What states are non spousal States?

Spousal Consent In states without community property laws, such as Florida, you can name anyone as a beneficiary without even consulting your spouse. In a community property state, you can only name someone other than your spouse as the beneficiary if your significant other signs a spousal consent form. Correspondingly, is NJ A spousal State? New Jersey is not a community property state.

What states do not have alimony?

in many states, including Texas, you will generally not pay alimony if your spouse cheats. Nor will you pay alimony if you are such a horrible SOB that you drive her to seek comfort elsewhere. (not to excuse infidelity, but there are more than one marital sins).

What states require spousal consent?

What are the spousal States?

- Arizona.

- California.

- Idaho.

- Louisiana.

- Nevada.

- New Mexico.

- Texas.

- Washington.

What states recognize spousal abandonment?

- What is Considered Abandonment in a Marriage?

- Will Abandonment Have an Effect on Finances?

- The Emotional Turmoil Abandonment May Bring

- How to Handle Child Custody After Abandonment

- Marital Abandonment and Divorce

- How to Claim Abandonment

Which states are non spousal States?

Which States Are Community Property States?Community property states include: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. ... California, Nevada and Washington also include domestic partnerships under community property law.More items...•Jan 25, 2022

Is Florida a spousal state for mortgage?

Before the law changed, if the spouse was on the Homestead Act they were required to sign the mortgage (even if not on title)....By admin.STATEFLORIDACOMMUNITY PROPERTYNoDOWERNoHOMESTEADYesSPOUSE MUST SIGNYes; If homestead property, must sign mortgage, a separate waiver is insufficient49 more columns•Feb 26, 2012

Is California a spousal state?

Along with nine other states, California is a community property state. Spouses are entitled to one-half of the marital assets when they split up. It doesn't matter which spouse contributed more during the marriage.Jun 20, 2019

Is Texas a spousal state?

Yes. Texas is a community property state, which means that most property acquired during the marriage belongs to both spouses, and the court must divide it at divorce. In contrast, each spouse gets to keep his or her separate property when the marriage ends.

Is Florida a 50 50 state in a divorce?

Under Florida divorce law, all marital property is subject to an equitable distribution. Typically, the court will divide marital property 50/50, unless there are reasons why an equal split would be inequitable (unfair).Sep 23, 2020

Who makes house payment during divorce?

Ideally, spouses either agree to sell their home or refinance their mortgage so that only one person's name is on it. That former spouse is then responsible for making the mortgage payments each month.

Is a house owned before marriage marital property California?

The answer is both simple and complex. Owning a house before marriage of course means it is premarital property. It also does mean you should have a separate property interest in it during divorce.

Is California Still a community property state?

California is a community property state. In plain English, this means that generally, property acquired during the marriage by either spouse is presumed to be owned by each spouse equally.

Are separate bank accounts marital property California?

Separate bank accounts can still be considered community property. If you opened a bank account during your marriage, for example, even if it is only in your name, state law views it as communal property.Sep 30, 2021

When a spouse dies Who gets the house in Texas?

In Texas, a married couple can agree in writing that all or part of their community property will go to the surviving spouse when one person dies. This is called a right of survivorship agreement. The right of survivorship agreement must be filed with the county court records where the couple lives.Jul 13, 2021

Who owns the house in a marriage?

The common law system provides that property acquired by one member of a married couple is owned completely and solely by that person. Of course, if the title or deed to a piece of property is put in the names of both spouses, however, then that property would belong to both spouses.May 19, 2020

Who gets the house in Texas divorce?

During a divorce, who gets the house? Generally, both spouses have a right to live in the house while a divorce is pending, but there are times when one spouse can exclude the other from the house. After you initiate a divorce, you or your spouse can file a motion for a temporary injunction.May 12, 2021

What Does Community Property Mean?

Community property is the principle that all the assets and (most) debts acquired during a marriage are split 50/50 between the spouses, even if the individual spouse was not the one who accrued the debt. Creditors can go after joint assets in a community property state no matter whose name is on the title document to the asset.

How Does Community Property Affect the VA Loan Application Process?

According to the VA, when applying for a VA loan in a community property state the lender must “obtain a credit report on the non-purchasing spouse in addition to the Veteran’s credit report, consider the spouse’s credit history in reaching a determination [, and] include the monthly payment of the non-purchasing spouse’s debts on the VA Form 26-6393.” These are not the only steps a VA lender must take in ascertaining a married couple’s creditworthiness in a community property state, but they are the most significant..

What Is the VA Loan Process in Spousal States?

In spousal states, the spouse must be included in signing documents acknowledging the loan. These documents usually include the Deed of Trust, the Right to Cancel, the Truth in Lending, and some title and settlement documents.

What Can Be Done to Improve Credit and DTI?

If you are in a community property state, there are some steps you and your spouse can take to prepare for the application process and receive the best terms. To lower DTI and improve credit history, collectively take these steps, at least, six months prior to beginning the application process:

We Can Help You Get the Best Terms

At Arcus VA Mortgage, we specialize in VA loans and helping Veterans get the best terms possible. No matter where you and your spouse are credit-wise, we can advise you on how to get where you want to be. If you’d like to get more information on VA loans, or how your state’s marital property laws govern the process, contact us.

