An installment lease is a financing agreement where the lessee A lease is a contractual arrangement calling for the lessee (user) to pay the lessor (owner) for use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment is also leased.Lease

What is an installment sale of a lease?

An installment sale is done for short periods and for assets like light moving vehicles, electrical items, small machinery etc. In the case of operating lease financing, the repairs, and maintenance of the asset is borne by the lessor and in the case of the financial lease, it is borne by the lessee.

What is an installment payment?

Rather, you are making installment payments, on a monthly basis, on the total amount you agreed to pay for the whole period (again, usually about 350 days) that you, and we, agreed to let you live in our of our great places, and we are so very glad to have you. Your first one, and your last one are always due before moving in.

What are the different types of installment loans?

Here are some of the most common types of installment loans: Auto loans can help you pay for a new or used car. An auto loan is secured by the car you buy. Auto loans usually have fixed interest rates and repayment periods that typically range from two to seven years.

What happens when you take out an installment loan?

When you take out an installment loan, you immediately receive the money you’re borrowing or the item you’re purchasing. You pay it off—sometimes with interest—in regularly scheduled payments, known as installments. You typically owe the same amount on each installment for a set number of weeks, months or years.

What is the difference between leasing and installment?

Ownership of the Asset The ownership transfers to the user at the end of the installment period in an installment sale. Whereas in the case of lease financing, the lessee has to transfer the asset to the lessor after the end of the lease period, and the lessee has an option to purchase or not to purchase the asset.

Is installment the same as rent?

Installments: Many companies will indicate that you will pay 12 equal monthly installments on the full lease amount. These are not rent payments for the month, instead they are installment payments.

What does it mean to pay per installment?

any of several parts into which a debt or other sum payable is divided for payment at successive fixed times; the scheduled periodic payment made on an installment loan: to pay for furniture in monthly installments.

Does installment mean monthly?

An installment debt is a loan that is repaid by the borrower in regular installments. An installment debt is generally repaid in equal monthly payments that include interest and a portion of the principal.

Is an installment sale agreement a finance lease?

On a financial lease, anything that you put down as a payment to the bank is tax deductible, including your deposit. However, on an instalment sale, you can only claim finance charges and wear and tear – you can't claim the deposit, so this is another way you're not making full use of your tax deductions.

What is difference between installment and finance?

Conversely, in finance, while buying the asset you need to pay the cash down, i.e. down payment and the remaining amount in equal monthly payments. The installment amount consists of the cost of using the asset. On the other hand, the installment amount consists of principal and interest.

Is it good to pay in installments?

Installment Payments Are Just Another Form of Debt And these “easy payments” companies are boasting about aren't any different. They aren't a smart way to buy things you want. They aren't more harmless than a credit card. And they aren't a fancy way to “budget” for a purchase.

How do Installments work?

When you take out an installment loan, you immediately receive the money you're borrowing or the item you're purchasing. You pay it off—sometimes with interest—in regularly scheduled payments, known as installments. You typically owe the same amount on each installment for a set number of weeks, months or years.

How do installment plans work?

Installment plans allow you to finance a purchase by paying for it over a set period of time — generally anywhere from a few weeks to a year. Unlike revolving credit, an installment plan is a short-term loan with a predetermined payment schedule.

What happens if you don't pay installments?

If you don't pay an installment loan, you may be charged late fees and your credit score will go down. Some other consequences of not paying an installment loan include defaulting on the loan, getting pestered by debt collectors and potentially a lawsuit.

What is installment with example?

The definition of installment is the act of putting something new in, or an installment is one part of something that has multiple parts such as a payment or story. An example of an installment is the putting in of a new kitchen. An example of an installment is a per month payment plan. noun. 1.

How are installment payments calculated?

The equation to find the monthly payment for an installment loan is called the Equal Monthly Installment (EMI) formula. It is defined by the equation Monthly Payment = P (r(1+r)^n)/((1+r)^n-1). The other methods listed also use EMI to calculate the monthly payment. r: Interest rate.

What does per installment mean for car insurance?

An installment fee is a small service charge to cover the cost of processing additional premium payments, usually on a quarterly or monthly basis.

What do you mean by lease?

(Entry 1 of 2) 1 : a contract by which one conveys real estate, equipment, or facilities for a specified term and for a specified rent took out a five-year lease on the house also : the act of such conveyance or the term for which it is made. 2 : a piece of land or property that is leased.

What does rent is based on monthly frequency mean?

Key Takeaways. Month-to-month tenancy is a periodic tenancy wherein the tenant rents from the owner on a monthly basis. This type of tenancy is most commonly found in residential leases. Other variations of tenancies found in lease contracts include tenancy for years, tenancy at will, and tenancy at sufferance.

