What Are the Five Steps of Posting in Accounting?

- Enter Account Name and Number. Income statement accounts include sales (aka revenues), cost of goods sold, marketing and advertising expenses, depreciation expenses, interest and taxes.

- Post the Entry Details. The second step is to post the date, description and reference number of each journal entry for each account during an accounting period.

- Enter the Debits and Credits. The recording of debits or credits is the next step in the posting process. Each transaction must have at least one debit and one credit.

- Find the Running Balances. The fourth step is to calculate the running debit and credit balance for each account. ...

- Correct Any Errors. The final step in the posting process is to check for mathematical and data transfer errors. ...

What are the steps in posting accounts?

Steps in posting involve the following: Various accounts, along with the transactions, are to be recorded in their respective ledgers. The general ledger is the ledger in which balances of all sub-ledgers and general journals are to be transferred.

What is the final step in the accounting posting process?

The final step in the posting process is to check for mathematical and data transfer errors. Accounting software packages may reduce these errors through automation, but verifying the numbers is a prudent step that prevents errors from propagating to the financial statements. AccountingTools: What Is Posting in Accounting?

What is an example of posting in accounting?

Posting in Accounting Examples. The details of XYZ internationals are as under: XYZ international issues 20 invoices to its customers and record each transaction in the sales account and the respective debtor’s account. Also, the company purchased from 10 suppliers the recorded in purchases accounts and respective creditors’ accounts.

What are the five steps of posting from the journal to Ledger?

The five steps of posting from the journal to ledger include typing the account name and number, specifying the details of the journal entry, entering the debits and credits for the transaction, calculating the running debit and credit balances, and correcting any errors.

What is the posting process in accounting?

Posting in accounting is when the balances in subledgers and the general journal are shifted into the general ledger. Posting only transfers the total balance in a subledger into the general ledger, not the individual transactions in the subledger.

What are the 6 steps in posting?

Terms in this set (6)Write date INTO LEDGER.Write JOURNAL page number INTO LEDGER.Write correct amount from journal INTO LEDGER.Calculate new balance FROM LEDGER.Enter new account balance INTO LEDGER.Step 6 - ONLY STEP IN JOURNAL. Enter ledger number into post reference column INTO JOURNAL.

What step in the accounting cycle is the posting process?

The 8 Steps of the Accounting CycleStep 1: Identify Transactions. ... Step 2: Record Transactions in a Journal. ... Step 3: Posting. ... Step 4: Unadjusted Trial Balance. ... Step 5: Worksheet. ... Step 6: Adjusting Journal Entries. ... Step 7: Financial Statements. ... Step 8: Closing the Books.

What are the 4 types of accounting?

Discovering the 4 Types of AccountingCorporate Accounting. ... Public Accounting. ... Government Accounting. ... Forensic Accounting. ... Learn More at Ohio University.

What is posting in accounting class 11?

Explanation: Posting means transferring the entries from the Journal to the Ledger Accounts. Recording of a transaction in the Journal is termed as Journalising. Thus, when entries are posted or transferred to the respective ledger accounts, this process is termed as posting.

How many steps are in the accounting process?

Steps in the Accounting Cycle#1 Transactions. Transactions: Financial transactions start the process. ... #2 Journal Entries. ... #3 Posting to the General Ledger (GL) ... #4 Trial Balance. ... #5 Worksheet. ... #6 Adjusting Entries. ... #7 Financial Statements. ... #8 Closing.

How do we post transactions to the ledger?

How to post journal entries to the general ledgerCreate journal entries.Make sure debits and credits are equal in your journal entries.Move each journal entry to its individual account in the ledger (e.g., Checking account)Use the same debits and credits and do not change any information.More items...•

What is accounting cycle in accounting?

The accounting cycle is the process of accepting, recording, sorting, and crediting payments made and received within a business during a particular accounting period.

What is the final step in a balance sheet?

The final step is to cross verify the balances and recheck whether there are any mathematical errors; if any of the errors found, rectify them so as to maintain proper records.

Why is posting in the ledger important?

Posting in the ledger is the manual process; hence manpower is needed. It ensures that all assets and liabilities are to be recorded properly. The balances of nominal accounts are directly transferred to the profit and loss account, and the balances related to balance sheet items are to be transferred to the general ledger account.

What is a ledger in accounting?

Posting in the ledger#N#Ledger Ledger in Accounting, also called the Second Book of Entry, is a book that summarizes all the journal entries in the form of debits & credits to use for future reference & create financial statements. read more#N#is the accounting process through which the balances of the general journal and various sub-ledgers are to be transferred at various intervals ranges from daily to yearly. It is very helpful and useful in large organizations, as keeping track of the balance becomes very easy. Also, with the posing in a ledger, the arithmetic accuracy of the accounts can be verified, and the balances can be analyzed thoroughly so as to maintain the proper and accurate records.

Is posting a manual process?

