Is a house really an asset?

In many neighbourhoods in Canada, zoning rules dictate that the only type of development permitted is the demolition of a small house to replace it with a big one. This has no net effect on supply and can dramatically raise prices. It’s not uncommon for ...

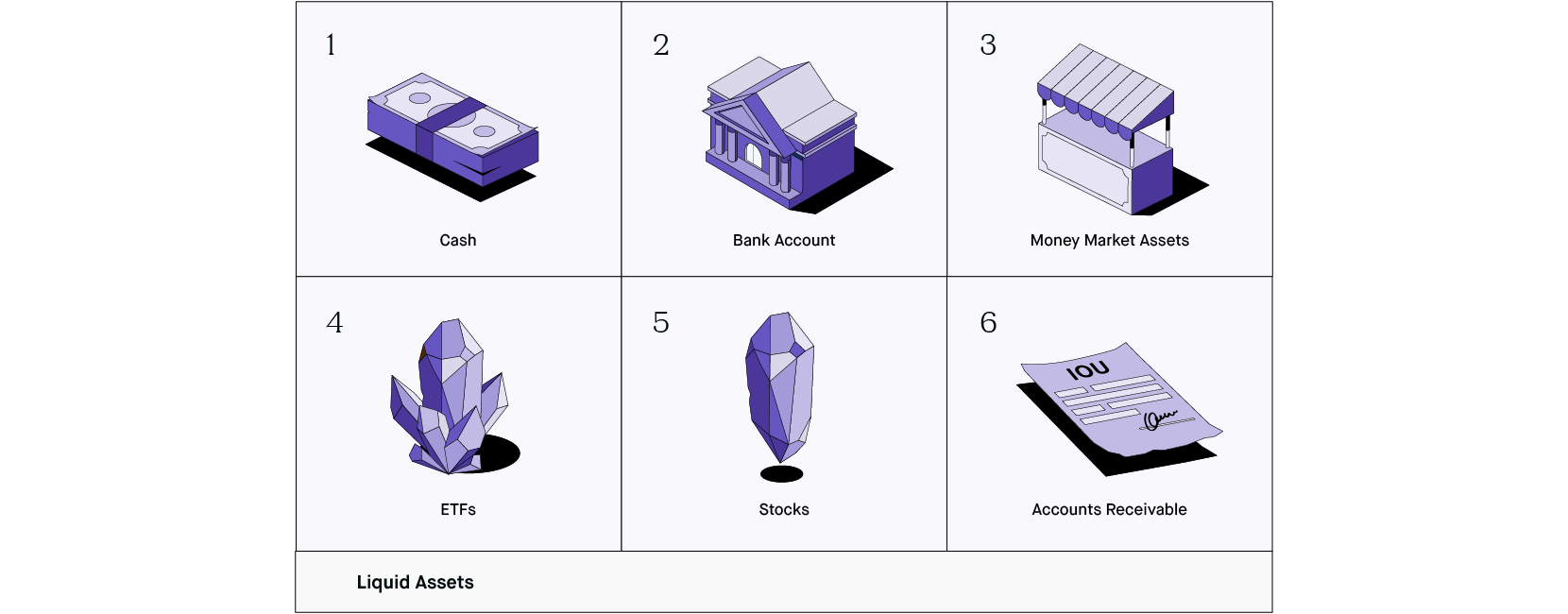

What qualifies as a liquid asset?

Some types of investments that are considered liquid assets are:

- Stocks: Any stocks you own or are held in your name are typically liquid.

- Cash equivalents: In the business world, these refer to a company’s short-term investments.

- Mutual funds: This is a fund that pools money from many investors to purchase stocks and other securities.

What assets are considered liquid assets?

Liquid assets include things like cash, money market instruments, and marketable securities. Both individuals and businesses can be concerned with tracking liquid assets as a portion of their net worth. For the purposes of financial accounting, a company’s liquid assets are reported on its balance sheet as current assets.

Which assets are considered most liquid?

List of the Most Liquid Assets

- Cash and Currency. The most liquid asset is cash in your domestic currency. When you hand debtors cash, the payment is...

- Other Cash Equivalents. Cash equivalents are another example of liquid assets. These assets can be converted into cash...