Examples of Installment lease contract in a sentence

Installment lease contract " means a lease contract that authorizes or requires the delivery of goods in separate lots to be separately accepted, even though the lease contract contains a clause "each delivery is a separate lease" or its equivalent.

More Definitions of Installment lease contract

Installment lease contract means a lease contract that authorizes or requires the delivery of goods in separate lots to be separately accepted, even though the lease contract contains a clause "each delivery is a separate lease " or its equivalent.

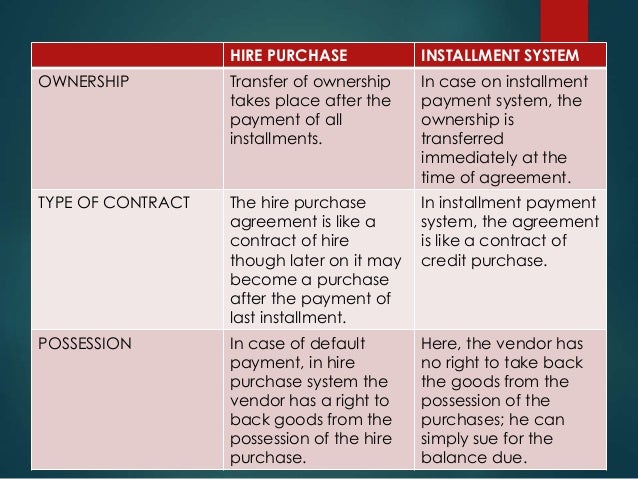

What is the difference between installment sale and leasing?

Generally, leasing is suitable for longer periods and for assets like land, property, heavy vehicles and huge plant and machinery. An installment sale is done for short periods and for assets like light moving vehicles, electrical items, small machinery etc.

What happens to the ownership of an asset in an installment sale?

Ownership of the Asset. In an installment sale, the ownership transfers to the user at the end of the installment period. Whereas in a case of lease financing, the lessee has to transfer the asset to the lessor after the end of the lease period and the lessee has an option to purchase or not to purchase the asset.

What is leasing in finance?

Leasing is a practice which allows a person to use the asset for an agreed period of time against payment of lease rentals. At the end of the term, the lessor can sell the asset to a lessee or terminate/extend the agreement as per mutual consent. Table of Contents. Financial Lease. Operating Lease.

What is an operating lease?

Operating Lease. This type of lease is short-term in nature and is generally for a specific period which is much less than the economic life of the asset. The total lease rentals during the leased period do not exceed the cost of the leased asset. Hiring a car, for instance, is an example of operating lease.

What is financial lease?

Financial Lease. This type of lease is long-term in nature and is continued till the economic life of the asset. The cumulative lease rental payments throughout the contract are greater than the initial cost of the asset. Examples are: Taking a building or factory on a lease.

Is the value of an asset capitalized in a lease financing?

In lease financing, the value of the asset is not included in the financial statements since the les see is not the owner. Whereas in the case of installment sale, the installments are capitalized i.e. the asset appears on the asset side of the balance sheet and a corresponding liability against such asset appears on the liability side.

Is a car lease an example of an operating lease?

Hiring a car, for instance, is an example of operating lease. An installment sale is one of the finance facilities to buy vehicles or other assets in exchange for a specified series of payments. The ownership transfers at the end of the credit agreement. It may or may not include interest. It carries certain tax advantages i.e.

When are installments due in a lease?

Generally, each installment is due the 15th and must be received in the office by that date. Installment 2, Last Months rent, due based on your lease, but usually May 15th. Installment 2 and 3 are DUE on the dates specified in the lease and are subject to delinquent account fees if not paid in full and on time.

How many installments are there in a lease?

(Okay, your lease total is divided into 12 installments, but there is also the security deposit, or SecDep, which makes for 13 total installments, 3 due at some time before you move in. The rest due each month of the lease period, except the last one).

How long is a lease for an apartment?

Your lease is for about 350 days. Here’s how it works: you are actually leasing the apartment for a period of approximately 350 days (that period is fully specified in your lease, look it up!). You agreed to pay a specific amount (again, see your lease) for that entire period of time.

Why do we recommend monthly installments?

We recommend monthly installments if you are money-conscious, and want to save as much as you can. Because consumers are keeping their phones longer than the length of installment plans, you’ll save hundreds over time. Plus there’s no interest, and you own your phone at the end without any extra fees.

Which carriers offer installment plans?

Of the major carriers, AT&T, T-Mobile and Verizon offer installment plans. Smaller carriers, also known as MVNOs, offer installment plans too but they work with third-party companies who will charge you interest over the course of your installments, so it’s more like a loan.

