What is a DE 9 form?

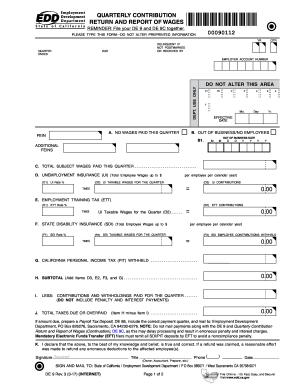

The Quarterly Contribution Return and Report of Wages – or DE 9 Form – is a form required of all employers by the California Employment Development Department (EDD). According to the EDD, the DE 9 Form reconciles reported wages and paid taxes for each quarter.

What is the difference between DE9 and de9c in California?

Herein, what is the difference between de9 and de9c? Quarterly Contribution Rerurn and Report of Wages, California Form DE9 and DE9C. DE9 is to pay taxes and DE 9C is to declare your employees wages and taxes paid. One may also ask, what is CA DE 9c? Form DE9C is the quarterly wage and withholding report for California employers.

What is a DE4 form?

The DE 4 Form is often referred to as the California Personal Income Tax (PIT) withholding form. This is the document that is used to determine the amount of taxes to be withheld from an employee’s paycheck.

When should I complete the de 9adj form?

Complete the DE 9ADJ when you are filing a claim for refund, adjusting the subject wages or taxes, adjusting Personal Income Tax (PIT) wages or withholding, correcting employee(s) Social Security number(s) (SSN) or name(s), or reporting employee(s) previously not reported to the EDD.

What is a CA DE 9C?

When is California DE 9 due?

Where to mail DE 88?

What is the 941 form?

See more

About this website

What is the difference between 941 and DE9?

If you are doing payroll by yourself, remember that you need to fill out 941 Form that you will mail to IRS and two form for Employment Development Department: form DE9 and DE 9C. DE9 is to pay taxes and DE 9C is to declare your employees wages and taxes paid.Oct 21, 2016

What is a DE9 and DE9C?

Quarterly Contribution Return and Report of Wages (DE 9) and (Continuation) (DE 9C) You must file both a Quarterly Contribution Return and Report of Wages (DE 9) and the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) each quarter.Feb 14, 2022

How do I file a DE9?

0:103:21I Want to File a Tax Return or Wage Report - YouTubeYouTubeStart of suggested clipEnd of suggested clipSelect the file or adjust a return or wage report link from the i-12 menu. Select file now next toMoreSelect the file or adjust a return or wage report link from the i-12 menu. Select file now next to tax return answer yes or no to the question.

How do I get a copy of my DE9?

Where can i find my previously filed DE9 and DE9C tax liability...Go to Taxes > Payroll Tax.In the Forms section. ... Select DE9 or DE9C from the second drop-down menu and click form name link to view the information.Click the View button and this will open the PDF on a new window.Select the Download or Print icon.Jul 24, 2021

Do you have to report EDD on taxes?

Annual unemployment compensation must be reported to the federal Internal Revenue Service (IRS). The Form 1099G is provided to people who collected unemployment compensation from the EDD so they can report it as income on their federal tax return.

What is a 941 form?

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.Nov 24, 2021

Where can I get DE9?

Here's how.Click Employees at the top menu bar.Select Payroll Center.Click on the File Forms tab.In the File Forms screen, scroll down and look for your DE9, DE9C, and Federal 941 and click to open.Jan 23, 2020

How do I fill out a 941 without paying wages?

As an employer, if you have not paid your employees any wages for the quarter, your tax amount will automatically be zero. Even if your tax amount is zero, the IRS expects you to file your Form 941. There is no need to waste your time entering zeros throughout your Form 941.

Where do I send my 941 without a payment?

Department of the Treasury Internal Revenue Service; Ogden, UT 84201-0005—this address is used for any business that wishes to file without a payment attached. Internal Revenue Service PO Box 37941; Hartford, CT 06176-7941—this address is for businesses that wish to include a payment with their 941 tax form.

