Cash Inflow Examples

- Customer payments;

- Bank loan receipts;

- Bank interest;

- Sale of fixed assets;

- Supplier refunds;

- Directors loans to the business;

- Grants & Funding proceeds;

How to calculate initial cash flows?

Key Takeaways

- Initial cash flow is the total capital available to a new business project under development.

- The figure is determined by deducting all upfront costs from the total amount of the investment. ...

- Due to the high cost of startups, initial cash flow is typically a negative number.

What is an example of a cash flow statement?

Statement of Cash Flows Direct Method Example Assume that accounts payable was only used to acquire inventory. Use the preceding information to compute the following: 1. Cash Received from Customers. Sales − ∆ AR 5,000,000 – (-40,000) = 5,040,000 2. Cash Paid to Suppliers for Inventory

What are cash flow items?

Cash Flow Definition. The term cash flow refers to cash receipts and cash payments during an accounting period, and analyzing the company’s cash provides critical information with respect to understanding business activities, reported earnings, and projecting the future cash flows at the same time.

How to understand cash flow statements?

The following is a list of the various areas of the cash flow statement and what they mean:

- Cash flow from operating activities. This section measures the cash used or provided by a company's normal operations. ...

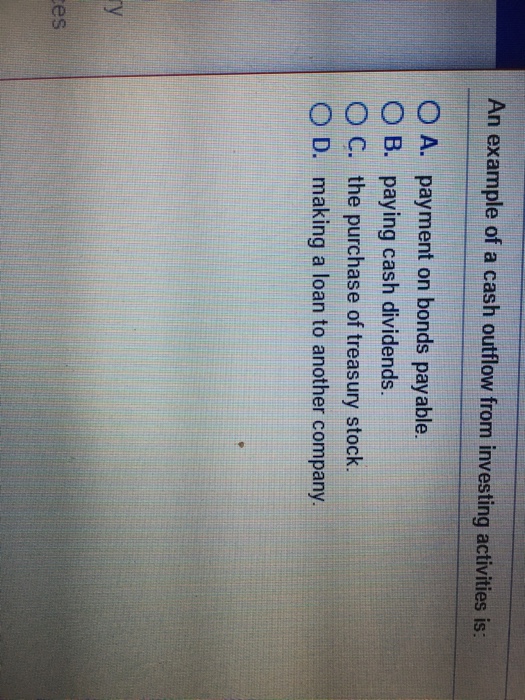

- Cash flows from investing activities. This area lists all the cash used or provided by the purchase and sale of income-producing assets. ...

- Cash flows from financing activities. ...

What are 3 examples of cash inflows?

Examples of cash inflow include customer payments, return on investments, and interest you receive on loans you have given to another entity.

What are two examples of cash inflows?

Examples of the direct method of cash flows from operating activities include:Salaries paid out to employees.Cash paid to vendors and suppliers.Cash collected from customers.Interest income and dividends received.Income tax paid and interest paid.

What is an inflow of cash?

Cash Inflow describes all of the income that is brought to your business through its activities-- any strategy to bring profits into the business. Cash Outflow includes any debts, liabilities, and operating costs-- any amount of funds leaving your business.

What is cash outflow examples?

Types of cash outflow Payments made to clear borrowing such as bank loans. Money used to purchase any fixed assets. Dividends paid out to any shareholders. Salaries and wages paid to employees. Any transport costs – such as vehicle leasing fees – related to business use.

What is cash inflow and outflow?

Cash inflow is the money going into a business which could be from sales, investments or financing. It's the opposite of cash outflow, which is the money leaving the business.

What are the 4 types of cash flows?

Types of Cash FlowCash Flows From Operations (CFO)Cash Flows From Investing (CFI)Cash Flows From Financing (CFF)Debt Service Coverage Ratio (DSCR)Free Cash Flow (FCF)Unlevered Free Cash Flow (UFCF)

How do you find cash inflows?

Subtract total fixed costs and total variable costs from the company's sales for the year to derive net cash inflow. Using the same example, if total variable costs are $200,000 and total fixed costs are $90,000, subtracting both from the company's total sales of $500,000 gives a net cash inflow of $210,000.

What's inflow mean?

/ˈɪn.fləʊ/ the action of people or things arriving somewhere: The government wanted an inflow of foreign investment. Synonym. influx.

What causes a cash inflow?

It usually comes in from payments from your customers or through selling assets. If your business is unprofitable, you won't have enough money on hand to cover all your outgoings. This might lead you to borrow more cash than you can repay or worse, close your business down.

Are receipts cash inflows?

Cash inflows (proceeds) from capital financing activities include: Receipts from proceeds of issuing or refunding bonds and other short or long-term borrowings used to acquire, construct or improve capital assets.

Is a bank loan a cash inflow?

The cash inflows received through short-term bank loans and the cash outflows used to repay the principal amount of short-term bank loans are reported in the financing activities section of the statement of cash flows.

Is rent a cash outflow?

A business that leases property should include the actual rental payments each month in the "Rent Expense" line of the cash flow statement. Rent or lease payments are a significant part of the cash outlay of the business, so this expense is typically illustrated on a line of its own.

What is cash inflow?

Cash inflow is the money going into a business. That could be from sales, investments or financing. It's the opposite of cash outflow, which is the money leaving the business. A business is considered healthy if its cash inflow is greater than its cash outflow.

What happens if a company has a lower cash inflow than cash outflow?

If a company ends up with a lower cash inflow than cash inflow it may eventually become bankrupt. By looking at a company's cash inflow compared to its outflow, you can balance up whether the risk of investing is worth any potential gains.

What is cash flow?

