How is 200 db Hy depreciation calculated?

Double Declining Balance Depreciation Example You calculate 200% of the straight-line depreciation, or a factor of 2, and multiply that value by the book value at the beginning of the period to find the depreciation expense for that period.

What is Hy depreciation method?

HY = Half-Year: Depreciation is halved for the first and last year once it is in service. MY = Modified Half-Year: If put into service before the midpoint of the year, the fixed asset receives a full year of depreciation for the first year, but none on the last.

How do you calculate 150 DB Hy depreciation?

Depreciation rate for 150 percent declining balance method = 20% * 150% = 20% * 1.5 = 30% per year. Depreciation = $140,000 * 30% * 9/12 = $31,500.

Is 200DB the same as Macrs?

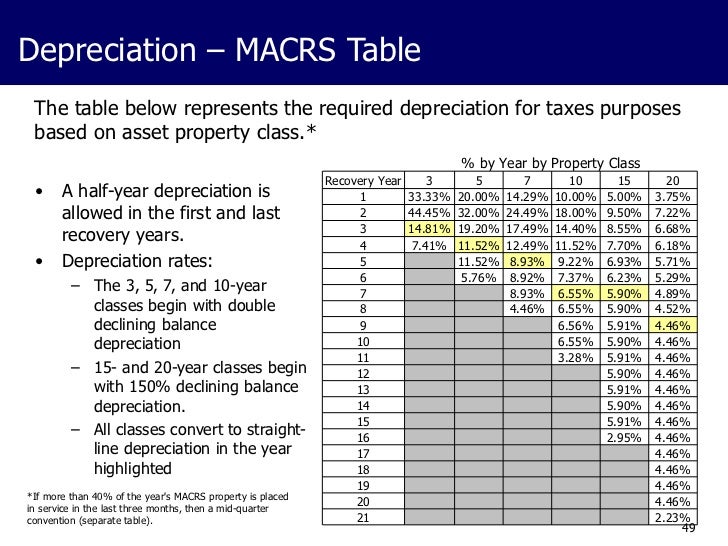

Reports will show the depreciation method allowed under MACRS (200DB, 150DB, S/L) that is being used to calculate the current depreciation for an asset, rather than displaying MACRS. This is the same as how the method is reported, per IRS instructions, on Form 4562.

What is the half-year rule for depreciation?

The half-year convention is used to calculate depreciation for tax purposes, and states that a fixed asset is assumed to have been in service for one-half of its first year, irrespective of the actual purchase date. The remaining half-year of depreciation is deducted from earnings in the final year of depreciation.10-May-2017

When must you use half-year convention?

If you place property in service between January and September (the first nine months), you must use the half-year convention. This convention assumes you placed property in service in the middle of the year even if it was placed in service the beginning of the year.

What is Matheson formula?

Declining Balance Method is sometimes called the Constant-Percentage Method or the Matheson formula. The assumption in this depreciation method is that the annual cost of depreciation is the fixed percentage (1 - K) of the Book Value (BV) at the beginning of the year. ... Annual Rate of Depreciation(K): SV = FC (1 - K)05-Jul-2018

How do you calculate 200 declining balance depreciation?

Double declining balance is calculated using this formula:2 x basic depreciation rate x book value.Your basic depreciation rate is the rate at which an asset depreciates using the straight line method.Cost of the asset is what you paid for an asset. ... Once you've done this, you'll have your basic yearly write-off.More items...•11-Feb-2020

Do you subtract salvage value double declining balance?

This means that your depreciation rate for double declining depreciation is 40%, making your first year depreciation $40,000. You'll depreciate the asset until the book value reaches $8,000. ... Remember, in straight line depreciation, salvage value is subtracted from the original cost.02-Jan-2021

Does MACRS use salvage value?

MACRS Depreciation Calculation When using MACRS, an asset does not have any salvage value. This is because the asset is always depreciated down to zero as the sum of the depreciation rates for each category always adds up to 100%. ... For example, depreciate an asset classified under 3-Year MACRS for 4 years.

What is MACRS 7-year property?

7-year property. 7 years. Office furniture and fixtures, agricultural machinery and equipment, any property not designated as being in another class, natural gas gathering lines. 10-year property.29-Jul-2021

What does DB Hy mean?

