A consideration clause is a stipulation in an insurance policy that outlines the cost of coverage and when payments should be made. Basics of a Consideration Clause Consideration clauses are most commonly used in insurance policies and define the amount due for coverage. These clauses also usually define a payment schedule.

What does consideration clause include?

While these requirements vary by state, generally these requirements include:

- An intent by both parties to enter into the agreement

- The subject matter must be legal

- One party must make an offer

- The other party must accept an offer

What is included in the insuring clause?

- The name of the person that may file the claim

- Details about the circumstance that may result in the claim

- An act or omission that the policyholder believes will result in legal liability

What is consideration in insurance?

consideration. Something with monetary value, voluntarily exchanged for an act, benefit, forbearance, interest, promise, right, or goods or services. In insurance, the insurance company's offer to make a loss good is a consideration in exchange for payment of premium.

What is the average clause in an insurance policy?

Average Clause. Hidden In the wordings of all Insurance Policies which cover material damage (Buildings, Contents & Tenant’s Improvements) is a clause which Insurers refer to as the average clause. Put simply this little known clause has the ability to restrict settlements of claims when you have provided (deliberately or not) an inadequate ...

What is considered given by an insurer in the consideration clause?

Investor-Originated Life Insurance. What is the consideration given by an insurer in the Consideration clause of a life policy? Promise to pay a death benefit.

What consideration is given by the insurer in an insurance contract?

Consideration. This is the premium or the future premiums that you have to pay to your insurance company. For insurers, consideration also refers to the money paid out to you should you file an insurance claim. This means that each party to the contract must provide some value to the relationship.

What is consideration from the insured?

A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid.Aug 26, 2016

Which of the following is an example of insured consideration?

An example of the insured's consideration is a paid premium.

What type of consideration does the proposed insured?

In an insurance policy contract, the insured's consideration is his premium payment, and the insurer's consideration is the promise of indemnity. Intent is not a requirement for a valid contract.

What is the insuring clause in an insurance policy?

In insurance: Liability insurance. One is the insuring clause, in which the insurer agrees to pay on behalf of the insured all sums that the insured shall become legally obligated to pay as damages because of bodily injury, sickness or disease, wrongful death, or injury to another person's property.

What is consideration and types of consideration?

There are six kinds of consideration in contract law. Executory (Future) Consideration. Executed (Present) Consideration. Past Consideration. Conditional Consideration.Dec 8, 2020

What is an example of consideration?

The definition of consideration is careful thought or attention or compassionate regard for someone or something. An example of consideration is someone deciding between two options for dinner. An example of consideration is someone bringing a friend dinner who just had a baby.

What is consideration clause?

Updated November 4, 2020: A consideration clause is a stipulation in an insurance policy that outlines the cost of coverage and when payments should be made.

Why do we use deferred consideration?

Deferred consideration is used to protect the interests of the buyer and to make sure the value they are receiving is what they were promised. When the person selling the company fails to uphold their promises, the buyer may want to recover their losses.

Why are penalties so expensive?

The reason these penalties are so expensive is to help to prevent a breach of contract.

Do penalties have to be sums of money?

However, penalties do not always have to be sums of money. For instance, some penalties may involve the transfer of assets to the injured party. They can also prevent the party that breached the contract from receiving an amount of money that they would have been owed had the contract not been breached.

Can you defer consideration?

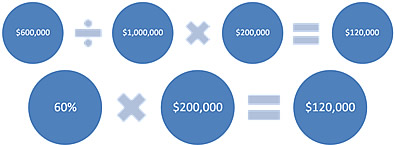

For example, when a company is acquired, the person buying the company might want to spread out their payments instead of making one large payment. When this occurs , consideration will often be based on some sort of performance goal , such as the company reaching a certain level of sales or an important employee staying with the company .

Can a clause be a penalty?

Thanks to the decision in one court case, clauses will not be penalties if there is proof that the clause is commercially justifiable. If you need help understanding the consideration clause, you can post your legal needs on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site.

What is consideration clause?

Consideration clauses are used to define the total amount due for coverage. They are the terms and conditions that determine how payment is made in exchange for mutual consideration. Some consideration clauses include penalty clauses if one party fails to meet their requirements.

What is considered clause in real estate?

Essentially, they set the terms around how one party pays another party for something valuable, like a house or insurance policy.

What is consideration in insurance?

A consideration is an exchange of money for the guarantee of an act preformed or another benefit provided. In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid. If a person wants to continue to have the option of this consideration, then they can buy a policy and pay premiums.

What is it called when you pay premiums?

When done in the insurance world, it is called paying premiums. Doing so allows a person to receive fair consideration from the insurance company.

What is an insurance contract?

Insurance contracts are aleatory in that the amount the insured will pay in premiums is unequal to the amount that the insurer will pay in the event of a loss. Insurance policies are offered on a "take it or leave it" basis, which make them. Contracts of Adhesion.

What is it called when an insurance application is true to the best of the applicant's knowledge?

Statements made on an insurance application that are believed to be true to the best of the applicant's knowledge are called. representations . Statements made on an insurance application that are believed to be true to the best of the applicant's knowledge are called representations .

What is the part of a life insurance policy that is guaranteed to be true?

The part of a life insurance policy guaranteed to be true is called a (n) warranty. Warranties are statements that are considered literally true. A warranty that is not literally true in every detail, even if made in error, is sufficient to render a policy void. E and F are business partners.

Why are life insurance policies considered unilateral contracts?

Life and health insurance policies are considered unilateral contracts because one party makes a promise, and the other party can only accept by performa. Q purchases a $500,000 life insurance policy and pays $900 in premiums over the first six months. Q dies suddenly and the beneficiary is paid $500,000.