What happens if a Form 8300 is filed on you? The IRS requires that you file Form 8300 within 15 days of receiving the money in a transaction. Failing to do so will accrue you or your business penalties if the IRS finds out. If you simply fail to file on time, then the penalties will be $100 for each occurrence. Click to see full answer.

What does the IRS do with Form 8300?

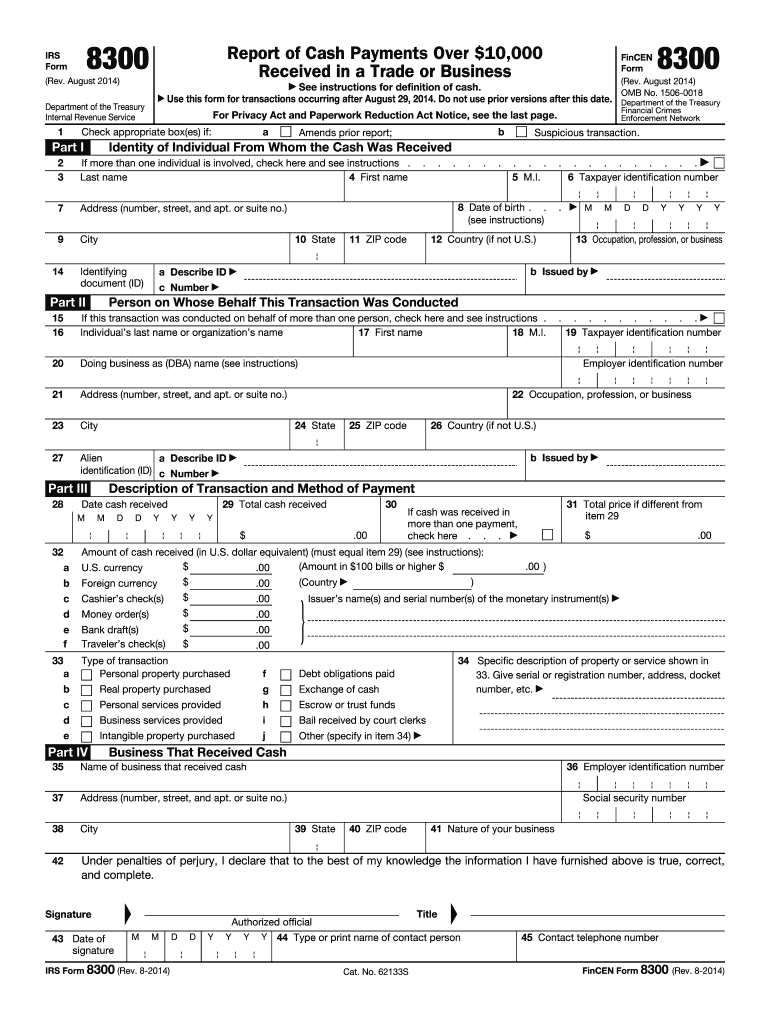

IRS Form 8300 is Report of Cash Payments Over $10,000 Received in a Trade or Business. It is used to help prevent money laundering. You do not report it on your tax return. Subsequently, question is, how do I stop Form 8300?

What is the 8300 IRS Form supposed to be for?

Form 8300 is designed to provide the Treasury Department about information pertaining to these large cash transactions. In 2011, nearly 200,000 paper submissions of Form 8300 were filed with the Treasury department. Since 2012, the IRS has made e-filing available for Form 8300 free of charge.

When do you fill out Form 8300?

You must file Form 8300 by the 15 th day after the date the cash transaction occurred. Besides filing Form 8300, you also need to provide a written statement to each party whose name you included on the Form 8300 by January 31 of the year following the reportable transaction.

What happens if a Form 8300 is filed on You?

You do not have a reportable event on your individual tax return. If you sold cryptocurrency for cash, you do have a taxable event. And you need to go back and assess what your gross proceeds were from that transaction and compare it to your cost basis, which is essentially what you paid for the asset.

What will IRS do with form 8300?

More In File The Form 8300, Report of Cash Payments Over $10,000 in a Trade or Business, provides valuable information to the Internal Revenue Service and the Financial Crimes Enforcement Network (FinCEN) in their efforts to combat money laundering.19-Aug-2021

Do I have to report Form 8300 on my taxes?

The law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing IRS/FinCEN Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business PDF.

How do I avoid IRS Form 8300?

5 Steps to Avoid Form 8300 Problems With the IRSGet Business Tips From Leafly. ... Learn How Leafly Can Help Your Business. ... File Online. ... Keep Copies for Five Years. ... You Must File Within 15 Days of Receiving the Money. ... Create and Send Customer Statements. ... Understand Which Transactions Count.14-Jul-2016

What happens if I don't file Form 8300?

The IRS requires that you file Form 8300 within 15 days of receiving the money in a transaction. Failing to do so will accrue you or your business penalties if the IRS finds out. If you simply fail to file on time, then the penalties will be $100 for each occurrence.

