An external transaction refers to any transaction that occurs between the company and an external entity. Each transaction involves the transfer of resources. These resources include products, services or cash. The entities involved determine what resource they have to offer and what resource they’d like to receive. The company and the external entity exchange one resource for another in the transaction.

What is an example of an external transaction?

Types of Accounting Transactions based on the Exchange of Cash

- Cash transactions They are the most common forms of transactions, which refer to those that are dealt with cash. ...

- Non-cash transactions They are unrelated to transactions that specify if cash’s been paid or if it will be paid in the future. ...

- Credit transactions

What are the examples for internal transaction?

Types of Accounting Transactions based on Objective

- Business transactions These are everyday transactions that keep the business running, such as sales and purchases, rent for office space, advertisements, and other expenses.

- Non-business transactions These are transactions that don’t involve a sale or purchase but may involve donations and social responsibility.

- Personal transactions

What is external transaction in accounting?

Types of Accounting Transactions

- Events in Accounting are classified into two groups; Monetary events. Non-monetary events. All events are not transactions. ...

- Nature and Features of Accounting Transactions. All transactions are events but all events are not transactions. ...

- Types / Classification of Accounting Transactions. External transactions. ...

What is internal transaction?

Simply put, internal transactions are transactions between contracts. Internal transactions, despite the name, are not actual transactions. When two smart contracts "interact,'' the product or consequence of this interaction is a transaction.

What is external transaction example?

External Transaction Most transactions that a business makes during an accounting period are external transactions. Examples of external transactions include the purchase of merchandise from a supplier, payment of cash to a creditor, and payment of salary to a worker.

What is meant by an external transaction?

An external transaction is a business transaction which takes place between the business and an outside third party. An external transaction therefore involves two or more parties. External transactions involve exchange of resources between the business and outside third parties.

What is meant by an internal transaction?

An internal transaction is any financial activity that occurs within an organization rather than with a third party. It is typically an exchange of finances between departments or the company and its employees. Internal transactions aren't sales like external transactions are, but they affect the company's finances.

Is borrowing money from a bank an external transaction?

Examples. Businesses experience a variety of external transactions throughout their daily operation. These include selling products to customers, paying employees, borrowing money from a bank, or purchasing supplies from a vendor.

What are the three types of transactions?

Based on the exchange of cash, there are three types of accounting transactions, namely cash transactions, non-cash transactions, and credit transactions.

What does external account mean?

Definition of external account : an account of a firm or corporation with any outside party.

What is external and internal account?

External users of accounting information are those on the outside of a company looking in. Internal users are those that are inside the company. The common thread between the two is that both use the exact same accounting information, but for different reasons.

What is external transaction cost?

The external transaction costs are the costs to create and monitor this agreement. If a firm decides to expand its boundaries to handle the exchange internally, there are new internal transaction costs. These would be the costs to plan and coordinate these internal exchanges.

What are external events in accounting?

External Events An external accounting event is when a company engages in a transaction with an outside party or there is a change in the company's finances due to an external cause.

What are five examples of different types of financial transactions?

Examples of financial transactions include cash receipts, deposit corrections, requisitions, purchase orders, invoices, travel expense reports, PCard charges, and journal entries.

What are different types of transactions in bank?

Types of Bank Transactions Types of bank transactions include cash withdrawals or deposits, checks, online payments, debit card charges, wire transfers and loan payments.

What are examples of transactions?

Examples of transactions are as follows: Paying a supplier for services rendered or goods delivered. Paying a seller with cash and a note in order to obtain ownership of a property formerly owned by the seller. Paying an employee for hours worked.

What is an external transaction?

External Transactions. An external transaction refers to any transaction that occurs between the company and an external entity. Each transaction involves the transfer of resources. These resources include products, services or cash.

What is external entity?

External entities conduct business with the company based on the benefits derived from that relationship. These entities might provide products or services to the company. Or they might receive products or services from the company.

What does the entity involved determine?

The entities involved determine what resource they have to offer and what resource they’d like to receive. The company and the external entity exchange one resource for another in the transaction. Each company records the exchange in their financial records.

What is accounting transaction?

Accounting Transactions. Accounting transactions impact the financial position of the company and need to appear in the financial records. The accounting department records each transaction in the financial records once it receives knowledge that the transaction occurred.

What documents do accountants receive?

These documents include customer invoices, vendor billing statements or employee expense reports. The accountant uses information from the document to enter the dollar amount and the proper account for each transaction.

Is a business transaction internal or external?

