Is redeemable debentures a current liability?

When debentures are redeemable at a premium the liability for premium payable on redemption is recorded in the books at the time of issue of the debentures although the actual liability will arise only at the time of redemption.

Are bond funds riskier than bonds?

While some bonds may be a safer investment than bonds, there are a lot of variables that could affect the relative risks of the two securities. When investing in any type of security, it's important to consider the unique risks of the investment, the price of the investment, and the broader market conditions.

Are notes payable considered current liabilities?

Thus, notes payable with maturity period of greater than one year are reported as non – current liabilities. Whereas, notes payable with a maturity period of less than a year are represented under current liabilities in balance sheet. Additionally, notes payable may further be of two types:

Are my bonds taxable?

Overall, they did quite a good job covering the topic in a light-hearted manner (If you are interested you can read my more serious, comprehensive estate tax article here) Bonds and equities tend to be less correlated. When bonds do not do well ...

Are bonds payable part of current liabilities?

Are bonds and notes payable Current liabilities?

Is bonds payable current or long term liability?

Is payable a current liabilities?

Examples of current liabilities include accounts payable, short-term debt, dividends, and notes payable as well as income taxes owed.

Are bonds payable a current asset?

Are bonds a liability or equity?

Is dividend payable a current liability?

The dividends declared by a company's board of directors that have yet to be paid out to shareholders get recorded as current liabilities.

Which of the following is a current liabilities?

What is current liabilities and non-current liabilities?

What are other current liabilities?

When are bonds payable reported as a current liability?

Are bonds payable reported as a current liability if they mature in six months? Bonds payable that mature (or come due) within one year of the balance sheet date will be reported as a current liability if the issuer of the bonds must use a current asset or will create a current liability in order to pay the bondholders when the bonds mature.

Is a bond sinking fund a long term liability?

However, the bonds could be reported as a long-term liability right up to the maturity date if: The company has a sufficient, long-term investment that is restricted for the purpose of paying the bondholders when the bonds mature. This type of investment is known as a bond sinking fund. The company has a binding agreement that guarantees ...

What is a bond payable?

What are Bonds Payable? Bonds payable are recorded when a company issues bonds to generate cash. Cash Equivalents Cash and cash equivalents are the most liquid of all assets on the balance sheet. Cash equivalents include money market securities, banker's acceptances. . As a bond issuer, the company is a borrower.

What is amortizing bonds payable?

Amortizing Bonds Payable. If a bond is issued at a premium or at a discount, the amount will be amortized over the years through to its maturity. On issuance, a premium bond will create a “premium on bonds payable” balance. At every coupon payment, interest expense will be incurred on the bond. The actual interest paid out (also known as ...

What is the carrying value of a bond?

Carrying Value of Bonds. The carrying value of a bond is not equal to the bond payable amount unless the bond was issued at par. When a bond is issued at a premium, the carrying value is higher than the face value of the bond. When a bond is issued at a discount, the carrying value is less than the face value of the bond.

Who can create an amortization schedule for bonds?

An analyst or accountant can also create an amortization schedule for the bonds payable. This schedule will lay out the premium or discount, and show changes to it every period coupon payments are due. At the end of the schedule (in the last period), the premium or discount should equal zero.

Is a bond a borrower?

As a bond issuer, the company is a borrower. As such, the act of issuing the bond creates a liability. Thus, bonds payable appear on the liability side of the company’s balance sheet. Balance Sheet The balance sheet is one of the three fundamental financial statements.

Is the book or carrying value of a bond the same as the face value?

On maturity, the book or carrying value will be equal to the face value of the bond. Both of these statements are true, regardless of whether issuance was at a premium, discount, or at par.

Is the coupon higher than the interest paid?

The actual interest paid out (also known as the coupon) will be higher than the expense. The difference is the amortization that reduces the premium on the bonds payable account. It is also true for a discounted bond, however, in that instance, the effects are reversed.

What is a bond payable?

Bonds payable. Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. This account typically appears within the long-term liabilities section of the balance sheet, since bonds typically mature in more than one year. Then, what is discount on bonds payable in balance sheet?

What is a discount on bonds payable?

discount on bonds payable definition. A contra liability account that reports the amount of unamortized discount associated with bonds that are outstanding. The discount on bonds payable originates when bonds are issued for less than the bond's face or maturity amount.

What is the balance in a premium or discount account?

Hence, the balance in the premium or discount account is the unamortized balance.

Is a bond payable a current liability?

Consequently, is Bonds Payable a current liability? Bonds payable that mature (or come due) within one year of the balance sheet date will be reported as a current liability if the issuer of the bonds must use a current asset or will create a current liability in order to pay the bondholders when the bonds mature.

What is a bond payable?

What is Bonds Payable? Bonds Payable are the long term debt issued by the company with the promise to pay the interest due and principal at the specified time as decided between the parties and is the liability, bond payable account is credited in the books of accounts of the company with the corresponding debit to cash account on the date ...