Cash Flow (CF) is the increase or decrease in the amount of money a business, institution, or individual has. In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period. There are many types of CF, with various important uses for running a business and performing financial analysis.

Why is cash flow important?

Cash Flow has many uses in both operating a business and in performing financial analysis. In fact, it’s one of the most important metrics in all of finance and accounting.

Why do investors care about CF?

Investors and business operators care deeply about CF because it’s the lifeblood of a company. You may be wondering, “How is CF different from what’s reported on a company’s income statement#N#Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or#N#?” Income and profit are based on accrual#N#Accrual Accounting In financial accounting, accruals refer to the recording of revenues that a company has earned but has yet to receive payment for, and the#N#accounting principles, which smooths-out expenditures#N#Expenditure An expenditure represents a payment with either cash or credit to purchase goods or services. An expenditure is recorded at a single point in#N#and matches revenues to the timing of when products/services are delivered. Due to revenue recognition policies and the matching principle, a company’s net income, or net earnings, can actually be materially different from its Cash Flow.

What is cash inflow?

Cash inflows refer to all such activities that result in the business getting cash coming into the business. Cash flow statement’s main objective is to determine the impact of cash on various types of cash inflows and outflows.

Why is cash inflow important?

Cash is essential for maintaining the day to day operations of the business. Without cash a business would not be able to pay for its operating expenses, staff salaries and the bills.

What are the three categories of cash inflows?

Cash inflows can be classified into three major categories, which are: 1.Cash inflow from operating activities: Let us look at some of the cash inflow examples that arise from the operating activities. a. Cash received from the debtors for providing goods and services. b.

What happens if a business doesn't receive cash?

2. A business contract won’t be complete if businesses do not receive regular cash inflow. It will result in delay and rejection of the contract.

What is cash flow and why does business cash flow matter?

Cash flow is the net amount that flows into your business and out of your business during a period. This period is usually a month, quarter, or year. Cash flows occur from three major sources; operating activities, financing activities, and investing activities.

What is cash inflow?

Cash inflow is the amount of cash coming into your business. In the case where the cash inflow is greater than cash outflow, the cash flow is positive. Cash inflow includes gains you receive from an investment you made. It includes the cash your customers pay immediately for the products or services you sell.

What is cash outflow?

Cash outflow is when cash is moving out of your business. In the case of operations, cash outflow occurs when you are paying salaries to your employees and when you pay for rent. Cash outflow includes how much you spent on fixed assets as well as the interest payments your business is required to pay for a loan you took.

Why maintain positive cash flow in your business?

Businesses must maintain a positive cash flow in the business because you should have enough cash to run and operate your business. A positive cash flow is when cash inflow is higher than cash outflow. You can invest in your business when you have a positive cash flow.

What is a financial report?

Financial reports and financial statements are often thought to be the same but they aren’t. Financial statements include the statement of cash flows, income statement, and balance sheet. Financial statements fall under financial reports.

How can you enhance your business cash flow?

You can improve your business cash flow in numerous ways. You can offer incentives to customers so they pay instantly as this can improve your business cash flow. For example, you can offer discounts on future purchases if they continuously pay on time. You want to take a good look at your inventory.

How to calculate cash flow from operations?

There are two ways to calculate cash flow from operations – 1) Direct method and 2) Indirect method. The indirect method is used in most of the cases. Here we will look at only the indirect method for computing cash flow from Operations.

What are the parts of cash flow analysis?

Cash Flow Analysis is divided into three parts – Cash flow from Operations, Cash flow from Investments, and Cash flow from financing. We discuss each of these one by one.

What is non cash expense?

Expenses Non-cash expenses are those expenses recorded in the firm's income statement for the period under consideration; such costs are not paid or dealt with in cash by the firm. It involves expenses such as depreciation. read more. is they are not actually expensed in cash (but in the record).

How does Google generate cash?

Additionally, Google generates cash through sales of apps, in-app purchases and digital content, hardware products, licensing arrangements, and service fees received for Google Cloud offerings . Google’s Cash flow from operation shows an increasing trend primarily due to an increase in Net Income.

Can cash flow analysis give you the right picture of a company?

Only cash flow analysis would not be able to give you the right picture of a company. Look for net cash inflow, but also make sure that you have checked how profitable the company is over the years. Also, cash flow analysis is not an easy thing to calculate.

Is buying back or issuing stocks included in cash flow analysis?

First, if there is any buying back or issuing stocks, it will come under financing activities in cash flow analysis. Borrowing and repaying loans on a short term or long term issuing notes and bonds, etc.) will also be included under financing activities. We also need to include dividend paid (if any).

Types of Cash Flow

Uses of Cash Flow

- Cash Flow has many uses in both operating a business and in performing financial analysis. In fact, it’s one of the most important metrics in all of finance and accounting. The most common cash metrics and uses of CF are the following: 1. Net Present Value – calculating the value of a business by building a DCF Model and calculating the net present...

Cash Flow vs Income

- Investors and business operators care deeply about CF because it’s the lifeblood of a company. You may be wondering, “How is CF different from what’s reported on a company’s income statement?” Income and profit are based on accrual accounting principles, which smooths-out expendituresand matches revenues to the timing of when products/services are delivered. Due t…

Cash Flow Generation Strategies

- Since CF matters so much, it’s only natural that managers of businesses do everything in their power to increase it. In the section below, let’s explore how operators of businesses can try to increase the flow of cash in a company. Below is an infographic that demonstrates how CF can be increased using different strategies. Managers of business can increase CF using any of the lev…

Additional Resources

- Thank you for reading CFI’s guide to Cash Flow. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below: 1. What is Financial Modeling? 2. Types of Financial Models 3. Valuation Methods 4. Financial Statement Analysis