Full Answer

What is EZpay?

EZPay is our convenient automated payment plan. Through EZPay, your trip payment installments come directly out of the bank account or debit card you authorize us to use.

Can I use EZ-Pay in my ERP gantry?

Right now, only a handful of carparks accept EZ-Pay (click here for the most updated list of carparks accepting EZ-Pay), but it is 100% ready for use at all ERP gantries. For EZ-Pay enabled carparks, EZ-Pay will take precedence over other forms of payment, like a complimentary parking ticket.

What are the requirements to sign up for EZ-Pay?

To sign up, you will need to provide your Name, NRIC/FIN number, Mobile Number and Email Address. You will also have to enter your vehicle number and the NRIC/FIN number of its owner. Do note that only non-company registered car are eligible for EZ-Pay currently.

Do I need a CashCard to use EZ-Pay?

Since these charges are debited directly to your debit or credit card, that means you don’t need to have a CashCard in your in-vehicle Unit (IU). Right now, only a handful of carparks accept EZ-Pay (click here for the most updated list of carparks accepting EZ-Pay), but it is 100% ready for use at all ERP gantries.

Does PG&E have auto pay?

To set up automatic payments (also known as recurring payments) follow these steps: Sign in to Your Account. Scroll to Payment Options and select Set Up Recurring Payment. Add a Payment Account, using either your bank checking or savings account or credit/debit card.

How do I set up auto pay for PG&E?

To enroll, follow these steps:Sign in to Your Account.Scroll to Payment Options and select Set Up Recurring Payment.Add a Payment Account, using either your bank checking or savings account or credit/debit card. ... Select Pay Bill Upon Receipt OR Pay by Due Date.Select Pay up to a maximum of OR Pay full amount due.More items...

Why is PGE bill so high?

Utility company says higher bills are because of rising natural gas costs, demand.

How do I cancel my PG&E Auto pay?

To stop your Auto Pay, contact our Customer Service Department at 1-800-743-5000 and a Customer Service Expert will be happy to stop your Auto Pay program. If you have enjoyed the convenience of the Auto Pay program, PG&E recommends enrolling in our Recurring Payments program online.

What happens if you pay PG&E late?

If the bill continues to be unpaid, a 24-hour notice of nonpayment will be issued to the Gas ESP. After this 24-hour period, PG&E may terminate the Gas ESP Agreement without any further notice.

What payment methods does PG&E accept?

You have the following payment options:Visa, MasterCard, Discover or Amercian Express credit or debit card. Card payments require a $1 or $1.35 convenience fee.*Bank account. Payments from a checking or savings account do not require any service fees.

What uses most house electricity?

Here's what uses the most energy in your home:Cooling and heating: 47% of energy use.Water heater: 14% of energy use.Washer and dryer: 13% of energy use.Lighting: 12% of energy use.Refrigerator: 4% of energy use.Electric oven: 3-4% of energy use.TV, DVD, cable box: 3% of energy use.Dishwasher: 2% of energy use.More items...•

How much will PG&E rates go up in 2022?

CARE customers in the low-income program can expect to see increases of 1.1% in their electricity bills and 1.5% in their gas bills, PG&E estimated. PG&E monthly bills have jumped twice in 2022 already, including an increase that took effect in January and a second upswing in costs that took effect in March.

How much is the average PG&E bill?

The average residential bill of $152 per month now will spike to $166 per month starting in March. While Paulo notes this is another pass-through cost, that might be little comfort to customers still coming to terms with the significant gas and electric rate increase that just went into effect in January.

Can you negotiate with PGE?

Can I negotiate my PG&E bill? Yes, you can negotiate your PG&E bill. If you come from a low-income household, you are much more likely to have a successful negotiation. The sooner you get yourself in the mindset that anything is negotiable, the better for your future well-being.

How do I stop a scheduled payment?