Declining BalanceMy CPA for the last year used DB-HY (Declining Balance). I want to know what I should change in my current year TurboTax to see. 1.01-Jun-2020

Does double declining balance include salvage value?

The double declining balance calculation does not consider the salvage value in the depreciation of each period however, if the book value will fall below the salvage value, the last period might be adjusted so that it ends at the salvage value.

What is the term for the value of an asset at the end of its useful life?

the value of the asset at the end of its useful life; also known as residual value or scrap value. Useful Life. the expected time that the asset will be productive for its expected purpose. Placed in Service. select the month and enter the year the asset started being used for its intended purpose. Year.

How many months are in a mid year convention?

For mid year convention, for example, will have 6 months in the first and last years.

What does double depreciation mean?

The "double" means 200% of the straight line rate of depreciation, while the "declining balance" refers to the asset's book value or carrying value at the beginning of the accounting period. Since book value is an asset's cost minus its accumulated depreciation, the asset's book value will be decreasing when the contra asset account Accumulated ...

Is depreciation expense faster in the early years or later years?

This means that compared to the straight-line method, the depreciation expense will be faster in the early years of the asset's life but slower in the later years. However, the total amount of depreciation expense during the life of the assets will be the same.

How to determine depreciation convention?

A depreciation convention is a rule that is used to determine four different criteria: 1 The depreciation method you can use 2 The depreciation schedule you can use, dependent on the useful life 3 The amount of depreciation that can be claimed once the fixed asset is disposed of 4 The amount of depreciation that can be claimed in the first and last year of the fixed asset’s recovery period

What is a half year depreciation?

The half-year depreciation convention is a tax rule that assumes the asset is obtained and disposed of partly through the acquisition and disposal year . The maximum allowable depreciation amount is therefore half the annual amount. It is crucial to remember that deprecation is halved in the first year, with the remainder ...

When is deprecation halved?

It is crucial to remember that deprecation is halved in the first year, with the remainder of that depreciation being taken in the last year of the asset’s useful life. Rules created by the U.S. Internal Revenue Service (IRS) aim to prevent manipulation of tax deductions by restricting the maximum allowed.

Does HM depreciate for disposal?

It does not receive depreciation for the month of disposal. HM = Modified Half Month: If the fixed asset is put into service during the first half of the month, it receives a full month of depreciation. If it is put into service during the second half of the month, the calculation of depreciation begins the preceding month.

What is depreciation method?

The depreciation schedule you can use, dependent on the useful life. The amount of depreciation that can be claimed once the fixed asset is disposed of. The amount of depreciation that can be claimed in the first and last year of the fixed asset’s recovery period.

Do you have to prove when a fixed asset was placed into service?

A half-year convention does not require taxpayers to prove when the fixed asset was placed into service. Instead, the U.S. Internal Revenue Service (IRS) created a rule that assumes fixed assets are placed into service on July 1 st of the year it was actually placed in service.

What is a Macrs?

MACRS stands for “Modified Accelerated Cost Recovery System.”. It is the primary depreciation methods for claiming a tax deduction. Of course, like all things accounting, depreciation can be tricky and it’s impossible to remember all the intricate details. Click below to download our free ultimate guide to Macrs depreciation.

Can you write off the cost of a business asset?

MACRS is the primary depreciation method used for tax purposes. When you purchase an asset for business ( such as equipment, software, or even buildings), you typically cannot write off the entire cost of the asset in the year of purchase.

What is the depreciation system for MACRS?

There are two types of depreciation systems that fall within the MACRS depreciation method: the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). In general, most small businesses must use GDS unless you are required by law to use ADS.

Can you deduct a portion of an asset each year?

However, you are able to deduct a portion of the cost each year using the MACRS depreciation method. MACRS stands for Modified Accelerated Cost Recovery System because it allows you to take a larger tax deduction in the early years of an asset and less in later years.

Can you deduct a computer purchase in the same year?

For example, if you purchase a computer for $1500, you generally can’t deduct the entire $1500 in the same year that you purchase the computer. However, you are able to deduct a portion of the cost each year using ...