Does Bank of Hawaii have a secured credit card? We offer secured visa credit cards that are well suited for people who have just moved to Hawaii and have not yet established credit in the United States. As long as your you have a valid SSN or ITIN, as well as a valid US address, you can apply for our Secured Visa Credit Card.

Full Answer

What bank issues the Hawaiian Airlines Bank of Hawaii World Elite Mastercard?

The Hawaiian Airlines Bank of Hawaii World Elite Mastercard is issued by Barclays Bank Delaware pursuant to a license by Mastercard International Incorporated. Mastercard, World Mastercard and World Elite Mastercard are registered trademarks, and the circles design is a trademark of Mastercard International Incorporated.

What is a bank of America secured credit card?

BankAmericard® Secured Credit Card from Bank of America A secured credit card can help establish, strengthen and even rebuild your credit.

How do I apply for a First Hawaiian Bank credit card?

First Hawaiian Bank offers a variety of credit cards 1 to meet your needs. Learn more and apply online at the links below. You can also visit a branch or call 643-CARD (2273) (Guam and CNMI residents: Call (800) 403-7167).

How do I Check my Hawaiian Bank card balance online?

Visit HawaiianBOHCard.com and log into your account. If you don’t have an account online, select “Set up online access.” Download the Barclays US Mobile app. Once you are logged-in, you’ll be able to check your balance, sign up for paperless statements, make payments, and manage your account.

What banks offer a secured credit card?

Banks That Offer Secured Credit CardsBank of America.Capital One.Citi.Discover.USAA (Visa and Amex)U.S. Bank.Wells Fargo.

What is the minimum deposit for a secured credit card?

around $200Secured credit card deposit minimums typically start at around $200 (there are cards that require lower deposits), and some maximum deposit limits can be as high as $5,000.

Who qualifies for a secured credit card?

Secured cards are specifically on the market for people who have no credit history, poor credit history or a damaged credit score. They are often considered a surefire way to build credit. With deposits as low as $49 (for the Capital One Platinum Secured Credit Card), they are meant to be accessible.

Can I be denied for a secured card?

Yes, you can be denied for a secured card if you have major negative items on your credit report such as an ongoing or recently discharged bankruptcy, collection accounts, or repossessions. You could also be denied if you don't meet the issuer's minimum requirements for approval.

Which bank give credit card easily?

1. HDFC Bank instant approval credit card. HDFC Bank credit cards are not only 100% secure, but they also provide instant activation and ownership.

How much should you spend on a $200 credit limit?

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60.

Do you need income for a secured credit card?

A secured card can be a way to get access to credit even if you have limited income. To open a secured credit card account, you'll need to put down a refundable security deposit as collateral. The deposit protects the credit card issuer if you fall behind on payments.

How much will a secured credit card raise my score?

If you properly manage your secured credit card, you could see a 200 point increase to your credit score within 12 months. If you have bad credit, a score in the 500s or below, opening three secured credit cards and a credit builder loan can get you into the 700s within 12 months.

Do I get my deposit back from a secured credit card?

Do I get my deposit back from a secured credit card? You will get your secured credit card deposit back after the account is closed. Once you've increased your credit score with your secured card, you can simply close the secured card account—but you need to understand the risks first.

What are 2 reasons someone might want to open a secured credit card?

Here's why someone would use a secured credit card:High Approval Odds – You can get approved for a secured credit card no matter how damaged your credit may be. ... Low Costs – Secured cards tend to have very low annual fees, thanks to their refundable security deposit.More items...•

Why won't my bank give me a credit card?

You Have High Balances on Credit Cards and Loans High balances mean high monthly payments and a risk of defaulting on new credit card balances. Carrying a lot of debt will make it harder to get a credit card, even if you're looking for a credit card to help alleviate some of your debt burden.

How can I build credit if I can't get approved for anything?

3 things you should do if you have no credit historyBecome an authorized user. One of the simplest ways to build credit is by becoming an authorized user on a family member or friend's credit card. ... Apply for a secured credit card. ... Get credit for paying monthly utility and cell phone bills on time.

Can you carry a balance on a secured savings account?

If you need to improve or re-establish your credit history, 1 here's a great way to begin that process. With the Secured Card, you'll enjoy the convenience of credit including the option to carry a balance while earning interest on your secured savings account.

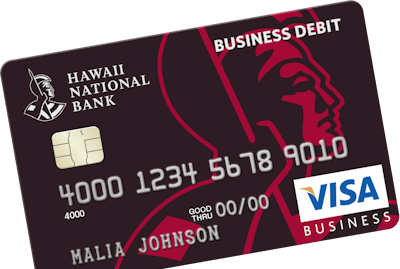

Can you call Hawaii National Bank to validate your credit card?

We do not call customers to validate account/credit card numbers, and you should never provide password or PIN information over the phone or through text message. Please notify us immediately at (808) 528-7800 if you receive a suspicious call or text. Hawaii National Bank. Sign In.

1. American Savings Bank

Great customer service! Friendly staff and always there to help. I applied for a home equity line of credit and they were able to help me save over…

3. HawaiiUSA Federal Credit Union

I've started to come to this branch because its closer to work and the reason for changing bank just recently. I came in on Thursday Nov. 5th and…

4. ALOHA PACIFIC FEDERAL CREDIT UNION

From Business: It was back in 1936 that a group of Honolulu City & County employees gathered to charter its own credit union in order to help fellow workers who were not being…

5. Navy Federal Credit Union

From Business: Navy Federal puts our members’ financial needs first with low fees, great rates and discounts. Visit us at navyfederal.org or at one of our 340+ branches—many…

6. Salt Lake Shopping Center

From Business: Located in the beautiful Windward side of Oahu, Aikahi Park Shopping Center opened its doors in 1969. With over 102,000 square feet of retail and office space,…

8. Central Pacific Bank

From Business: Central Pacific Banks can help you reach your financial goals, whether it's starting or growing a small business, realizing the dream of homeownership, planning…

16. CIT Bank

From Business: CIT is a leading national bank focused on empowering businesses and personal savers with the financial agility to navigate their goals. CIT Group Inc. (NYSE:…

Which banks don't offer secured credit cards?

