Risk Bearing Theory. The risk bearing theory of profit is established by Hawley. It suggests that entrepreneur's profit depends on his risk taking behavior.

What is the meaning of risk bearing?

Risk bearing refers to having or sharing responsibility for accepting the losses if projects go wrong. Most economic activities are capable of resulting in losses under some circumstances, however good the expected results may be. Somebody has to bear the risk of meeting any losses.

What is the risk bearing theory of profit?

The risk bearing theory of profit is established by Hawley. It suggests that entrepreneur's profit depends on his risk taking behavior. That is, how much risk the entrepreneur will bear during the production determines the amount of profit enjoyed by him. Click to see full answer.

What are the criticisms of the risk-bearing theory?

The risk-bearing has been criticised on the following grounds: The theory establishes a direct relationship between profit and risk-taking which is not correct. A high degree of risk in an enterprise does not necessarily mean a high rate of profit. Sometimes it so happens that the entrepreneurs incur losses in more risky enterprises.

What is RBC in risk and uncertainty bearing theory?

Risk Bearing Capacity (RBC) can be used in the process of defining the firm's risk appetite and tolerance to the financial impact of risk. Considering this, what is risk and uncertainty bearing theory? The theory of uncertainty bearing theory of profit was developed by Prof. F.H.

What is risk bearing theory of Knight?

Knight regards profit as the reward for bearing non-insurable risks and uncertainties. He distinguishes between insurable and non-insurable risks. Certain risks are measurable, the probability of their occurrence can be statistically calculated. The risks of fire, theft, flood and death by accidents are insurable.

What is risk bearing concept?

Risk bearing refers to having or sharing responsibility for accepting the losses if projects go wrong. Most economic activities are capable of resulting in losses under some circumstances, however good the expected results may be. Somebody has to bear the risk of meeting any losses.

What is risk and uncertainty bearing theory?

The theory of uncertainty bearing theory of profit was developed by Prof. F.H. Knight in 1921. According to him, profits are the reward for uncertainty bearing rather than risk taking. He has divided the risk into insurable risks and non-insurable risks.

What is risk bearing ability?

Risk-bearing capacity is the capacity an investor has to reach their financial goal. It will depend on your age, your financial health, as well as your position in the family.

What is the importance of risk bearing?

Risk Bearing is another element – of entrepreneurship. Every entrepreneur has to bear the risk of the business. He should have the courage to take the risk rather than avoid it. A new business always involve risk because one invests money to get profits in the future.

What is risk bearing function of entrepreneur?

Risk-Bearing Function: It is the most important and specific function of an entrepreneur. Every business involves risk. There is no other factor of production except the entrepreneur, who bears the risk of the business. The risk is caused by uncertainties attached to the production, investment, and profits.

Who propounded risk bearing theory?

economist F.B.HawleyRisk bearing theory of profit was propounded by the American economist F.B. Hawley in .

Who introduced the risk bearing theory of profit?

HawleyThe risk bearing theory of profit is established by Hawley. It suggests that entrepreneur's profit depends on his risk taking behavior. That is, how much risk the entrepreneur will bear during the production determines the amount of profit enjoyed by him.

What are the 3 types of risks?

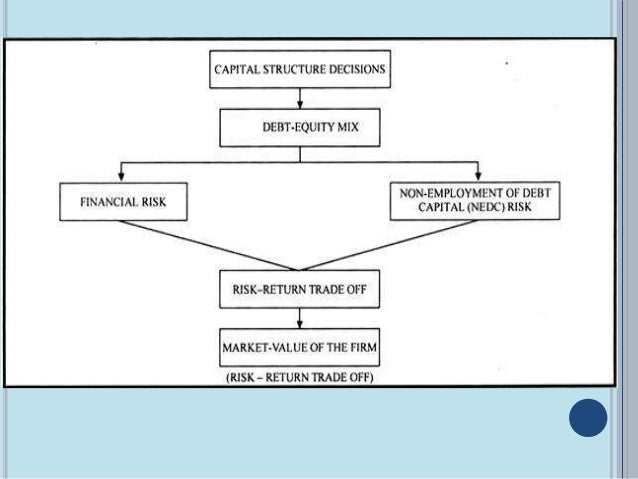

Risk and Types of Risks: Any action or activity that leads to loss of any type can be termed as risk. There are different types of risks that a firm might face and needs to overcome. Widely, risks can be classified into three types: Business Risk, Non-Business Risk, and Financial Risk.

What is risk bearing capital?

Risk-bearing capital (RBC) is a balance sheet item that corresponds to the “Technical provisions” typically used in the insurance industry. In accordance with SERV-V, provisions for losses not yet incurred must be shown as equity items.

What is risk bearing in warehousing?

Risk bearing When the goods are stored in warehouses they are exposed to many risks in the form of theft, deterioration, exploration, fire, etc. Warehouses are constructed in such a way as to minimize these risks. Contract of bailment operates when the goods are stored in wave-houses.

What is an example of risk shifting?

Another example of risk shifting is an office building that hires a janitorial service to keep the premises clean and safe. These janitorial services may be asked to sign a contract that transfers some of the risks involved.

How does degree of risk vary in different industries?

The degree of risk varies in different industries and within the same industry, also different entrepreneurs undertake different degrees of risks according to their ability and inclination and they receive different rates of profit.

Is higher risk greater or less?

Higher the risk, greater is the possibility of profit. But it should be remembered that the rate of profit must be more than the normal return on capital, for if it is equal to or less than the normal return on capital, no entrepreneur would be prepared to undertake the risk.

Who is the risk bearer for economic activities?

The first risk-bearer for any project is the entrepreneur in a private firm, or the equity shareholders in a company.

What is risk and uncertainty?

The two terms ‘risk’ and ‘uncertainty’ are often used interchangeably to refer to a situation of potential loss of the firm’s investment resulting from the fact that it is operating in an uncertain business environment.

Why are management decisions taken under uncertain conditions?

Unfortunately, most management decisions are taken under uncertain conditions, since they are rarely repetitive in nature and there is little past data available to act as a guide to the future. Such market uncertainty as to the likelihood and extent of losses which might arise in launching a new product can only be assessed by managers through combining the limited data which is available with their own judgment and experience.

Why is perfect knowledge open to criticism?

This cognitive assumption of perfect knowledge is open to criticism for various reasons. The entrepreneur has to take risks. The entrepreneur must risk his capital in carrying out production in anticipation of a successful outcome — he cannot guarantee success , neither can he insure against the risk s of failure .

Who is at risk of a business collapse?

If the losses are sufficiently large, other people connected with a firm are also at risk, including creditors, the tax authorities, customers who have paid deposits on goods to be delivered later, and workers left unpaid when a business collapses.

Is a firm's ability to survive and prosper insurable?

Certain risks are insurable (for example, the risks of fire or theft of the firm’s stock), but not the firm’s ability to survive and prosper. The firm itself must assume the risks of the market place. If it cannot sell its products it will go bankrupt; if it is successful it will make profits.