How do you calculate tax title and license on a vehicle in Texas? According to the Texas Department of Motor Vehicles, car owners must pay a motor vehicle tax of 6.25 percent. To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625). Click to see full answer.

- Sales Tax: 6.25% of the total vehicle purchase price.

- Title Transfer Fee: $28 to $33 (varies by county)

- Tag / License Fee: $51.75 base fee, $10 local fee.

How do you calculate sales tax on a new car in Texas?

07/12/2021 · In Texas, the title fee is $33 in most of the counties. For the sales tax of both new and used vehicles to be paid, it is calculated by multiplying the cost of buying the car by 6.25 percent. For instance, if a vehicle is sold at $20,000, the sales tax is calculated by multiplying $20,000 by 6.25 percent.

How much does it cost to title a car in Texas?

In most counties in Texas, the title fee is around $33. The sales tax on both new and used vehicles is calculated by multiplying the cost of the vehicle by 6.25 percentage. For instance, if you purchase a car for $20,000, you will pay a sales tax of $1,250, which is $20,000 multiplied by 6.25/100.

What is a tax title and license in Texas?

12/06/2020 · How do you calculate tax title and license on a vehicle in Texas? According to the Texas Department of Motor Vehicles, car owners must pay a motor vehicle tax of 6.25 percent. To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625). Click to see full answer.

How do I calculate tax on a title and license?

To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625). For example, if you purchased a car with a sales price of $16,000, the tax on the vehicle is 16,000 multiplied by 6.25 percent, or $1,000.

What percent is tax title and license in Texas?

6.25%A used car in Texas will cost $90 to $95 for title and license, plus 6.25% sales tax of the purchase price. If you purchased the car in a private sale, you may be taxed on the purchase price or the “standard presumptive value” (SPV) of the car, whichever is higher.

How do you calculate sales tax on a car in Texas?

Bill of sale is not itemized or no sales tax has been paid to the state where the vehicle was purchased Sales tax is calculated using the following formula: (Vehicle Price – Trade in Value) x 6.25%.

How much are taxes and fees on a car in Texas?

The State of Texas imposes a motor vehicle sales and use tax of 6.25% of the purchase price on new vehicles and 80% of the Standard Presumptive Value (non dealer sales) of used vehicles. New Texas residents pay a flat $90.00 tax on each vehicle, whether leased or owned when they establish a Texas residence.

How much is car title and registration in Texas?

Registration FeesFeeAmountRegistration Fee$51.75Local Fee$10.00Special Plates Fee(s)$0.00Inspection Fee$7.504 more rows

How do you calculate sales tax on a vehicle?

0:001:12How To Find Out How Much Sales Tax - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe formula for calculating sales tax on something is sales tax equals the cost of the item. TimesMoreThe formula for calculating sales tax on something is sales tax equals the cost of the item. Times the sales.

How do you calculate sales tax on a car?

To calculate the sales tax on your vehicle, find the total sales tax fee for the city. The minimum is 7.25%. Multiply the vehicle price (before trade-in or incentives) by the sales tax fee. For example, imagine you are purchasing a vehicle for $20,000 with the state sales tax of 7.25%.06-Jul-2021

How do you calculate tax in Texas?

The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price....U.S. Sales Tax.StateGeneral State Sales TaxMax Tax Rate with Local/City Sale TaxTexas6.25%8.25%Utah5.95%8.35%Vermont6%7%Virginia5.30%6%49 more rows

How do u calculate tax?

Estimating a tax bill starts with estimating taxable income. In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. What's left is taxable income. Then we apply the appropriate tax bracket (based on income and filing status) to calculate tax liability.

How much is title and registration?

Vehicle Registration Fees, Insurance, and Other Costs by State for 2021StateRegistration FeeTitle FeeCalifornia$64 plus extra fees like CHP and Transportation Improvement$23ColoradoBased on weight$7.20Connecticut$120 for a new registration, $80 to renew for two years$25Delaware$40$3540 more rows

How do I avoid paying sales tax on a car in Texas?

You can avoid paying sales tax on a used car by meeting the exemption circumstances, which include:You will register the vehicle in a state with no sales tax because you live or have a business there.You plan to move to a state without sales tax within 90 days of the vehicle purchase.The vehicle was made before 1973.More items...•31-May-2021

How much does it cost to put a title in your name in Texas?

