What financial statement is merchandise inventory on?

- Net sales = Sales revenue – Sales discounts – Sales returns and allowances.

- Gross margin = Net sales – Cost of goods sold.

- Total Operating Expenses = Selling expenses + Administrative expenses.

- Income from operations = Gross margin – Operating (selling and administrative) expenses.

- Total other revenues (expenses) = Other Revenues – Other Expenses

What items are included in merchandise inventory?

Stationery Items

- Journals. Journals are stationery items that are still in frequent use, even in the current technological age.

- Greeting Cards. Greeting cards should be a definite inclusion on your stationery product list. ...

- Invitations. ...

- Calendars. ...

- Other Stationery Print on Demand Items to Offer: Stationery products will be hot sellers for you. ...

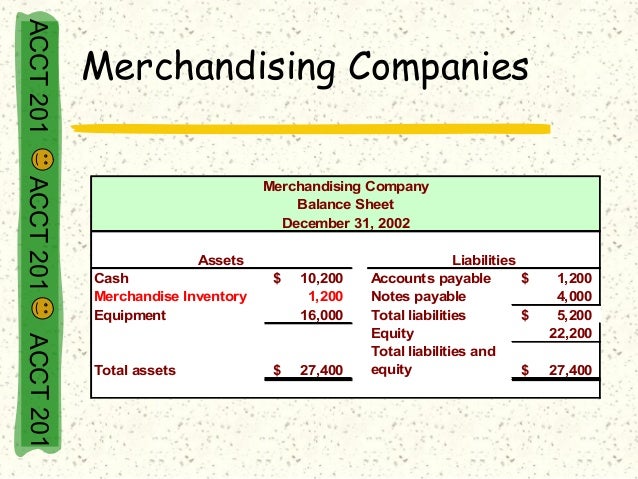

How to evaluate inventory on balance sheet?

What are the methods used to value inventory?

- LIFO (last in, First Out)

- FIFO (First in First Out)

- Weighted average

Does inventory go on a balance sheet?

Inventory is an asset and its ending balance is reported in the current asset section of a company's balance sheet.Inventory is not an income statement account. However, the change in inventory is a component in the calculation of the Cost of Goods Sold, which is often presented on a company's income statement.

What classification is merchandise inventory?

current assetMerchandise inventory (also called Inventory) is a current asset with a normal debit balance meaning a debit will increase and a credit will decrease. To determine the cost of goods sold in any accounting period, management needs inventory information.

Is merchandise inventory a current asset?

A current asset is any asset that will provide an economic benefit for or within one year. Inventory production is typically closely correlated with demand, so inventory usually sells within one year of being produced. Therefore, inventory/merchandise is a current asset.Jan 21, 2022

How is inventory classified in the balance sheet?

As noted above, inventory is classified as a current asset on a company's balance sheet, and it serves as a buffer between manufacturing and order fulfillment. When an inventory item is sold, its carrying cost transfers to the cost of goods sold (COGS) category on the income statement.

What account is merchandise inventory?

current assetBecause merchandise inventory includes physical goods, a retailer includes this as a current asset. When a business accountant organizes the balance sheet for the accounting period, they record any inventory left over as merchandise on hand, listing it as an asset and recording it as a debit to accounts payable.Nov 16, 2021

How do you record merchandise inventory?

For a merchandising company, Merchandise Inventory falls under the prepaid expense category since we purchase inventory in advance of using (selling) it. We record it as an asset (merchandise inventory) and record an expense (cost of goods sold) as it is used.

How is merchandise inventory classified on the balance sheet and what is its normal balance?

Merchandise inventory is the account on a balance sheet that reflects the total amount paid for products that are yet to be sold. As a current asset, merchandise inventory is basically a holding account for inventory that's waiting to be sold. It has a normal debit balance, so debit increases and credit decreases.

What are the categories of inventory?

There are four main types of inventory: raw materials/components, WIP, finished goods and MRO.Dec 21, 2021

How do you define inventory and also explain the types of inventory?

Inventory refers to all the items, goods, merchandise, and materials held by a business for selling in the market to earn a profit. Example: If a newspaper vendor uses a vehicle to deliver newspapers to the customers, only the newspaper will be considered inventory.

What is an example of merchandise inventory?

Furniture manufacturers purchase wood, plastic, glue, nails and other required raw materials and convert them into finished products like a table, chairs, shelves, desks, etc. and these are finished goods inventory. To be included in merchandise inventory finished goods must be ready for sale.