Should I worry about form 8300?

Failing to file Form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the IRS. Additionally, failing to file on time will result in a $100 penalty for each occurrence. ... If you deliberately fail to file form 8300, your business may incur a higher financial cost.

Is structuring money illegal?

Structuring is illegal regardless of whether the funds are derived from legal or illegal activity. The law specifically prohibits conducting a currency transaction with a financial institution in a way to circumvent the currency transaction reporting requirements.10-Apr-2020

How much cash can you spend without raising a red flag?

The Rule, as created by the Bank Secrecy Act, declares that any individual or business receiving more than $10 000 in a single or multiple cash transactions is legally obligated to report this to the Internal Revenue Service (IRS).

What amount does the bank report to the IRS?

$10,000Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300 PDF, Report of Cash Payments Over $10,000 Received in a Trade or Business.

Do banks report ACH transfers to the IRS?

Banks do not report deposits made into a bank account to the Internal Revenue Service except under abnormal circumstances, and reporting does not depend upon the total amount of money in the account.

Do banks report cashier's checks?

Note that under a separate reporting requirement, banks and other financial institutions report cash purchases of cashier's checks, treasurer's checks and/or bank checks, bank drafts, traveler's checks and money orders with a face value of more than $10,000 by filing currency transaction reports.

Do money orders get reported to IRS?

Money orders and cashier's checks under $10,000, when used in combination with other forms of cash for a single transaction that exceeds $10,000, are defined as cash for Form 8300 reporting purposes.08-Oct-2021

What happens when a currency transaction report is filed?

A currency transaction report (CTR) is used to report to regulators any currency transaction that exceeds $10,000. The CTR is part of anti-money laundering efforts to ensure that the money is not being used for illicit or regulated activities. ... Banks do not have to tell you when they file a CTR unless you ask.

When do you file Form 8300?

Generally, a business must file Form 8300 within 15 days after they receive the cash.

How to report suspicious transactions on Form 8300?

The business may report suspicious transactions by checking the "suspicious transaction" box (box 1b) on the top line of Form 8300. If a business suspects that a transaction is related to terrorist activity, the business should call the Financial Institutions Hotline at 866-556-3974.

What is an example of a nonresident alien with no SSN?

Example: A nonresident alien with no SSN or ITIN makes a purchase requiring Form 8300 reporting and presents a Mexican driver's license to verify his name and address. A driver's license issued by a foreign government would be acceptable documentation for name and address verification purposes.

What is the form to report cash payments?

The law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing IRS/FinCEN Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business PDF. Transactions that require Form 8300 include, but are not limited to:

How long do you have to report a transaction?

Related transactions are transactions between a payer, or an agent of the payer, and a recipient of cash that occur within a 24-hour period. If the same payer makes two or more transactions totaling more than $10,000 in a 24-hour period, the business must treat the transactions as one transaction and report the payments. A 24-hour period is 24 hours, not necessarily a calendar day or banking day.

How many hours apart are transactions related?

Transactions are related even if they are more than 24 hours apart when a business knows, or has reason to know, that each is a series of connected transactions.

When is a cashier's check required to report a transaction?

When a customer uses currency of more than $10,000 to purchase a monetary instrument, the financial institution issuing the cashier's check, bank draft, traveler's check or money order is required to report the transaction by filing the FinCEN Currency Transaction Report (CTR).

What happens if you don't file Form 8300?

The statement must also indicate that you provided this information to the IRS. Civil and criminal penalties may apply if you fail to file Form 8300 and provide a written statement to each person named on Form 8300. Penalty amounts are adjusted annually for inflation.

When do you need to file Form 8300?

Besides filing Form 8300, you also need to provide a written statement to each party whose name you included on the Form 8300 by January 31 of the year following the reportable transaction. This statement must include the name, address, contact person and telephone number of your business and the aggregate amount of reportable cash.

When will Form 8300 be efiled?

For more information about Form 8300 e-filing, see the FinCEN news release announcing electronic filing. Effective April 8, 2019 , Form 8300 filers have the option to batch file their reports as opposed to discrete filing.

Where to mail Form 8300?

You may mail Form 8300 to the IRS at: Detroit Federal Building, P.O. Box 32621, Detroit, Michigan 48232. Regardless of whether you file electronically or on paper, you must timely file a complete and accurate form.

What is the amount of cash you need to report on Form 8300?

Form 8300 and Reporting Cash Payments of Over $10,000. Generally, if you're in a trade or business and receive more than $10,000 in cash in a single transaction or in related transactions, you must file Form 8300.

What Does the IRS do with Form 8300?

Even though the IRS will keep detailed records of all of your forms and files, it’s still a good idea to maintain copies of everything you file for at least five years. Form 8300 is essentially for the IRS’s record keeping to make sure that your business is being honest about its transactional reporting.

What is the number to call to file Form 8300?

Don’t get flagged by the IRS for an error that could have been prevented by a tax professional; call Community Tax today (888) 684-5803.