What is EDD form DE 9C?

Quarterly Contribution Return and Report of Wages (DE 9) and (Continuation) (DE 9C) You must file both a Quarterly Contribution Return and Report of Wages (DE 9) and the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) each quarter.Feb 14, 2022

Where can I find my EDD award letter?

Request for Public Records Mail a request to: EDD Legal Office, 800 Capitol Mall, MIC 53, Sacramento, CA 95814-4703. Make a request at any EDD public office.Jan 26, 2022

How can I get my EDD pay stubs?

How to Get Unemployment Pay StubsFind the website for the unemployment department in your state. If you're not familiar with where to go, a list of all the unemployment agencies can be found on the Employee Issues website. ... Log onto your online account. ... references & resources.More items...

De9C - Fill Out and Sign Printable PDF Template | signNow

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission.

QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES

3. INSTRUCTIONS FOR COMPLETING THE . QUARTERLY CONTRIBUTION RETURN AND REPORT OF WAGES (DE 9) PLEASE TYPE ALL INFORMATION. Did you know you can le this form online using the EDD’s e-Services for Business?

Online Forms and Publications

Employment Development Department. The documents on this webpage are PDFs. To complete forms, you may need to download and save them on the computer, then open them with the no-cost Adobe Reader. Visit Accessibility if you need reasonable accommodation or an alternative format to access information on our website. Employers: To avoid stocking outdated forms, order a six-month supply or less.

Quarterly Contribution Return and Report of Wages (DE 9)

If this form is not preprinted, please include your business name and address, state employer payroll tax account number, the . quarter ended date, and the year and quarter for which this form is being filed.

Quarterly Contribution and Wage Adjustment Form (DE 9ADJ)

BUSINESS NAME EMPLOYER ACCOUNT NO. SECTION III: QUARTERLY WAGE AND WITHHOLDING ADJUSTMENTS Enter amounts that should have been reported; if unchanged, leave field blank.

What is a DE 4 form?

What is the DE 4 Form? The DE 4 Form is often referred to as the California Personal Income Tax (PIT) withholding form. This is the document that is used to determine the amount of taxes to be withheld from an employee’s paycheck.

What is a DE 4?

The DE 4 Form is often associated with the Form W-4, which is the federal Internal Revenue Service tax form that an employee completes indicating their tax withholdings for their employer. California and its tax forms can be confusing for taxpayers and employers.

Do you need a California tax form?

When it comes to California and taxes, there’s generally a form for every withholding and business transaction. This is especially true for California businesses and employers. I’m often asked which tax forms need to be completed and which ones are required. Here’s a look at three of the most common California tax forms and whether your business should be making sure they’re completed.

What is DE 9?

Each quarter, California employers are required to complete a Quarterly Contribution Return and Report of Wages (DE 9). It is used to reconcile California payroll tax payments and the total subject wages reported for the quarter.

When will California eliminate the DE 7?

Several important payroll tax reporting changes will take place beginning with the first quarter of 2011. The California Annual Reconciliation Statement (DE 7) will be eliminated for the tax year 2011. California employers will file the NEW Quarterly Contribution Return and Report of Wages (DE 9) to report contributions due each quarter. In addition to the DE 9, employers will file a Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) in place of the Quarterly Wage and Withholding Report (DE 6).

What is the DE6 form called?

Please take note that the DE6 form is now called as the DE9C form.

Where is the payroll tax form in QuickBooks?

All payroll forms in QuickBooks are accessible under the Payroll Tax menu. If the page is unresponsive or will not launch the option to view state returns, try opening your account in a private browser. Sometimes, the data in the cache can cause unexpected issues in QuickBooks Online.

Why is Form De9 so popular?

form de9�s browser has gained its worldwide popularity due to its number of useful features, extensions and integrations. For instance, browser extensions make it possible to keep all the tools you need a click away. With the collaboration between signNow and Chrome, easily find its extension in the Web Store and use it to eSign de9 right in your browser.