- Receivables from Sales. Receivables are the amounts of money owed to you from others. Though...

Are houses a liquid asset?

As we already mentioned, real estate isn't considered liquid, so any investment properties you own aren't classified as liquid assets. Selling a property can take a long time, and you might not necessarily get its market value back when you sell it – especially if you're trying to do so quickly.

What is considered liquid asset?

A liquid asset is an asset that can easily be converted into cash in a short amount of time. Liquid assets include things like cash, money market instruments, and marketable securities. Both individuals and businesses can be concerned with tracking liquid assets as a portion of their net worth.

Is a house a fixed or liquid asset?

Examples of fixed assets include collections of art or antiques, jewelry, and real estate, such as your home.

What is not considered a liquid asset?

Assets are classified as either liquid or non-liquid. A liquid asset can fairly quickly and easily be turned into cash, while a non-liquid asset cannot. A home is a non-liquid asset because it might take several months to find a buyer for it and several more weeks before you receive the money from the transaction.

Is a mortgage an asset for a bank?

A home loan is an asset for the lender. The home loan payments are a form of accounts receivable that the lender expects to receive payment on. These receivables are secured by the property itself, which the lender maintains a lien on until the loan is repaid. This is how lenders make money.

Is a bank account a liquid asset?

Examples of liquid assets Cash or currency: The cash you physically have on hand. Bank accounts: The money in your checking account or savings account.

Why is a house not liquid?

Land and real estate investments are considered non-liquid assets because it can take months for a person or company to receive cash from the sale. For example, suppose a company owns real estate property and wants to liquidate because it has to pay off a debt obligation within a month.

What are the most liquid assets?

Common liquid assets include:Cash. Cash is the ultimate liquid asset. ... Treasury bills and treasury bonds. ... Certificates of deposit. ... Bonds. ... Stocks. ... Exchange traded funds (ETFs). ... Mutual funds. ... Money market funds.More items...•

Is life insurance cash value a liquid asset?

The cash value of a permanent life insurance policy is a liquid asset, but the death benefit is not. Term life insurance is not an asset.

What kind of asset is a house?

Tangible assets: These are physical objects, or the assets you can touch. Examples include your home, business property, car, boat, art and jewelry. Liquid assets: Liquid assets are cash or the things that can be sold and converted to cash quickly, like readily tradable stocks and bonds.

Are houses and cars liquid assets?

Non liquid assets are assets that cannot be sold or converted into cash easily without a significant loss of investment. Some examples of such assets include houses, cars, land, televisions and jewelry.

Where do millionaires keep their money?

For more than 200 years, investing in real estate has been the most popular investment for millionaires to keep their money. During all these years, real estate investments have been the primary way millionaires have had of making and keeping their wealth.

What is liquid asset?

A liquid asset is something you own that can quickly and simply be converted into cash while retaining its market value. Some examples of assets that would be considered liquid are: The sum of all your assets combined, liquid or otherwise, minus your liabilities (debts you owe), makes up your net worth. While your net worth is a good number ...

What is asset liquidity?

Asset liquidity is one of those financial terms that sounds a lot more complicated than it actually is. It’s a concept worth learning about, especially if you’re in the market for a mortgage. It doesn’t mean your money is literally liquid (don’t go melting down all your precious metals just yet).

Why is cash considered liquid?

Cash is considered to be highly liquid because it’s already in its most liquid form and doesn’t need to be converted, while money you have in stocks is slightly less liquid because there are more steps involved in converting it to cash.

What happens when you apply for a mortgage?

When you’re applying for a mortgage, your lender will likely consider this exact situation. They’ll verify the assets you own and how liquid they are, and determine if you have enough easily accessible money in reserve to cover your mortgage payments if you were to encounter a temporary financial hardship.

Why is liquidity important?

Liquidity is important in cases of financial emergency. When you encounter hardship, you won’t necessarily have time to go through the process of putting your house on the market or selling your collection of rare artwork.

Why do we need quick access to funds?

You’ll need quick access to funds so you can pay for your essentials and stay on top of your bills. In a dire financial situation, it doesn’t matter what your net worth is or how wealthy you are on paper. What matters is whether or not you have funds that you can get immediate access to.

Is it important to know the total value of liquid assets?