It is more of a manual process and involves manpower work. In the case of posting, consolidation of accounts is also required. With the advancement of technology, posting has become a traditional process, and it is rapidly eliminated due to the availability of automated software.

Is the debit balance credited on the debit side?

The amount is to be shown in the amount column, and the debit balance is to be debited debit side, and the credit balance is to be credited on the credit side. The balance in the nominal accounts is to be transferred directly to the profit and loss account. Assets are to be debited, and liabilities are to be credited.

How to record transactions in accounting?

Recording transactions is a procedure called journalizing. This is a chronological list of the transactions identified in the analysis stage. A double-entry accounting system records each transaction as a four-part journal entry. These parts are: 1 The account and amount of debit 2 The account and amount of credit 3 The transaction date 4 The transaction description

What is the accounting cycle?

It is a systematic series of steps that aids the collection, processing and reporting of financial data. While there are many versions of the accounting cycle that include greater detail, the general process includes five major steps essential to the integrity ...

Why do double entry accounting transactions always match?

Trial Balance. Because double entry accounting has a debit and credit made for every transaction, these amounts should always match. When they don’t, it indicates a problem which then needs tracking down. These comparisons are called trial balances.

What is journal posting?

Typically now, posting is an automated function at the end of the day or some other financial period, carried out by an accounting software application. In the hard copy world, several journals could have their contents transferred to the general ledger.

What is the process of recording transactions?

Recording transactions is a procedure called journalizing. This is a chronological list of the transactions identified in the analysis stage. A double-entry accounting system records each transaction as a four-part journal entry. These parts are: The account and amount of debit. The account and amount of credit. The transaction date.

What is general accounting?

General accounting procedures are a series of steps that guide the accountant or bookkeeper with a standard of conduct to create and maintain a detailed and accurate ledger, whether on paper or in a computer program.

What is the Accounting Cycle?

The accounting cycle is the various steps or stages of work or activity that we go through each year in accounting.

Steps in the Accounting Cycle

Source documents are documents, such as cash slips , invoices, etc. that form the source of, and serve as proof for, a transaction .

Closing Entries

There is a final step in the accounting cycle not shown above, which is the closing off of accounts (or closing entries ), which are done at the end of each year along with the production of the financial statements.

Manual vs Computerized Accounting Systems

It is important to note that these days many businesses use computerized accounting systems, and so the accounting cycle is largely automated.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

The Accounting Cycle Mini Quiz

1. True or false: Source documents are the first documents that exist relating to a transaction. *

What is posting in accounting?

Posting in accounting is when the balances in subledgers and the general journal are shifted into the general ledger. Posting only transfers the total balance in a subledger into the general ledger, not the individual transactions in the subledger. An accounting manager may elect to engage in posting relatively infrequently, such as once a month, ...

How often should an accounting manager post?

An accounting manager may elect to engage in posting relatively infrequently, such as once a month, or perhaps as frequently as once a day. Subledgers are only used when there is a large volume of transaction activity in a certain accounting area, such as inventory, accounts payable, or sales.

What happens if a posting accidentally does not occur?

If posting accidentally does not occur as part of the closing process, the totals in the general ledger will not be accurate, nor will the financial statements that are compiled from the general ledger.

What is the post in financial statements?

From the perspective of closing the books, posting is one of the key procedural steps required before financial statements can be created. In this process, all adjusting entries to the various subledgers and general journal must be made, after which their contents are posted to the general ledger.

Where is posting information stored?

Instead, all information is directly stored in the accounts listed in the general ledger. When posting is employed, someone researching information in the general ledger must "drill down" from the account totals posted into the relevant general ledger accounts, ...

What is the eight step accounting cycle?

The eight-step accounting cycle process makes accounting easier for bookkeepers and busy entrepreneurs. It can help to take the guesswork out of how to handle accounting activities. It also helps to ensure consistency, accuracy, and efficient financial performance analysis.

When is cash accounting recorded?

Cash accounting requires transactions to be recorded when cash is either received or paid. Double-entry bookkeeping calls for recording two entries with each transaction in order to manage a thoroughly developed balance sheet along with an income statement and cash flow statement.

What is the second step in the cycle?

The second step in the cycle is the creation of journal entries for each transaction. Point of sale technology can help to combine steps one and two, but companies must also track their expenses. The choice between accrual and cash accounting will dictate when transactions are officially recorded. Keep in mind, accrual accounting requires the matching of revenues with expenses so both must be booked at the time of sale.

What is the accounting cycle?

The accounting cycle is a process designed to make financial accounting of business activities easier for business owners. There are usually eight steps to follow in an accounting cycle. The closing of the accounting cycle provides business owners with comprehensive financial performance reporting that is used to analyze the business.

What happens after closing?

After closing, the accounting cycle starts over again from the beginning with a new reporting period. At closing is usually a good time to file paperwork, plan for the next reporting period, and review a calendar of future events and tasks.

