BUDGET PROJECTIONS FOR FY 2022

| OUTLAYS | $5.9 Trillion |

| REVENUES | $4.8 Trillion |

| DEFICIT | $1.0 Trillion |

| DEBT HELD BY THE PUBLIC (End of Fiscal Y ... | $24.2 Trillion |

What are government outlays?

Where do most taxes go?

- The Federal Budget. Federal spending is projected to be close to $5.08 trillion for fiscal year 2022, according to the CBO. …

- Social Security. …

- Medicare. …

- Defense. …

- Medicaid. …

- Income Security Programs. …

- Federal Civilian and Military Retirement. …

- Veterans Programs.

What is the largest expenditure in the federal budget?

- Reducing the COLA by one percentage point: 75%

- Indexing the COLA to prices rather than wages, except for bottom one-third of income earners: 65%

- Raising the payroll tax rate by one percentage point: 50%.

- Raising the payroll tax cap (currently at $106,800) to cover 90% instead of 84% of earnings: 35%

- Increasing the full retirement age to 68: 30%

How to balance the federal budget?

This, however, is the outcome and not the objective. The objective of both actions was higher growth while having prices under control. It means maintaining a fine balance. For example, if the government spends more, it will help with growth but lead to demand-driven inflation.

What is the actual federal budget?

Total outlays in recent budget submissions

- United States federal budget – $4.4 trillion (submitted 2018 by President Trump)

- United States federal budget – $4.1 trillion (submitted 2017 by President Trump)

- United States federal budget – $4.2 trillion (submitted 2016 by President Obama)

- United States federal budget – $4.0 trillion (submitted 2015 by President Obama)

What do federal outlays include?

Outlays generally are recorded on a cash basis, but also include cash-equivalent transactions, the subsidy cost of direct loans and loan guarantees, and interest accrued on public issues of Treasury debt.

What are our major budget outlays?

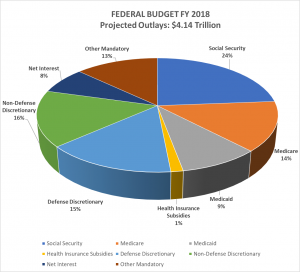

Mandatory expenditures, such as Social Security, Medicare, and the Supplemental Nutrition Assistance Program, account for about 65% of the budget. Budget expenditures are estimated to exceed federal revenues by $1.873 trillion for FY 2022. Most of these revenues come from taxes and earnings from quantitative easing.

What are government receipts and outlays?

What are Government Receipts and Expenditures? Tax receipts, spending, and other transactions data for state and local governments combined and for the U.S. government. These statistics are used to assess the fiscal health of different levels of government and to see trends over time.

What is the difference between federal income and federal outlays?

A budget deficit is the difference between what the federal government spends (called outlays) and what it takes in (called revenue or receipts).

What are mandatory expenses?

Mandatory spending is simply all spending that does not take place through appropriations legislation. Mandatory spending includes entitlement programs, such as Social Security, Medicare, and required interest spending on the federal debt.

What percentage of US budget is military?

The United States spent $754 billion on national defense during fiscal year (FY) 2021 according to the Office of Management and Budget, which amounted to 11 percent of federal spending; that percentage was lower than the 15 percent of the budget spent on defense in the four years before the pandemic.

What is the difference between budget authority and outlays?

The spending totals in the budget resolution are stated in two different ways: the total amount of “budget authority,” and the estimated level of expenditures, or “outlays.” Budget authority is how much money Congress allows a federal agency to commit to spend; outlays are how much money actually flows out of the ...

What do federal outlays include quizlet?

The categories of federal government outlays from largest to smallest are transfer payments, expenditure on goods and services, and debt interest.

What are expenditures and receipts?

What are the key expenditures and receipts? They can both be categorised under capital and revenue. Capital expenditure is used to create assets like roads or to pay back loans, and revenue expenditure includes salaries and administrative expenses.

What percentage of gross domestic product GDP is government outlays?

Government Spending To GDP in the United States averaged 37.20 percent from 1970 until 2020, reaching an all time high of 44 percent in 2020 and a record low of 33.40 percent in 1973.

What are intergovernmental expenditures?

