How much does flood insurance cost in zone AE?

How Much Does Flood Insurance Cost in Flood Zone AE? Our flood insurance premiums for Zone AE average $424 a year. Compare that to the National Flood Insurance Program’s average premium of $1,025 a year. Your cost depends on the limits you choose and your home’s flood history. Want to know how much your flood coverage will be? Get a quote ...

How do you determine a flood zone?

There are several options to view your property or community’s flood risk:

- Visit your Community Map Repository, which is usually maintained by the community floodplain administrator or officials at the planning and zoning office and ask for a copy of your property’s ...

- View and download the FIRM from the FEMA Flood Map Service Center

- View and download the National Flood Hazard Layer (NFHL) data using the FEMA GeoPortal. ...

What to do if you're in a flood zone?

If your home is in a flood zone, Harper advises taking these steps: Elevate your furnace, water heater, and electric panels to protect them from possible floodwaters. Keep storm drains and gutters free of debris, and install check valves (or one-way valves) to keep floodwater from backing into your drains. Seal your basement walls with waterproofing materials. More items...

What determines the cost of flood insurance in zone AE?

The best way to get the lowest cost for flood insurance in flood zone AE is to get a flood expert to shop for you. The Flood Nerds shop all options to get you the best coverage at the best price. The flood zone determination and the flood zone significantly affects the cost of flood zone AE insurance.

What is the best flood zone rating?

Flood zone X, also known as flood zone X500, is arguably the safest flood zone designation, as it's considered to be outside the 500-year floodplain and is also protected by a flood control system, such as a levee or dam, from the 100-year floodplain.

Does flood zone AE require flood insurance in Florida?

Flood insurance in Florida's SFHAs In particular, AE flood zones or any zone designated by the letters A or V have a 1% chance of flooding annually. If you live in an AE zone and have a federally backed mortgage, you are required to purchase flood insurance.

How much is flood insurance in Zone AE?

How Much Does Flood Insurance Cost in Flood Zone AE? Our flood insurance premiums for Zone AE average $424 a year. Compare that to the National Flood Insurance Program's average premium of $1,025 a year. Your cost depends on the limits you choose and your home's flood history.

What does AE flood zone mean in Florida?

Defining AE flood zones AE flood zones are areas that present a 1% annual chance of flooding and a 26% chance over the life of a 30-year mortgage, according to FEMA. These regions are clearly defined in Flood Insurance Rate Maps and are paired with detailed information about base flood elevations.

How much can I save by buying a private flood insurance plan?

Private flood insurance is more affordable than NFIP policies and provides greater coverage limits. Homeowners can reduce their rates by 20% to 40%...

What types of flood insurance can I buy for my home?

You can buy flood insurance as an add-on endorsement to your home insurance or a separate flood policy.

Should people in low-risk areas buy flood insurance?

According to the Federal Alliance for Safe Homes, 25% of flood claims occur in low to moderate-risk flood zones. Homeowners can purchase NFIP plans...

What is Flood Zone AE?

AE flood zones are areas that have a 1 percent chance of flooding in a given year and a 26 percent chance of flooding during a 30-year mortgage.

Is flood insurance mandatory in Flood Zone AE?

Flood Zone AE is subject to mandatory flood insurance purchase requirements. Federally-backed or regulated lenders can only offer loans to people w...

What regulations do homes in Flood Zone AE have to meet?

Many building regulations have to do with the base flood elevation, or BFE. The lowest level and all electrical, plumbing and HVAC must be above th...

What can homeowners do to prevent flood damage?

Simple steps like cleaning gutters, diverting runoff, and having sandbags on hand can help homeowners in Zone AE minimize damage from a flood.

What is a flood zone AE?

What Is Flood Zone AE? Flood Zone AE is one of the many Special Flood Hazard Areas (SFHA) defined by the Federal Emergency Management Agency (FEMA). Like Flood Zone A, it also has a one percent risk of flooding annually with a 26 percent risk of flooding over the course of a 30-year mortgage. Homes in Flood Zone AE may be close to floodplains ...

What is the lowest level of a home in a flood zone?

Homes built in Flood Zone AE must meet the following regulations: The lowest level of the home must be at or above the base flood elevation (BFE) or the height floodwaters are expected to rise during a base flood.

What to do if a flood is imminent?

This could mean placing sandbags at doorways to direct the flow of water away from the structure or moving belongings to a higher floor or on top of counters.

How can property maintenance reduce flood damage?

Did you know that property maintenance can reduce the chance of flood damage? By clearing gutters and positioning rain spouts so runoff moves away from your home, you reduce your chance of having a home flood. Also, pay attention to where water collects in your yard when it does rain. You may be able to adjust your landscaping to prevent water from pooling near the foundation of your home.

What to do if you see flooding after a rain?

If you’re seeing streets and parks flooding after a rain, talk to officials about remedies such as improved drainage to make the area safer for all.

What equipment must be kept above the BFE?

All electrical, plumbing, and HVAC equipment must be kept above the BFE.

Does traditional homeowners insurance cover flood damage?

Traditional homeowners insurance doesn’t cover damages from floods. If you don’t have flood insurance, consider it. If you do have it, make sure the coverages are up to date for your structure and belongings.

How is flood zone determined?

These zones are determined by the flood insurance rate map (FIRM) to see if structures of the properties can keep up with the possible flood risk in the area. It's important that the flood map uses the data of chance of flooding in the area, the base flood elevation of the community or the property, and as mentioned before the probability of a flood in the event that there's heavy rainfall or somewhere along those lines.

Why is it important to use flood maps?

It's important that the flood map uses the data of chance of flooding in the area, the base flood elevation of the community or the property, and as mentioned before the probability of a flood in the event that there's heavy rainfall or somewhere along those lines.

