Compute the value at which inventory should be reported in financial statements if LCNRV rule is followed? Solution: NRV (8,500) < Cost (10,000) therefore, inventory will be valued at 8,500.

What is the lcnrv value of inventory?

NRV (8,500) < Cost (10,000) therefore, inventory will be valued at 8,500. Application of LCNRV rule can be done individual item basis, group basis or on overall basis. What basis entity must use depends on the nature of inventory itself and management’s policy.

How do you calculate lcnrv?

Herein, how do you calculate Lcnrv? Net realizable value is the estimated selling price of goods, minus the cost of their sale or disposal. It is used in the determination of the lower of cost or market for on-hand inventory items.

How do you calculate the value of inventory?

The value of the inventory is based on the cost to manufacture the item or -- if you are a retailer -- your cost to purchase the item. Every time you add an item to the inventory, add the cost to the ledger; every time an item is removed from your inventory, deduct the cost from the ledger. Secondly, how do you calculate cost per unit inventory?

What does net realizable value mean in lcnrv?

The term "net realizable value" in LCNRV generally means the estimated selling price in the ordinary course of business less reasonably predictable costs of completion and disposal. You just studied 4 terms!

What is Lcnrv formula?

Lower of cost or NRV (new rule) The new rule, LCNRV, was designed to simplify this calculation. NRV is the estimated selling price in the ordinary course of business, minus costs of completion, disposal, and transportation. Say Geyer Co.

What is Lcnrv inventory?

Generally accepted accounting principles require that inventory be valued at the lesser amount of its laid-down cost and the amount for which it can likely be sold—its net realizable value(NRV). This concept is known as the lower of cost and net realizable value, or LCNRV.Jan 19, 2016

What is the formula of value of inventory?

Use this figure to calculate ending inventory using the following formula: Beginning inventory + COGS = total cost of goods available for sale. Gross profit x sales = estimated cost of goods sold. Total cost of goods available for sale - cost of goods sold = ending inventory.Jan 27, 2022

What is the purpose of the Lcnrv method?

What is the purpose of the LCNRV method? The purpose of using the LCNRV method is to reflect the decline of inventory value below its original cost. A departure from cost is justified on the basis that a loss of utility should be reported as a charge against the revenues in the period in which it occurs.

Do you apply the Lcnrv method to each individual item to a category or to the total of the inventory?

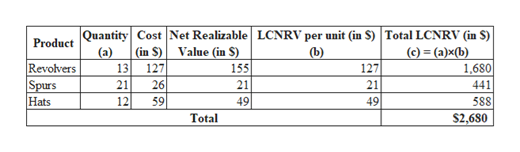

The LCNRV rule can be applied to each inventory item, each inventory class, or total inventory, and each may have different results.

What is the purpose of LCNRV?

The purpose of using the LCNRV method is to reflect the decline of inventory value below its original cost. The term "net realizable value" in LCNRV generally means the estimated selling price in the ordinary course of business less reasonably predictable costs of completion and disposal. You just studied 4 terms!

Why is NRV lower than cost?

Also Know, why NRV is lower than cost? 1 Reasons for lower NRV NRV may falls below cost for two main reasons; either cost has increased or sales price has dropped. Some of the examples include: Goods are now obsolete.

How to value inventory at the lower of cost?

First, determine the historical purchase cost of inventory. 2. Second, determine the replacement cost of inventory. It is the same as the market value of inventory. 3.

What happens if inventory is not reassessed?

If the inventory value were not reassessed to the appropriate value, it would overstate the company’s assets and mislead users. However, as will be discussed below, the lower of cost or market inventory valuation method is not as simple as just comparing cost and market.

What is the difference between market value and cost?

Cost refers to the purchase cost of inventory, and market value refers to the replacement cost of inventory. The replacement cost cannot exceed the net realizable value or be lower than the net realizable value less a normal profit margin.

What is LCM in accounting?

Lower of cost or market (LCM) is an inventory valuation method required for companies that follow U.S. GAAP. GAAP GAAP, Generally Accepted Accounting Principles, is a recognized set of rules and procedures that govern corporate accounting and financial. .

What is the lower of cost method?

In the lower of cost or market invent ory valuation method, the company’s inventory purchased at cost is compared against the market value of that inventory. The market value of inventory is essentially the replacement cost of that inventory or the amount of money it would take to replace the inventory in the open market.

What is the balance sheet of inventory?

When inventory is purchased by a company, it sits on the balance sheet. Balance Sheet The balance sheet is one of the three fundamental financial statements. These statements are key to both financial modeling and accounting. at cost. However, over time, the value of the inventory may depreciate or appreciate.

Is replacement cost lower than net realizable value?

The replacement cost cannot be lower than net realizable value less a normal profit margin. Net realizable value is the sale price of the inventory minus any costs incurred to prepare the inventory for sale. A normal profit margin is the average spread between the cost and sale price of the inventory.