How is IPR calculated? When feed is given in inches per tooth (ipt), you must calculate ipr by multiplying the number of teeth on the tool you are using by the ipt. Click to see full answer. Keeping this in view, how is IPM calculated? Surface Feet Per Minute. SFM = .262 x D x RPM. Inches Per Minute. CPT x Z x RPM = IPM.

Full Answer

How to calculate an initial investment?

Investment Calculator

- I is the initial amount invested

- r is the rate of interest

- F is the frequency of interest being paid

- n is the the number of periods for which investment shall be made.

How is IPR calculated?

How is IPR computed? When feed is given up inches per tooth (ipt), you should compute ipr by increasing the variety of teeth on the device you are making use of by the ipt crushing instances from the previous slide making use of the midpoint ipt; 3: Milling device steel with a 7/16″ dia.. How do you compute IPM? IPM formula IPM is computed by increasing the variety of project mounts by 1000 ...

How do I calculate the potential of system?

Where:

- m - mass

- h - height

- g - the gravitational field strength (9.81 on Earth)

How to calculate the power loss in a resistor?

and the Power Equation. P = I × V. A simple use of these is finding the power rating required for resistors. In this case, enter any two of the following values: the voltage across the resistor, the current through the resistor, or its resistance in ohms to find the power dissipation in watts. This is the minimum power rating you can use on your resistor.

What is IPR in oil and gas?

Inflow Performance Relationship (IPR) of a well is the relation between the production rate and flowing bottom hole pressure. For oil wells, it is frequently assumed that fluid inflow rate is proportional to the difference between reservoir pressure and wellbore pressure.

What is IPR analysis?

Liquid flow into a well depends on both the reservoir characteristics and the sandface flowing pressure. The relationship of liquid inflow rate to sandface flowing pressure is called the inflow performance relationship (IPR).

How do you draw an IPR curve?

4:215:57Well Production System: VLP and IPR - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe flow rate is Q sub 1 if the flow rate is a higher value say Q sub 2 the stabilized wellboreMoreThe flow rate is Q sub 1 if the flow rate is a higher value say Q sub 2 the stabilized wellbore flowing pressure will drop to P sub W. F2. By testing a well in this manner.

How is tubing performance curve calculated?

Use equation (1.39) to calculate the tubing performance relation of this well (up to the rate of 24 MMscf/D). The first step in calculating the approximate tubing performance relation is to determines in equation (1.39): s = 0.0375(0.75) (7300)/(120 + 460) (0.78) = 0.454.

What are types of IPR?

There are four main types of intellectual property rights, including patents, trademarks, copyrights, and trade secrets....For instance, trademark law protects a product's name, whereas copyright law covers its tagline.Patents. ... Trademarks. ... Copyrights. ... Trade Secrets.

What are the 4 types of intellectual property?

Understanding the different types of intellectual property is an important knowledge that all in-house counsel should master. Patents, trademarks, copyrights, and trade secrets are valuable assets of the company and understanding how they work and how they are created is critical to knowing how to protect them.

What is IPR reservoir engineering?

Inflow Performance Relationship (IPR) is defined as the well flowing bottom-hole pressure (Pwf) as a function of production rate. It describes the flow in the reservoir. The Pwf is defined in the pressure range between the average reservoir pressure and atmospheric pressure.

What is oil formation volume factor?

Oil formation volume factor is defined as the volume of oil (and dissolved gas) at reservoir pressure and temperature required to produce one stock tank barrel of oil at the surface. The oil formation volume factor is expressed in units of reservoir volume over standard volume (usually rbbl/STB).

What is flowing bottom hole pressure?

Bottom hole pressure is the pressure at the bottom of the hole, usually measured in pounds per square inch. In a flowing well the bottom hole pressure is equal to the pressure drop in the tubing plus the wellhead pressure. The reservoir or formation pressure at the bottom of the hole is known as bottom hole pressure.

How do I choose a tubing size?

When working with suction lift or pressure: Select tubing with thicker wall thickness. Viscous liquids: Select tubing with thicker wall thickness and bigger inner diameter. High precision requirement: Select the tubing with the smallest inner diameter that can meet the flow rate requirement.

What is TPR curve?

The TPR curve is a combination of all possible steady state production conditions for the well, given certain conditions. To determine the actual or natural production conditions the characteristics of the reservoir need to be taken into account.

What is tubing performance?

1. n. [Well Completions] A mathematical tool used in production engineering to assess the performance of the completion string by plotting the surface production rate against the flowing bottomhole pressure.

Why is IPR important?

