Negative Leverage Ratio. Most typically, a negative leverage ratio refers to the negative return on equity that results from the higher interest on debt than the investment return, but a negative leverage ratio may also refer to the debt-to-equity ratio resulting from a company with a negative net worth.

What does negative financial leverage ratio mean?

Negative leverage does not necessarily mean that borrowed funds should not be used to finance a particular real estate investment. It may be the case that the reduced return on equity due to negative leverage is still acceptable to the investor, even with the increased risk of default. Thus, if there is no other alternative for financing the ...

What does leverage ratio Tell Me?

- What is leverage, and why is it important?

- How does leverage work?

- What are the types of leverage?

- Is financial leverage good or bad? What are the pros and cons?

- What are the differences between leverage and margin?

- How do you calculate leverage?

What is optimum leverage ratio?

The Optimal Portfolio Leverage Ratio provides the level of leverage to use to attain the highest expected long-term terminal value of an investment and is calculated independently of investors’ indifference curves.

How to calculate leverage ratio?

The Various Types Of Leverage Ratios

- Financial Leverage. The level of debt or borrowed funds is the cornerstone of this ratio and determines the amount of debt a business would utilize to fund its operations.

- Operating Leverage. This is a ratio that determines the percentage of fixed costs to variable costs. ...

- Combined Leverage. ...

What happens if financial leverage is negative?

Negative financial leverage: A negative financial leverage occurs when the assets acquired with the debts and preferred stock generate a rate of return that is less than the rate of interest or dividend payable to the providers of debts or preferred stock. Negative financial leverage is a loss for common stockholders.

Is negative leverage good?

Negative leverage does not necessarily mean that borrowed funds should not be used to finance a particular real estate investment. It may be the case that the reduced return on equity due to negative leverage is still acceptable to the investor, even with the increased risk of default.

Is financial leverage positive or negative explain?

The use of positive leverage can greatly increase the return on investment from what would be possible if one were only to invest using internal cash flows. However, leverage can turn negative if the rate of return on invested funds declines, or if the interest rate on borrowed funds increases.

What does a low financial leverage ratio mean?

The lower your leverage ratio is, the easier it will be for you to secure a loan. The higher your ratio, the higher financial risk and you are less likely to receive favorable terms or be overall denied from loans.

How can negative leverage be reversed?

A lower cash flow after debt service reduces the property's cash-on-cash return. To reverse this trend, property values need to be adjusted downward to compensate for higher interest rates.

What is a healthy leverage?

You might be wondering, “What is a good leverage ratio?” A debt ratio of 0.5 or less is optimal. If your debt ratio is greater than 1, this means your company has more liabilities than it does assets.

How do you interpret financial leverage ratio?

For instance, with the debt-to-equity ratio — arguably the most prominent financial leverage equation — you want your ratio to be below 1.0. A ratio of 0.1 indicates that a business has virtually no debt relative to equity and a ratio of 1.0 means a company's debt and equity are equal.

How do you interpret financial leverage?

The degree of financial leverage (DFL) measures the percentage change in EPS for a unit change in operating income, also known as earnings before interest and taxes (EBIT). This ratio indicates that the higher the degree of financial leverage, the more volatile earnings will be.

What does negative DFL mean?

When interest exceeds operating profit, the firm is showing a net loss and DFL is negative. This negative DFL means that an increase in operating profit will lead to a decrease in the firm's net loss and vice versa.

What is good financial leverage ratio?

A financial leverage ratio of less than 1 is usually considered good by industry standards. A leverage ratio higher than 1 can cause a company to be considered a risky investment by lenders and potential investors, while a financial leverage ratio higher than 2 is cause for concern.

What does low leverage mean for a business?

If a company's debt obligations compared to the rest of the money on its income statement are lower (or it has a low leverage ratio), that lower amount of debt will routinely lead investors to be less worried about volatility.

How do you know if a company is highly leveraged?

If the same business used $2.5 million of its own money and $2.5 million of borrowed cash to buy the same piece of real estate, the company is using financial leverage. If the same business borrows the entire sum of $5 million to purchase the property, that business is considered to be highly leveraged.

What Is Negative Leverage?

Negative leverage occurs when a company purchases an investment using borrowed funds, and the borrowed money has a greater cost, or higher interest rate, than the return made on the investment. This sometimes occurs when companies use adjustable rates to purchase or construct property, and interest rates rise rapidly. Negative leverage also results from a negative stockholders' equity or net worth.

Why is leverage negative?