The major banks that do not offer secured cards are American Express, Barclaycard, Chase, PNC and Synchrony Bank. But remember, it’s not a secured credit card’s issuer that really matters. Your goal should be to find the card with the lowest possible annual fee, no matter who offers it. And you can achieve that goal by comparing secured credit ...

What is the best secured credit card with a low deposit?

One of the best secured credit cards with a low deposit is the Secured Mastercard® from Capital One because new cardholders may be able to put down either $49, $99 or $200 and still get a $200 credit line, which would make the card only partially secured. And there’s a $0. annual fee.

How much can you deposit on a secured credit card?

There is another high limit secured credit card that lets you deposit as much as $5,000: the Harley-Davidson® Secured Credit Card. But several others allow limits in the thousands.

Does Capital One Secured have a low deposit?

Capital One Secured doesn’t guarantee a low deposit, but it does offer the chance of one. If your credit is toward the bottom of the bad credit range, you’ll probably still have to put down a $200 deposit. But the higher your credit score is, the better chance you’ll have of being assigned a low deposit. show less.

Card Details

A secured credit card designed to help establish, strengthen or rebuild credit

Security & Features

We block potential fraud if abnormal patterns are detected and let you know if we suspect fraudulent activity. Plus, you always get a $0 Liability Guarantee for fraudulent transactions.

What is secured credit card?

A secured credit card is a type of credit card that requires a security deposit or savings account collateral. To get a secured credit card, you need to provide a cash deposit—usually $200-$500—which usually matches your credit limit and will be held by the lender in case of late or missed payments. You can't immediately withdraw your deposit, but ...

How to build credit with secured credit card?

You can help build your credit with a secured credit card by developing these habits: 1 Make payments on time: On-time payments are one of the main things that will help you build a good credit score. 2 Watch your credit limit: Credit score bureaus also closely watch how close you are to using up your credit limit. Try to keep the balance on your cards at less than 30 percent of your total credit limit.

Do secured credit cards charge late fees?

Like traditional credit cards, secured credit cards charge late fees in cases of missed payments and might have high interest rates as well as annual fees. Before applying for a card, it's key to compare interest rates between different secured credit cards.

Do secured credit cards help your credit score?

Secured credit cards may help build or establish your credit score if you make consistent on-time payments, avoid late fees and keep your balance low. Most secured credit cards will report your payment activity to the three credit reporting bureaus, Equifax ®, Experian ® and TransUnion ®.

Why is a secured credit card the best tool for rebuilding from bad credit?

Secured credit cards tend to have relatively lenient approval requirements because the deposit serves as your credit line, thus preventing you from spending more than you can afford to repay and minimizing risk from the issuer's perspective. That's why a secured card is the best tool for rebuilding from bad credit.

How to cancel a secured credit card?

To cancel your U.S. Bank Secured card just call them at 800-285-8585. They'll be able to help you cancel the card. Depending on what your balance looks like, you'll also get your deposit back, or at least a part of it.You should keep in mind, though, that closing your credit card will hurt your score. show more….

How long does it take to get pre-approved for a secured bank?

There is no way to get pre-approved for the U.S. Bank Secured. A hard pull usually causes an applicant's credit score to drop by 5-10 points. Most people’s scores bounce back within 3-6 months with responsible credit management, but it can take up to 12 months.

How to check if my bank is secure?

You can check your U.S. Bank Secured application status by either logging in to your U.S. Bank account online, using the US Bank app on iOS and Andoid, or calling customer service at 800-947-1444 and providing your Social Security number. show more…. votes votes.

Is a US bank secured credit card good?

The US Bank Secured Visa Credit Card is a good card for people with bad credit or as a first credit card. The only real negative thing about it is that it has a higher minimum deposit than others credit cards in its class at $300, and the annual fee is also a little more than others at $35.

Is there a monthly fee for a secured Visa card?

While the interest rates may be a bit higher than what you may hope for, for a secured card they are not outrageous. There are no monthly fees or one-time fees with US Bank Secured Visa® Credit Card, so that is a nice thing to have. as someone with bad credit.

Does US Bank pay interest on credit cards?

US Bank does pay a small. amount of interest on your deposit with them, but the goal with any of the pre-paid and secured credit cards is not to hold them for a long period of time, rather, you want to use them to rebuild your credit and establish a good reputation with the cardholder as soon as possible.

What is a secured Visa deposit?

The deposit is used to open a U.S. Bank secured savings account to ensure your card balance can be paid. The savings account is FDIC-insured, earns interest and won't be touched as long as your account remains open and in good standing. Purchases with the U.S. Bank Secured Visa Card are billed to you each month as with any credit card.

How to open a secure Visa card?

Bank Secured Visa Card, you can choose to: Apply and fund online using your checking or savings account. Print an application and mail a cashier’s check or money order. Personal checks are not accepted.

How to build your credit?

Build your credit and create a foundation for the future. 1. Build your credit and create a foundation for the future with the U.S. Bank Secured Visa Card. This secured credit card can be used like any other credit card and is accepted world-wide – with no annual fee. .