It honors the transient flow regime, and it provides a very important link to connect the reservoir model with the production system. This provides benefits such as helping to optimize the size and timing of installation of tubing in the wellbore, or to correctly size pipeline and equipment (i.e compressors, pumps and any other artificial lift) for optimum well performance.

What is the inflow performance relationship?

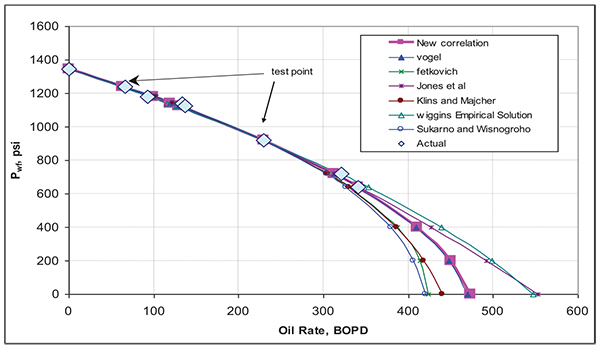

The inflow performance relationship (IPR) defines a curve that relates the production flow rate with the reservoir energy. Basically, it defines the ability of the reservoir to provide volumes to the well at different flowing pressures, as shown in Figure 5.

Is IPR constant or variable?

The IPR will not be constant though; as the reservoir pressure declines, its energy depletes and hence will have a reduction in the reservoir inflow capacity, so any optimization using a given IPR curve will not be valid for the whole life of the well.

What is the IPR rate?

IPR cannot exceed 30% of the taxable salary. The indemnities and allowances paid to an employee in relation with the termination of one’s contract of employment are taxed to IPR at the specific rate of 10%.

How much is personal income tax?

The personal income tax (IPR) is calculated according to the following annual progressive tax table: IPR cannot exceed 30% of the taxable salary. The indemnities and allowances paid to an employee in relation with the termination of one’s contract of employment are taxed to IPR at the specific rate of 10%.

How to calculate APR?

To calculate APR, use the following steps: 1 Calculate the interest rate 2 Add the administrative fees to the interest amount 3 Divide by loan amount (principal) 4 Divide by the total number of days in the loan term 5 Multiply all by 365 (one year) 6 Multiply by 100 to convert to a percentage

How does APR work?

APR only works when you know that you will pay the loan in full term. If you plan to refinance the loan halfway through, the terms and conditions for getting a new APR from a different lender may change, making your initial APR calculations useless. APR differs from lender to lender.

Why is annual percentage rate important?

Annual percentage rate is a good way to calculate the cost of borrowing because it takes into account all associated costs of borrowing, including extra charges like late fees, closing fees and administrative fees. APR does not take into account the compounding effect of interest where it applies.

Why is variable APR subject to change?

Variable APR: A variable APR is subject to change because the interest rate applied to the principal varies from time to time. It depends on the movement of the U.S. prime lending rate. The variable nature means that once there is an upward surge in interest rate, the borrower pays more.

Why is APR not applied to credit cards?

Credit card holders who pay their bills in full and on time tend not to be affected by APR. This is because APR is calculated based on the remaining balance. If the balance is paid out in full and on time, the APR will not apply.

What are the two types of APR?

Types of APR. There are two types of APR: Fixed APR: In a fixed APR, the interest rate applied to the principal amount borrowed does not change. The APR calculated based on the interest rate will also be fixed. There is no variation of the rate, and so the amount paid per year for borrowing that money remains the same.

Is APR a good measure of total cost of borrowing?

APR, while a good measure for calculating the total cost of borrowing, also has drawbacks that make it imperfect for comparing loans. Below are the key disadvantages of using APR alone as a comparison index when choosing a loan package:

Calculator Use

The Advanced APR Calculator finds the effective annual percentage rate (APR) for a loan (fixed mortgage, car loan, etc.), allowing you to specify interest compounding and payment frequencies. Input loan amount, interest rate, number of payments and financing fees to find the APR for the loan.

What is APR?

APR is the annual rate that is charged for a loan, representing the actual yearly cost of a loan over the term of the loan. This includes financing charges and any fees or additional costs associated with the loan such as closing costs or points. (Some fees are not considered "financing charges" so you should check with your lending institution.)

What is IRR in finance?

What is IRR? IRR stands for the internal rate of return. The IRR is an interest rate which represents how much money you stand to make from an investment, helping you estimate its future growth potential. In technical terms, IRR can be defined as the interest rate that makes the Net Present Value ...

Is ROI a fixed value?

However, the ROI uses fixed values and doesn’t consider how money changes over time. A investment of $100 in 1976 which returns $200 in 2020 is obviously not such a successful investment as an investment of $100 in 1976 which returns $200 in 1977.