What is Bank Reconciliation Formula?

- Unpresented Cheques: Unpresented cheques mean cheques issued by the company but not presented in Bank. ...

- Deposit in Transit. : Deposit in Transit is also one of the reasons for differences in the balances on reconciliation date.

- Errors in Bank. : Amount which is wrongly entered by Bank in Company’s ledger.

- Errors by Company. ...

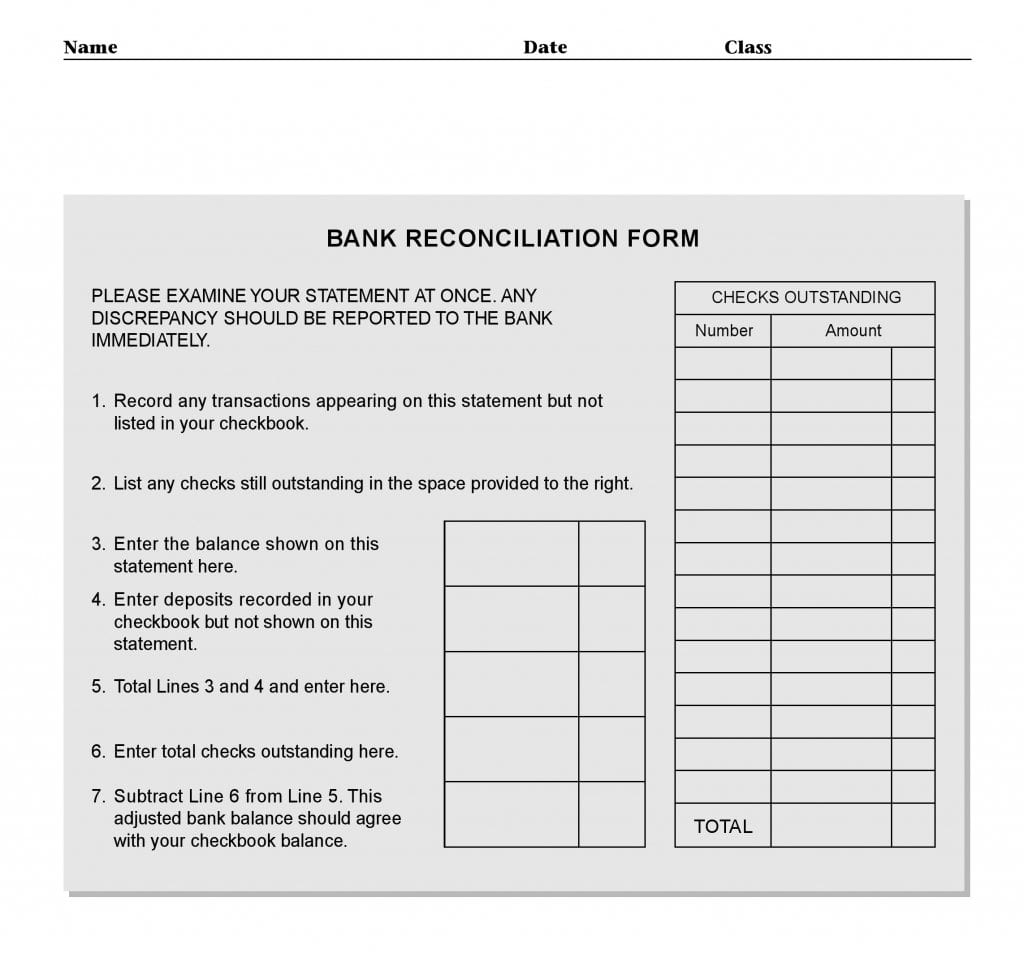

How to prepare a bank reconciliation?

Aug 17, 2021 · Deposits in transit are a major part of bank reconciliations, in which an accountant completes a monthly reconciliation of the cash figure on …

What is an example of bank reconciliation?

Deposits in Transit, also known as outstanding deposits, are those deposits that are not reflected in the bank statement on the reconciliation date due to the time lag between when a company deposits cash or cheque in its account and when the bank credits it. Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is …

What are bank reconciliations?

A deposit in transit is added to a bank balance in the preparation of a bank statement reconciliation. It is added if the reconciliation method used is the adjusted method, and is mostly preferred because it shows the actual cash in bank balance of the depositor .

How to record outstanding check?