While your net worth is a good number to have on hand, it’s also important to know the total value of your liquid assets, because that tells you how much cash you’d have quick access to if you were in a tough spot. It’s also good to know what types of assets aren’t considered liquid. Generally, anything that would take some time to convert ...

What is liquid asset?

Liquid assets can be easily converted to cash in order to pay current obligations. A liquid asset refers to cash or any other asset that can be easily converted to cash at or near its market value. Aside from cash, liquid assets include items like investments, as well as accounts receivable and inventory. Non-liquid assets include things such as ...

What are some examples of illiquid assets?

Example of illiquid assets. In contrast to liquid assets, some assets are illiquid, meaning that they typically cannot be sold quickly at a reasonable market value. In personal finance , assets like homes and land are illiquid, or non-liquid assets.

What order are assets listed on a company's balance sheet?

On a company's balance sheet, assets are listed in descending order of liquidity, with cash listed first. To be clear, these aren't the only kinds of liquid assets, but are some of the most common examples.

How much is Coca Cola worth?

As a specific example, Coca-Cola 's brand name is valued at approximately $73 billion, according to Interbrand. However, that doesn't mean the company could sell the rights to its brand name for this amount quickly if it needed to raise cash.

Is a stock considered liquid?

Investments such as stocks, bonds, and mutual funds are also considered to be liquid assets. Stocks can be sold quite easily at a price within a few cents of their market value, and often with the simple click of a button.

Can bonds be sold daily?

Bonds have varying degrees of liquidity, but can generally be sold fairly quickly without sacrificing too much of their market value. And mutual funds can be sold daily -- meaning that if you place a "sell" order, the position will be liquefied, or converted to cash in your account by the following day. In the case of businesses, assets that can be ...

Is a home worth $250,000 a liquid asset?

However, this would be a major discount to its market value, and therefore, your home is not a liquid asset. Image source: Getty Images.

Why is liquid asset similar to cash?

An asset that can readily be converted into cash is similar to cash itself because the asset can be sold with little impact on its value. Liquid assets are usually seen as the same as cash, as their value remains largely the same when sold. Several factors must be present for a liquid asset to be considered liquid: It must be in an established ...

What is non liquid asset?

Non-Liquid Assets. Non-liquid assets are assets that can be difficult to liquidate quickly. Land and real estate investments are considered non-liquid assets because it can take months for a person or company to receive cash from the sale. For example, suppose a company owns real estate property and wants to liquidate because it has to pay ...

What is an intangible asset?

Tangible assets are at risk of being damaged, lost, or stolen due to the actions of people or acts of nature. An intangible asset, by contrast, is not physical in nature. An intangible asset could be such things as goodwill, brand recognition, or intellectual property like patents, trademarks, and copyrights. 2.

What is a cash equivalent?

A cash equivalent is an investment with a short-term maturity that can be quickly converted to cash, such as stocks, bonds, and mutual funds. Liquid assets differ from non-liquid assets, such as property, vehicles or jewelry, which can take longer to sell and therefore convert to cash, and may lose value in the sale.

What is an estate asset?

These assets are often referred to as an "estate.". Assets in an estate may be used to pay debts left by the decedent, or they may be distributed to beneficiaries as specified in the decedent's will or trust. Assets are usually classified as either tangible or intangible assets.

What is an asset?

In general, anything that can be owned by an individual or entity that has, or is expected to have economic value, is an asset. The value of an asset is often taxed. One example of this is taxes levied on assets left by someone who dies. These assets are often referred to as an "estate.".

Is a mutual fund considered liquid?

Mutual funds are considered liquid since investors can sell their shares at any time and receive their money within days.) Money-market funds, a type of mutual fund that invests in low-risk low-yielding investments like municipal bonds (Similar to mutual funds, money market funds are also liquid investments.)

What is liquid asset?

Answering this question is predicated on defining what liquid assets are. In simple terms, an asset is considered liquid if it can easily be converted into cash. Liquid assets can also be described as “ cash-like ” assets because their value is not significantly impacted when they’re sold. Here are some examples of assets that are classified as liquid:

What is cash flow in real estate?

