The Differences Between Income Statements and Profit and Loss Accounts

- Income Statements. Income statements show how much money a business has made over a specific period of time. ...

- Profit and Loss Accounts. Profit and loss accounts are special accounts that show all expenses and only the gross profit for a company.

- Similarities. ...

- Differences. ...

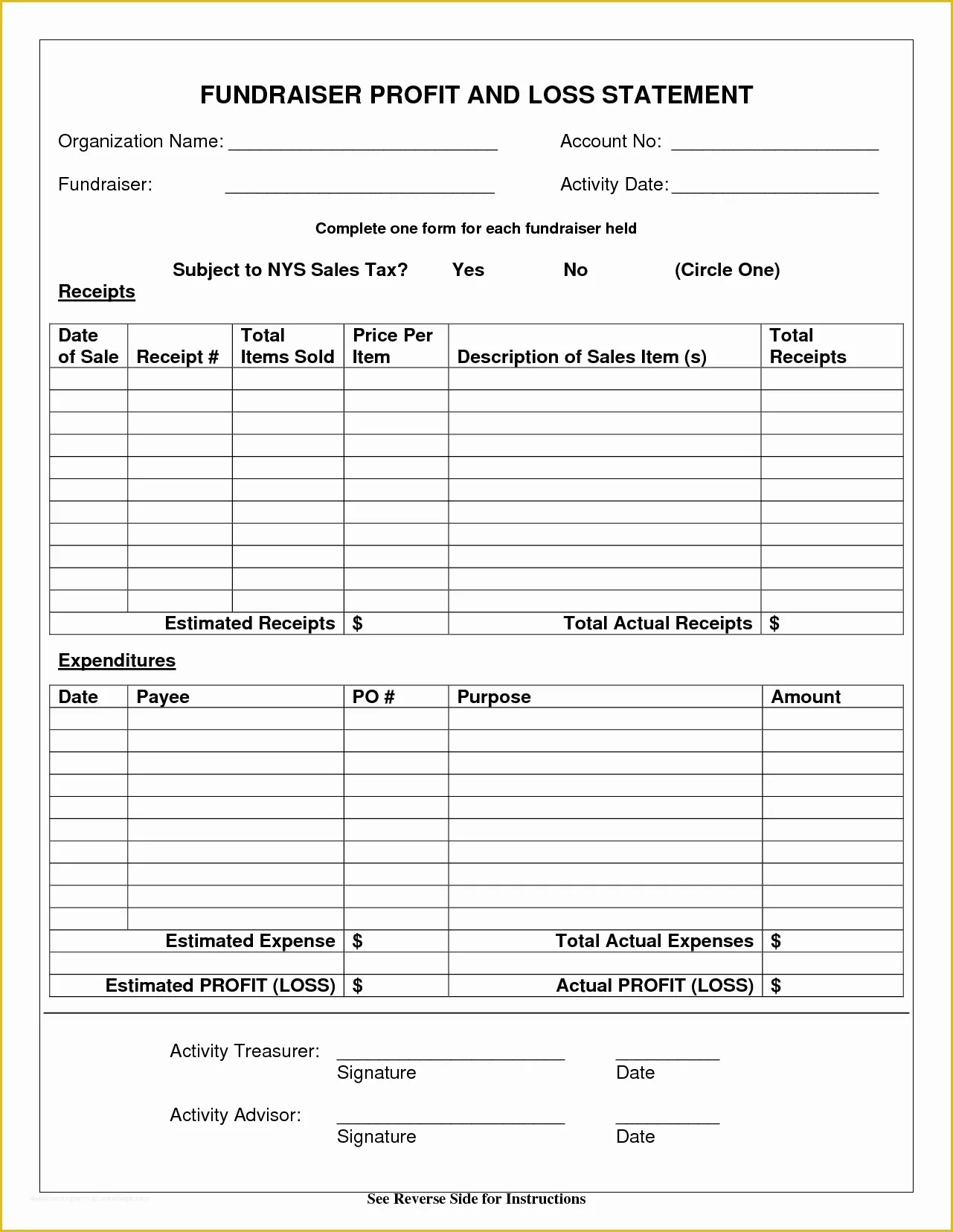

How to make a profit and loss statement?