What does "bonds payable" mean?

and payable. As you can understand, bonds are debt. And payable means you are yet to pay that amount. So bonds payable stands for debt that’s not being paid. To be more specific, bonds payable is a long-term debt that has remained outstanding.

What is par value in bond?

Par value – The amount of money that is paid to the bondholders at maturity. It generally represents the amount of money borrowed by the bond issuer. Bond is issued in the denomination of $1000. Coupon – Coupon payments represent the periodic interest payments from the bond issuer to the bondholder.

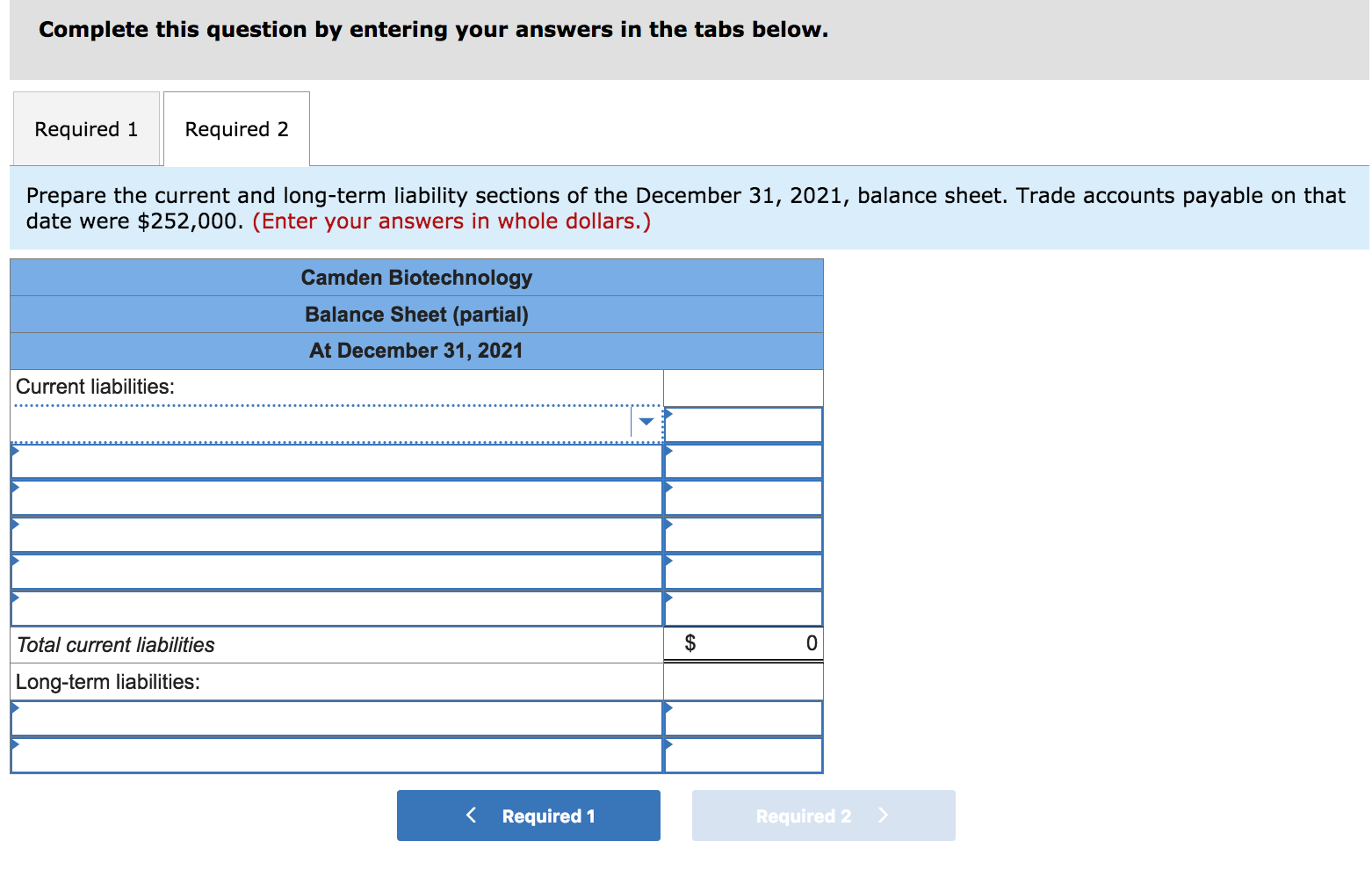

What is current liability?

Current Liability Current Liabilities are the payables which are likely to settled within twelve months of reporting. They're usually salaries payable, expense payable, short term loans etc. read more. as well as long-term liability sections.

How often does Nike pay interest?

As we note from above, Nike’s bond pays interest semiannually; generally, one half of the annual coupon is paid to the bondholders every six months. Coupon rate – The coupon rate, which is generally fixed, determines the periodic coupon or interest payments. It is expressed as a percentage of the bond’s face value.