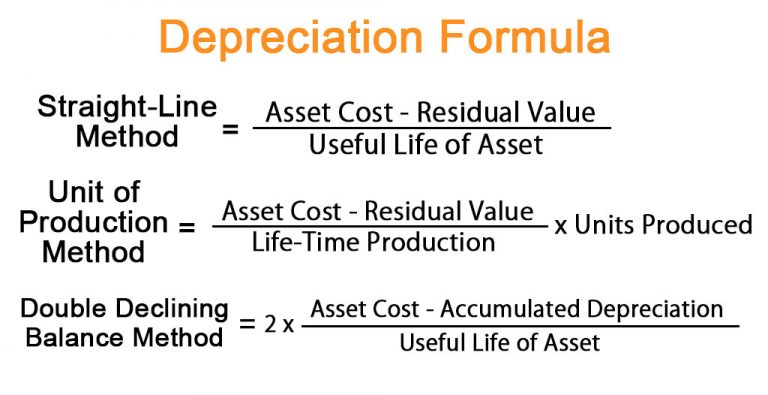

To calculate depreciation using the straight-line method, subtract the asset's salvage value (what you expect it to be worth at the end of its useful life) from its cost. The result is the depreciable basis or the amount that can be depreciated. Divide this amount by the number of years in the asset's useful lifespan.

Where does the salvage value go?

Salvage value is a commonly used, if not often discussed, method of determining the value of an item or a company as a whole. Investors use salvage value to determine the fair price of an object, while business owners and tax preparers use it to deduct from their yearly tax liabilities.

What is salvage value?

Salvage value is the estimated resale value of an asset at the end of its useful life. It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. Thus, salvage value is used as a component of the depreciation calculation.

How to find residual value?

The formula to figure residual value follows: Residual Value = The percent of the cost you are able to recover from the sale of an item x The original cost of the item. For example, if you purchased a $1,000 item and you were able to recover 10 percent of its cost when you sold it, the residual value is $100.

How to determine how much depreciation to claim each year?

To determine how much depreciation to claim each year, you need to estimate how much you will receive when you sell the asset once its useful life is over. This amount is the asset's residual value, also known as its salvage value. Accountants make no distinction between the two terms.

What happens if you have a high residual value?

With a high residual value, the difference between the final sale price and the vehicle's projected worth is lower, so the total amount you owe on your lease is lower. Conversely, a low residual valueincreases the total amount you owe on the lease.

How to depreciate a property in straight line?

Under straight-line depreciation, you first subtract the salvage value from the cost of the property and then divide this value by the number of years in the property's useful life. The result is your annual fixed depreciation amount, which is the amount you can deduct every year until depreciation is complete.

What is residual in regression?

A residual is the difference between what is plotted in your scatter plot at a specific point, and what the regression equation predicts "should be plotted" at this specific point.

What percentage of residual value is a 36 month lease?

Residualpercentages for 36-month leases tend to hover around 50 percent but can dip into the low 40s or be as high as the mid-60s.

What Is Residual Value?

The residual value, also known as salvage value, is the estimated value of a fixed asset at the end of its lease term or useful life. In lease situations, the lessor uses the residual value as one of its primary methods for determining how much the lessee pays in periodic lease payments. As a general rule, the longer the useful life or lease period of an asset, the lower its residual value.

How to determine residual value of asset?

To determine the residual value of an asset, you must consider the estimated amount that the asset's owner would earn by selling the asset (minus any costs that might be incurred during the disposal). Residual value is often used when referring to a leased car.

What is the depreciable base of a tangible asset?

For tangible assets, such as cars, computers, and machinery, a business owner would use the same calculation, only instead of amortizing the asset over its useful life, he would depreciate it. The initial value minus the residual value is also referred to as the "depreciable base.".

How to calculate residual value of a car?

The residual value of cars is often expressed as a percentage of the manufacturer’s suggested retail price (MSRP). For example, residual may be expressed this way: $30,000 MSRP * Residual Value of 50% = $15,000 value after 3 years. So, a car with an MSRP of $30,000 and a residual value of 50% after three years would be worth $15,000 at the end of its lease.

What will influence the total depreciable amount a company uses in its depreciation schedule?

The residual value will influence the total depreciable amount a company uses in its depreciation schedule.

Why do companies need residual value insurance?