The data items that you must be able to provide to construct a P & L statement are:

- Net Sales

- Cost of Goods Sold

- Selling and Administrative Expenses

- Other Income and Other Expense

How to fill out a profit and loss statement?

There are two basic methods of creating a profit and loss report manually. Primarily used by service-based industries and small businesses, the single-step method determines net income by subtracting expenses and losses from revenue and gains. It uses a single subtotal for all revenue line items and single subtotal for all expense items.

What does a profit and loss statement tell you?

The term profit and loss (P&L) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. These records provide information about a company's ability or inability to generate profit by increasing revenue, reducing costs, or both.

What exactly are profit and loss statements?

What Is the Difference between Your P&L Statement and a Balance Sheet?

- Expand your business within a specific geographic area

- Explore a new market or launch a side project

- Grow your production capacity

- Hire more employees or contractors

- Stop selling a product with low revenue and high costs

- Invest more in a new department or product line

Is profit & Loss same as income statement?

Profit and Loss (P&L) Statement A P&L statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time, usually a fiscal year or quarter.

What is the other name of the income statement?

An income statement shows a company's revenues, expenses and profitability over a period of time. It is also sometimes called a profit-and-loss (P&L) statement or an earnings statement. It shows your: revenue from selling products or services.

What is the new name for profit and loss account?

Another name for a profit and loss statement is the income statement.

Why the income statement can also be called a profit and loss statement?

A profit and loss statement is also called a P&L, an income statement, a statement of profit and loss, an income and expense statement, or a statement of financial results. The P&L shows management and investors whether a company made a profit or lost money in the time period covered by the report.

What are examples of income statements?

The most common income statement items include:Revenue/Sales. Sales Revenue is the company's revenue from sales or services, displayed at the very top of the statement. ... Gross Profit. ... General and Administrative (G&A) Expenses. ... Depreciation & Amortization Expense. ... Interest. ... Income Taxes.

What is in an income statement?

An income statement is a financial report detailing a company's income and expenses over a reporting period. It can also be referred to as a profit and loss (P&L) statement and is typically prepared quarterly or annually. Income statements depict a company's financial performance over a reporting period.

What is income statement report?

An income statement is a report that shows how much revenue a company earned over a specific time period (usually for a year or some portion of a year). An income statement also shows the costs and expenses associated with earning that revenue.

Is income statement same as statement of financial position?

There are two key elements to the financial statements of a sole trader business: Statement of financial position, showing the financial position of a business at a point in time, and. Income statement, showing the financial performance of a business over a period of time.

Background

There are numerous success factors for businesses, among which efficient and effective management of finances takes utmost importance. Financial statements are the primary tools businesses use for financial management, planning and forecasting.

What is an Income statement?

The income statement is a components of financial statement that shows the revenues and expenditures of a firm and helps to calculate the net profit or loss over a period of time. The income statement analysis helps management in better strategy formulation and evaluation.

Major Components of Income Statement

Following are the essential components that make up the income statement.

Income statement and P&L statement

Three terms are used interchangeably in accounting; income statement, profit, and loss statement and profit and loss accounts. There is practically no difference between a profit and loss statement and an income statement. P&L is just another name for an income statement because it shows net profits and losses.

What is a Profit and Loss Account?

The Profit and Loss Account is a T-account made at the end of the year to show the company’s annual expenses and gross profit. The expenses and Tax are then deduced from the gross profit to calculate the company’s net profit at the end of the year. This net profit/loss figure should be the same as the one shown on the income statement.

Main features of Income statement and P&L

Following are some of the main features related to income statements and P&L.

Conclusion

Income statement and profit and loss statement are used interchangeably. There is no such difference in these terms, and both can be used in place of another. It’s one of the main components presented in the financial statement.