- Overview. As the depreciation is calculated based on the estimation in the accounting process, the company may find that the depreciation made is too low or too high which results ...

- Calculate revised depreciation. The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the revision ...

- Revised depreciation journal entry. After the calculation, the company can make the revised depreciation journal entry by debiting the calculated amount of revised depreciation to the depreciation expense account and ...

- Revised depreciation example. For example, the company ABC has a delivery truck with the original cost of $32,000 and an estimated salvage value of $2,000.

What are the different ways to calculate depreciation?

Revised Depreciation Overview. As the depreciation is calculated based on the estimation in the accounting process, the company may find that... Calculate revised depreciation. The company can calculate the revised depreciation by determining the …

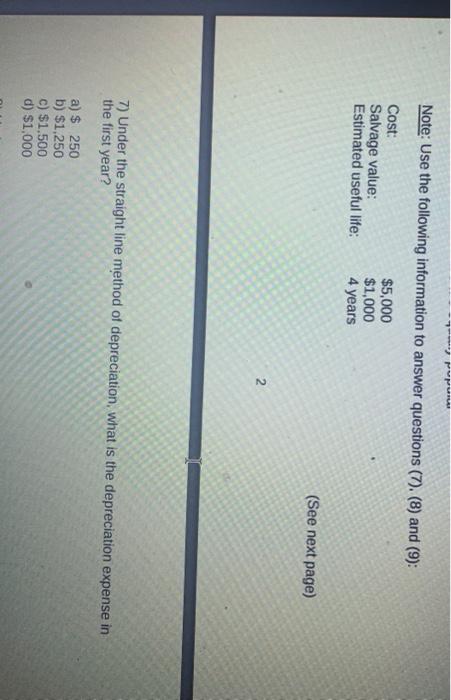

How do you calculate straight line depreciation?

Jun 16, 2020 · How is revised depreciation calculated? Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Determine the useful life of the asset. Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation. Click to see full answer.

What is the formula to calculate depreciation?

Apr 25, 2020 · Use the following steps to calculate monthly straight-line depreciation: Subtract the asset's salvage value from its cost to determine the amount that can be depreciated. Divide this amount by the number of years in the asset's useful lifespan. Divide by 12 to tell you the monthly depreciation for the asset.

How to find depreciation expense formula?

Dec 24, 2021 · equip= 64,000 accum. dep. = 18,000 (64,000 + 18,000- 4,000 = 78,000 annual depreciation = 78,000 / 5= 15,600.00 But I think it could be: 64,000 -18,000- 4,000= 42,000 annual depreciation = 42,000 / 5 = 8,400.00

What is revised depreciation?

Usually a change in the estimated useful life of an asset or a change in the estimated salvage value. The change usually causes a change in the depreciation expense for the current year and subsequent years. The depreciation expense of previous years is not changed.

How do you calculate revised annual depreciation on each asset?

Determine the cost of the asset. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. Determine the useful life of the asset. Divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation.

How do you calculate new and old depreciation?

1:475:37Calculating Depreciation - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd you divided the asset you so you divide that number by the estimated useful life of the asset toMoreAnd you divided the asset you so you divide that number by the estimated useful life of the asset to get a straight line or consistent depreciation charge for each year.

How do you calculate depreciation after change in useful life?

For instance if a $6,000 asset was using straight line depreciation over 5 years, then the annual depreciation amount would be $1200 or $100 per period. If the useful life was then changed to 1 year after 2 years have already been depreciated, the remaining $3,600 would be spread over 12 months or $300 per period.Jun 21, 2012

How do you calculate double declining depreciation?

Double declining balance is calculated using this formula:2 x basic depreciation rate x book value.Your basic depreciation rate is the rate at which an asset depreciates using the straight line method.Cost of the asset is what you paid for an asset. ... Once you've done this, you'll have your basic yearly write-off.More items...•Feb 11, 2020

How do you calculate double declining balance depreciation?

Double Declining Balance Method Formula Using the Double-declining balance method, the depreciation will be: Double Declining Balance Method Formula = 2 X Cost of the asset X Depreciation rate or. Double Declining Balance Formula = 2 X Cost of the asset/Useful Life.

How do I calculate depreciation percentage?

Each period's depreciation amount is calculated using the formula: annual depreciation rate/ number of periods in the year. For example, in a 12 period year, if an asset's expected life is 60 months, the annual depreciation rate for the asset is: 12/60 = 20%, and the depreciation rate per period is 20% /12 = 0.0167%.

How do you calculate depreciation example?

