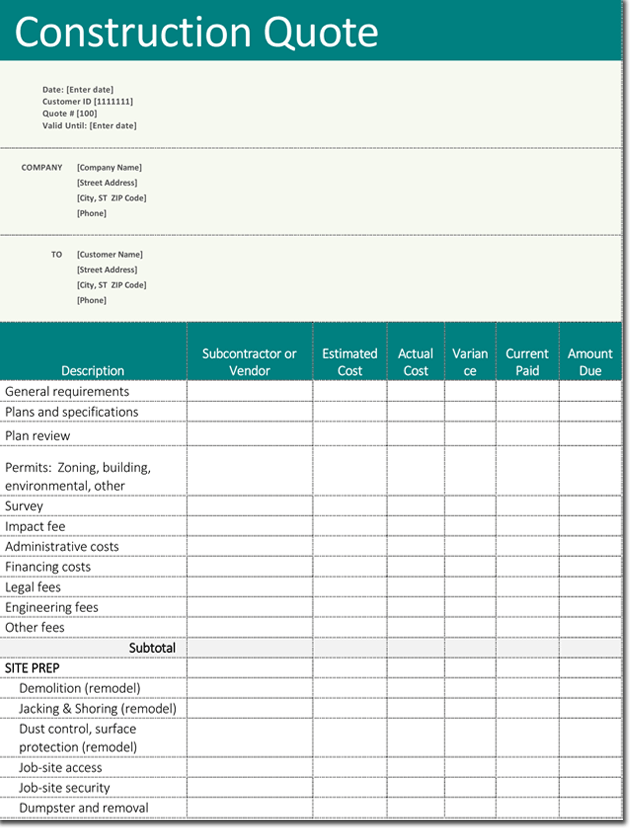

A job cost sheet normally includes the following information:

- Job Number.

- Job starting date.

- Job completion date.

- Description of the job.

- Number of completed units.

- The total cost of labor.

- Total direct material cost.

- Total manufacturing overhead.

- Summary of the total cost.

- No of sold units and no of units in stock .

What is the purpose of a job cost sheet?

The actual costs of a job typically include the following items:

- Direct materials

- Shipping and handling

- Sales taxes

- Supplies

- Direct labor

- Payroll taxes

- Employee benefits

- Outsourced costs

- Allocated overhead costs

What does a job cost sheet contain?

- raw material;

- work in progress;

- and finished goods.

How to prepare a cost sheet?

Items Required for Preparation of the Cost Sheet:

- i. Stock of Raw Materials. ...

- ii. Stock of Work-in-Progress: Work-in-progress refers to the semi-finished goods on which some work has been done but which are not yet complete at the end of the period.

- iii. Stock of Finished Goods: Stock of finished goods refers to the stock of products on which all factory work has been completed.

- iv. ...

- v. ...

- vi. ...

What is Job Order cost sheet?

What is Job Order Costing?

- Job Order Costing vs Process Costing. ...

- Actual Costing (form of job order costing) One type of job-order costing is called actual costing. ...

- Normal Costing. ...

- The formula to determine this overhead rate: Where the cost allocation base refers to the estimated machine hours or estimated labor hours, depending on which one the company chooses to ...

What information is on a job cost sheet?

Why is the job cost sheet used?

Who is responsible for recording manufacturing costs?

Is administrative cost included in product cost?

What is a Job Cost Sheet?

A job cost sheet is a compilation of the actual costs of a job. The report is compiled by the accounting department and distributed to the management team, to see if a job was correctly bid. The sheet is usually completed after a job has been closed, though it can be compiled on a concurrent basis. The actual costs of a job typically include the following items:

What is an outsourced cost sheet?

Outsourced costs. Allocated overhead costs. A job cost sheet can be quite complex to create, since it may involve different labor rates for dozens of people, as well as a labor allocation for the payroll taxes and benefits incurred by those people, and overtime, plus potentially hundreds of components that should include the cost ...

What is job cost sheet?

Definition and explanation. Job cost sheet is a complete sheet, which is prepared by the factory accountant for every job started in the factory. It is a primary document for accumulating all costs related to a particular job. In a job order costing system, we maintain a job cost sheet for each job. It tells about the total cost of a particular job.

What is cost summary?

Cost summary (total cost of materials, labor, and manufacturing overheads for a particular job and cost per unit)

What is job number?

Job Number (It is a number, assigned to each job by the factory accountant) Description (It’s a complete name of the product which is to be manufactured) Total cost of raw material (With date, requisition #, quantity and rate) Total cost of Direct labor (With time card #, labor hours, rate)

What Does Job Cost Sheet Mean?

This is where a job cost sheet comes into play. A job cost sheet is exactly what it sounds like. It’s a record of the costs incurred for a single job. A job cost sheet usually includes the customer name, address, job number, job description, date started, date completed, and estimated completion date.

Why use job cost sheets?

Management can use job cost sheets not only to improve production efficiencies and cut costs, but they can also use these sheet to help estimate product sale prices. For instance, Gibson might see the job cost sheet and realize the job actually cost $4,500 to make, but it only quoted the customer $3,900 initially. A. B.

What information is on a job cost sheet?

The information about a job or order that is shown on job cost sheet usually includes job number, product name, starting date, completing date, number of units completed etc.

Why is the job cost sheet used?

It is used as a subsidiary ledger to the work in process account because it contains all details about the job in process.

Who is responsible for recording manufacturing costs?

The accounting department is responsible to record all manufacturing costs ( direct materials, direct labor, and manufacturing overhead) on the job cost sheet. A separate job cost sheet is prepared for each individual job.

Is administrative cost included in product cost?

No, only those costs incurred in relation to manufacturing operations are included in the Product Cost. Administrative and Ordering Costs are classified as Operating Expenses, not as Manufacturing Costs, hence are not shown in the Job Cost Sheet.