To manage asset-value risk, companies that have numerous expensive fixed assets, such as machine tools, vehicles, or medical equipment, may purchase residual value insurance to guarantee the value of properly maintained assets at the end of their useful lives.

What is a lease buyout?

A lease buyout is an option that is contained in some lease agreements that give you the option to buy your leased vehicle at the end of your lease. The price you will pay for a lease buyout will be based on the residual value of the car.

What is Salvage Value?

Salvage value is defined as the book value of the asset once the depreciation has been completely expensed. It is the value a company expects in return for selling or sharing the asset at the end of its life.

How is Salvage Value Calculated?

Simply put, when we deduct the depreciation of the machinery from its original cost, we get the salvage value.

Why is salvage value important?

Salvage value is important in accounting as it displays the value of the asset on the organization’s books once it completely expenses the depreciation. It exhibits the value the company expects from selling the asset at the end of its useful life.

What is a depreciation schedule?

A depreciation schedule helps you with mapping out monthly or yearly depreciation.

Why is depreciation important?

Depreciation is an essential measurement because it is frequently tax-deductible.

What is the value of a good sold off?

When a good is sold off, its selling price is the salvage value and this is called the before tax salvage value.

Is salvage value interchangeable?

This is also how we define salvage value. So, to summarize, the two terms are interchangeable and imply the same.

What is the difference between resale value and residual value?

And while residual value is pre-determined and based on MSRP, resale value can change based on market conditions.

What is residual value?

Residual value is your car’s estimated worth at the end of your lease term. It helps determine your monthly payment and the price to purchase the vehicle after your lease is up. As with most things involving value, it’s usually ideal to lease a vehicle with a high residual value.

How does residual value affect my monthly payment?

Your monthly payment is largely determined by the difference between the total amount you owe and the final sale price. That amount is spread across the length of your lease.

How much would you owe if your residual value was $2,000?

Subtract the $15,000 residual value, and you’d owe a total of $12,000 spread throughout your monthly payments. If your residual value were $2,000 higher, you would only owe $10,000 and have a lower monthly payment.

What happens if you have a high residual value?

With a high residual value, the difference between the final sale price and the vehicle’s projected worth is lower, so the total amount you owe on your lease is lower. Conversely, a low residual value increases the total amount you owe on the lease. This may work to your advantage if you write off your vehicle for business or decide ...

What would happen if you sold your car?

If you sold it, your ownership cost would be $2,400 a year. You could also continue to drive the vehicle, which could lower your annual cost but may also lower your resale value. The residual value in a lease is static, leaving you with a fixed cost per year.

What is salvage value?

Salvage value is a tool used in accounting to estimate the value that a tangible asset can be sold for when it has reached the end of its useful life —in short, what the asset can be salvaged for when a company can no longer make viable use of it.

What is the difference between book value and salvage value?

When valuing a company, there are several useful ways to estimate the worth of its actual assets. Book value refers to a company's net proceeds to shareholders if all of its assets were sold at market value. Salvage value is the value of assets sold after accounting for depreciation over its useful life.

What is liquidation value?

The liquidation value is the value of a company's real estate, fixtures, equipment, and inventory. Intangible assets are excluded from a company's liquidation value. Liquidation value is usually lower than book value but greater than salvage value.

Why are assets sold at a loss?

The assets continue to have value, but they are sold at a loss because they must be sold quickly. Liquidation value does not include intangible assets such as a company's intellectual property, goodwill, and brand recognition. However, if a company is sold rather than liquidated, both the liquidation value and intangible assets determine ...

Does liquidation include intangible assets?

Liquidation value does not include intangible assets such as a company's intellectual property, goodwill, and brand recognition. However, if a company is sold rather than liquidated, both the liquidation value and intangible assets determine the company's going-concern value. Value investors look at the difference between a company's market capitalization and its going-concern value to determine whether the company's stock is currently a good buy.

What is residual value?

Residual value is the projected value of a fixed asset when it’s no longer useful or after its lease term has expired. What is considered residual value varies across industries, but the core meaning is nevertheless retained. Keep reading to know more about the meaning of residual value, its benefits and how to calculate it.

Why do companies need residual value insurance?

This insurance helps to minimise asset-value risk by assuring the post-useful-life value of assets enjoying proper maintenance.

What determines the residual value of a lease?

In the case of leasing, the lessor determines the residual value based on future estimates and past models.