What is property tax folio number BC? The first 3-digits of the folio represent the assessment jurisdiction followed by 8 digits commonly referred to as the assessment roll number. Parcel Identifier Number (PID) is often required to access land title and survey records.

What is a folio number on a property tax bill?

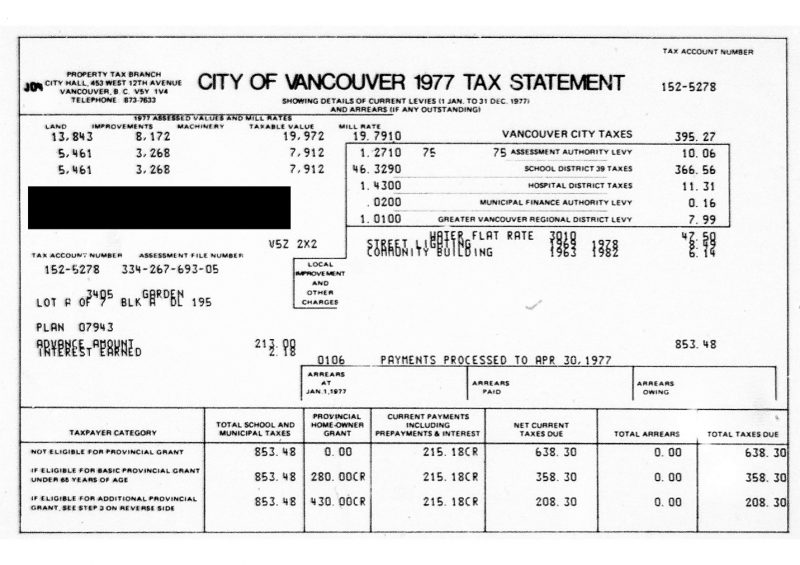

The first 3-digits of the folio number is the assessment jurisdiction. Roll number A number assigned to the property for assessment administrative purposes. Folio number The number used to identify your property. Account number The code that identifies you as a property taxpayer. Letter ID The number that identifies your tax notice.

How do I enter a BC Assessment folio number?

You would enter both of these numbers in the Folio Number field with a space between them, like this: 754 003513.000. The BC Assessment Folio Number takes the form nnnnnn.nnn (six digits, one decimal, three digits).

How do I find my property's jurisdiction number and assessment folio number?

You need to know the property's Jurisdiction Number and BC Assessment Folio Number, both of which can be found in correspondence from the Surveyor of Taxes (e.g., Tax Notice). For example, 754 is the three-digit Jurisdiction Number for Bulkley Valley, and 003513.000 is a unique BC Assessment Folio Number.

Where do I Find my folio number and access code?

Where do I find my Folio Number and Access Code? Your Folio Number and Access Code can be located on your property tax notice. For information on where to locate your utility account information, click here.

Where do I find my property tax number?

Look on your last tax bill, the deed to your property, a title report (which may be in your closing documents) or perhaps even on the appraisal report of your property to locate the property ID number.Nov 17, 2018

What is a PID number BC?

What is a folio ID?

How do I find out my property taxes in BC?

- Log in to your account.

- Set up an online account. You will need your access code. It can be found on your tax notice.

- Get your property tax account balance. No login or registration required.

How do I find my BC folio number?

What does a PID number look like?

How do you use a folio number?

Is folio number same as certificate number?

How do you use folio?

What is property tax in BC?

What are the taxes in BC?

British Columbia is one of the provinces in Canada that charges separate 7% Provincial Sales Tax (PST) and 5% federal Goods and Services Tax (GST). Most goods and services are charged both taxes, with a number of exceptions.

Do tenants pay property taxes?

What is the first 3 digits of a folio number?

The first 3-digits of the folio number is the assessment jurisdiction. A number assigned to the property for assessment administrative purposes. The number used to identify your property. The code that identifies you as a property taxpayer. The number that identifies your tax notice.

How many classes of property are there in BC?

The type or use of your property determined by BC Assessment. There are nine different classes that your property can be categorized into. Each property class has its own tax rate. The assessed value, determined by BC Assessment, of your land and any improvements (such as buildings) on the land that are taxable.

What is parcel tax?

Parcel tax. A tax amount that spreads the cost of a service equally between taxpayers in a service area regardless of assessed value. Residual home owner grant. The remaining home owner grant amount available to be applied to other taxes after it has been applied to the school tax. Total 2021 property taxes.

What is a provincial rural tax?

Provincial rural tax. The provincial rural tax helps fund provincial services in rural areas including maintenance and snow removal for public secondary roads (does not include highways or private roads). Police tax.

Do all property owners pay police tax?

All property owners in a rural area pay police tax. The tax rate for police tax is the same within each regional district electoral area. Specific local services are listed on your property tax notice. You are required to pay for local services when your property is within a local service area's boundaries.

How to determine a property's tax value?

To determine the tax value, your property’s taxable value is multiplied by a rate set by the taxing authorities.

What is a property tax pin number?

Property Tax ID/Folio/Pin Numbers are U.S. identification numbers for homes assigned to a certain plot of property, each of which possesses a property tax value. One of the major responsibilities of owning a home is paying property taxes.

How is business property assessed?

Business property is typically assessed using this method, most notably investment properties leased to tenants such as apartment complexes, malls , and office buildings. The property’s value is determined by measuring the property’s annual income after expenses and comparing that to the rates of return for comparable investments.

Why is property assessment important?

Why is this important? Because the amount of property tax paid should form a proportional relationship to the value of the property owned. Governed by states Law, this is known as “ad valorem” tax.

How to reduce number of folios in multiple results?

To reduce the number of folios in a Multiple Results screen, you can use a set of filters. Filters can make it easier to find the Tax Folio you want. (Please note that a successful filter can take some planning and tweaking.)

What is a rural property tax search?

The Rural Property Tax Search lets you search for property folios. These are the property tax records for all rural properties in British Columbia. Rural property tax records are maintained by the Surveyor of Taxes, and are constantly updated.