Follow these steps:

- Click on “ Enroll Now “

- Enter the account number or debit/ATM card associated with the account

- Enter your account or ATM card PIN (for loans, CDs or IRAs, enter your date of birth instead of the PIN)

- Enter your Social Security or tax ID number

- Create a login ID

- Add a password

- Answer a security question

- Sign in with your new TCF Bank login

Full Answer

What happens when I log in to TCF digital banking?

Answer: For most customers, when you log in to TCF digital banking, we will guide you through username and password updates, if we haven’t already, to make sure you are ready for a seamless transition to Huntington Online Banking.

How do I contact TCF customer service?

For questions related to your TCF accounts and services, visit https://www.tcfbank.com/contact/faqs/personal . To contact TCF, visit https://www.tcfbank.com/contact. How will my deposit accounts transfer to Huntington?

When will TCF join Huntington online banking?

TCF officially joins Huntington (Keep banking as usual.) We’ll help you update your username and password on tcfbank.com so you’ll be all set to log in to Huntington Online Banking starting October 12. (Applies to most customers.) Your Huntington Welcome Package is mailed with details to help with a smooth transition.

When will my TCF debit card be deactivated?

You may continue to use your TCF debit card until you have activated your new Huntington card. Your TCF debit card will be deactivated on November 4, 2021, if you have not previously activated your new Huntington debit card or you have not received a new card.

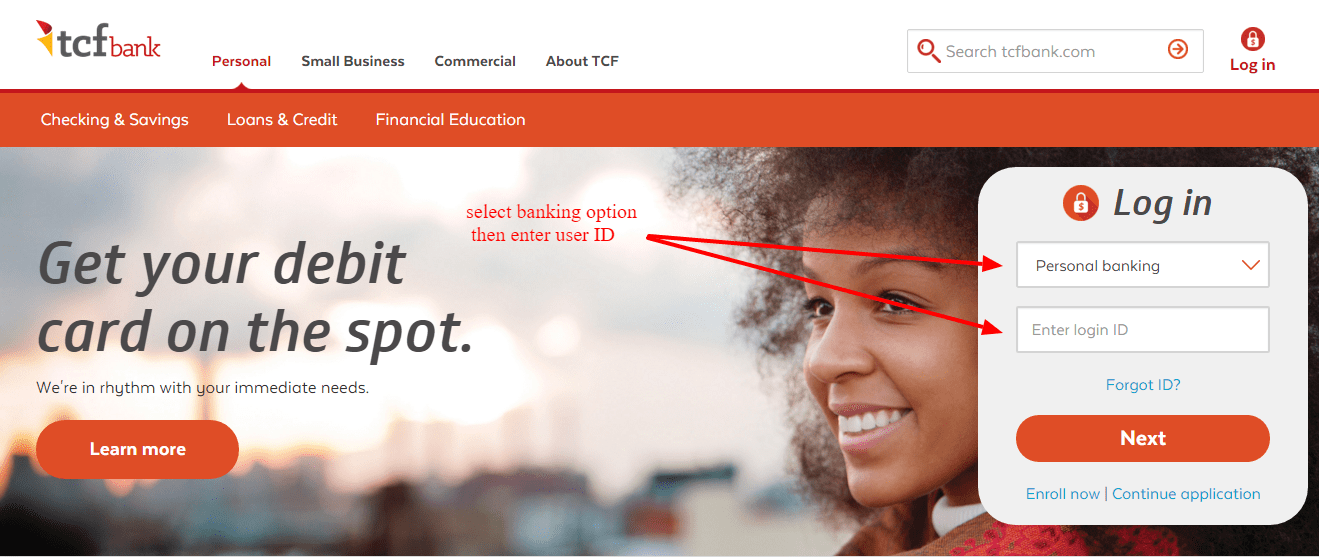

How do I log into my TCF account?

How To Log In to Your TCF Bank Account From a Mobile Phone or TabletFollow the prompts to enter your account number or debit card number.Enter your card's PIN.Enter your Social Security number or tax ID number for verification.Choose a login and password.Answer a security question.

How do I activate Digital banking?

Navigate to the bank's official website. Click on the 'login' or 'register button. Enter the account number, registered mobile number, branch code, CIF number, and any other information required, then click the 'submit button.