For Example – asset is purchased for rs. 1,00,000 and useful life is 10 years with salvage value of Rs. 10,000 then depreciation is charged at Rs. 9,000 for each of the 10 years....Straight Line Method (SLM)YearDepreciation as per SLMDepreciation as per WDV1017,0006,267.04Total Depreciation1,70,0001,70,0009 more rows

What is depreciation formula?

The formula is: Depreciation = 2 * Straight line depreciation percent * book value at the beginning of the accounting period. Book value = Cost of the asset – accumulated depreciation. Accumulated depreciation is the total depreciation of the fixed asset accumulated up to a specified time.

Can depreciation rate be changed?

When there is a significant change in the pattern of the future economic benefits from the asset then the method of depreciation should also be changed. As per the Accounting Standard 1- Disclosure of Accounting Policies, the change in the method of depreciation is a change in the accounting estimate.

Can I change depreciation life?

If you have been doing it incorrectly for more than 2 years, in order to correct it, you will have to use IRS Form 3115 to Change the Accounting Method and adjust depreciation taken in year discovered and then future years can be handled correctly.Jun 4, 2019

Can you change depreciation years?

Depreciation errors are generally corrected by the filing of an amended tax return or through the request of a change in accounting method. If an impermissible method of depreciation has been reported for at least two consecutive years, then a change in accounting method would be required to correct any errors.May 6, 2020

How is depreciation estimate calculated?

A depreciation estimate is calculated based on the chosen method of depreciation, and on estimates of an assets useful life and salvage value. Of course both useful life and salvage value cannot be known at the time and it is often the case than one or the other or both need to be revised during the lifetime of an asset.

What factors can change the salvage value of an asset?

Factors such as a change in how an asset is used, unexpected wear and tear, technological advancement, and changes in market conditions, may indicate that the salvage value or useful life of an asset has changed. In addition, the chosen method of depreciation may no longer be appropriate. The pattern of usage of the asset may change ...

What is depreciation in accounting?

For accounting, in particular, depreciation concerns allocating the cost of an asset over a period of time, usually its useful life. When a company purchases an asset, such as a piece of equipment, such large purchases can skewer the income statement confusingly.

When is partial year depreciation calculated?

One method is called partial year depreciation, where depreciation is calculated exactly at when assets start service.

What is depreciation in a car?

Depreciation. Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. For instance, a widget-making machine is said to "depreciate" when it produces fewer widgets one year compared to the year before it, or a car is said to "depreciate" in value after a fender bender or the discovery ...

When to use depreciation factor?

Use a depreciation factor of two when doing calculations for double declining balance depreciation. Regarding this method, salvage values are not included in the calculation for annual depreciation. However, depreciation stops once book values drop to salvage values.

What is salvage value?

Salvage Value. In regards to depreciation, salvage value (sometimes called residual or scrap value) is the estimated worth of an asset at the end of its useful life. If the salvage value of an asset is known (such as the amount it can be sold as for parts at the end of its life), the cost of the asset can subtract this value to find ...

What is straight line depreciation?

Straight-line depreciation is the most widely used and simplest method. It is a method of distributing the cost evenly across the useful life of the asset. The following is the formula:

Is SYD depreciation faster than straight line depreciation?

It is generally more useful than straight-line depreciation for certain assets that have greater ability to produce in the earlier years, but tend to slow down as they age.

What is depreciation expense?

Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. of an asset. Different methods of asset depreciation are used to more accurately reflect the depreciation and current value of an asset.

What are the different types of depreciation methods?

Depreciation Methods The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.

What is salvage value?

Salvage value is also known as scrap value. . Straight line depreciation is the most commonly used and straightforward depreciation method. Depreciation Expense When a long-term asset is purchased, it should be capitalized instead of being expensed in the accounting period it is purchased in. for allocating the cost of a capital asset.

What is double declining balance?

The double-declining balance method is a form of accelerated depreciation. It means that the asset will be depreciated faster than with the straight line method. The double-declining balance method results in higher depreciation expenses in the beginning of an asset’s life and lower depreciation expenses later.

Is depreciation higher in periods of high usage or low usage?

Therefore, depreciation would be higher in periods of high usage and lower in periods of low usage.

What is straight line depreciation?

The straight line calculation, as the name suggests, is a straight line drop in asset value. The depreciation of an asset is spread evenly across the life. And, a life, for example, of 7 years will be depreciated across 8 years.

What is the term for the value of an asset at the end of its useful life?

the value of the asset at the end of its useful life; also known as residual value or scrap value. Useful Life. the expected time that the asset will be productive for its expected purpose. Placed in Service. select the month and enter the year the asset started being used for its intended purpose. Year.