Dec 07, 2021 · A deposit in transit is cash and checks that have been received and recorded by an entity, but which have not yet been recorded in the records of the bank where the funds are deposited. If this occurs at month-end, the deposit will not appear in the bank statement issued by the bank, and so becomes a reconciling item in the bank reconciliation prepared by the entity.

How is deposit in transit treated in bank reconciliation?

So, the proper treatment of unrecorded deposits (deposit in transit) on bank reconciliation is to show them as an addition per bank statement/ passbook balance in order to reconcile the two balances.

How do you reconcile deposits in transit?

Once you've received it, follow these steps to reconcile a bank statement:COMPARE THE DEPOSITS. Match the deposits in the business records with those in the bank statement. ... ADJUST THE BANK STATEMENTS. Adjust the balance on the bank statements to the corrected balance. ... ADJUST THE CASH ACCOUNT. ... COMPARE THE BALANCES.Dec 3, 2019

What is deposit in transit in bank reconciliation Mcq?

Deposits in Transit, also known as outstanding deposits, are those deposits that are not reflected in the bank statement on the reconciliation date due to the time lag between when a company deposits cash or cheque in its account and when the bank credits it.

What is deposit in transit in bank reconciliation quizlet?

Deposits in transit represent deposits recorded on the books, which have not yet been recorded on the bank statement. They are therefore added to the bank statement balance.

What is outstanding deposit in transit?

Deposits in Transit, also known as outstanding deposits, are those deposits that are not reflected in the bank statement on the reconciliation date due to the time lag between when a company deposits cash or cheque in its account and when the bank credits it. Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is deposited, the balance as per bank statement would be lower than the balance as per cash book until the deposit is processed by the bank. Therefore, any outstanding deposits must be subtracted from the balance as per cash book in the bank reconciliation statement.

Does a bank statement have to be lower than a cash book?

Since the company records the increase in bank balance in its accounting records as soon as the cash or cheque is deposited, the balance as per bank statement would be lower than the balance as per cash book until the deposit is processed by the bank. Therefore, any outstanding deposits must be subtracted from the balance as per cash book in ...

How is deposit in transit treated in the bank reconciliation statement?

Deposits in transit. These deposits are called deposits in transit and cause the bank statement balance to understate the company’s actual cash balance. Since deposits in transit have already been recorded in the company’s books as cash receipts, they must be added to the bank statement balance.

How do you record a deposit in transit?

At the top of the bank reconciliation, enter the ending balance from the bank statement. Total the deposits in transit. Add up the deposits in transit, and enter the total on the reconciliation. Add the total deposits in transit to the bank balance to arrive at a subtotal.

How are deposits in transit shown on the bank reconciliation quizlet?

In a bank reconciliation, deposits in transit are: added to the bank balance. The reconciling item in a bank reconciliation that will result in an adjusting entry by the depositor is: bank service charges.

What is deposit in transit in bank reconciliation Mcq?

Deposits in Transit, also known as outstanding deposits, are those deposits that are not reflected in the bank statement on the reconciliation date due to the time lag between when a company deposits cash or cheque in its account and when the bank credits it.

What does bank transit mean?

A bank transit number is commonly referred to as a routing number, or ABA RTN (American Banking Association routing transit number). A bank transit number is a nine-digit code that identifies a specific financial institution. … That number is on all negotiable instruments that issue from the institution.

Is deposit in transit a current asset?

The reconciliation process will identify this difference as a deposit in transit. This reconciliation process is part of the accounting cycle, allowing the company to accurately report cash, a current asset, on its balance sheet.

Do you add or subtract deposits in transit?

Deposits in Transit must be added to the bank side of the reconciliation because they have been added to the book side when the deposits were recorded by the company. … Bank service charges are subtracted from the book balance since they are a decrease in the account balance and have not yet been recorded.

What is a deposit in transit?

A company's deposit in transit is the currency and customers' checks that have been received and are rightfully reported as cash on the date received, and the amount will not appear on the company's bank statement until a later date. A deposit in transit is also known as an outstanding deposit.

When is $4,600 reported on bank statement?

However, the bank statement will report the $4,600 as a deposit on Monday, July 1, when the bank processes the items from its night depository. When preparing a bank reconciliation as of June 30, the company needs to adjust the balance on the bank statement by adding $4,600 for the deposit in transit. This is done because the $4,600 is rightfully ...