How long does it take to file Form 8300?

Form 8300 Requirements. The IRS requires that you file Form 8300 within 15 days of receiving the money in a transaction. Failing to do so will accrue you or your business penalties if the IRS finds out. If you simply fail to file on time, then the penalties will be $100 for each occurrence. If your business makes less than $5 million per year, ...

How does the IRS make sure that businesses stay honest?

One way the IRS makes sure that businesses stay honest is by requiring Form 8300. If you run a business that handles large cash deals, hiring a tax professional, whether it be a CPA or enrolled agent, should be a top priority. The IRS has little tolerance for errors and failure to file Form 8300 can result in penalties.

How much cash is required to be reported on Form 8300?

All transactions that are considered related and exceed $10,000 in cash payments as a whole, must be reported in a Form 8300. It doesn’t matter how many transactions a deal is broken into or how long (within a 12-month period of time) your transactions are spaced out; if the IRS considers them to be related, you can be penalized for failing to file.

Who is required to give detailed information on a business transaction?

The person on whose behalf this transaction was conducted: If you are a business owner and one of your employees handles the transaction, you are required to give detailed information such as their name and employee ID.

How much can you pay in penalties for a business that makes less than $5 million a year?

If your business makes less than $5 million per year, the maximum amount you can pay the IRS in penalties is $500,000 per fiscal year. However, if you correct the failure to file within 30 days, the penalty ceiling will drop to $75,000. Other important requirements include:

When do you have to file an 8300?

If multiple payments are made in cash to satisfy bail and the initial payment does not exceed $10,000, the initial payment and subsequent payments must be aggregated and the information return must be filed by the 15th day after receipt of the payment that causes the aggregate amount to exceed $10,000 in cash. In such cases, the reporting requirement can be satisfied by sending a single written statement with the aggregate Form 8300 amounts listed relating to that payer.

What is IRS Form 8938?

IRS form 8938 is a form developed to ensure individuals with Specified Foreign Financial Assets get into compliance by disclosing their foreign assets and information to the IRS. The form is “average” when it comes to complexity of IRS forms. It generally only requires an individual to identify, list, and report assets and accounts (under certain scenarios) to the IRS.

What is suspicious transaction?

A suspicious transaction is a transaction in which it appears that a person is attempting to cause Form 8300 not to be filed, or to file a false or incomplete form.

How long does it take for a transaction to be related?

Transactions are considered related even if they occur over a period of more than 24 hours if the recipient knows, or has reason to know, that each transaction is one of a series of connected transactions.

What is the penalty for not reporting cash?

A minimum penalty of $25,000 may be imposed if the failure is due to an intentional or willful disregard of the cash reporting requirements.

What is the penalty for not furnishing a timely statement?

A minimum penalty of $25,000 may be imposed if the failure is due to an intentional or willful disregard of the cash reporting requirements.

When is a FBAR required?

An FBAR is required to be filed when a person or business (explained below) has an annual aggregate total of foreign accounts that exceeds $10,000 on any day throughout the year. It does not matter if all that money is in one account or if a person had 11 accounts with $1000.00 in each account. Once your overseas foreign accounts exceed $10,000, it is now time to report all of the foreign accounts.

What is Form 8300?

Form 8300 is a component of the monetary and currency reporting regime under the Bank Secrecy Act and ...

What is a transaction subject to Form 8300?

A “transaction” subject to Form 8300 reporting includes, but is not limited to, the following: A sale of goods or services; A sale of real property; A sale of intangible property; A rental of real or personal property; An exchange of currency for other currency; The establishment, maintenance of, or contribution to an escrow, trust, ...

How long does it take to file Form 8300?

§ 6050I and 31 U.S.C. § 5331, that person is required to file a Form 8300 with the IRS within 15 days of the cash receipt. A person must also file Form 8300 if ...

What is not considered cash on a 8300?

Personal checks drawn on the writer’s account as well as a cashier’s check, bank draft, traveler’s check, or money order with a face value of more than $10,000 are not considered “cash” for Form 8300 purposes.

How long is a person fined for a violation of Title 31?

If a person willfully violates 31 U.S.C. § 5331, then the person may be fined up to $250,000 and/or imprisoned for up to five years. However, if the violation is committed while violating another law or committed repeat of a pattern of illegal activities involving more than $100,000 in any 12-month period, then the fine ceiling is increased to $500,000 and/or imprisonment for up to ten years.

Do financial institutions need to file Form 8300?

First, financial institutions are not required file a Form 8300 because such entities are required to file a Currency Transaction Report (“CTR”) under other provisions of the Bank Secrecy Act and its regulations. Second, transactions that occur entirely outside the United States and its territories do not require the filing of a Form 8300.

Who is required to report cash receipts on Form 8300?

It is important to note that a person who acts as an agent and holds cash for more than 15 days for the principal is required to report the cash receipt on a Form 8300. A “transaction” subject ...