How to Write a Cash Payment Receipt?

- The Cash Payment Receipt template Can be downloaded from the site. ...

- Introduce the payment Recipient As the Issuer of the Receipt. The entity issuing this receipt must identify itself at the beginning. ...

- Produce the documentation For this Cash Payment Receipt Template. ...

- Payment Information shuld Include to define the Cash Received. ...

How to make a receipt of payment?

- The seller’s name

- Logo (optional)

- A label “payment receipt”

- The original invoice number

- The date the payment was received

- The sum amount received

- Any remaining amount due

How to type up a receipt?

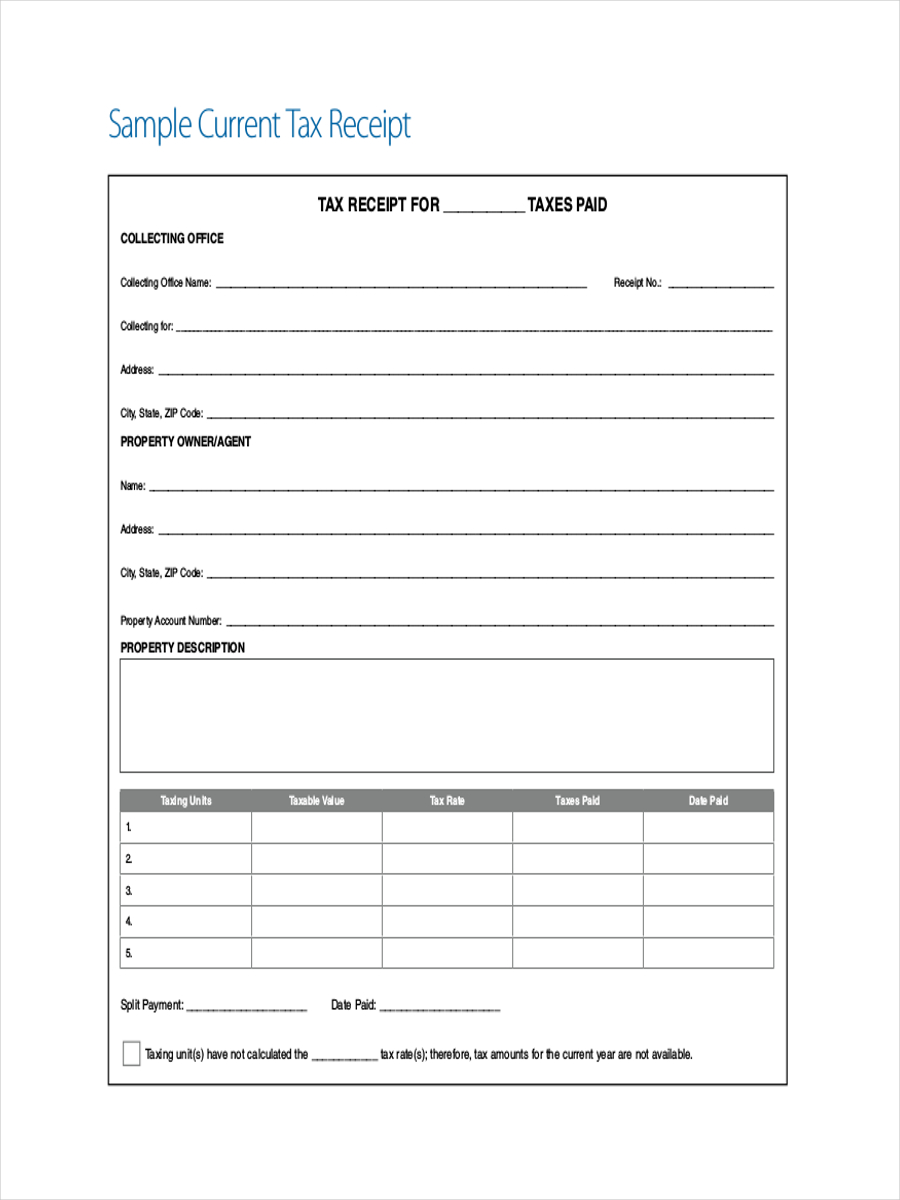

To complete a receipt the following information must be entered (see image below):

- Date;

- Receipt Number;

- Amount Received ($);

- Transaction Details (what was purchased?);

- Received by (seller);

- Received from (buyer);

- Payment Method (cash, check, credit card, etc.);

- Check Number (if applicable); and

- Credit Card Details (if applicable).

How do I write a handwritten receipt?

