How do you calculate total reserves? Total reserves = required reserves + excess reserves, 450 = 300 + excess reserves, excess reserves = $300. We can then use the money multiplier to figure out the current deposit balance, 300*mm (10) = $3,000.

- Required Reserves = RR x Liabilities.

- Excess Reserves = Total Reserves - Required Reserves.

- Change in Money Supply = initial Excess Reserves x Money Multiplier.

- Money Multiplier = 1 / RR.

What is the formula for actual reserves?

There is a reasonably simple formula to do this: Amount Required to be Paid x (1+the rate of interest)^ -years =The Amount Required to be Invested Now this may look complicated but if we assume the rate of interest to be a steady 6% on our investments the example above can be worked out like this:

What is the formula for calculating excess reserves?

how to calculate excess reserves from balance sheet

- Calculating Excess Reserves

- Calculating a Bank’s Excess Reserves

- Required Reserves | Economics | Chegg Tutors

- Required and Excess Reserves

How do you calculate the required reserves?

Required

- Calculate the Required Reserves of each bank and determine if they meet the Central Bank's requirements.

- Assume that, in the current year, Walls Fargo wishes to minimize its bank reserves. ...

- Assume that, in the current year, JR Morgani's deposits increase by $20 Million. By how much must its bank reserves increase or decrease?

What is the formula for excess reserve?

Recommended Articles

- Reserve Price

- Reserve Ratio

- Cape Ratio

- Repo Rate vs. Reverse Repo Rate

How do you calculate reserves?

A bank's reserves are calculated by multiplying its total deposits by the reserve ratio. For example, if a bank's deposits total $500 million, and the required reserve is 10%, multiply 500 by 0.10. The bank's required minimum reserve is $50 million.

What are total reserves?

total reserves. sum of the deposits that depository institutions may count toward their legal reserve requirements. Included in the calculation are reserve account balances on deposit with a reserve bank during the most recent week, currency and coin in a bank's vault, including cash in transit to or from reserve banks ...

How do you calculate change in total reserve?

AR = ARR. AR in this case is the initial change in reserves, and ARR is the change in required reserves that must occur. We know that required reserves are equal to the bank's reserves multiplied by the required reserve ratio.

What is total reserve ratio?

The reserve ratio is the portion of reservable liabilities that commercial banks must hold onto, rather than lend out or invest. This is a requirement determined by the country's central bank, which in the United States is the Federal Reserve. It is also known as the cash reserve ratio.

What are the 3 types of reserves?

Reserve in accounting is mainly of 3 types....Types of ReservesRevenue Reserve. ... Capital Reserve. ... Specific Reserve.

What are reserves in economics?

Reserves, in the world of business and finance, refers to 'money in hand' – money that is available to be used for a wide range of possibilities, including meeting future planned payments, unexpected events, emergencies, opportunities, etc.

What is the actual reserve?

Actual Reserves means the statutory policyholder reserves (excluding, for the avoidance of doubt, any interest maintenance reserves, additional actuarial reserves or asset valuation reserves) as of the Closing Date with respect to the FA Contracts, excluding any reserves with respect to the Non-Qualified FA Contracts, ...

How do you calculate cash reserve ratio?

Cash Reserve Ratio = Reserve Requirement * Bank Deposits Net Demand and Time liabilities are nothing but a summation of savings accounts, current accounts, and fixed deposits, which the bank holds. The equation for calculating the cash reserve ratio is quite simple.

How do you calculate reserve requirement percentage?

The requirement for the reserve ratio is decided by the central bank of the country, such as the Federal Reserve in the case of the United States. The calculation for a bank can be derived by dividing the cash reserve maintained with the central bank by the bank deposits, and it is expressed in percentage.

How do you calculate excess reserves in macroeconomics?

You can calculate excess reserves by subtracting the required reserves from the legal reserves held by the bank. If the resulting number is zero, then there are no excess reserves.

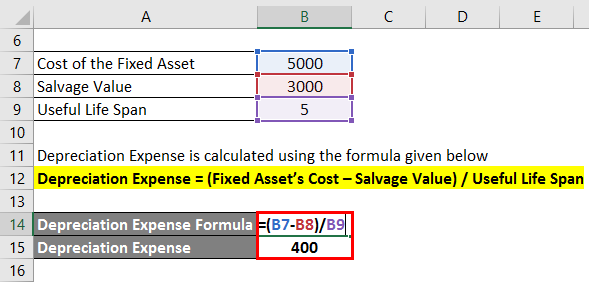

What is excess reserves formula?

1. The excess reserves formula looks like this: Excess Reserves = Total Reserves - Required Reserves. In essence, a bank's excess reserves are any cash it keeps over the required minimum.

How do you calculate reserve requirement for AP macros?

0:292:43The Money Multiplier and Reserve Requirement - YouTubeYouTubeStart of suggested clipEnd of suggested clipIt's one over. Point one or one over one tenth. Right one over one tenth. Right equals ten the moneyMoreIt's one over. Point one or one over one tenth. Right one over one tenth. Right equals ten the money multiplier can be ten any anomaly that comes in the system is going to get multiplied. Times ten.

How much does the US have in reserves?

U.S. Reserve Assets (Table 3.12)Asset20191Total129,4792Gold stock111,0413Special drawing rights2 350,7494Reserve position in International Monetary Fund2 526,1532 more rows

Which country has the most reserves of money?

China10 Countries with the Biggest Forex ReservesRankCountryForeign Currency Reserves (in billions of U.S. dollars)1China$3,222.4 (November 2021)2Japan$1,259.9 (January 2022)3Switzerland$1,033.84India$569.96 more rows

What is the total reserve of Pakistan?

However, total reserves with the State Bank of Pakistan (SBP) and banks, stand at $17bn.

What are excess reserves?

Excess reserves are capital reserves held by a bank or financial institution in excess of what is required by regulators, creditors, or internal controls. For commercial banks, excess reserves are measured against standard reserve requirement amounts set by central banking authorities.

What is reserve requirement?

Reserves Required Reserve Requirement is the minimum liquid cash amount in a proportion of its total deposit that is required to be kept either in the bank or deposited in the central bank, in such a way that the bank cannot access it for any business or economic activity . read more. ).

What does excess reserve mean?

Excess Reserves refers to the amount kept or deposited with the principal or central regulatory authority (in India, Reserve Bank of India) over and above the statutory requirements. If reserves are positive, then it simply means that the bank has kept the amount in reserves more than the statutory requirement and vice versa.