Which states have cut back on spousal support?

As of 2018, the states that may still grant permanent alimony are New Jersey, Connecticut, Vermont, North Carolina, West Virginia, Florida, and Oregon.

What is spousal support?

Spousal support refers to financial payments made to one spouse by the other in the event of a legal separation or divorce. The amount of these payments is determined by several factors that consider the financial ability of one spouse to pay a specified amount to the other spouse.

What to do if you don't pay spousal support?

In order to ensure that you are fully aware of your state’s laws, and to avoid any legal penalties for failing to make spousal support payments on time, you should consult with a skilled and knowledgeable divorce lawyer.

What does a judge consider when awarding spousal support?

Judges that award permanent spousal support consider the length of the marriage, one spouse’s contribution to the career or lifestyle of the other spouse, and any especially significant financial inequality. Traditionally, states would limit or prohibit spousal support if the spouse that needed financial support was somehow at fault in ...

How much spousal support is required in divorce?

Only ten to fifteen percent of all divorces include spousal support as part of the divorce decree. As noted above, spousal support is not commonly permanent. Below are some examples of when spousal support may end include: When the terms set forth in the spousal support order are met; The terms set forth in the prenuptial agreement are met;

What are the grounds for limiting or prohibiting spousal support?

Some states consider behavior such as adultery, abandonment, and marital misconduct as grounds for limiting or prohibiting spousal support. To find out if your state is one of those states, you should contact a divorce lawyer who will be able to explain all of the details of your state’s law.

What expenses are included in a divorce?

Such expenses include food, clothing, housing, and basic travel (gas, auto insurance, etc). Not all divorces involve spousal support, especially if both spouses have stable incomes and are capable of covering their own basic needs. Only ten to fifteen percent of all divorces include spousal support as part of the divorce decree.

Does Alaska have a community property act?

No. ALASKA. Yes; In 1998 AK passed a unique Community Property Act, under which spouse may opt-in to creation of a community property estate. However, for title purposes only the spouse (s) vested in title need sign the documents.

Do consensual liens have priority over homestead?

Yes; Consensual liens have priority over homestead. The homestead need not be waived. Homesteads normally will not appear in title evidence since they are created automatically. Yes, unless the property was acquired by one spouse before the marriage or by gift, devise or descent durring the marriage. No.

Do spouses have to sign a mortgage?

But, this law is no longer in effect. Spouses are now only required to sign a mortgage if they are on title or a non-title borrower (which would require the mortgage to state that they are a non-titled borrower or the registry may not accept the recording).

Do non-loaning spouses have to sign property?

Be mindful of these additional requirements. Essentially all non bor rowing spouses must sign throughout the nation unless the subject property is in a state that is a common law jurisdiction without applicable homestead exemptions.

Can a non-borrower spouse get a mortgage loan in Arizona?

ARIZONA. Yes – However, if lender is looking to community property, such as wages or salary of the borrower spouse, for repayment of a mortgage loan, the non-borrower spouse must execute a marital community joinder to legally bind the marital community to the repayment of the mortgage loan. No.

Which states have different state tax schemes?

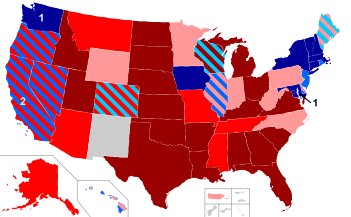

These are: Arizona, California, Louisiana, Nevada, Idaho, New Mexico, Texas, Washington, and Wisconsin. The rest of the remaining states employ different schemes, which can actually vary quite widely from state to state.

Can you choose a location for divorce?

Thus, distribution of property can vary from place to place. However, the parties generally cannot simply choose a location to file for divorce only because it may yield a more favorable distribution outcome for them.

How many states are community property states?

Only nine states are classified as community property states, but state laws vary; some lean more toward the community property standard, and others abide by a common law standard.

What happens if a married couple files taxes separately?

If a married couple files taxes separately, figuring out what is community property and what isn't can get complicated. The ownership of investment income, Social Security benefits, and even mortgage interest can be complicated by state laws.

What happens if there is a prenup?

What If There's a Prenup? Anything can happen in court, but the existence of a prenuptial agreement signed prior to the marriage will almost certainly determine the outcome of a divorce, even in a community property state. A prenuptial agreement almost always overrides the community property law.

What is common law property?

In contrast to community property, common law property is considered to be the property of the spouse who acquires it during a marriage unless it is put in the names of both spouses. In a common law state, for example, if one spouse purchases a car or a boat and has their name exclusively on the title, the car or boat belongs to that individual.

Can a divorced couple split assets 50/50?

Key Takeaways. Community property law requires that a divorcing couple split their assets 50/50, but only assets acquired while they were domiciled in the state. Property owned by either spouse prior to the marriage or after the legal separation may not be considered or divided as community property.

Is gifting a spouse considered shared?

And if you purchased property with a combination of community and individual funds, only the part bought with community funds is considered shared.

Is a community property state excluded from the 50/50 split?

Most of the time, property purchased in a community property state using funds that were earned in a state that is not a community property state is excluded from the assets to be split 50/50.