How do you log into your online banking account?

Go to your bank's website. Whenever you want to access your account, all you have to do is open your web browser and visit your bank's website. After the page loads, look for the tab or button that says "online banking." Click the link that says "online banking" or "login" to access your account.

How can I use mobile banking app?

0:180:58Here's How to use Mobile Banking - YouTubeYouTubeStart of suggested clipEnd of suggested clipTo get started you can simply choose a four digit access code to log on to mobile banking. You canMoreTo get started you can simply choose a four digit access code to log on to mobile banking. You can do most of your normal payments and transfers. And it's easy to check your accounts. And balances.

How do I find my bank activation code?

You'll need an Online Banking activation code when you register or re-register for Online Banking. It's used to generate or reset your security number and password for your online access. We'll send your activation code by text message if you have a valid mobile number, or by post if you don't have one on file.

How long does it take for internet banking to start?

9. Once you have successfully entered the login password, you will be advised to login to internet banking services after an hour as per SBI call centre. It will ask you to create a new username of your choice. Select the checkbox to accept the Internet banking terms and conditions.

Why can't I log into my Online Banking?

Ensure you can access other websites. Clear your browser cache. Delete cookies (this will remove your saved settings for sites you've previously visited such as username, password, or other personal information) Close all browser windows then reopen and try accessing Online Banking again.

How can I check my account online?

Log In Online To get started, navigate to your bank's website and access your account information. You can also use a mobile app, as described below. In most cases, you'll look for an option like “Login” or “Account Access.” If it's your first visit, select options like “Register” or “First-time User.”

How do I set up mobile banking?

0:101:53How to set up mobile banking on your phone or tablet | Money on your MindYouTubeStart of suggested clipEnd of suggested clipNow don't worry if you don't have that number just tap enter your personal details. Instead. WellMoreNow don't worry if you don't have that number just tap enter your personal details. Instead. Well then ask you to add in your online banking password if you've already registered.

How do I log into mobile banking?

Launch the app and use option- New User Registration. Users will receive OTP (One Time Password) through SMS on registered mobile number after submitting CIF Number. After successful validation, register it – Using Debit Card information or Internet Banking User ID & Password or through ATM or Branch.

What is the difference between mobile banking and online banking?

Mobile banking is performed on an app using a portable device, such as a smartphone or tablet. Online banking can be carried out on any device with an internet connection (e.g., desktop or laptop computer, smartphone, tablet) and doesn't require users to download an app.

What is difference between Internet banking and mobile banking?

The biggest difference between the two is their functionality. Internet Banking allows you to conduct online transactions through your PC or laptop and an internet connection. On the other hand, mobile banking can be done with or without internet. Many banks nowadays have their mobile apps for mobile banking.

How to download transactions from Hub?

There you’ll see an option to Download Account Transactions. For business accounts, The Hub’s Transactions tool has a download link. Your transactions can be downloaded into Quicken, QuickBooks and CSV formats.

How to select which accounts are included in financial tools?

Answer: At the bottom of The Hub, click the Manage Hub & Tool Views link. You can select which accounts are included in your financial tools by default. Select at least one of the available accounts for each tool.

What is a transaction on a Huntington card?

Answer: A transaction is any individual credit or debit in your Huntington checking, savings, money market, personal credit line or Voice Credit Card® accounts. Note, eligible accounts may vary for personal and business customers.

How to improve accuracy of financial tools?

To improve the accuracy of your financial tools, you can re-categorize these transactions. Click on the transaction to bring up the Transaction Detail window. Then click Edit to open the Select Category window. Or you can use a debit or credit card instead of cash or checks.

What is a First Bankcard?

First Bankcard ® is a federally registered trademark of First Bankcard, a division of First National Bank of Omaha. 1 $50 Safety Zone ℠ and 24-Hour Grace ® do not apply to returned items and their associated fees. Your account will be automatically closed if it remains negative in any amount for 60 days.

When will Huntington Online Banking be available?

Get familiar now with the many digital tools that will be available to you on October 12, 2021.

Is MasterCard a trademark?

Mastercard and the Mastercard Brand Mark are registered trademarks of Mastercard International Incorporated.