- your company’s details including name, address, phone number and/or email address

- the date of transaction showing date, month and year

- a list of products or services showing a brief description of the product and quantity sold

How can I get a copy of a receipt?

Some of these apps are:

- Ibotta

- Fetch

- Receipt Hog

- Receipt Pal

- Pogo

- Bitmo

- ReceiptJar

How do you write a handwritten cash receipt?

What information must I put on a receipt?your company's details including name, address, phone number and/or email address.the date of transaction showing date, month and year.a list of products or services showing a brief description of the product and quantity sold.More items...

What is cash receipt example?

Timmy sells a glass of lemonade for $1, and without say it's expected that you have to immediately pay Timmy $1 to receive a glass of lemonade. In this example, each sale generated by Timmy's lemonade stand generates a $1 cash receipt.

How do you document cash payments?

Every case is different, but here are some potential ways to prove you paid for something with cash:Save Receipts. This seems like a no-brainer... and it is. ... Cashier's Checks or Money Orders. ... Bank Statements and ATM Receipts. ... Find a Witness.

What is an example of a receipt?

Receipt is defined as to accept something given to you or is a record of money being received. An example of receipt is when someone hands you a box of chocolates and you take it. An example of receipt is a paper you get at the supermarket listing your groceries and what you paid for them.

What is a cash receipt?

A cash receipt is a printed acknowledgment of the amount of cash received during a transaction involving the transfer of cash or cash equivalent. The original copy of this receipt is given to the customer, while the other copy is kept by the seller for accounting purposes. In other words, it is generated when a vendor accepts cash ...

Why are cash receipts important?

Another importance of cash receipts is that at certain times, it can also be useful for tax purposes. It can be used to legally minimize or decrease tax payable. Since it can be used as expenses that are deducted to sales, it will reduce the payment due to lower net income.

What is debit in accounting?

Debit Debit is an entry in the books of accounts, which either increases the assets or decreases the liabilities. According to the double-entry system, the total debits should always be equal to the total credits. read more. the cash account, credit the receivable account).

Can receipts be used to claim expenses?

Also, a receipt asked during purchases or payments can be validly used to claim as an expense and then utilized as a deduction to sales in case the purchaser is a sales tax registered.

W hat Is a Cash Payment Receipt?

A cash payment receipt is a formal record of payment made with physical currency for a product or service by a customer. Since the exchange is not electronic, the receipt acts as proof that a company or entity received the funds.

What Is a Cash Payment Receipt Template?

If you regularly receive cash payments for your transactions, you will need a receipt every time you cater to a customer. A cash receipt template is a document from which you can easily create a receipt. It contains all the elements needed to record a cash transaction.

How to Accept a Cash Payment

It is advisable that you prepare a cash receipt at the same time as the transaction so that all the information is recorded in the presence of both parties. But before your issue a receipt here is how to accept cash payments from customers:

Essential Elements of a Cash Payment Receipt

The exact details included in a cash payment receipt will vary from company to company and depending on the seller. Nonetheless, all receipts contain the following key data:

How to Write

Now that you know what details a Cash Payment Receipt should include, you have to arrange the information in a way that makes sense to both parties. The following step-by-step guide will help you turn purchase data into a formal receipt:

Cash Payment Receipt Templates & Formats

A Cash Payment Receipt proves that a customer paid a monetary amount to a company or organization in exchange for products or services. Many transactions can be recorded using this document, so a company must create a cash receipt template.

What should a cash receipt include?

It should include: the date the client paid you, who provided the payment, the payment amount, what the payment was for (i.e. rent ), who received the payment, subtotal, taxes, and the remaining balance due (if any).

Do you need receipts for every purchase?

Receipts should be provided for every product or service purchased from your business, even if the customer is paying with cash. You can print the receipt as you sell the product or service and give it to the customer immediately after their purchase.

How to Accept Cash Payment?

When you are accepting a cash payment it’s important for the transfer of goods or services to occur at the same time (if applicable). Moreover, the main benefit of paying in cash is that there is no fee. In the current economy, people can still use cash or use websites and mobile apps that allow them to send money electronically for free.

How to Send money Electronically?

There are many ways to send money electronically but the common methods are PayPal. Venmo and CashApp.

How to Write a Cash Payment Receipt?

To issue a receipt you can bring it in the document the payment made in cash, download and open the template on this page. Moreover, you can complete it by checking the file link to .odt, .doc and PDf buttons to preview the picture.