Is merchandise the same as inventory?

As nouns the difference between merchandise and inventory is that merchandise is (uncountable) commodities offered for sale while inventory is (operations) the stock of an item on hand at a particular location or business.

What does the term merchandise inventory mean?

Definition: Merchandise inventory is goods that a company purchases and plans to resell to customers at a higher price. Typically, retailers and wholesalers are the only businesses with merchandise inventory. Manufacturers produce inventory, but they don't purchase it and resell it.

How is merchandise inventory classified on a balance sheet?

Merchandising inventory is considered a “current asset” in the balance sheet that shows the current value of sellable inventory.

Is merchandise inventory a long-term asset?

No, merchandise inventory is a current asset that is expected to be sold. A long-term asset is property a business owns (or leases that is used for...

Is merchandise inventory a debit or credit?

Any unsold merchandise inventory in a particular accounting period is recorded as a debit to accounts payable. And new inventory purchases will be...

What is merchandise inventory?

Merchandise inventory refers to the value of goods in stock, whether it’s finished goods or raw materials that are ready to sell, that are intended to be resold to customers. Think of it as a holding account for inventory that is expected to be sold soon.

Examples of merchandise inventory

Let’s say a furniture store buys desks that will be sold directly to the end customer. The store also buy computers for employees to use regularly. Here, the desks can be categorized as merchandise inventory, but not the computers.

Why merchandise inventory is important for accounting

Since merchandise inventory is almost always an online brand’s biggest assets, managing and tracking inventory accurately is crucial since it directly impacts a brand’s financial well-being.

Accounting for merchandise inventory

Tracking inventory and its value can be done by using several different inventory valuation methods. Each method has its own set of pros and cons, and it really comes down to what method makes sense for your business.

Calculating the value of merchandise inventory

To better illustrate how merchandise inventory value and COGS are calculated, let’s take the example of a footwear merchandiser who:

How ShipBob makes it easy to track & account for your merchandise inventory

Growing an online business requires your attention to focus on revenue-driving initiatives, making it hard to oversee logistics operations .

What is inventories in business?

Inventories are the assets that are held for trading in the due course of business. These inventories are known to be the finished goods, the assets being held under the manufacturing process known as the work in progress, or material and supplies consumed during the production process.

What is the reporting figure of inventory?

The reporting figure of the inventory is dependent on the quantity owed by the business and the valuation. The quantity needs to be verified at the end of the period as physical verification is made to ensure the existence and completion of the stock.

What does understated inventory mean?

In addition, the understated inventory indicates that there is significantly less inventory that you are holding rather than the actual stock amount.

What is inventory adjustment?

Therefore, inventory adjustment is a technique that is required to correct and rectify the overall differences so that you might avoid the understatement and overstatement of your income statement.

What happens when the cost of goods sold is overstated?

If the cost of goods sold is overstated, the company’s inventory and net income are understated. Furthermore, when the cost of goods sold is understated, the inventory and the net income of the company are overstated.

Is inventory a hazardous item?

The inventory is considered to be a hazardous item in the balance sheet. The risk even increases if the business operates in the manufacturing sector. The reason is that business operating in manufacturing segment is expected to have a greater quantity of raw material, work in process, and the finished goods.

What is classified balance sheet?

What is a Classified Balance Sheet? A classified balance sheet is a financial statement that reports asset, liability, and equity accounts in meaningful subcategories for readers’ ease of use.

What is equity section of balance sheet?

The equity section of a classified balance sheet is very simple and similar to a non-classified report. Common stock, additional paid-in capital, treasury stock, and retained earnings are listed for corporations. Partnerships list member capital accounts, contributions, distributions, and earnings for the period.

What is the asset section?

Assets Section. The assets section is typically broken down into three main subcategories: current, fixed assets , and other. Current assets include resources that are consumed or used in the current period. Cash and accounts receivable the most common current assets. Also, merchandise inventory is classified on the balance sheet as a current asset.

What is considered current liabilities?

Current liabilities include all debts that will become due in the current period. In other words, this is the amount of principle that is required to be repaid in the next 12 months. The most common current liabilities are accounts payable and accrued expenses.

Is inventory a current asset?

Also, merchandise inventory is classified on the balance sheet as a current asset. Fixed assets consist of property, plant, and equipment that are long-term in nature and are used to produce goods or services for the company.