Is Cost of goods sold a credit or debit?

| Debit | Credit | |

| Cost of goods sold expense | 750,000 | |

| Purchases | 450,000 | |

| Inventory | 300,000 |

What does it mean to debit 'cost of goods sold'?

3 rows · Jan 26, 2020 · Cost of goods sold is the inventory cost to the seller of the goods sold to customers. Cost ...

How to account for cost of goods sold?

Dec 02, 2012 · The expenses are a debit so cost of goods sold are a debit. If you use an item from the inventory you should credit your inventory account (asset) and debit your cost of goods sold. A different approach would be to debit your cost of goods sold when you purchase something and credit cash or accounts payable.

Is cost of goods sold a nominal account?

4 rows · Jun 23, 2021 · The cost of goods sold journal entry is: This entry matches the ending balance in the ...

Can the negative cost of goods sold be expected?

Jan 13, 2022 · You may be wondering, Is cost of goods sold a debit or credit? When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference between your COGS Expense and Purchases accounts. Your COGS Expense account is increased by debits and decreased by credits.

Is COGS a debit or a credit?

Create a journal entry You may be wondering, Is cost of goods sold a debit or credit? When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference between your COGS Expense and Purchases accounts.Jan 13, 2022

Is cost of goods sold credited?

When the retailer sells the merchandise the Inventory account is credited and the Cost of Goods Sold account is debited for the cost of the goods sold.

Is cost of goods a credit?

The nature of the cost of goods sold is an expense and is recorded in the income statement of the company during the period goods are sold. Increase of it are recording debit and decrease of it are record in credit.

What type of account is cost of goods sold?

business expenseBecause COGS is a cost of doing business, it is recorded as a business expense on the income statements.

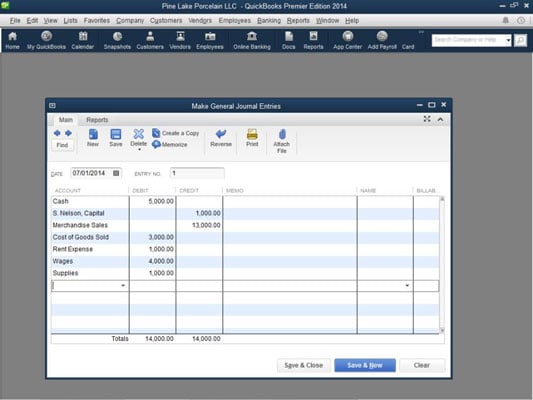

How do you record cost of goods sold?

Journal Entry for Cost of Goods Sold (COGS)Sales Revenue – Cost of goods sold = Gross Profit.Cost of Goods Sold (COGS) = Opening Inventory + Purchases – Closing Inventory.Cost of Goods Sold (COGS) = Opening Inventory + Purchase – Purchase return -Trade discount + Freight inwards – Closing Inventory.

What is the journal entry for sold goods?

In the case of a cash sale, the entry is: [debit] Cash. Cash is increased, since the customer pays in cash at the point of sale. [debit] Cost of goods sold.Feb 2, 2022

What is the journal entry for cost of sales?

Example of a Cost of Goods Sold Journal EntryDebitCreditCost of goods sold expense750,000Purchases450,000Inventory300,000May 13, 2017

What are costs of goods?

Cost of goods sold is the total amount your business paid as a cost directly related to the sale of products. Depending on your business, that may include products purchased for resale, raw materials, packaging, and direct labor related to producing or selling the good.Jul 16, 2021

Is cost of goods sold an asset or equity?

Cost of goods sold is not an asset (what a business owns), nor is it a liability (what a business owes). It is an expense. Expenses is an account that contains the cost of doing business. Expenses is one of the five main accounts in accounting: assets, liabilities, expenses, equity, and revenue.

Is cost of goods sold an operating expense?

Key Takeaways Operating expenses (OPEX) and cost of goods sold (COGS) are discrete expenditures incurred by businesses. Operating expenses refer to expenditures that are not directly tied to the production of goods or services, such as rent, utilities, office supplies, and legal costs.

Why cost of goods sold is an expense?

Why the Cost of Goods Sold is an Expense However, the cost of goods sold is also an expense that must be matched with the related sales. Hence, a company's operating income is its operating revenues minus the cost of goods sold and its sales, general and administrative expenses.

What is gross profit?

Gross profit can show you how much you are spending on COGS. Knowing your business’s COGS helps you determine your company’s bottom line and calculate net profit. COGS is also known as the cost of doing business. For higher net profits, businesses want to keep their COGS as low as possible.

How to calculate COGS?

2. Calculate COGS. Calculate your COGS using the formula: COGS = Beginning inventory + purchases during the period – ending inventory. 3. Create a journal entry. Once you prepare this information, you can generate your COGS journal entry.

How to record COGS?

Follow the steps below to record COGS as a journal entry: 1. Gather information. Gather information from your books before recording your COGS journal entries. Collect information such as your beginning inventory balance, purchased inventory costs, overhead costs (e.g., delivery fees), and ending inventory count. 2.