Here's how you can do a stop payment order:To stop the next scheduled payment, give your bank the stop payment order at least three business days before the payment is scheduled. ... To stop future payments, you might have to send your bank the stop payment order in writing.More items...•

Is PG&E shutting off power for non payment?

Financial assistance and support for customers. ALERT: The moratorium on disconnections for non-payment put in place by the California Public Utilities Commission (CPUC) in March 2020 has formally ended. We remain committed to supporting customers.

How to sign up for EZ Pay?

There are two ways you can sign up with EZ-Pay. You could do so through the EZ-Link mobile application or the EZ-Pay website. To sign up, you will need to provide your Name, NRIC/FIN number, Mobile Number and Email Address. You will also have to enter your vehicle number and the NRIC/FIN number of its owner.

Do you need a cash card for ERP?

Completely free-to-use, it allows drivers to use their bank cards to pay for Electronic Road Pricing (ERP) and carpark (EPS) charges. Since these charges are debited directly to your debit or credit card, that means you don’t need to have a CashCard in your in-vehicle Unit (IU).

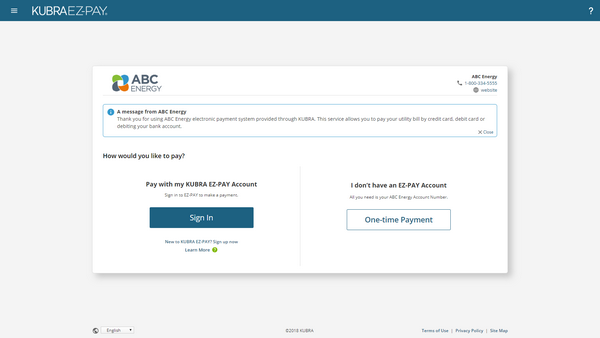

What is KUBRA EZ-PAY?

Cloud-based payment processing solution that helps businesses process and track check, credit card and debit card payments.

Deployment & Support

Here are some products we think might be a good fit based on what people like you viewed. Learn more about pricing

KUBRA EZ-PAY Alternatives

Best For: AvidXchange has customers in nearly every B2B industry with special focus in Real Estate, HOA, Construction, Banking, Hospitality and Healthcare and Social Services.

Compare with Similar Products

B2B payables management solution that automates the entire process related to paying suppliers and partners....

Allow customers to experience better payments with the option to pay bills how and where they want

Building customer loyalty can be as easy as providing flexible, on-demand, payment options that support a variety of payment types and a multitude of payment channels. Whether your customers prefer to pay online, over the phone, or by SMS, check, credit card, debit card, or cash, they rely on you to make it happen.

Comprehensive Payment Application

The KUBRA EZ-PAY on-demand payment application is an all-inclusive solution that supports both enrolled and non-enrolled customer payments.

Real-Time Payment Processing

KUBRA EZ-PAY provides real-time account and authorization tools, and direct feeds into multiple credit card processors, debit ATM networks, and ACH originators. To make account management easier, you gain access to a consolidated dashboard that supports payer reconciliation, returns management, reporting, and payment administration.

Advanced Features

Your customers will be thrilled to have access to a series of features that are designed to simplify and shorten the time it takes to make a payment.

Next-Generation Payment Security

Providing utilities, insurance, and government entities with the highest level of security when accepting payments is a top priority for KUBRA. Data protection is so important that not only is KUBRA PCI level 1 compliant, we’ve joined the PCI Security Standards Council as a Participating Organization.

Open an E-ZPass Account

There are four convenient ways to start saving. Open an account today to become a Road Pro.

Manage Your Account

Managing your E-ZPass account online is convenient, making travel even simpler.

Unpaid Tolls

Maintaining unpaid tolls could risk suspension of a vehicle registration. Act 165 of 2016 allows the suspension of PA vehicle registration with six or more unpaid PA Turnpike tolls or toll invoices totaling $500 or more.

Lost or Stolen Transponders

It is very important to immediately report lost or stolen E‑ZPass transponders.