Why is it important to know the amount of time for each accounting cycle?

Overall, determining the amount of time for each accounting cycle is important because it sets specific dates for opening and closing. Once an accounting cycle closes, a new cycle begins, restarting the eight-step accounting process all over again.

What is double entry accounting?

Double-entry accounting is required for companies to build out all three major financial statements: the income statement, balance sheet, and cash flow statement.

Explanation

Posting in Accounting Examples

- The details of XYZ internationals are as under: XYZ international issues 20 invoices to its customers and records each transaction in the sales account and the respective debtor’s account. Also, the company purchased from 10 suppliers the records in purchases accounts and respective creditors’ accounts. In addition, some of the payable liability is recorded in the genera…

Rules

- Posting in a ledger to be made in a chronological manner, i.e., date-wise.

- While posting in the ledger, entry is to be made into both accounts, i.e., double entriesDouble EntriesThe double-entry accounting system refers to the double effect of every journal entry. It is b...

- The amount is to be shown in the amount column, the debit balance is to be debited, and the …

- Posting in a ledger to be made in a chronological manner, i.e., date-wise.

- While posting in the ledger, entry is to be made into both accounts, i.e., double entriesDouble EntriesThe double-entry accounting system refers to the double effect of every journal entry. It is b...

- The amount is to be shown in the amount column, the debit balance is to be debited, and the credit balance is credited on the credit side.

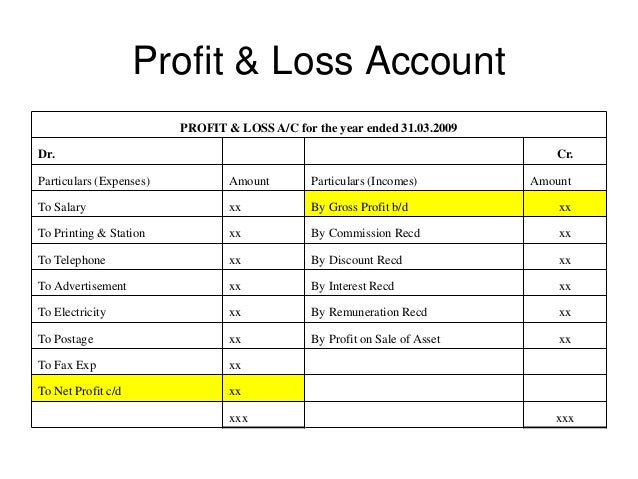

- The balance in the nominal accounts must be transferred directly to the profit and loss accountProfit And Loss AccountThe Profit & Loss account, also known as the Income statement, is a financial s...

Importance

- You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked For eg: Source: Posting in Accounting(wallstreetmojo.com) 1. Balance can be Easily Verified –With the posting in the accounts, the balances of each account can be easily known as on the date. It creates a clear un…

Conclusion

- Posting in the ledgerLedgerLedger in accounting records and processes a firm’s financial data, taken from journal entries. This becomes an important financial record for future reference. It is used for creating financial statements. It is also known as the second book of entry.read moreis the accounting process. The balances of the general journal and various sub-ledgers are to be tr…

Recommended Articles

- This has been a guide to What is Posting in Accounting & its Definition. Here we discuss the step to calculate the posting in accounting and examples and rules and importance. You can learn more about it from the following articles – 1. Ledger Balance 2. Subsidiary Ledger 3. Purchase Ledger 4. Sales Ledger

What Is The Accounting Cycle?

- The accounting cycleis the various steps or stages of work or activity that we go through each year in accounting. The cycle is depicted diagrammatically below: The cycle above is a cycle of actions we go through when accounting for any business.

Steps in The Accounting Cycle

- 1. Source Documents

Source documents are documents, such as cash slips, invoices, etc. that form the source of, and serve as proof for, a transaction. In other words, they are the first documents that exist relating to a transaction. Bookkeepers and accountants need to keep source documents for each transacti… - 2. Journals

Journal entriesare that first basic entry of debit and credit for each transaction, chronological (date-order) records of transactions entered into by a business. In the examples we have been doing in previous chapters, where we debited one account and credited another, we have been d…

Closing Entries

- There is a final step in the accounting cycle not shown above, which is the closing off of accounts (or closing entries), which are done at the end of each year along with the production of the financial statements. This involves closing out temporary accounts (incomes and expenses), and transferring their balances through a profit account into the owners equity (reserves). Closin…

Manual vs Computerized Accounting Systems

- It is important to note that these days many businesses use computerized accounting systems, and so the accounting cycle is largely automated. This means that the bookkeeper or accountant simply enters the basic data about a transaction, and the posting is then automatically done to the relevant accounts and through the trial balance to the financial statements. Temporary account…

Test Yourself!

- Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed. Difficulty rating: Beginner Quiz length: 4 questions Time limit: 5 minutes Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, …