All transactions can be classified as internal or external transactions. Internal transactions use the resources of the business and involve no outside entities. Many of the transactions experienced by companies fall into the category of external transactions.

What is an external transfer?

An external transfer is a way to move money electronically from an account in one financial institution to an account in another financial institution. External transfers can be used to move money between accounts that you hold at different banks; to send money to the bank account of a friend or family member;

What is the difference between EFT and ACH?

The Difference Between EFT and ACH. One of the most common sources of confusion when it comes to external transfers is the difference between EFT and ACH. ACH stands for automat ed clearing house , which is becoming a very popular way to make external transfers . The ACH network essentially acts as a financial hub and helps people ...

What is the EFTA Act?

government passed the Electronic Fund Transfer Act (EFTA). This act put in place consumer protections around specific types of electronic transfers of money. 8. Several different types of external transfer are covered by the EFTA: Electronic checks.

How long does it take for an ACH payment to be processed?

ACH payments, by contrast, are processed in batches each day. This means that funds sent via ACH can take from one to four days to move from one account to another, depending on the two financial institutions involved in the transaction. Larger banks can often process ACH payments faster than smaller banks . 11.

Can I set up recurring external transfers?

Recurring External Transfers. It may take extra time to set up your first external transfer. You'll not only have to find all the details you need, but your bank may also do extra security checks to make sure that your transfer is genuine and that the recipient is legitimate. 7. However, banks usually make it easier to set up ...

Can I use an external transfer to pay for goods?

Because there are fewer protections for your money with an external transfer, you should only use it to pay for goods or services if you know and trust the seller.

Can I send money to someone else?

Using an external transfer, you can send money to an account you hold or one held by someone else. The process is usually the same, no matter where you are sending the money within the U.S. External transfers can be used to send money to a friend or family member—for example, to settle up a shared expense, or to send money for a birthday ...

What is the difference between internal and external transactions?

Meaning. An internal transaction is a business transaction which is not undertaken with any external third party. An external transaction is a business transaction which is undertaken with one or more external third parties.

What is internal transaction?

Exchange of resources. Internal transaction is a result of internal functions of a business and may not involve exchange of resources. If it involves exchange of resources it would be between internal departments of an organisation. External transaction is an exchange of resources between the organisation and one or more external third parties.

How many parties are involved in an internal transaction?

Number of parties. Internal transaction only involves one party – the organisation itself. External transactions involve 2 or more parties – the organisation and one or more third parties. 5. Trigger. Internal transactions are triggered by internal functions of a business or by simple passage of time.

What is a business transaction?

Every business encounters and accounts for a plethora of transactions while undertaking its operations. Any business event which impacts the finances of the business would constitute a transaction. Business transactions can be categorized into several types. Categorization helps determine the accounting treatment to be given to each transaction.

Why does true exchange of values occur in external transactions?

While both internal and external transactions have a monetary impact on the finances of the company, true exchange of values occurs in external transactions as it involves exchange of resources between parties.

Do internal transactions affect financial statements?

Internal transactions do impact the financial statements however they rarely result in exchange of values and are more in the nature of shift of values from one part of the business to another part. Previous Difference between accounting and bookkeeping. Next Difference between par value and no par value stock.

Do internal transactions affect cash flow?

As internal transactions are concerned with inter-departmental transactions or as a result of internal functions of the business, they generally do not have an impact on the cash flow of the business.

What is a Business Transaction?

A business transaction is a financial transaction between two or more parties that involves the exchange of goods, money, or services. To engage in a business transaction, the business exchange must be measurable in monetary value so it can be recorded for accounting purposes.

Types of Business Transactions

There are two ways to classify business transactions in accounting: cash and credit transactions or internal and external transactions.

Examples of Business Transactions

Every day a business participates in multiple business transactions that affect the company’s accounting. Some examples of everyday business transactions include:

Features of a Business Transaction

To be considered a business transaction, the exchange must have these key features:

Steps of a Business Transaction Analysis

After a business transaction takes place, it needs to be entered into a company’s accounts and analyzed. The five steps of the accounting cycle are as follows:

Get Help with a Business Transaction

Do you have questions about a business transaction and want to speak to an expert? Post a project on ContractsCounsel today and receive bids from business lawyers who specialize in business transactions.

Meet some of our Business Transaction Lawyers

Ryan A. Webber focuses his practice primarily on Estate Planning, Elder Law, and Life Care Planning. His clients range from young families concerned about protecting their family as well as aging individuals. Ryan provides Estate Planning, Trust Planning, Special Needs Planning, Public Benefit Planning, and Estate Administration.