This is the rental income that the real estate investor collects minus the expenses that come with owning a rental property. These expenses include insurance, professional property management fees, and mortgage payments. In order to make a profit, the investment property should be able to generate positive cash flow. This means that rental income should be higher than expenses.

What are the pros and cons of cash flow investments?

This is one of the main pros of cash flow investments. The income that is being generated by the rental property can cover several expenses, namely mortgage payments. In addition to this , the extra income can go towards growing the real estate investor’s wealth or financing other ventures.

Is it easier to manage a rental property?

If your investment strategy relies solely on appreciation, then managing the property will be much easier. Not renting out the property saves you the hassle of dealing with tenant-related issues. Furthermore, you won’t have to incur the ongoing costs of managing a rental property or the fees of professional property management.

What are assets not considered liquid?

Tax refunds. Assets not considered to be liquid include real estate, venture capital investments, and collectibles. This is because the value of such items is likely to fluctuate greatly, especially if they are sold quickly. Additionally, ownership of such assets as real property cannot be transferred quickly.

What is liquid asset?

Liquid assets are any assets that can quickly be converted into cash with a minimal impact on the asset’s value. In general, liquid assets are viewed in the same manner as cash, as their value remains largely the same when sold. In order for an asset to be considered liquid, it must be in an established market, with a large number of interested buyers, and with the ability for ownership to be transferred easily. This type of asset is the most basic used by consumers and businesses alike. To explore this concept, consider the following liquid assets definition.

What is the opposite of tangible assets?

Intangible assets are the opposite of tangible assets, as they are not physical in nature. Intangible assets are things that do not have a clear face value, and must be reassessed from time to time to determine their current value.

What are assets in a will?

Assets are the things owned by individuals or entities that have, or are expected to have, economic value. An individual or entity can be taxed on the value of its assets, and the assets left by someone who dies is referred to as his “estate.” Assets in such an estate may be used to pay debts left by the decedent, or distributed to beneficiaries as specified in the decedent’s will or trust. Assets come in a variety of forms, including tangible and intangible assets.

What are some examples of liquid assets?

Examples of liquid assets include: Certifications of deposit. Accounts receivable.

What are liabilities in accounting?

Liabilities include such debts or payments owed as credit card debt, mortgages, home equity loans, student loans, and car loans. Finally, the sum total of liabilities is subtracted from the total value of assets to obtain the net worth.

What is tangible asset?

Tangible assets are physical in nature, and have a material value on the public market that can be easily ascertained. Tangible assets come with a risk of becoming damaged, lost, or stolen due to the acts of another person, or an act of nature. Tangible assets are either current or fixed (also referred to as “long term”).

What is liquid asset?

A liquid asset is a type of asset that can be rapidly converted into cash while keeping its market value. There are other factors that make assets more or less liquid, including: Cash on hand is the most liquid type of asset, followed by funds you can withdraw from your bank accounts.

What are liquid assets? What are some examples?

Examples of liquid assets 1 Cash or currency: The cash you physically have on hand. 2 Bank accounts: The money in your checking account or savings account. 3 Accounts receivable: The money owed to your business by your customers. 4 Mutual funds: A fund that pools money from many different investors into a diverse portfolio. 5 Money market accounts: A type of low-risk, interest-bearing savings account. 6 Stocks: The shares you own. 7 Treasury bills, notes, and bonds: A safe and reliable investment option with a variety of maturity dates, or the date when the investor will receive their principal back. 8 Certificates of deposit: A savings account with a fixed withdrawal date. 9 Prepaid expenses: The insurance, rent, and other bills you’ve paid ahead of schedule. 10 Retirement investment accounts: 401 (k)s, IRAs, and other accounts.

Why is liquidity important?

Liquidity, or your business’s ability to quickly convert assets into cash, is vital on multiple fronts. These resources help you weather financial challenges, secure credit, and settle liabilities with short notice. It's important for businesses to have a combination of liquid and non-liquid assets.

Why are investments called cash equivalents?

Investments are next on the liquidity ladder. Some investment accounts are called cash equivalents because they can be liquidated in a fairly short time span (generally 90 days or fewer). As a general rule, long-term holdings are less liquid than short-term holdings.

Why are stocks less liquid than cash?