The title fee is $33, plus motor-vehicle sales tax (6.25 percent). There is also a $2.50 transfer of a current registration fee. If the license is not current, there may be a registration fee.

How much are taxes on a car?

If you buy a vehicle in California, you pay a 7.5 percent state sales tax rate regardless of the vehicle you buy. Local governments can take up to 2.5 percent for a vehicle's sales tax along with the sales tax that goes to counties and cities.13-Apr-2020

How much sales tax do you pay on a car in Texas?

Sales Tax. According to the Texas Department of Motor Vehicles, car owners must pay a motor vehicle tax of 6.25 percent. To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625).

Do you have to pay registration fees in Texas?

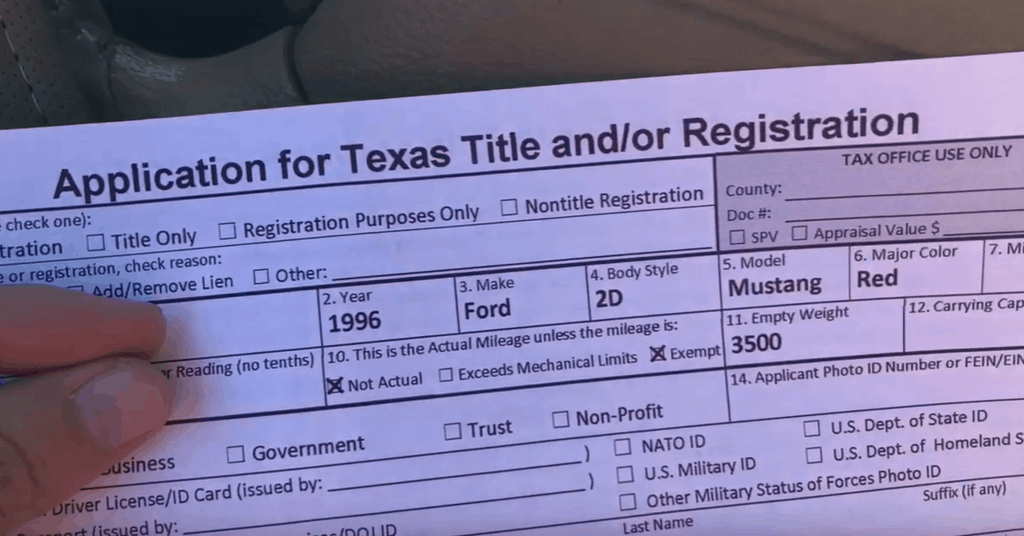

If you've just purchased a new car in Texas, set aside some funds for initial fees. Texas residents must pay registration fees, any vehicle sales tax due and sometimes additional local fees when applying for a Texas title. Vehicle sales tax is generally a factor of the car purchase price, while registration fees are fixed depending on vehicle type ...

What happens if you don't pay sales tax?

If you don't square out your fees and pay them on time, you'll get hit with extra penalties. Owners whose sales tax payment is between one and 30 days late must pay an extra 5 percent of sales tax as a late penalty. Owners who pay more than 30 days late must pay an additional 10 percent of the original sales tax bill.

How much does it cost to register a motorcycle?

Motorcycles and mopeds cost $30 annually to register. Residents must pay annual registration of $45 on trailers weighing 6,000 pounds or less and $54 on vehicles between 6,000 and 10,000 pounds.

What is the Texas Department of Motor Vehicles?

The Texas Department of Motor Vehicles is an agency that has been empowered to manage all tax, title, and license matters in Texas. The activities and operations of the TxDMV are governed by the Board that formulates policies concerning its activities. The Board consists of nine members. The Executive Director is the person at the helms ...

How much is the title fee in Texas?

In Texas, the title fee is $33 in most of the counties. For the sales tax of both new and used vehicles to be paid, it is calculated by multiplying the cost of buying the car by 6.25 percent. For instance, if a vehicle is sold at $20,000, the sales tax is calculated by multiplying $20,000 by 6.25 percent. That means the sales tax of the car will be ...

Who is responsible for a driver's license in Texas?

The Texas Department of Public Safety has the responsibility of issuing driver licenses. The Texas Department of Motor Vehicles is not in charge of giving out driver licenses. These processes are o be carried out at the office of the local county tax assessor-collector.

Do you have to pay sales tax on a new car in Texas?