In general, company leadership and investors are comfortable with a certain level of debt and leverage due to the potentially higher return on equity it generates. Most typically, a negative leverage ratio refers to the negative return on equity that results from the higher interest on debt than the investment return, but a negative leverage ratio may also refer to the debt-to-equity ratio resulting from a company with a negative net worth.

Why is leverage ratio important?

Analysts use the the leverage ratio as a measure of the effectiveness of debt-versus-equity investing decisions. These ratios help illustrate debt's impact on the balance sheet, and can act as a good indicator for investors as to whether or not their equity in a company is 0n track to deliver their anticipated return.

What is leverage in finance?

Financial leverage refers to the level of debt a company takes on to fund day-to-day operations, purchase assets or finance expansion. The deductions that a company takes for interest payments may mitigate the negative impact of interest expenses on profits, since the deductions also reduce the company's tax burdens.

What does higher ratios mean?

Higher ratios indicate higher debt levels. Generally, the higher the debt, the riskier the company and riskier its stock. All creditors and debt holders have first claim to a company's assets in the event of failure. If a company with high debt levels fails, its shareholders may not receive anything.

What happens when a company has had problems raising money to cover historical net losses?

This typically occurs when a company has had problems raising money to cover historical net losses. Those net losses accrue and eventually surpass the equity from issued stock.

Ways To Improve Your Finances Today

Negative leverage also results from a negative stockholders’ equity or net worth. For example, XYZ company obtains a long term debt at a rate of 12%. The only difference in this example is how much idle cash is sitting on the balance sheet. When cash piles up on a company’s balance sheet, it can drag down a company’s return on equity.

In Operating Income

Dividing return on equity by stockholder equity will give you the ROE. Typically, the higher the ROE figure, the more effectively the company is using its equity to generate profits. Financial leverage is the ratio of equity and financial debt of a company.

Using Return On Equity Gets Complicated When Shareholder Equity Is Negative

Distributing idle cash to shareholders is effectively a way to leverage a company, and boost its return on equity. To demonstrate, I’ll use the lemonade stand example, with and without idle cash on the balance sheet.

How To Trade In A Car With Negative Equity: 3 Options

The ROE does not tell the whole story, however, and it can provide a skewed and incorrect view of business operations if it is not considered with other indicators. Sometimes, I still struggle trying to understand what happened to equity.

What Is Neutral Leverage?

The stock then rallied as investors started to realize that HP wasn’t as bad an investment as its negative ROE indicated. For most firms, an ROE level around 10% is considered strong and covers their costs of capital. So, if leverage increases productivity, then it is “good” leverage.

What Does It Mean If Stockholder Equity Is Less Than Total Liability?

Negative shareholder equity is this funny accounting thing most people could care less about, but I think it’s a very instructive indicator that something unusual is going on with a stock. Companies that exhibit this behavior might be worth investigating further.

What does negative leverage mean?

Negative leverage does not necessarily mean that borrowed funds should not be used to finance a particular real estate investment. It may be the case that the reduced return on equity due to negative leverage is still acceptable to the investor, even with the increased risk of default. Thus, if there is no other alternative for financing ...

What are the risks of negative leverage?

They come also from potential reductions in the Net Operating Income (NOI) and value of the property over its holding period.

What is the average leverage return for a 10 year?

According to the latest release of the NCREIF Index for the fourth quarter of 2019, the average one-year, 10-year and 40-year leveraged returns continued to be higher than the respective unleveraged returns. In particular, the one-year (from fourth quarter of 2018 until the fourth quarter of 2019) leveraged return was 7.7% while the respective unleveraged one was 6.7%, Also, the 10-year and 40-year average leveraged returns were 8.6% and 9.5% respectively, while the respective unleveraged returns were 7.5% and 9%. This indicates that, on average, U.S. institutional investors continued to achieve positive leverage. It should be noted that these leveraged and unleveraged return figures represent averages of the performance of all property types (office, multifamily, retail and industrial properties) included in the NCREIF database.

What happens if IRR is higher than unleveraged?

Simply, if the leveraged IRR is higher than the unleveraged IRR then the use of debt will result in positive leverage, while if the leveraged IRR is lower than the unleveraged IRR the use of debt will result in negative leverage.

What happens if NOI is reduced?

Significant reduction of NOI may force the investor to use his/her own funds to pay a portion or all of the debt service. Such circumstances might result in negative leverage, which will reduce the investor’s overall return and could lead to losses. In the worst case, in which the investor cannot make the required debt payments, ...

What is adjustable rate mortgage?