What is a de9 and de9c?

Quarterly Contribution Rerurn and Report of Wages, California Form DE9 and DE9C. ... DE9 is to pay taxes and DE 9C is to declare your employees wages and taxes paid.

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at [email protected] & Regards!

How can I fill out the BITSAT Application Form 2019?

Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

How can I fill out the application form for the JMI (Jamia Millia Islamia) 2019?

Form for jamia school have been releaseYou can fill it from jamia siteJamia Millia Islamia And for collegeMost probably the form will out end of this month or next monthBut visit the jamia site regularly.Jamia Millia Islamiacheck whether the form is out or not for the course you want to apply.when notification is out then you have to create the account for entrance and for 2 entrance same account will be used you have to check in the account that the course you want to apply is there in listed or not ….if not then you have to create the different account for that course .If you have any doubts you can freely ask me .

What is a de6?

California Form DE-6 | EDD Form DE6 | CA DE 6 Instructions. California DE-6 Form, Quarterly Wage and Withholding Report, is a required report to be filed by California employers. Business owners will report individual employee's wages and personal income tax (PIT) withholdings.

What is the difference between a 940 and a 941 form?

Both forms go to the IRS. Form 940 is for reporting and paying unemployment taxes annually. Form 941 is for reporting payroll taxes quarterly. The payroll taxes included in this report are for federal income tax withholding and for withholding of FICA taxes for Social Security and Medicare.

What is a CA DE 9C?

Furthermore, what is CA DE 9c? Form DE9C is the quarterly wage and withholding report for California employers. The form is used to report wage and payroll tax withholding information for California employers. In a way, it is the California equivalent of the Form 941 except the detailed withholding for each employee is reported.

When is California DE 9 due?

The payroll form is due January 1, April 1, July 1, and October 1 each year.

Where to mail DE 88?

If an amount is due, submit a Payroll Tax Deposit (DE 88) with your payment and mail to P.O. Box 826276, Sacramento, CA 94230-6276. NOTE: Mailing payments with the DE 9 form delays payment processing and may result in erroneous penalty and interest charges.

What is the 941 form?

Most employers are required to file Form 941, Employer's Quarterly Federal Tax Return, to report both the federal income taxes you withheld and the FICA taxes you withheld and paid during a calendar quarter. (Employers who qualify for annual reporting/payment, file Form 944.)

New and Updated Forms and Publications

Online Forms

- The following tax returns, wage reports, and payroll tax deposit coupons are no longer available in paper: 1. Quarterly Contribution Return and Report of Wages (DE 9) 2. Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) 3. Employer of Household Worker(s) Annual Payroll Tax Return (DE 3HW) 4. Employer of Household Worker(s) Qu...

Forms

- DE 1 – Commercial Employer Account Registration and Update Form Note: Most employers should use this form.

- DE 1AG – Agricultural Employer Account Registration and Update Form

- DE 1GS – Governmental Organizations, Public Schools, and Indian Tribes Registration and Update Form

- DE 1HW – Employers of Household Workers Registration and Update Form

Publications

- DE 3DI-I – Disability Insurance Elective Coverage (DIEC) Rate Notice and Instructions for Computing Annual Premiums

- DE 3F – Instructions for Reporting Wages and Contributions for Employers Who Have Elected Unemployment and State Disability Insurance Coverage Under Section 708(a) of the California Unemployment In...

- DE 3DI-I – Disability Insurance Elective Coverage (DIEC) Rate Notice and Instructions for Computing Annual Premiums

- DE 3F – Instructions for Reporting Wages and Contributions for Employers Who Have Elected Unemployment and State Disability Insurance Coverage Under Section 708(a) of the California Unemployment In...

- DE 40 – Tax Audit Guidelines

- DE 44 – California Employer's Guide California Withholding Schedules Visit Employer’s Guide – Historicalfor past guides.

Information Sheets