What is sales taxes payable?

Sales taxes payable refers to the liability account that is created when an entity collects sales taxes on behalf of the government and stores the aggregate amount of taxes before paying to the concerned taxes authority.

Does accounts payable have a debit or credit balance?

Since Accounts Payable is a liability account, it should have a credit balance. The credit balance indicates the amount that company or organization owes to its suppliers or vendors. ... Accounts Payable is debited when a payment is made to a supplier or vendor.

Why are we paying with a debit on the balance sheet?

We are paying down the debt. The normal balance in a liability account is a credit balance so in order to pay off that balance we would need to debit the account. How are we paying with sales tax?

Is the sales tax account debited or credited?

Sales Tax account is debited since this is the amount of sales tax recoverable from the tax authorities. The accounting entry to record credit purchases involving sales tax will therefore be as follows: Subsequent payment of dues to the supplier will result in the following double entry:

Is tax payable a debit or credit?

Taxes payable refers to one or more liability accounts that contain the current balance of taxes owed to government entities. Once these taxes are paid, they are removed from the taxes payable account with a debit.

What type of account is sales tax payable?

liability accountSales taxes payable is a liability account in which is stored the aggregate amount of sales taxes that a business has collected from customers on behalf of a governing tax authority.

Is sales tax payable an expense?

Now if you are talking about sales taxes you pay on purchases, then in that case, I would post the taxes to the same expense account as the purchase. In other words, if you purchased office supplies on which sales taxes were charged, the entire amount including sales taxes paid would post to office supplies.

How do you account for sales tax payable?

To record your sales tax payable:Create a journal entry.Debit your cash account for the amount of sales tax you collected on your sales tax payable balance sheet.Then, enter two separate journal entries: your sales revenue and the amount of sales tax you collected.

What does debit on sales tax payable mean?

Sales Tax Payable. Once the sales taxes are remitted, you'll debit the Sales Tax Payable account and credit Cash. If a business buys any items from its vendors and pays a sales tax on these items, it charges the sales tax to expense in the current period, along with the cost of the items purchased.

Is sales tax payable a current liability?

Sales tax and use tax are usually listed on the balance sheet as current liabilities. They are both paid directly to the government and depend on the amount of product or services sold because the tax is a percentage of total sales.

Is sales tax an asset?

In the least common scenario, a company buys a fixed asset, which includes a sales tax. In this case, it is allowed to include the sales tax in the capitalized cost of the fixed asset, so the sales tax becomes part of the asset.

How do I record sales tax payable in Quickbooks?

Record a sales tax paymentGo to Taxes, then select Sales tax (Take me there).From the Sales tax list, go to the tax agency you're recording the payment for and select View return.Select Add an adjustment, make the adjustment as required.Select Record payment.More items...

Why do accountants specialize in sales tax?

There are a number of accountants who specialize in sales tax regulation because the laws can be so complicated. Historically, in order for a company to be required to collect sales tax in a state, the company must have nexus in the state. Nexus refers to physical presence in the state.

When are sales taxes collected?

Sales tax is collected by retailers when goods and services are sold to the final user. Sales taxes are not imposed when materials that will be used to manufacture a product are sold to a manufacturer. When the manufacturer sells their products to a retailer, no taxes are imposed.

What is added to the cost of an asset?

If you think back to the asset purchase rules, all costs associated with acquiring an asset must be added to the cost of the asset. These costs include sales tax. If a company purchases supplies and pays sales tax, the sales tax is added to the cost of the supplies.

How many states do not have sales tax?

There are only five states in the United States that do not have a state sales tax. There is little consistency in how states apply sales tax. Some states only collect sales tax on goods and not services. Some states give exemptions for items that are considered necessities, like food and clothing. Some states exempt some services like hair cuts ...

When recording a transaction, what is the record?

When recording the transaction, record the cash that was received, the revenue the company earned, and the sales tax that is payable to the state. As the month goes on and more sales transactions occur, the sales tax payable account will grow. Most states require monthly payment for sales tax collected.

Can you add sales tax to a product?

A few states have made exemptions to this rule, like charging contractors sales tax on materials. There are two ways that companies can add sales tax to their products. Most companies add sales tax to the price of their products.

When do you report income on cash basis?