Intergovernmental expenditures are "amounts paid to other governments as fiscal aid in the form of shared revenues and grants-in-aid, as reimbursements for performance of general government activities and for specific services for the paying government, or in lieu of taxes.

What are the 5 major sources of revenue for the government?

The 5 major sources of revenue for the Government are Goods and Services Tax (GST), Income tax, corporation tax, non-tax revenues, union excise duties .

What is the budget for 2022?

The discretionary budget for 2022 is $1.688 trillion. 1 Much of it goes toward military spending, including Homeland Security, the Department of Veterans Affairs, and other defense-related departments. The rest must pay for all other domestic programs.

How much is discretionary spending?

Discretionary spending, which pays for everything else, will be $1.688 trillion. The U.S. Congress appropriates this amount each year, using the president's budget as a starting point. Interest on the U.S. debt is estimated to be $305 billion.

How much is Biden's budget for 2022?

President Biden’s budget for FY 2022 totals $6.011 trillion, eclipsing all other previous budgets. Mandatory expenditures, such as Social Security, Medicare, and the Supplemental Nutrition Assistance Program account for about 65% of the budget. For FY 2022, budget expenditures exceed federal revenues by $1.873 trillion.

How long does it take for the President to respond to the budget?

The president submits it to Congress on or before the first Monday in February. Congress responds with spending appropriation bills that go to the president by June 30. The president has 10 days to reply.

Why is Medicare underfunded?

Medicare is already underfunded because taxes withheld for the program don't pay for all benefits. Congress must use tax dollars to pay for a portion of it. Medicaid is 100% funded by the general fund, also known as "America's Checkbook.".

What is the budget deficit for 2021?

BUDGET PROJECTIONS FOR FY 2021. If current laws generally remain unchanged, the federal budget deficit will total $3.0 trillion and federal debt will reach 103 percent of GDP in fiscal year 2021, CBO estimates, and real GDP will grow by 7.4 percent in calendar year 2021.

When will the federal debt triple?

March 12, 2020. From the end of 2008 to 2019, the amount of federal debt held by the public nearly tripled. This report describes federal debt, various ways to measure it, CBO’s projections for the coming decade, and the consequences of its growth.

How much was the FY2013 budget cut?

The FY2013 defense budget would be reduced 11%, from $525 billion to $472 billion, after already having been cut from $571 billion in the first installment of cuts in the Budget Control Act. Secretary of Defense Leon Panetta initially gave the total cut figure as 23%.

What was the theme of the 2012 budget?

President Obama's February 2012 budget message to Congress addressed themes of economic crisis and response, an updated defense strategy, taxation fairness, income equality, fiscal responsibility, and investments in education and research to help the U.S. compete economically.

How much did the Budget Control Act reduce the military budget?

Secretary of Defense Leon Panetta, pictured here with Chairman of the Joint Chiefs of Staff Mike Mullen, estimated that the Budget Control Act would reduce the base military budget by 23% from the funding levels expected by the Defense Department.

How many pages are in the 2012 budget?

On May 16, 2012, the United States Senate voted on a 52-page budget amendment billed as a summary of the nearly 2,000 pages in the Obama administration's 2013 budget proposal.

When was the original budget request issued?

The original spending request was issued by President Barack Obama in February 2012. The Budget Control Act of 2011 mandates caps on discretionary spending, which under current law will be lowered beginning in January 2013 to remove $1.2 trillion of spending over the following ten years.

Who was the co-chair of the Budget Control Act of 2011?

Senator Patty Murray ( D - WA) and Representative Jeb Hensarling ( R - TX) were co-chairs of a committee set up by the Budget Control Act of 2011 to identify $1.2 trillion in cuts over ten years. The committee failed to agree on any deficit reduction plan, triggering mandatory across-the-board cuts. Hensarling blamed Democratic committee members for insisting on "a minimum of $1 trillion in higher taxes" and unwillingness to agree to "structural reforms" to health-care entitlement programs, while Murray says Republican committee members "insisted that the wealthiest Americans and biggest corporations be protected from paying a penny more" at the expense of the middle class.

When was the budget control act passed?

The Budget Control Act of 2011 was passed in August 2011 as a resolution to the debt-ceiling crisis. The fiscal year (abbreviated as FY) 2013 budget is the first to be affected by the second of two rounds of budget cuts specified in the act.