Why do you need an elevation certificate?

You may avoid this by using an elevation certificate to prove that you have a lower risk for flooding compared to the area around it. This elevation certificate should be signed and filled in by a licensed surveyor or a professional engineer. You can learn more on elevation certificates by checking out our podcast below:

Do you need flood insurance on a mortgage?

Properties in this area will be required by the federal government and your mortgage to get a flood insurance policy with the property. This is to make sure that the property's value, structure, and integrity is protected and preserved in the event of a flood disaster.

What is flood zone AE?

Flood zone AE (high-risk flood zone) The practical meaning of flood zone AE is your mortgage lender is required by federal law to force you to buy a flood insurance policy. Flood zone is also called the 100-year flood zone or special flood hazard area. This high-risk zone is also labeled flood zone A, flood zone A1 – 30, AH flood zone, or AO flood zone.

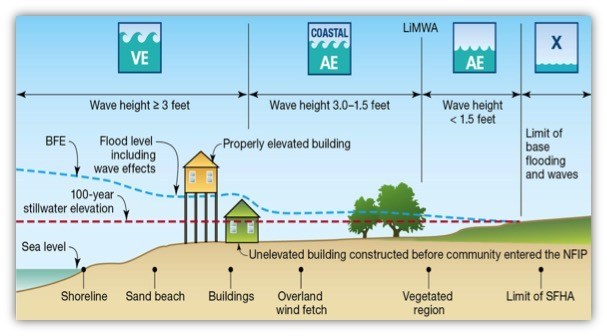

What is the VE zone?

The VE zone is called the coastal high-risk flood zone. It’s found where property is by a large body of water and can even include Great Lakes areas on rare instances. The V stands for velocity or wave action. It’s also called the V, VE, or V1-31 flood zone.

How much does flood insurance cost in Florida?

There are many private flood insurance options for Florida property owners. The average flood insurance cost for Florida is $550. Are you paying more? Let a Flood Nerd shop for Florida flood insurance.

How many flood insurance companies are there?

There are over 40 private flood insurance companies and they often offer broader coverage and a much better cost than government flood insurance. But shopping 40 companies is time consuming and hard work. The kind of tedious stuff you dread is the kind of stuff that gets a real Flood Nerd excited.

Can a flood nerd capitalize on a flood insurance claim?

If the seller has an Elevation Certificate, a Flood Nerd can capitalize on that to lower your new flood insurance cost. And your closing will never be delayed for lack of flood coverage. Flood Nerds move like cheetahs to get you covered fast.

Does the government have a monopoly on flood insurance?

Luckily for property owners in flood zone AE, the government no longer has a monopoly on the flood insurance market. Monopoly may be a fun game to play with family and friends but it’s an awful way to offer any insurance. Especially when the money is real!

Do you need flood insurance if you have a mortgage?

If you have a mortgage, the lender requires you to buy flood insurance if the house is in flood zone AE. Buying a house in flood zone AE means buying insurance. Most people just buy insurance through the NFIP. Most people pay too much money for flood insurance.

What is a flood hazard area?

SFHA are defined as the area that will be inundated by the flood event having a 1-percent chance of being equaled or exceeded in any given year. The 1-percent annual chance flood is also referred to as the base flood or 100-year flood. SFHAs are labeled as Zone A, Zone AO, Zone AH, Zones A1-A30, Zone AE, Zone A99, Zone AR, Zone AR/AE, Zone AR/AO, Zone AR/A1-A30, Zone AR/A, Zone V, Zone VE, and Zones V1-V30. Moderate flood hazard areas, labeled Zone B or Zone X (shaded) are also shown on the FIRM, and are the areas between the limits of the base flood and the 0.2-percent-annual-chance (or 500-year) flood. The areas of minimal flood hazard, which are the areas outside the SFHA and higher than the elevation of the 0.2-percent-annual-chance flood, are labeled Zone C or Zone X (unshaded).

What is the area of minimal flood hazard?

The areas of minimal flood hazard, which are the areas outside the SFHA and higher than the elevation of the 0.2-percent-annual-chance flood, are labeled Zone C or Zone X (unshaded). Last updated July 8, 2020.

What Are Flood Zones?

That’s what flood zones are in a nutshell: shorthand for how likely flooding is in any given area.

What is a numbered flood zone?

Unlike the unnumbered Flood Zone V, the numbered zones have a flood map with BFEs determined within the zone. These have the same probability of flooding as Flood Zone V and have mandatory flood insurance requirements.

What is a letter grade FEMA?

FEMA gives each zone a letter grade based on the type and likelihood of flooding. Zones with a letter grade of A or V are considered high-risk areas with a one in four chance of flooding during a 30-year mortgage period. Those with letter grades of B, C, or X are considered low to moderate risk zones but still account for 20 to 25 percent of National Flood Insurance Program (NFIP) claims each year.

What is the chance of flooding in Zone V?

Flood Zone V. Like Flood Zone A, Flood Zone V has a one percent annual chance of experiencing a flood and a 26 percent chance of flooding over the course of a 30-year mortgage. This zone does not provide BFE for homes in it but is considered high-risk with mandatory flood insurance requirements.

What is the probability of flooding in flood zone AH?

This flooding is generally labeled with the probability of one to three feet of water that pools in areas. True to Flood Zone A, this area has a 26 percent chance of flooding over the course of a 30-years mortgage.

How deep is a flood zone?

These areas are typically protected by levees or have shallow flooding areas. Flood depths average less than one foot and drainage is less than one square mile. These flood zones are not a Special Flood Hazard Areas.

Why is flood insurance required in Zone A?

Flood insurance is required in Zone A because of its likelihood of experiencing a 100-Year Flood – a flood that has a one percent annual chance of happening.