What is the maximum amount for sending an e Transfer?

How much money can I send and request using the INTERAC e-transfer service? These are the standard limits for Interac e-Transfer ® that we provide to personal and business customers: Sending limits 1. Per transfer: $3,000. 24 hours 2: $3,000. 7 days 2: $10,000. 30 days 2: $20,000. Sending limits apply when: You send money to a recipient

What is the maximum amount of money I can send to TD?

25/04/2020 · Yes. Your Interac e-Transfer send limit is based on your client card's daily access limit. To learn more on what your individual limit is simply send us a secure email through the Online Banking Message Centre or call 1-800-769-2555. There is a minimum transfer limit of $0.01. Just so, how much can you e Transfer TD? Sending limits 2: Per Transfer: $3,000. 24 …

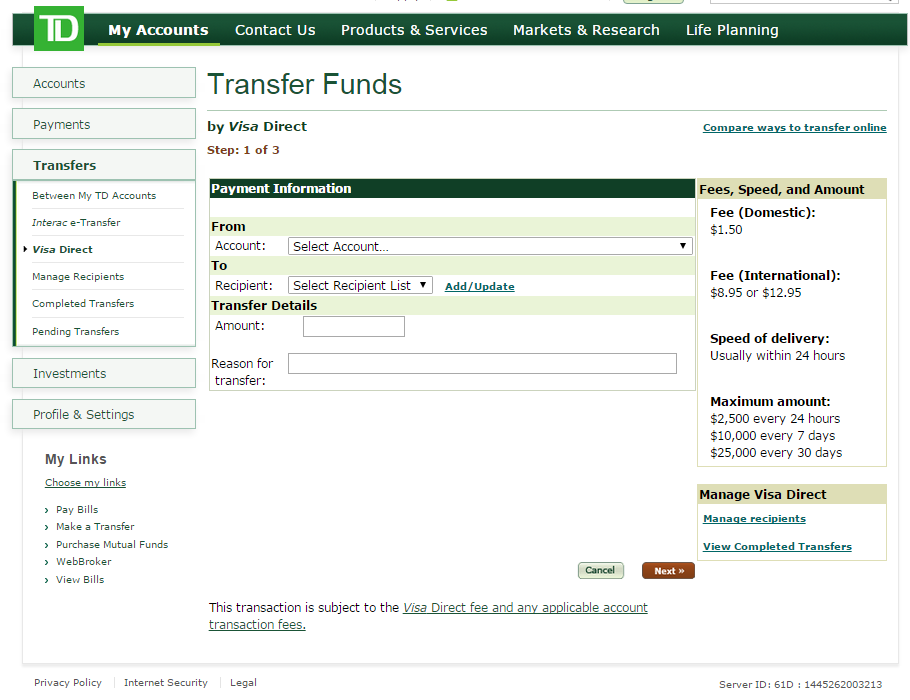

How much can you transfer from TD Bank online?

What are the fees and limits to send or request an INTERAC e-Transfer? A transfer fee applies when you send or request money as follows: Personal Accounts: Up to $100: $0.50 per transfer 1; Over $100: $1.00 per transfer 1; Business Accounts 1: Every Day A, Every Day B, and Every Day C: 2 free monthly transfers (send or receive), $1.50 per transfer thereafter

What are the limits for receiving e-Transfers?

03/01/2022 · TD Interac e-Transfer Limit. TD has a $3,000 cap per transaction and the following periodic limits when sending money: 24 hours: $3,000. 7 days: $10,000. 30 days: $20,000. When using the “Request Money” feature, there’s a limit of $3,000 per request.

How Does Interac e-Transfer Work?

For a little background, Interac Corporation (Interac Association + Acxsys Corporation), was founded by some of Canada’s largest banks, and Interac e-Transfer was formerly referred to as Interac Email Money Transfer.

Interac e-Transfer Limits

Banks have set various limits on how much money you can send using Interac e-Transfer over a specified period.

RBC Interac e-Transfer Limit

If you bank with RBC, your Interac e-Transfer send limit depends on how much you can spend daily using your client card.

TD Interac e-Transfer Limit

TD has a $3,000 cap per transaction and the following periodic limits when sending money:

CIBC Interac e-Transfer Limit

Using CIBC Online Banking, you can send as little as $0.01 using Interac e-Transfer.

BMO Interac e-Transfer Limit

Depending on your BMO Debit Card limit, you can send money up to either $2,500 or $3,000 per 24-hour period.

Simplii Interac e-Transfer Limit

When sending money via Interac e-Transfer using Simplii Financial, the following limits apply:

Are there limits on Interac e-Transfers?

Yes, there are daily send limits on Interac e-transfers. The limit is $3,000 for many of the banks and credit unions.

How Interac e-Transfers Send Limits Work

Each Interac e-Transfer you send is usually capped up to an amount. In many instances, this limit is the same as the 24-hour transfer limit.

Can I increase my e-transfer limit?

It depends on your bank or credit union. Some of them will let you increase it temporarily.

Dealing with Interac e-transfer limit

There are times when you need to transfer a substantial amount that is higher than your bank’s e-transfer limit.

Interac e-Transfer Limits at Different Banks in Canada

These are the current transfer limit at some of the popular banks in Canada.