What are accounting transactions?

Accounting transactions refer to any business activity that results in a direct effect on the financial status and financial statements#N#Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are#N#of the business. Such transactions come in many forms, including: 1 Sales in cash and credit to customers 2 Receipt of cash from a customer by sending an invoice 3 Purchase of fixed assets#N#Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment. Tangible assets are#N#and movable assets 4 Borrowing funds from a creditor 5 Paying off borrowed funds from a creditor 6 Payment of cash to a supplier from a sent invoice

What is a cash transaction?

They are the most common forms of transactions, which refer to those that are dealt with cash. For example, if a company purchases office supplies and pays for them with cash, a debit card, or a check, then that is a cash transaction.

What is double sided journal entry?

The double-sided journal entry comprises two equal and corresponding sides, known as a debit (left) and a credit (right). It will ensure that total debits will always equal total credits. CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)

What are the types of accounting transactions according to institutional relationships?

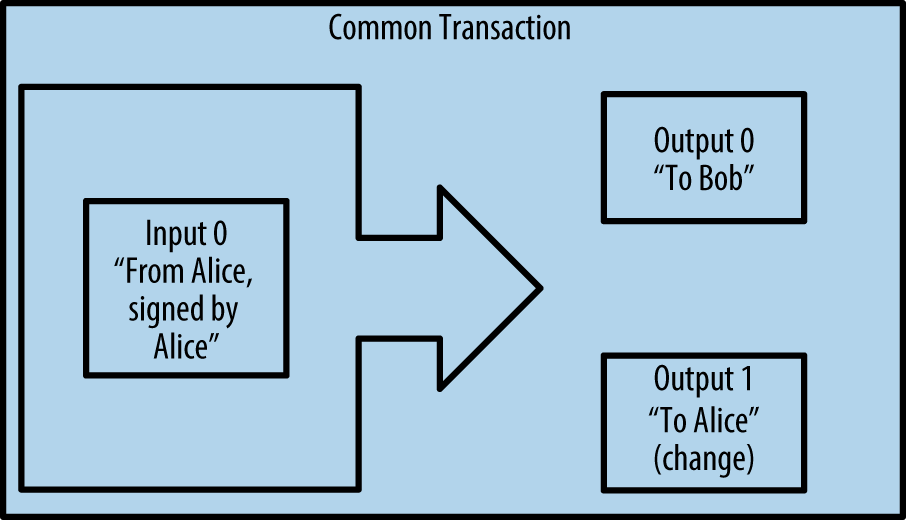

The first one that we will discuss is the types of accounting transactions according to institutional relationships, namely external and internal transactions. 1. External transactions. These involve the trading of goods and services with money. Therefore, it can be said that any transaction that is entered into by two persons or two organizations.

Why are credit transactions deferred?

Credit transactions. They are deferred cash transactions because payment is promised and completed at a future date. Companies often extend credit terms for payment, such as 30 days, 60 days, or 90 days, depending on the product or service being sold or industry norms.

What are the three financial statements?

Three Financial Statements The three financial statements are the income statement, the balance sheet, and the statement of cash flows. These three core statements are. of the business. Such transactions come in many forms, including: Tangible Assets Tangible assets are assets with a physical form and that hold value.

What is double entry in accounting?

When recording accounting transactions, the double-entry method is a system bookkeeping where every entry to an account requires an opposite entry to a different account producing balanced journal entries. The double-sided journal entry comprises two equal and corresponding sides, known as a debit (left) and a credit (right).

6 Get Started with Financials SOAP Web Services

What’s the difference between ERP Integration Service and Financial Utilities Service?

Relationships

The following table describes how this service data object is related to other service data objects or business object services.

What is the difference between external and internal transactions?

What is the difference between external transactions and Internal transactions? Register now or log in to answer. Internal transactions are those transactions with which no outside person or organization is involved, it does not relates with two parties or not involve any other second party. External Transaction are those transactions in which ...

What is internal transaction?

Internal transactions are those transactions with which no outside person or organization is involved, it does not relates with two parties or not involve any other second party. External Transaction are those transactions in which include two parties or it is the transaction between two parties. in organizations external transactions are mostly ...

The Basics of An External Transfer

How to Make An External Transfer

Recurring External Transfers

History of External Transfers

The Difference Between EFT and Ach

The Bottom Line

- External transfers are a fundamental part of the modern banking system, allowing individuals and corporations to move money easily between accounts. They are typically easy to set up, but you should be careful if you are asked to make an external transfer to a company or individual you don’t know personally.