Is vpdi the same as SDI?

Jun 18, 2020 · What is SDI VPDI? VDI is Voluntary Disability Insurance and VPDI is Voluntary Plan Disability Insurance. Click to see full answer. Simply so, what does VPDI mean? Voluntary Plan for Disability Insurance Additionally, how do I get a refund …

What is SDI and vdpi withholding?

May 05, 2020 · what is California voluntary disability tax? State Disability Insurance (SDI) Tax SDI is a deduction from employees' wages. Employers withhold a percentage for SDI on the first $122,909 in wages paid to each employee in a calendar year. The 2020 SDI tax rate is 1.00 percent (. 010) of SDI taxable wages per employee, per year.

What is a vpdi expense?

California wages are subject to SDI (State Disability Insurance) or VDPI (Voluntary Plan Disability Insurance) withholding up to a specific annual amount. If the employer withholds more than this amount, the taxpayer must contact the employer for reimbursement from the employer for the excess. SDI/VP withholding is reported via Form W-2.

How to enter voluntary plan for disability insurance (vpdi)?

California wages are subject to SDI (State Disability Insurance) or VDPI (Voluntary Plan Disability Insurance) withholding up to a specific annual amount. If the employer withholds more than this amount, the taxpayer must contact the employer for reimbursement from the employer for the excess. SDI/VP withholding is reported via Form W-2.

What is VPDI on my W2?

VPDI stands for Voluntary Plan for Disability Insurance, and this can be entered by entering the Description and Amount from your Form W-2 and then selecting the category Wages for SDI, VPDI, TDI, UI, etc.Jun 4, 2019

Where are SDI and VPDI reported on W2?

W2 box 14 CA VPDI tax.Jun 4, 2019

What is VPDI on W2 Box 14?

Select VPDI for your W-2 box 14 VDI. VDI is Voluntary Disability Insurance and VPDI is Voluntary Plan Disability Insurance.Jun 6, 2019

What is the California VPDI tax?

The State announced that effective January 1, 2019, the State Disability Insurance Plan tax rate will remain 1.0% and the taxable wage base will increase to $118,371 of an employee's annual earnings. The maximum annual deduction will increase to $1,183.71.Jan 1, 2019

Is VPDI same as SDI?

Despite its name, VPDI is not actually an optional expense. Employees are required to pay into either the state disability insurance plan (SDI) or a plan that the employer provides through a self-insured private disability plan. That provide disability plan is the VPDI expense.

Is CA VDI the same as VPDI?

CA VDI is the same as CA VPDI.May 31, 2019

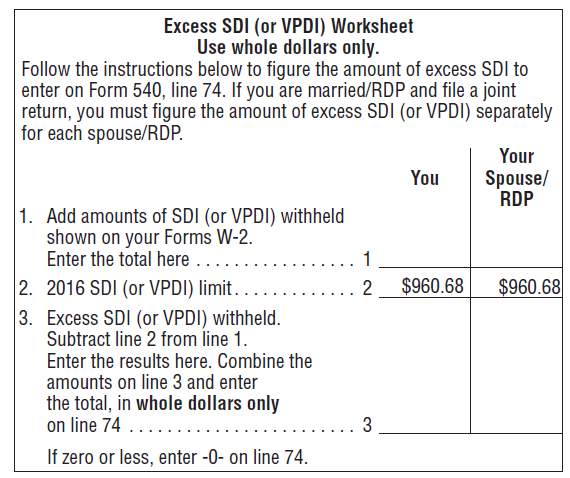

What is excess VPDI?

If you paid more than the maximum State Disability Insurance (SDI) or Voluntary Plan Disability Insurance (VPDI) tax, you may be eligible to claim a credit for excess SDI.Feb 3, 2022

Can you deduct CA SDI tax?

Since it is levied as a percentage of your wage income, the California SDI tax is deductible on your federal return. The amount you paid in SDI would be included in line 5, as long as you are deducting income and not sales taxes.

Is CA VDI tax deductible?

CA VDI plan contributions may not be tax deductible on your Federal tax return. However, here are the reasons employees should still consider joining the CA VDI Plan: If they are not a member of the CA VDI Plan, he/she will receive benefits ONLY from CA SDI if they have a disability.

Where is SDI reported on W-2?

Generally speaking, your SDI contribution will be recorded in Box 14 of your W-2, labeled "Other." In the event that your employer has opted to contribute a portion of your SDI duties themselves, this contribution will appear in Box 16 on your W-2.Dec 27, 2018

What is Vdica?

Other. The amount entered here is the amount withheld for CA SDI (State Disability) OR VDICA (Voluntary Disability Insurance – California) only. There is an annual limit on this amount.

How long is a refund check good for?

Refund checks are good for a year from the issue date. If it’s been more than a year, you must send us a request to receive a new check. Choose the correct way to request a new refund check. Date on the refund.

Why do I get a refund?

Common reasons include changes to a tax return or a payment of past due federal or state debts.