Can I own my phone when I lease it?

So, If you like upgrading regularly, and don’t need to own your device, leasing is a good option for you. If you fall into this category, just remember your phone needs to be in good condition when you return it and begin a new lease.

Is leasing good for everyone?

Leasing isn’t for everyone, but there are a few people who could benefit from it: If You Like the Latest and Greatest Tech. If you’re someone who is always spending money and upgrading to get the newest devices, leasing is definitely for you.

Do installment plans pay for phone?

Not only do installment plans from major carriers allow you to pay for your phone over time, there is no interest involved which allows you to save money instantly. Installment plans are perfect for someone who doesn’t want to drop a big amount of cash upfront, but still wants to own their phone.

Is leasing a cell phone a bad idea?

Leasing Cell Phones. Leasing a cell phone is similar to leasing a car, or renting a home—you pay for it monthly, but you won’t own it unless you pay more for it at the end of lease . In that regard, leasing can leave a bad taste in some people’s mouth. However, over the course of an 18-month lease, you’ll still be paying less money ...

What is lease option?

A lease with an option to purchase, also known as a "lease option," is a common real estate arrangement. The important income tax question in lease-option transactions is whether the tenant is leasing the property or, as an economic reality, an installment sale has occurred prior to the tenant exercising the purchase option.

What happens if a tenant acquires equity in a property during the lease period?

If the tenant acquires equity in the property during the period of the lease, it increases the likelihood that he will exercise the option to purchase, because this is the only way to protect his "investment.". Lease Terms.

What happens if you give a tenant an option payment?

If the IRS characterizes the lease option as an installment sale for income tax purposes, the ownership of the property is assumed to have been transferred at the time the tenant gave the landlord the option payment and the lease commenced. This timing alters the tax consequences considerably for both the tenant and the landlord.

What does it mean when a rent is above fair market?

Rents that are significantly above fair market rents, when combined with a "bargain" option price, indicate that the transaction is likely to be characterized as a sale and that the rental payments are, in fact, installment payments on the purchase price.

What is considered evidence of a lease option?

In analyzing lease option transactions, each of the following factors has been considered evidence that indicates a sale: The lease requires that the tenant make substantial improvements to the property and the tenant can recoup his investment only by exercising the option.

Can a tenant exercise a lease option?

However, there is no certainty that the tenant will exercise the option. Thus, if the tenant can demonstrate to the IRS that the reason for the lease option is that a sale was not possible because of economic conditions, the lease option will likely be upheld.

Is rent deductible?

Rent payments are deductible only for a property for which the tenant does not take title or hold equity interest. Two factors indicate that a tenant is acquiring an equity interest in a property: payment of rent in an amount that is substantially in excess of the actual fair market rental value of the property; and.

What are some examples of installment contracts?

Some common examples where installments contracts can be used may include: Contracts for the sale of a plot of land. Vehicle sales. Contracts where the goods are subject to seasonal cycles, such as produce or agricultural goods. Computer or other technology services that need to be updated regularly.

What is installment contact?

An installment contact is a particular type of contract in which the payments are made in a series (“installments”) rather than in one large lump payment. Alternatively, an installment contract can involve deliveries of goods or the provision of services that are done in a series rather than all at once. Installment contracts are used ...

What is an installment loan?

An installment loan is actually a common credit product. In fact, you might already have one or two of your own. Installment loans—also known as installment credit—are closed-ended credit accounts that you pay back over a set period of time. They may or may not include interest. Read on to learn more about different types ...

What is a buy now pay later loan?

You might have come across a buy-now, pay-later loan—also known as point-of-sale financing —while shopping. Some retailers offer the option at checkout. Buy-now, pay-later loans let you spread out your payments over a few installments, instead of paying for what you purchase right away.

What happens if you charge interest on a loan?

But keep in mind that if interest is charged, then the interest rate might depend on the type of installment loan and the borrower’s credit score. Those with lower scores may get higher interest rates. And the higher the rate, the more you could end up paying for the loan.

Do installment loans have a long repayment term?

Potentially long commitment: Some installment loans come with long repayment terms. That means a borrower has to commit to making regular payments over a long period of time. And be sure to read through the loan’s terms and conditions to see if there are any penalties for paying the loan off early.

Can you refinance with an installment loan?

Predictable regular repayments: With an installment loan, you know what your installment amount is going to be. And that can make budgeting easier. Chance of refinancing: If interest rates fall or if your credit score improves, you might get a chance to refinance.

Do all installment loans get reported to credit bureaus?

Plus, not all installment loans are reported to the credit bureaus. But if your installment loan is reported, it could help or hurt your credit scores when you’re: Applying for a loan: Applying for a loan could trigger a hard credit inquiry.