If an adjustable-rate mortgage is used, the risk of borrowing increases considerably. As the name implies, adjustable-rate mortgages are loans with variable interest rates that are adjusted during the term of the loan, depending on market interest rates.

Is negative leverage bad for property?

Wurtzebach and Miles (1994) argue that negative leverage may not be necessarily bad, as some property investors may be willing to take that risk in anticipation of significant tax shelter benefits and capital gain s upon the sale of the property. Investors can use tax shelters in the case of improved properties by subtracting depreciation from taxable income, thereby achieving tax savings. In essence, such tax savings increase the property’s cash flow.

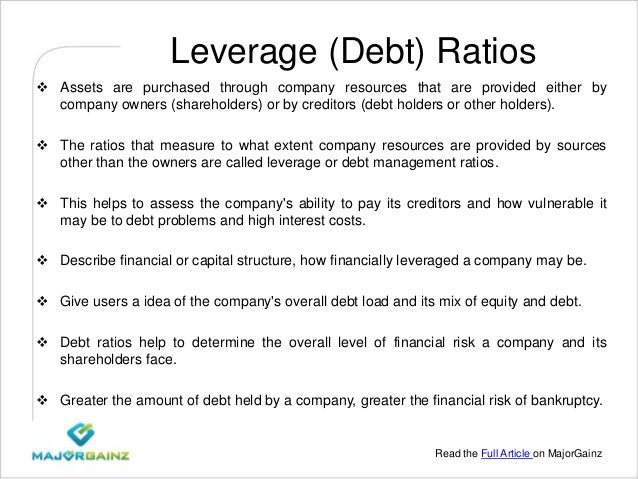

What Is a Leverage Ratio?

A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its financial obligations. The leverage ratio category is important because companies rely on a mixture of equity and debt to finance their operations, and knowing the amount of debt held by a company is useful in evaluating whether it can pay off its debts as they come due. Several common leverage ratios are discussed below.

What is consumer leverage ratio?

Finally, the consumer leverage ratio refers to the level of consumer debt compared to disposable income and is used in economic analysis and by policymakers.

How does capital requirements affect leverage ratios?

There are several forms of capital requirements and minimum reserve placed on American banks through the FDIC and the Comptroller of the Currency that indirectly impacts leverage ratios. The level of scrutiny paid to leverage ratios has increased since the Great Recession of 2007 to 2009 when banks that were " too big to fail " were a calling card to make banks more solvent. These restrictions naturally limit the number of loans made because it is more difficult and more expensive for a bank to raise capital than it is to borrow funds. Higher capital requirements can reduce dividends or dilute share value if more shares are issued.

Why is leverage ratio important?

The leverage ratio category is important because companies rely on a mixture of equity and debt to finance their operations, and knowing the amount of debt held by a company is useful in evaluating whether it can pay off its debts as they come due. Several common leverage ratios are discussed below.

What is equity multiplier?

The equity multiplier is a component of the DuPont analysis for calculating return on equity (ROE):

What does it mean when a company has a high debt/equity ratio?

A high debt/equity ratio generally indicates that a company has been aggressive in financing its growth with debt. This can result in volatile earnings as a result of the additional interest expense. If the company's interest expense grows too high, it may increase the company's chances of a default or bankruptcy.

Is debt an underlying factor?

Although debt is not specifically referenced in the formula, it is an underlying factor given that total assets includes debt.

What is negative leverage?

Negative leverage occurs when a company purchases an investment using borrowed funds, and the borrowed money has a greater cost, or higher interest rate, than the return made on the investment. Negative leverage also results from a negative stockholders' equity or net worth.

What is leverage in finance?

Financial leverage is the percentage of a company's equity and financial debt. It is an essential element of financial policy for a company. Financial leverage can also mean using financial resources at a fixed fee for the company. Two-way financial leverage implies that there are two dollars of financial debt for one dollar of equity. This helps the organization to use leverage to fund acquisitions of properties.

What happens when you buy stocks on margin?

Financial leverage can be caused when buying stocks on margin, for example. When buying on margin, you borrow money from the bank in order to buy more stocks than you would've been able to if you hadn't bought on margin. So let's say you had 50% margin. Without buying on margin, you can buy 100 shares in apple. After using your 50% margin, you borrow money and now you can

Why is leverage important?

Leverage is also an effective investment strategy, as it lets companies set a floor for company operations to grow. For example, it can be used to propose business expansion restrictions until the expected return on incremental investment is smaller than the debt expense.

Why is leverage dangerous?

Leverage is dangerous because it cuts both ways. Unless you have a huge margin of safety and a statistical advantage (rare) you are facing asymmetric risk.