Stocks are considered slightly less liquid than cash for another reason: If the market is down, you could be forced to sell below value. Other great examples of liquid investments include U.S. Treasury bills (T-bills), bonds, mutual funds, and money market funds, which are a type of mutual fund.

What happens if a company can't generate liquid cash?

A company may generate billions of dollars in revenue, but if it can't generate liquid cash, it will struggle. An individual might own multiple properties or prized artwork, but in a financial emergency, they’ll depend on liquid assets to stay afloat. Anything of financial value to a business or individual is considered an asset.

How long does it take to find a buyer for non-liquid assets?

Most non-liquid assets must be sold to tap into their value, requiring you to transfer ownership. It can take months or years to find the right buyer for non-liquid assets, and selling them quickly tends to have a negative effect on value.

What is liquid asset?

Key Takeaways. A liquid asset is an asset that can easily be converted into cash within a short amount of time. Liquid assets generally tend to have liquid markets with high levels of demand and security. Businesses record liquid assets in the current assets portion of their balance sheet. Business assets are usually broken out through ...

Why is liquid asset considered cash?

Liquid assets are often viewed as cash, and likewise may be called cash equivalents because the owner is confident the assets can easily be exchanged for cash at any time. Generally, several factors must exist for a liquid asset to be considered liquid. It must be in an established, liquid market with a large number of readily available buyers.

What is cash equivalent?

Cash equivalents and marketable securities follow cash as investments that can be transacted for cash within a very short period, often immediately in the open market. Other current assets can also include accounts receivable and inventory. On the balance sheet, assets become less liquid by their hierarchy.

Why is liquid asset important?

In business, liquid assets are important to manage for both internal performance and external reporting. A company with more liquid assets has a greater capability of paying debt obligations as they become due.

What is the long term asset portion of the balance sheet?

On the balance sheet, assets become less liquid by their hierarchy. As such, the long-term assets portion of the balance sheet includes non-liquid assets. These assets are expected for cash conversion in one year or more.

How does the balance sheet break down assets?

In financial accounting, the balance sheet breaks assets down by current and long-term with a hierarchical method in accordance to liquidity. A company’s current assets are assets a company looks to for cash conversion within a one-year period. Current assets have different liquidity conversion timeframes depending on the type of asset.

Which is the most liquid market in the world?

The foreign exchange market is deemed to be the most liquid market in the world because it hosts the exchange of trillions of dollars each day, 24 hours a day, making it impossible for any one individual to influence the exchange rate. 1 Other liquid markets include commodities and secondary market debt.

What is liquid asset?

Liquid Assets are the business assets that can be converted into cash within a short period, such as cash, marketable securities, and money market instruments. They are recorded on the asset side of the company's balance sheet. read more. Considering such an asset’s significant trading volume, some equitable securities might fast be transformed ...

Why are liquid assets important?

Overall, the liquid assets are of utmost importance to any individual or a company as it becomes convenient while making emergency debt repayments, purchasing equipment, hiring labor, payment of taxes, and several others.

What is marketable securities?

Marketable Securities Marketable securities are liquid assets that can be converted into cash quickly and are classified as current assets on a company's balance sheet. Commercial Paper, Treasury notes, and other money market instruments are included in it. read more. Accounts Receivable.

What is a cash equivalent?

Cash Equivalents Cash equivalents are highly liquid investments with a maturity period of three months or less that are available with no restrictions to be used for immediate need or use. These are short-term investments that are easy to sell in the public market.. read more. , accounts receivables, accrued income.

What is a checking account?

Checking Account Checking Account, also known as a transactional account, can be defined as a kind of deposits account held by a financial institution or non-banking financial institution which allows the holder of the account to deposit and withdraw money. This is one of the most liquid forms of money.

Is the stock market a liquid asset?

The stock market is believed to be the perfect example of any liquid market as there exist vast numbers of sellers and buyers, coupled with several other stocks being examples of liquid assets. Examples Of Liquid Assets. Liquid Assets are the business assets that can be converted into cash within a short period, such as cash, marketable securities, ...

Is a savings account liquid?

This is one of the most liquid forms of money. It differs from a normal bank savings account since it allows multiple deposits and withdrawal in a particular period. read more. . The account’s money is believed to be liquid since it can be taken out quite simply for settling liabilities.