The downside to it is that you accrue interest on the payments and will end up spending more in the process. Residents of Texas have to pay vehicle sales tax and registration fees when buying a new car. You also have to pay other fees to get a tax title. The sales tax is calculated from the cost of purchasing the vehicle.

What is the role of the executive director of the Texas Department of Motor Vehicles?

The Executive Director has to supervise and control the day-to-day running of the agency. The responsibilities of the Texas Department of Motor Vehicles include the registration of vehicles, regulation of the vehicles for commercial activities, and issuance of permits.

How much does it cost to register a car in Texas?

Residents of Texas are required to pay the sum of $50.75 on passenger vehicles, $30 for motorcycles, $45-$54 for trailers depending on the weight it carries as registration fee.

How long does it take to get a car registered in Texas?

All vehicles that come into Texas have a period of 1-30 days to get registered. The first step is to ensure that the car is inspected by the Texas Department of Public Safety.

How to calculate car tax in NJ?

To use the calculators above including the car payments calculator NJ, you'll usually need to enter some basic information about the vehicle you plan to purchase. The information you may need to enter into the tax and tag calculators may include: 1 The vehicle identification number (VIN). 2 The make, model, and year of your vehicle. 3 The date that you purchased (or plan to purchase) the vehicle. 4 The date the vehicle entered (or will enter) the state you plan to register it in. 5 The type of license plates/registration you need for the vehicle.

Does CarMax have a tax calculator?

In addition, CarMax offers a free tax and tag calculator for some states only. This calculator can help you estimate the taxes required when purchasing a new or used vehicle. Anytime you are shopping around for a new vehicle and are beginning to make a budget, it's important to factor in state taxes, titling and registration fees, ...

What happens after you calculate sales tax?

After calculating sales tax (depending on the new car sales tax rate), you may find your total fess have increased significantly. A major part of the final cost of a new vehicle purchase can be the taxes you'll need to pay and the registration/titling fees you'll owe to your state's Department of Motor Vehicles (DMV), Motor Vehicle Division (MVD), ...

What information do you need to register a vehicle?

The information you may need to enter into the tax and tag calculators may include: The vehicle identification number (VIN). The make, model, and year of your vehicle. The date that you purchased (or plan to purchase) the vehicle. The date the vehicle entered (or will enter) the state you plan to register it in.

What vehicles are not subject to tax?

Vehicles Not Subject to Taxation based on Standard Presumptive Value 1 New vehicles (not previously titled) 2 Vehicles purchased from licensed dealers (dealers use purchase price only) 3 Vehicles purchased at a governmental or foreclosure auction 4 Vehicles 25 years old or older 5 Off-road vehicles, such as dirt bikes or all-terrain vehicles (ATVs) 6 Salvage or abandoned vehicles (except rebuilt salvage vehicles) 7 Vehicles sold through a mechanic or storage lien 8 Vehicles given as gifts (see Affidavit of Motor Vehicle Gift Transfer) 9 Even-trade vehicles, when vehicles of equal value are swapped by the owners

What is SPV in Texas?

SPV applies wherever you buy the vehicle, in Texas or out of state. A vehicle's SPV is its worth based on similar sales in the Texas region. The Texas Legislature passed the law in 2009 to raise additional revenue to fund Texas schools.

What is an even trade vehicle?

Even-trade vehicles, when vehicles of equal value are swapped by the owners. For more information about SPV, you may contact the Comptroller of Public Accounts at (800) 252-1382 or you can visit the Comptroller's Web site.

What is the tax rate in Arizona?

At the high end, a total tax rate of 9.8 percent means that you'd owe about three times as much in Arizona compared to what you would pay in Alabama for car taxes and fees.

How much does it cost to register a car in Alabama?

Alabama has a much more straightforward fee structure, with yearly registration and title fees of $23 and $15, respectively. If you add $600 in taxes based on a $15,000-vehicle purchase at 4 percent, your total tax, title and registration costs are $638. Some states do charge a higher upfront registration fee at the time ...

What is agreed upon price?

by Neil Kokemuller. The agreed-upon price is just part of the total purchase amount when buying a vehicle. In addition, you pay sales taxes, title and registration fees. The specific add-on fees vary greatly based on your state, the vehicle and the net sales price.

Which states have the most complicated registration fees?

Louisiana and New York are among the other states that have more complicated registration fee systems, with charges based on the age and size of the automobile. Oklahoma has a sliding descending registration fee scale where you pay a little bit less after every four-year registration cycle.