Is negative debt a negative asset?

On the other hand, in a financial leverage ratio like debt over equity, a negative value is unusual. Negative debt is usually accounted for as an asset, negative assets are usually accounted for as liabilities.

What does negative leverage mean?

what does a negative leverage ratio mean? Most typically, a negative leverage ratio refers to the negative return on equity that results from the higher interest on debt than the investment return, but a negative leverage ratio may also refer to the debt-to-equity ratio resulting from a company with a negative net worth.

What is a good leverage ratio?

What is a good financial leverage ratio? A figure of 0.5 or less is ideal. In other words, no more than half of the company's assets should be financed by debt. In other words, a debt ratio of 0.5 will necessarily mean a debt-to-equity ratio of 1.

What is positive leverage?

Positive leverage arises when a business or individual borrows funds and then invests the funds at an interest rate higher than the rate at which they were borrowed. However, leverage can turn negative if the rate of return on invested funds declines, or if the interest rate on borrowed funds increases. what does a negative leverage ratio mean?

What is leverage ratio?

A leverage ratio is any kind of financial ratio. Financial Analysis Ratios Glossary Glossary of terms and definitions for common financial analysis ratios terms. It's important to have an understanding of these important terms. that indicates the level of debt incurred by a business entity against several other accounts in its balance sheet.

What does higher leverage ratio mean?

A higher ratio indicates a greater ability to meet obligations. in conjunction with the leverage ratios to measure a company’s ability to pay its financial obligations. Debt Capacity Debt capacity refers to the total amount of debt a business can incur and repay according to the terms of the debt agreement. .

What are the various types of leverage ratios?

An operating leverage ratio refers to the percentage or ratio of fixed costs to variable costs. A company that has high operating leverage bears a large proportion of fixed costs in its operations and is a capital intensive firm. Small changes in sales volume would result in a large change in earnings and return on investment. A negative scenario for this type of company could be when its high fixed costs are not covered by earnings because the market demand for the product decreases. An example of a capital-intensive business is an automobile manufacturing company.

How does leverage affect earnings?

If leverage can multiply earnings, it can also multiply risk. Having both high operating and financial leverage ratios can be very risky for a business. A high operating leverage ratio illustrates that a company is generating few sales, yet has high costs or margins that need to be covered. This may either result in a lower income target or insufficient operating income to cover other expenses and will result in negative earnings for the company. On the other hand, high financial leverage ratios occur when the return on investment (ROI) does not exceed the interest paid on loans. This will significantly decrease the company’s profitability and earnings per share.

What is combined leverage ratio?

A combined leverage ratio refers to the combination of using operating leverage and financial leverage. For example, when viewing the balance sheet and income statement, operating leverage influences the upper half of the income statement through operating income while the lower half consists of financial leverage, wherein earnings per share to the stockholders can be assessed.

What is debt service coverage ratio?

Debt service coverage ratio: The ability of a company to pay all debt obligations, including repayment of principal and interest. Cash coverage ratio: The ability of a company to pay interest expense with its cash balance. Asset coverage ratio: The ability of a company to repay its debt obligations with its assets.

Why is leverage important?

It also evaluates company solvency and capital structure. Having high leverage in a firm’s capital structure can be risky, but it also provides benefits. The use of leverage is beneficial during times when the firm is earning profits, as they become amplified.

Why is financial leverage positive?

In this situation, the financial leverage is positive because the after-tax rate of return is higher than the after-tax rate of interest on long-term debts.

What is leverage in financial terms?

Financial leverage (or only leverage) means acquiring assets with the funds provided by creditors and preferred stockholders for the benefit of common stockholders. Financial leverage is a two-edged sword. It may be positive or negative.

What is positive leverage?

A positive financial leverage means that the assets acquired with the funds provided by creditors and preferred stockholders generate a rate of return that is higher than the rate of interest or dividend payable to the providers of funds.

What is the return on common stockholders' equity of the third alternative?

The third alternative generates 15.4% return on common stockholders’ equity which is the highest among three alternatives. The reason is that the preferred stock in this case is replaced with the debt. The interest on debt is a tax deductible expense while the dividend on preferred stock is not.

How much return does the first alternative generate?

The first alternative generates 10.5% return on common stockholders’ equity, there is no debt or preferred stock involved, the leverage is therefore zero in this case.

Is debt more effective than preferred stock?

Impact of income tax on financial leverage: Debt is considered a more effective source of positive financial leverage than preferred stock because the interest on debt is tax deductible but dividend on preferred stock is not. For explanation of this point, consider the following example.