Conclusion

The cash payment receipt template is for the use of a product or service with the physical currency. If there is no electronic evidence of a cash transaction, you can provide the evidence through a cash receipt. This is the only proof for the receiving party.

How to keep cash receipts?

The cash payment receipts are kept in the record file and can be used: 1 For any future reference. 2 As proof of payment. 3 To resolve and address any misunderstandings or issues with the concerning parties. 4 To match with the accounting records and address any discrepancies.

Where are cash receipts kept?

The cash payment receipts are kept in the record file and can be used: For any future reference. As proof of payment. To resolve and address any misunderstandings or issues with the concerning parties. To match with the accounting records and address any discrepancies. As disbursing money and issuing cash payment receipts are a common ...

Why do we pay cash?

Some of the reasons for cash payment and the issuance of receipts are: Advertisement. Payment of the taxes. Payment of the day to day expenses, such as stationery. Payment of the utility bills. Payment of salaries. Payment for small expenses, such as vehicle maintenance.

What is the mode of payment?

Mode of payment, e.g. cash, cheque, money order, etc. Reason for payment. If any time of usage of product or service is involved, it can be mentioned as well. As mentioned before, cash payment receipts are widely used with the frequency as close as the daily basis. Some of the reasons for cash payment and the issuance of receipts are:

How to make a cash receipt?

How to Create a Cash Receipt 1 Purpose: Have a reason you are making the receipt. Apart from helping you track your income for accounting purposes, receipts also act as a proof when filing for tax returns. Always issue a receipt to your customers and get one when you make any purchases. 2 Proof of a Transaction: When issuing the receipt, make it clear to the customer that the document acts as proof of purchase. It also acts as a proof for warranties, returns, and exchanges. 3 Date: It is important to indicate when the transaction occurred. You may also include the time for your records purpose, but an effective receipt should only have the calendar date. 4 Parties Involved: When creating a cash receipt, make sure to include the parties involved in the sale of a product or service. Indicate your company’s information, such as the business name and number, as well as the consumer’s identity if the sale costs more than $1,000. 5 Goods or Services in the Transaction: A good cash receipt should identify the goods or services, quantity and the price per unit.

What is a cash collection receipt?

A cash collection receipt outlines cash sales (sales made for cash) and the cash a company collects from businesses or individuals whom it has previously issued an invoice. In essence, the activity in the accounts receivable and sales accounts determines the cash collection.

What is a sales receipt template?

A sales receipt template offers the easy way to write sales receipts. And with the correct template, it is a lot easier to create sales receipts for customers who pay with cash for single or multiple items. Typically, a sales receipt template contains one item, and is issued to a customer when they give you cash, often as a deposit for a product or service.

Why is it important to retain cash receipts?

Advertisements. So, why is it important to retain your cash receipt? In essence, receipts act as a proof of transaction between two parties. For a buyer, it helps in tracking expenses, budgeting and reconciling. It is also a proof of purchase for warranties, returns, exchanges and tax deductions. If you work in a business, ...

When issuing a receipt?

Proof of a Transaction: When issuing the receipt, make it clear to the customer that the document acts as proof of purchase. It also acts as a proof for warranties, returns, and exchanges.

Is a deposit receipt a confirmation receipt?

In most cases, businesses consider a deposit receipt as a confirmation receipt because they issue a receipt of acceptance once they receive a deposit, usually in cash. usask.ca. Details. File Format.

Is a cash receipt a debit or credit?

A cash receipt is accounted for as a debit. When a customer makes a payment or sends a check to clear the invoice amount, credit the cash sales in the sales journal and debit the cash receipts journal.

What is receipt in accounting?

Receipts serve as a document for customer payments and as a record of sale. If you want to provide a customer with a receipt, you can handwrite one on a piece of paper or create one digitally using a template or software system.

What should be included on a donation receipt?

Community Answer. A donation receipt would include the same things you'd include on the receipt for a sale. List what the donation is on the left side of the receipt and the estimated value of the goods on the right side of the receipt. You should also include your nonprofit ID number for tax purposes.

How to write down payment method?

The payment method could be cash, check, or credit card. On the last line of the receipt write the customer’s full name. If they paid by credit card, have them sign the bottom of the receipt.

Can you reset receipt numbers every day?

004. You can reset the receipt numbers every day as long as you also write the date on every receipt.

Can you handwrite receipts on paper?

Make sure to get booklets with 2 part forms so that you get a copy that you can keep for your records. If you don’t have a booklet on hand, you can simply handwrite receipts on a piece of paper and photocopy them.