However, when you use the cash basis method, you report your income when you receive it. Moreover, you'll have to ensure that you enter the correct payment date on when the sales tax payment happened.

Does QuickBooks calculate sales tax?

If this is a Cash basis, QuickBooks calculates sales tax payable only when you receive the payment. When you receive full payment for the invoice.

Why is sales tax recorded as net?

Sales is recorded net of sales tax because any sales tax received on the sales will be returned to tax authorities and hence, does not form part of income. Sales tax account is credited since this is the amount of tax payable that will be paid to tax authorities.

Is sales tax recorded on receivable?

When a credit sale involves the application of sales tax, the receivable balance includes the amount of sales tax since it will be recovered from the customer. Sales is recorded net of sales tax because any sales tax received on the sales will be returned to tax authorities and hence, does not form part of income.

Why do companies need to credit accounts payable?

If a company purchases additional goods or services on credit (as opposed to paying with cash), the company will need to credit Accounts Payable so that the credit balance will increase accordingly.

What is account payable credit?

Definition of an Accounts Payable Credit. Since Accounts Payable is a liability account, it should have a credit balance. The credit balance indicates the amount that a company or organization owes to its suppliers or vendors.

What is debit balance?

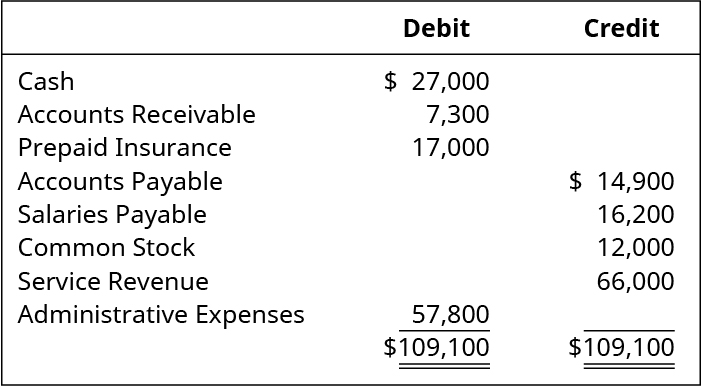

A debit balance is an account balance where there is a positive balance in the left side of the account. Accounts that normally have a debit balance include assets, expenses, and losses. Examples of these accounts are the cash, accounts receivable, prepaid expenses, fixed assets (asset) account, wages (expense) and loss on sale of assets ( loss) account. Contra accounts that normally have debit balances include the contra liability, contra equity, and contra revenue accounts. An example of these accounts is the treasury stock (contra equity) account.

Can a bank account have a negative balance?

Such an account is said to be overdrawn, and so is not actually allowed to have a negative balance - the bank simply refuses to honor any checks presented against the account that would cause it to have a debit balance. Alternatively, the bank will increase the account balance to zero via an overdraft arrangement.

Explanation

How to Record Sales Tax Payable?

- It is fairly simple. To record credit sales in a sales journal, create a separate column for capturing it for each credit sale. Ensure that the aggregate of this column is recorded in the sales taxes payable account maintained in the general ledger at a regular interval of time. Likewise, create a separate column for sales returns to record a reduction in sales taxes payable liability due to sal…

Journal Entries

- The journal entries for sales taxes payable are classified into two broad categories, which are as follows: 1. At the time of collection of sales taxes from customers 2. At the time of payment of sales taxes to the appropriate taxes authority At the time of collection of sales taxes from customers – When a firm collects sales taxes after sales of certain goods or services, the follow…

Examples

- Example #1

Let us take the example of ASD Inc. to illustrate the concept of a collection of sales taxes payable. The company executes only two sales during the second week of February 2020, which are as follows: 1. 03, 2020: Cash sale of $10,000, which is subject to sales taxes of 4.5%. 2. 05, 2020: C… - Example #2

Let us take the same example of ASD Inc. to illustrate the concept of remittance of such tax payable. The company remits the sales taxes collected in the first week of February 2020 to the appropriate taxes authority on March 05, 2020. Prepare the journal entry for the remittance of th…

Recommended Articles

- This has been a guide to Sales Taxes Payable and its definition. Here, we discuss recording sales tax payables, examples, and journal entries. You may learn more about accounting from the following articles – 1. Accounts Payable 2. Salary Payable 3. Dividend Payable 4. Bonds Payable